You do not need a thousand features to make futures market access online work for you. You need one calm routine, honest cost lines, and a platform that keeps the same ticket language across indices, energy, metals, and gas.

Choose a global futures broker that treats cash risk seriously. Then, access commodity futures from one platform without needing multiple logins or workflows. The rest is refinement.

The real promise of online futures access

Markets are plural, your day is singular. The best setup gives you one login, one ticket grammar, and statements you can read aloud. You rotate from an index future to a metal to an energy contract and the math never changes on you. Prices differ, rhythms differ, but your rules stay identical. That sameness is where confidence lives.

“A single routine across contracts beats a catalog you never touch.”

Futures vs CFDs vs venues in one glance

You will trade better when the tool matches the task. Keep the differences straight and pick the lane that fits your rhythm.

| Dimension | Exchange futures | Commodity CFDs mirroring futures |

| Venue | Central order book on exchange | Broker routed OTC instrument |

| Sizing | Standard or micro contracts | Flexible fractional sizing |

| Hours | Exchange schedule with extended sessions | Often mirrors futures hours, confirm |

| Costs | Commission, exchange, clearing, data | Spread, commission, funding |

| Best for | Strict transparency, deeper book | Small or fractional exposure, off hours tweaks |

Choose the instrument that keeps your process repeatable and your invoice predictable.

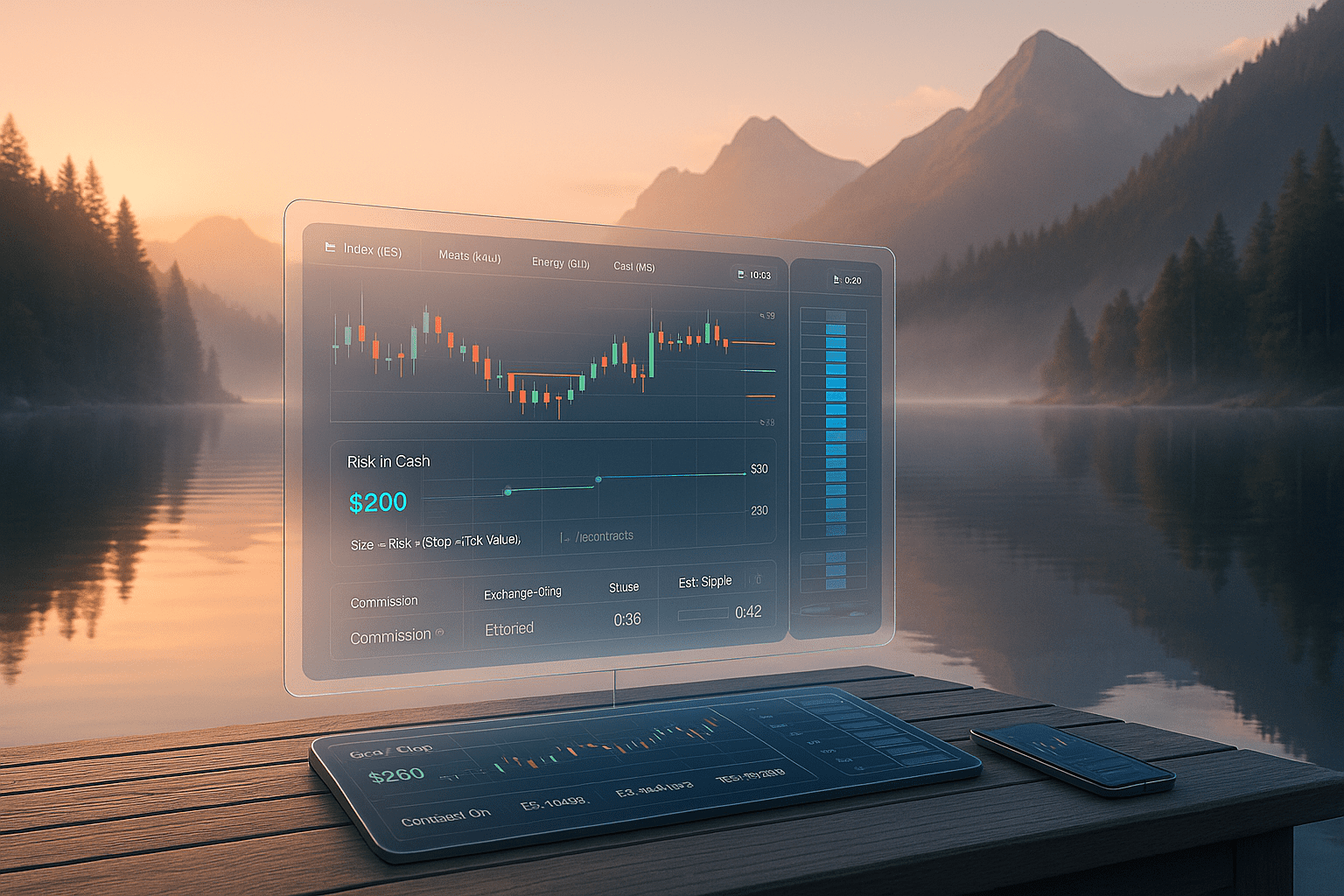

The platform feel that saves energy

A healthy global futures broker does quiet work you can feel in minutes.

- One order ticket for every instrument

- Brackets attach on entry so exits are automatic

- Cash risk preview on the ticket before you click

- Depth of Market or a consistent fill quality proxy

- Symbol specs in cash: tick value, contract value, trading hours, funding rules

- Exportable logs and clean monthly statements

If that list feels boring, good. Boring is what survives volatile weeks.

Sessions and catalysts that actually drive behavior

You do not need every time zone. You need the slice that fits your life and the contracts you trade.

| Lane | Active windows* | Common catalysts | Personality |

| Index futures | Pre market and first cash hour | Earnings, breadth, macro prints | Range break to retest, trend from open |

| Energy futures | Europe morning, US session | Inventories, OPEC tone, growth data | Faster swings, respect slippage |

| Metals futures | London morning, US macro hours | Real rates, USD tone, risk appetite | Trend friendly around data |

| Ags and softs | Contract specific | Weather, crop and stock reports | Quieter stretches with sharp pockets |

*Windows vary by season and venue. Pick one or two and protect them.

“Trade your window, not the whole day.”

Ticket math in plain cash

Let the platform do the arithmetic. You provide a fixed cash risk per trade. Everything else flows from that choice.

Example with micro S&P 500 futures (MES)

- Risk unit: 50 dollars

- Planned stop: 4 ticks equals 1 point

- Tick value: 1.25 dollars per tick on MES

- Risk per contract: 4 × 1.25 equals 5 dollars

- Position size: 50 ÷ 5 equals 10 contracts

The same logic works on micro Nasdaq, gold micros, or energy minis. Consistent math removes hesitation.

“You cannot control the market. You can always control position size.”

Cost lines that decide more than you think

Treat costs like an ingredient list. You will cook better.

| Cost or friction | Where it bites | Practical move |

| Commission per side | Every fill | Choose a tier that matches your average ticket, not dream volume |

| Exchange and clearing | Futures only | Subscribe to exactly what you use, review monthly |

| Market data | Depth and speed | Buy depth if you use it, skip if you do not |

| Slippage | Opens and data minutes | Prefer retests over chasing, use limits when momentum tempts you |

| Funding or swaps | Overnight on CFDs | Hold smaller or switch to exchange futures for multi day carries |

Keep a tiny log of total cost per trade for 20 sessions. Your schedule will naturally drift toward efficient hours and symbols.

Getting started with one platform across commodities

If your goal is to access commodity futures from one platform, make sure the basics feel consistent.

- Contract specs shown in cash terms

- Bracket and OCO orders on all listed commodity products

- Inventory and crop report times in your local timezone

- Swap tables and roll rules linked directly from the ticket

- Partial close supported for scaling out

A unified feel across gold, oil, and grains simplifies the only problem that matters: consistent execution.

Three durable entry frameworks

Definitions must be short enough to follow when your heart rate rises.

Range break and retest

Box the opening range. When the price closes outside, wait for a retest that holds. Enter with the bracket already set. Great for index opens and oil during active windows.

Pullback into value

Identify trends on a higher timeframe. Use VWAP bands or a prior value zone. Enter on the first pullback that pauses. Works well for metals around macro prints.

Quiet session fade

During calm stretches, when price stretches into a well tested band, fade back toward value with small size and firm stops. Keep targets tighter.

“If the entry needs a paragraph to justify it, it is not ready.”

Clean guardrails that protect your month

- Daily loss cap pauses trading until reset

- Max contracts per symbol and per ticket

- Two attempts per idea, then stand down

- Avoid top tier prints unless that is your explicit edge

- Clear on screen messages when limits trigger

Short messages prevent tickets:

“Order blocked. Free margin below threshold. Reduce size or fund.”

“Pause active. Daily limit reached. Resets at 00:00 server time.”

Two realistic routines, numbers included

Metals pullback with fixed risk

- Window: London morning or US macro hours

- Risk: 40 dollars per trade

- Plan: trend confirmation, first pullback into value

- Management: partial at 1R, trail behind structure

- Notes: stand down ten minutes before and after high impact prints unless that is your edge

Oil range break and retest

- Window: Europe morning or US session outside inventory minutes

- Risk: 50 dollars per trade, smaller on report days

- Plan: box the morning range, trade the retest after break

- Management: partial at 1.5R, accept slippage and keep size honest

“Small and repeatable beats big and random.”

Choosing a global futures broker without guesswork

Use a scorecard. Be picky. Evidence beats slogans.

| Category | Weak | Acceptable | Strong |

| Stability | Frequent freezes | Occasional blips | Uptime with public history |

| Cost transparency | Bundled, vague | Partial breakdown | Itemized commission, exchange, clearing, data |

| Ticket quality | Percent only risk | Cash in a hidden tab | Cash risk preview on the ticket |

| Tools | Basic stop orders | Brackets or OCO | Brackets standard, DOM or ladder available |

| Reports and exports | PDFs only | CSV download | API or webhooks with full logs |

| Support tone | Canned replies | Named contact | Fast, example driven answers |

When “Strong” becomes your everyday, your platform fades and your process shines.

Common mistakes and clean fixes

| Mistake | Why it hurts | Fix |

| Chasing first spikes at the open | Poor fills and regret | Wait for retest or first pullback |

| Sizing from memory | Inconsistent risk | Use cash preview and a fixed risk unit |

| Trading every time zone | Decision fatigue | One or two windows, close on time |

| Ignoring roll or reports | Surprise slippage | Calendar alerts with local time, read roll rules |

| Believing headline spreads | False confidence | Screenshot quotes at your hours and compare monthly |

A day that proves the point

Picture a Tuesday. You flag a gold pullback during London hours, size by cash, place the bracket, and let it work. Later, crude breaks its morning box. You size smaller, accept a bit of slippage, and take a partial at 1.5R. Your statement that evening is like your notes. It has clear commission lines, a realistic slippage amount, and no hidden blended fees. That is futures market access online doing what you hired it to do.

One Last Note Before Funding

Write a single risk number you can accept. Choose one index future and one commodity future that trade well in your time frame. Take screenshots of spreads twice a day for a week. If the pictures match your fills, and your statement matches your mental invoice, you have found the right global futures broker. This is the platform you should keep. If not, keep walking until the paper and the platform tell the same story.

FAQ

Is a global futures broker necessary for retail traders

If you want clean access across indices, metals, energy, and ags from a single login, yes. You get consistent tickets, unified statements, and one support team that understands the whole picture.

Can I access commodity futures from one platform alongside index futures

You can when the broker designs for it. Look for bracket orders everywhere, symbol specs in cash, and roll or swap rules linked from the ticket for each contract.

Will costs explode as I add contracts and sessions

Costs rise only if you stop measuring. Track total cost per trade for 20 sessions and prune the hours that do not pay their keep. Buy only the data you use.

Are micros a good start for index and metals exposure

Yes. Micros let you practice your exact routine with survivable risk. Scale size only when your average R stays stable for a month.

Should I trade through major reports

Only if that is your explicit edge. Many traders stand aside ten minutes before and after, then trade the retest when spreads and slippage normalize.

How do I keep my routine consistent across different commodities

Use cash based sizing, limit to two attempts per idea, and run the same bracket logic everywhere. Let the journal teach you which windows to keep.