Screens glow, headlines pile up, and every ticker looks urgent. The fix is not a bigger scanner. It is a steady rhythm that turns noise into a short list of top stocks to trade you can act on with tight risk and fewer second guesses.

“Preparation beats prediction when the bell is loud.”

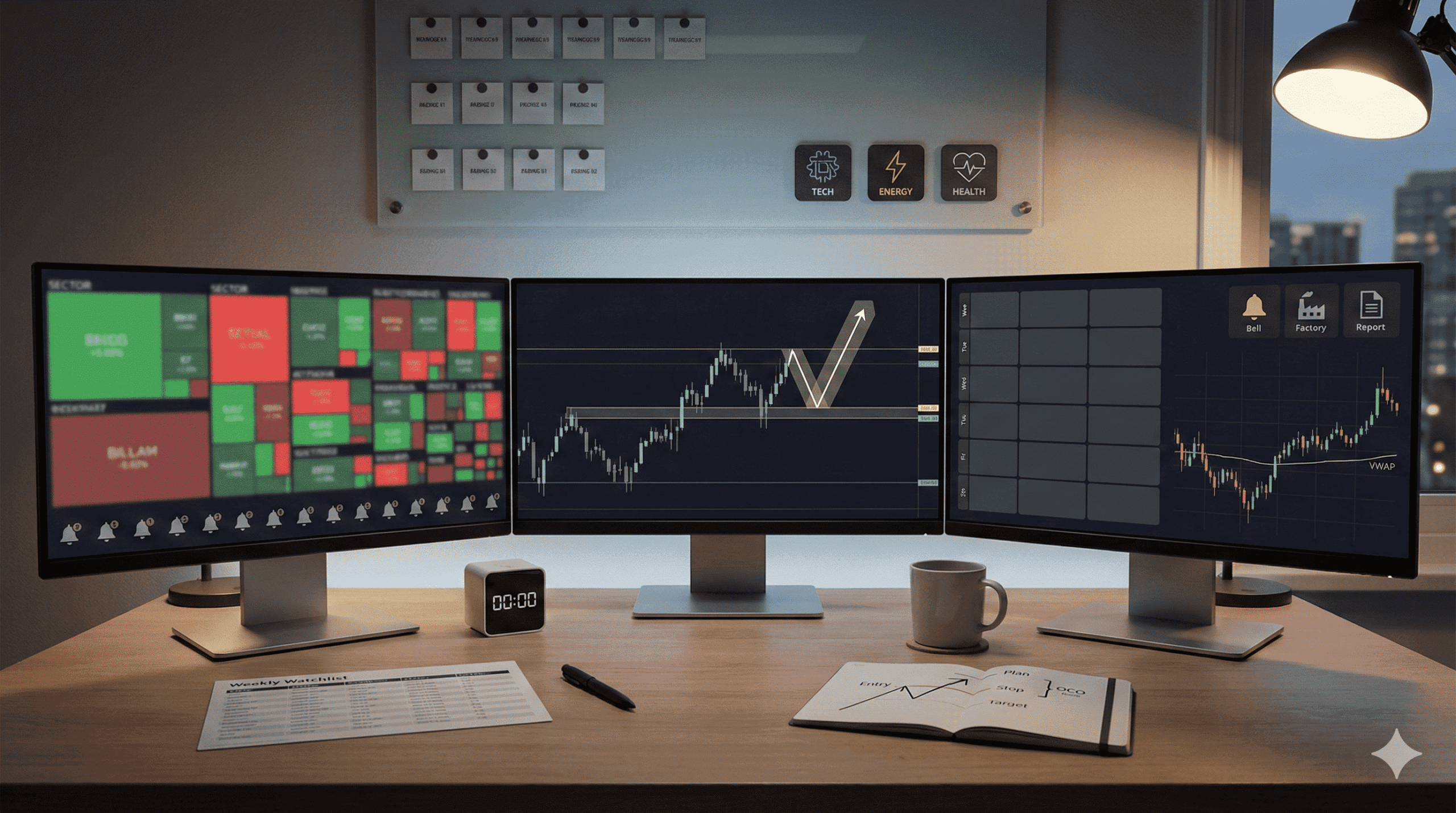

A weekly rhythm that actually works

| Day block | Focus | Output you keep |

| Weekend or late Sunday | Big picture and sector heat | 3 to 5 themes that matter this week |

| Monday open window | Liquidity and first rotations | Early read on leaders and laggards |

| Midweek check | Earnings, guidance, catalysts | Trim or add names to a weekly stock watchlist |

| Friday wrap | Stats and screenshots | Notes that refine next week’s plan |

Ingredients of a clean weekly stock watchlist

- One line per name with catalyst, level to act, and the invalidation price

- Liquidity check so orders fill without drama during your window

- A note on personality: trender, fader, or headline sensitive

“If the entry, stop, and first target fit one line, you can trade it. If not, it belongs in research.”

Buckets that surface stocks to watch weekly for trading

| Bucket | Why it earns a spot | Simple confirms |

| Fresh earnings movers | New info and volume attract follow-through | Break and hold above a key post-earnings level |

| Sector leaders | Relative strength cuts noise | Outperforming sector ETF on up days and down days |

| Event setup names | Product days, data, or policy tie-ins | Tight pre-event range with respectful wicks |

| Liquid ETFs for timing | Cleaner structure than single names | Opening range behavior guides bias |

From list to trade without the mess

- Mark levels first: prior day high and low, opening range, a simple midline like VWAP.

- Pick a single setup per name: break and retest or mean reversion.

- Size in cash before the click; the chart only tells you where to place risk.

Two setups you can reuse across names

- Break and retest

Price clears a level from your list, pulls back to it, stabilizes, you enter near the retest, stop just beyond structure, first target equals your cash risk, then trail. - Mean reversion to the session midline

A stretched run pauses, pace slows, you fade back toward the midline. Use smaller sizes near scheduled data.

Risk rules that keep the account steady

- Hard daily stop in cash ends your session cleanly

- One idea per name per day avoids revenge trades

- Log spread at entry and slippage on exit for ten sessions to learn your best minutes

“Small size plus strict exits beat perfect entries.”

Sample page you can copy today

| Symbol | Catalyst | Bias | Entry zone | Invalidation | First target | Notes |

| ABC | Earnings beat and raised guide | Long on retest | 49.80 to 50.10 | 49.30 closes | 51.00 | Keep size small near data |

| XYZ | Relative strength vs sector | Long on higher low | 102.40 to 102.70 | 101.90 closes | 104.00 | Watch opening range |

Keep this tight, print it, and trade the plan you wrote, not the chat you read.

Bringing it together

If this rhythm fits, build a two-page packet each Sunday: page one for themes, page two for your weekly stock watchlist. During the week, prune aggressively and let the notebook decide what stays. That is how top stocks to trade become a calm routine instead of a sprint. Ready to move now? Draft five lines for your best candidates, set the risk per idea in cash, and trade only those lines for the next five sessions.

FAQ

Do scanners replace a weekly plan

No. Scanners suggest candidates. Your plan decides levels, risk, and timing.

How many names should I track

Three to eight liquid candidates that match your hours. Fewer is often better.

Can this work if I only trade the open

Yes. Use opening range and one setup. Size smaller for the first ten to fifteen minutes.

Where does diversification fit for traders

Aim for uncorrelated drivers across your list so one headline does not hit all names the same way.