Running a multi account trading platform can feel like juggling torches while sorting glass. The moving parts multiply fast. Permissions, allocations, latency, fees, reporting, client updates, all while the market refuses to slow down.

The good news is that a clear routine plus a few guardrails keeps the whole system steady.

“Make the platform boring to operate. Let the trades be the exciting part.”

A calm day looks like this:

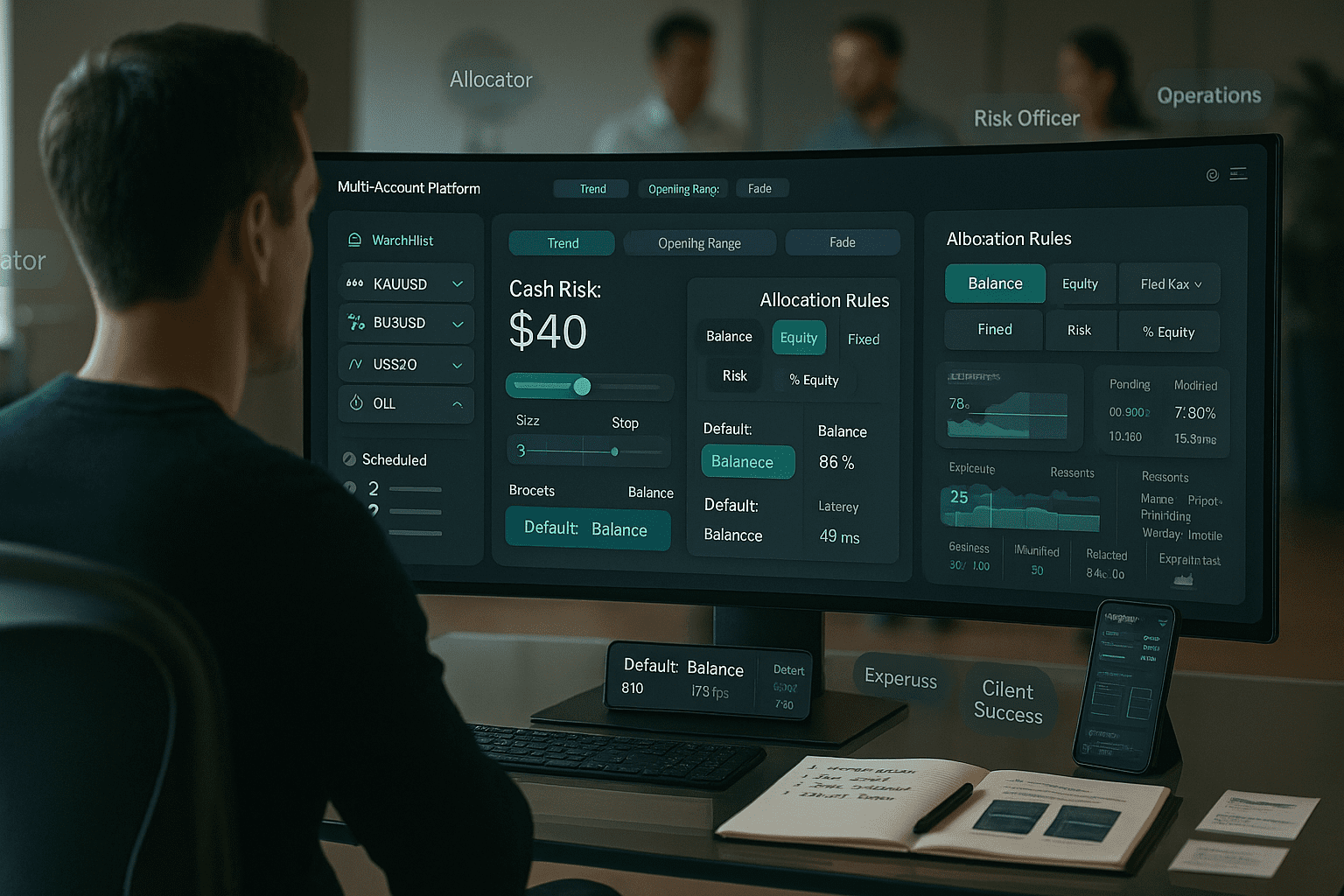

- One watchlist, three strategy tabs, color coded.

- A single ticket that always shows cash risk before submit.

- Brackets and OCO as defaults so exits are not a debate.

- Allocation rules pinned to the screen so nobody guesses.

- Two scheduled catalysts in local time with alerts.

- A live pane for slippage and spread so size can adapt.

“Clarity beats speed when accounts depend on your clicks.”

The moving parts behind a multi account trading platform

To keep service quality high, define the parts like a Lego set. That way, any new teammate can understand what each brick does and how they connect.

Core actors

- Lead trader operates the master ticket and approves allocations.

- Allocator configures rules per strategy and client.

- Risk officer sets limits by instrument, session, and account.

- Operations reconciles statements and keeps the status page tidy.

- Client success handles questions about fills, fees, and reports.

Order flow in plain language

- The master account sends an order with a linked stop and target.

- Allocation rules translate that order into child orders.

- Per account limits adjust size or reject the child if a guardrail triggers.

- Fills and rejections feed the blotter and the daily log.

- The system emails or posts a statement snapshot at the end of the session.

Data you want at a glance

- Current exposure by symbol and by strategy.

- Real time profit and loss plus unrealized risk units.

- Pending orders, modified orders, and rejected orders with reasons.

- Spread and slippage, both rolling and last fill.

- Latency from click to broker accept, averaged and last sample.

“If you cannot explain the state of all books in under one minute, the screen is too busy.”

MAM for MT5 brokers in practice

A MAM for MT5 brokers setup lets a manager place trades in a master account and allocate to multiple sub accounts based on rules. The benefit is obvious. A single ticket drives consistent execution across the client base, while logs and statements still reflect each client account.

Common allocation methods and where they shine

| Allocation method | How it works | Best use case | Pitfalls to watch |

| Proportional by balance | Size based on account balance | Mixed client sizes with similar risk profiles | Drift if balances change and rules are not updated |

| Proportional by equity | Size based on live equity | Volatile books where open PnL matters | Equity swings can change size mid session |

| Fixed lot per account | Same lots to each account | Small group with uniform goals | Unfair exposure if balances differ widely |

| Risk per account | Size to a cash risk per idea | Professional clients who care about risk units | Requires clean stop placement and consistent ticketing |

| Equal percentage risk | Same percent of equity per account | Balanced portfolios with clear guardrails | Sensitive to equity spikes during news |

All these methods work inside a multi account trading platform when the rules are explicit and visible. Decide on one default rule and document the exceptions.

Manage multiple trading accounts without chaos

The phrase manage multiple trading accounts does not need to mean manual copy paste or fragmented CSVs. Focus on five pillars and you will stay ahead of the complexity.

Pillar 1. One risk language

Pick cash risk per idea and stick with it. The ticket should show that cash number before you press submit. Brackets enforce exits and protect the book from decisions made under stress.

Pillar 2. One small playbook per strategy

A strategy can have two or three setups at most. Each setup needs a trigger, invalidation, and target logic. Fewer setups build sample size faster and simplify coaching.

Pillar 3. Role based access

Traders place orders, allocators apply rules, risk sets guardrails, ops reconciles. If a person needs to cross roles, log the reason and the time. Fewer permissions equal fewer surprises.

Pillar 4. Clean review loop

Capture two screenshots per trade and write a single line reason in and out. Tag each trade with one strength or one mistake. Reviews should be shorter than the trades themselves.

Pillar 5. Honest status and incident logs

A public status page and short incident reports build trust. Timestamp the problem, the impact, and the fix. Archive them so future teammates can learn quickly.

Setup blueprint that scales

Below is a compact blueprint you can adopt within a week. Treat it as a living document. Adjust for your instrument list and your client base.

Platform configuration

- Instrument catalog with tick value, minimum size, and margin notes.

- Default ticket that always loads with stop and first target.

- Templates for scalps, intraday swings, and multi day holds.

- Allocation rule presets named clearly: Balance, Equity, Fixed, Risk.

- Alert library for your major catalysts in local time.

Risk and dealing

- Loss caps per account and per strategy.

- Max contracts per symbol for the day and the session.

- News windows with size reduction or blocks.

- Slippage threshold that triggers an automatic size cut.

- Symbol filter so a strategy cannot wander into off book names.

Reporting and data

- Live blotter that shows fills, partials, and rejects.

- Downloadable CSVs and an API endpoint for external analytics.

- End of session email with exposure and realized PnL by account.

- Audit log for any allocation change with operator and time.

- Weekly rollup that highlights spread and slippage trends.

People and ownership

| Area | Owner | Tasks | Cadence |

| Risk | Risk officer | Limits, tripwires, audits | Weekly review |

| Trading | Lead trader | Ticket hygiene, brackets, playbook | Daily standup |

| Allocation | Allocator | Rule presets, exceptions, overrides | Pre session |

| Ops | Operations | Statements, reconciliation, status page | Daily close |

| Client success | CS lead | Client messages, reports, education | As needed |

“Write owners on the wall. If everyone owns it, nobody owns it.”

Two example playbooks that fit teams and clients

These are purposely simple. They are easy to teach and easy to monitor.

Opening range break with retest for index CFD

- Mark the first five minutes as the opening box.

- Wait for a clean break.

- Enter on a retest that holds the broken edge.

- Stop just outside the opposite edge plus a small buffer.

- First scale at 1R, runner trails at swing structure.

- Allocation rule equals proportional by balance for most clients.

Inventory reaction for energy CFD

- Flag the release time and reduce size pre-event.

- Let the first reaction settle, then trade the second push.

- Stop beyond the reaction wick.

- First scale at 1R, second scale near measured move.

- The allocation rule equals risk per account for professional clients.

“A setup is not ready until the invalidation is written and visible.”

Sizing in cash terms

Translate points and ticks into dollars before every session. Use a table like this to keep decisions consistent.

| Scenario | Cash risk per attempt | Stop distance | Cash per point | Contracts |

| Tight open | 40 | 1.5 pts | 5 | 5 |

| Trend pullback | 50 | 2.0 pts | 5 | 5 |

| Volatile reversal | 60 | 2.5 pts | 5 | 5 |

| Thin midday | 30 | 2.0 pts | 5 | 3 |

Adjust cash per point to your instrument. The shape stays the same across symbols.

Pitfalls and practical fixes

- Overfitting allocation rules

Fix by sticking with one default and a short list of exceptions. - Too many strategies per desk

Fix by limiting what you can review honestly each week. - Manual edits after the fact

Fix by making edits rare and heavily logged. - Noisy indicators

Fix by using price levels, session timers, and volume. - Switching symbols mid session

Fix by pre approving a watchlist and enforcing symbol filters.

Security and client trust

Security issues are rare until they are not. A few habits go a long way.

- Hardware keys for admin roles.

- IP allowlists for allocator and risk consoles.

- Permissions that expire and need renewal.

- Incident drills once per quarter with a short write up.

- Clear language in client updates that explains both wins and issues.

Education that creates confident clients

Clients appreciate clarity more than hype. Offer a two page primer that explains your process, allocation method, and review loop. Include screenshots of the ticket, the bracket template, and an example statement. Keep language human. Avoid jargon unless it is defined on the page.

“Clients stay when they can explain your process in their own words.”

When MT5 MAM meets real life constraints

Even the best setup needs tweaks. Two common real world situations and the fixes:

- Accounts with very different balances

Use proportional by balance for most, but switch a few to fixed lots if they would otherwise land below your platform minimum size. - Clients with individual risk caps

Combine a table of per account daily loss limits with an allocator override. If the override is used, log the reason so the review remains honest.

“The best exceptions are rare and well documented.”

Costs and spread math

Every order pays a spread and a commission. In a multi account trading platform the spread cost multiplies across accounts. Keep a simple calculation in your notebook.

- Average spread in points times cash per point equals spread cost.

- Add commission per contract times contracts.

- If your first scale is 1R at 2.0 points and your all in cost is 0.3 points, make sure your setups leave enough edge to grow after costs.

Action steps to go live with confidence

Use this action list to bring order to your next two weeks.

- Define three strategies and limit each to two setups.

- Pick one default allocation method and document two exceptions.

- Set per account and per strategy loss caps.

- Build bracket templates that preload on the ticket.

- Publish a status page and a short incident template.

- Create an end of session report with exposure and realized PnL.

- Schedule a weekly 20 minute review to prune or refine setups.

“Small, boring steps compound. Big leaps without guardrails rarely do.

A quick note if your team needs help

If your desk runs MAM for MT5 brokers or a similar allocator, a short audit often reveals immediate wins. Sometimes it is a naming convention that reduces errors. Sometimes it is a bracket template that saves seconds on every ticket. If you need a new perspective on your workflow or a simple worksheet to help you manage multiple trading accounts, contact me. I will share a starter kit that you can adjust to fit your needs.

FAQ

Is a multi account trading platform only for large managers

No. Small teams benefit even more because rules and guardrails replace manual work. A clean MAM configuration scales up without changing habits.

Do MAM systems work with MetaTrader 5 only

MT5 is common, but similar models exist elsewhere. The key is whether your platform supports master orders, allocation rules, and per account guardrails.

Which allocation method is best

The method that your clients understand and that you can explain in one sentence. Proportional by balance is a practical default. Risk per account is great for professional clients when your stops are consistent.

Can I switch allocation rules mid session

You can, but make it rare and log the reason. Frequent rule changes create confusion and reporting headaches.

How many strategies should a small desk run

Two or three is plenty. Fewer strategies means deeper sample sizes, better coaching, and cleaner reviews.