Thinking about opening a tradeview mt4 account and curious about the tradeview cTrader platform and the tradeview minimum deposit across account types and regions?

Here is the calm, factual rundown with links to official pages so you can verify every line.

“Choose platforms you can audit, not just admire.”

The quick picture

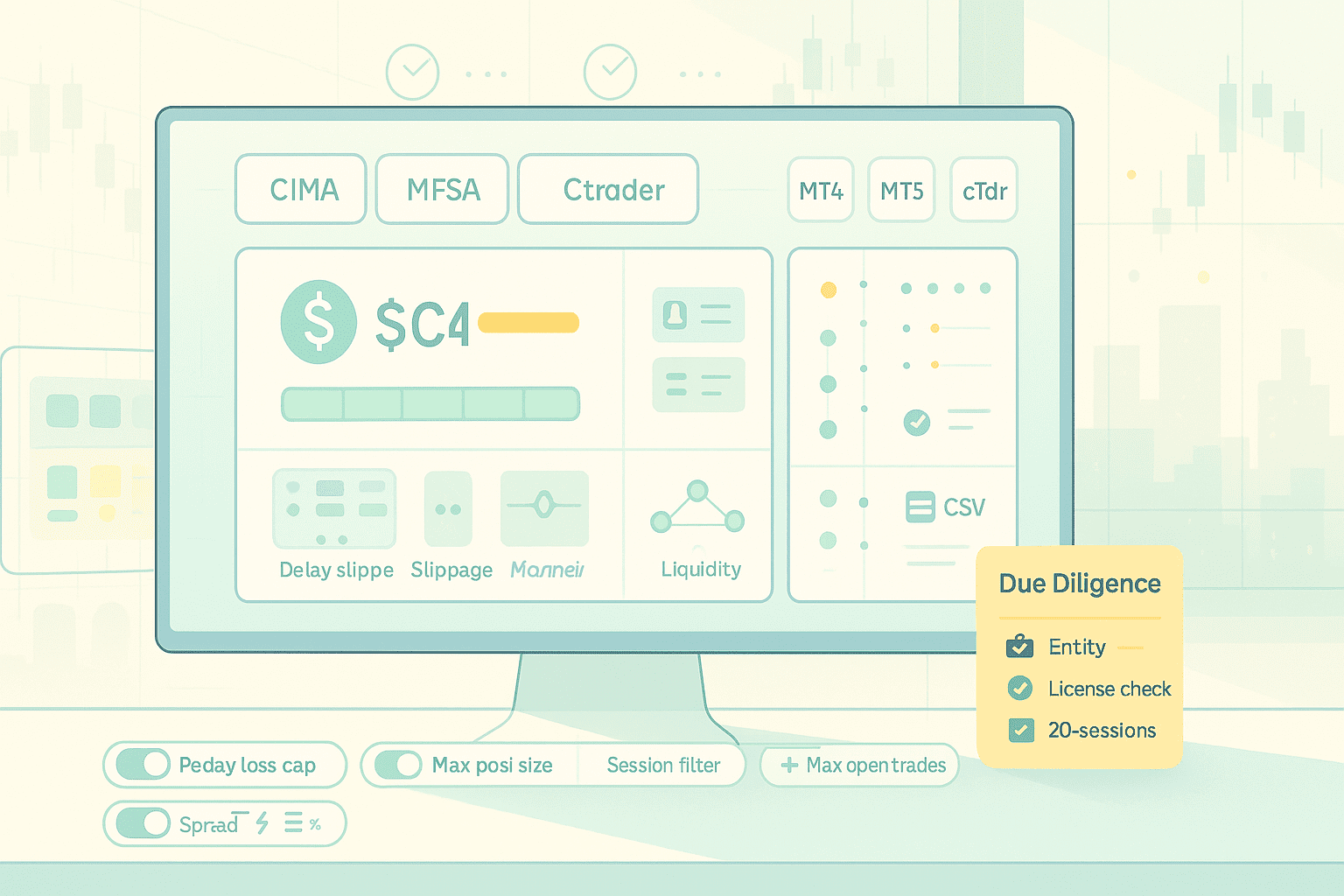

Tradeview offers MT4, MT5, and cTrader across different regulated entities and account types. Minimum deposits and trading conditions vary by account and by the entity that onboards you, so always match what you read to the exact branch that will hold your account.

Platforms at Tradeview in plain English

- MetaTrader 4 and 5: standard forex and CFD platforms with familiar order tickets and automation support. Listed as core options on Tradeview’s site.

- Tradeview cTrader platform: an ECN-style interface with depth of market and fast routing, promoted by Tradeview and Spotware. Useful if you like market depth and a modern UI.

“Pick one platform you can run in your sleep. Consistency beats intensity.”

Tradeview minimum deposit: why it differs

Tradeview shows two broad MT4/MT5 account families, plus cTrader. The minimum varies by the product and, in some cases, by jurisdiction.

| Account family | Typical label on site | Stated minimum | Notes |

| ILC (Innovative Liquidity Connector) | MT4 or MT5, ECN pricing | $1,000 | Seen on tvmarkets.com and EU pricing pages. Verify per entity. |

| XLeverage | MT4 or MT5, standard pricing | $100 | Shown on Tradeview’s market pages for Forex. |

| ILC Type 7 vs Type 5 (EU doc) | MT4 or MT5 | Type 7: “from 0” and Type 5: $1,000 | Language appears in EU FAQ and free PDF. Use as a signal to ask your entity which table applies. |

| cTrader | Tradeview cTrader platform | (site markets page markets the platform; minimums follow the account bucket you open) | Confirm with onboarding because the platform can sit on different account specs. |

What to do with this: before funding, confirm the exact entity and account type in your welcome email and match it to the stated minimum on that entity’s pricing or FAQ page. Screenshots help when policies differ by region.

Costs and execution, tested the right way

Tradeview markets ECN aggregation via its “Innovative Liquidity Connector” and lists spreads as low as zero on ILC. Your true cost is still spread plus commission plus slippage in your session, so measure it yourself for 20 sessions before scaling.

Quick checklist you can run:

- Track spread, commission, and slippage by symbol during your window.

- Export fills and confirm the totals match your statement. Keep the CSV as your source of truth.

“Receipts beat reviews. When statements equal exports, debates end.”

MT4 or the Tradeview cTrader platform: which fits your routine

| Question | MT4 answer | cTrader answer |

| Do you need a familiar, widely supported terminal | Strong ecosystem and EAs | Modern UI with depth of market |

| Do you want tight ECN routing visuals | Basic Level II via plugins | Native market depth and quick ticket |

| Mobile options | MT4 apps and web access | Tradeview cTrader app on mobile stores |

| Where to verify details | Tradeview platforms page | Tradeview cTrader pages and Spotware client page |

Citations: MT4/MT5 availability, cTrader site pages, and the Tradeview Markets cTrader app listing.

Safe, simple setup for a tradeview mt4 account

- Pick your entity and account bucket

Match your region to the entity and confirm ILC vs XLeverage and the minimum tied to it. - Install the platform

Download MT4 or consider the Tradeview cTrader platform if you prefer full market depth. - Fund with the smallest sensible amount

Use the minimum required for your account type and test execution in your real session. Check the funding page for methods and rules. - Run a two-week quality test

Log spreads and slippage by hour. Export fills and cross-check parity with statements.

Risk routine that travels across pairs and indices

- Keep risk per trade fixed in cash so size floats safely by symbol.

- Use bracket orders as default so exits are honest.

- Favor retests over first bursts in hot minutes.

- Read your local calendar in your time zone before you click.

“If you can explain the risk in one sentence, the trade is ready.”

Helpful reference links on minimums and accounts

- Tradeview markets page showing ILC and XLeverage examples with listed minimums.

- EU pricing and FAQ that split ILC Type 7 and Type 5 by deposit threshold.

- EU fee PDF that states “Minimum Deposit From 0” for Type 7 and “1000 base currency” for Type 5.

FAQ

What is the current Tradeview minimum deposit

It depends on your account and entity. Tradeview’s pages show ILC at $1,000 and XLeverage at $100. EU docs separate ILC Type 7 from 0 and Type 5 at $1,000. Confirm with the branch holding your account before funding.

Where do I find the Tradeview cTrader platform

Tradeview lists cTrader on its platform pages, and Spotware features Tradeview as a client. There is also a Tradeview Markets cTrader mobile app.

Can I open a tradeview mt4 account and switch to cTrader later

Yes. Both platforms are offered by the broker, but the account bucket and conditions may differ. Ask support to confirm fees, minimums, and symbol availability on the exact platform and entity before you switch.

How do I verify the account details I am offered

Match the entity name in your documents to that entity’s pricing or FAQ page, then confirm the minimum deposit, commissions, leverage limits, and funding methods in writing. Keep a copy of the page or PDF.

What is the quickest quality test after I fund

Trade one or two symbols in your normal window for two weeks. Track spread and slippage, and check that statement totals equal your CSV export. If parity is clean and costs sit inside your comfort band, scale gradually.