A strong forex copy trading platform is not a hype machine. It is a clear process. First, you set cash limits. Then, you choose reliable providers. After that, you check for delays and slippage as real costs. This guide explains how to copy forex strategies online easily. It also shows how to find the best forex traders to follow using real evidence, not just screenshots.

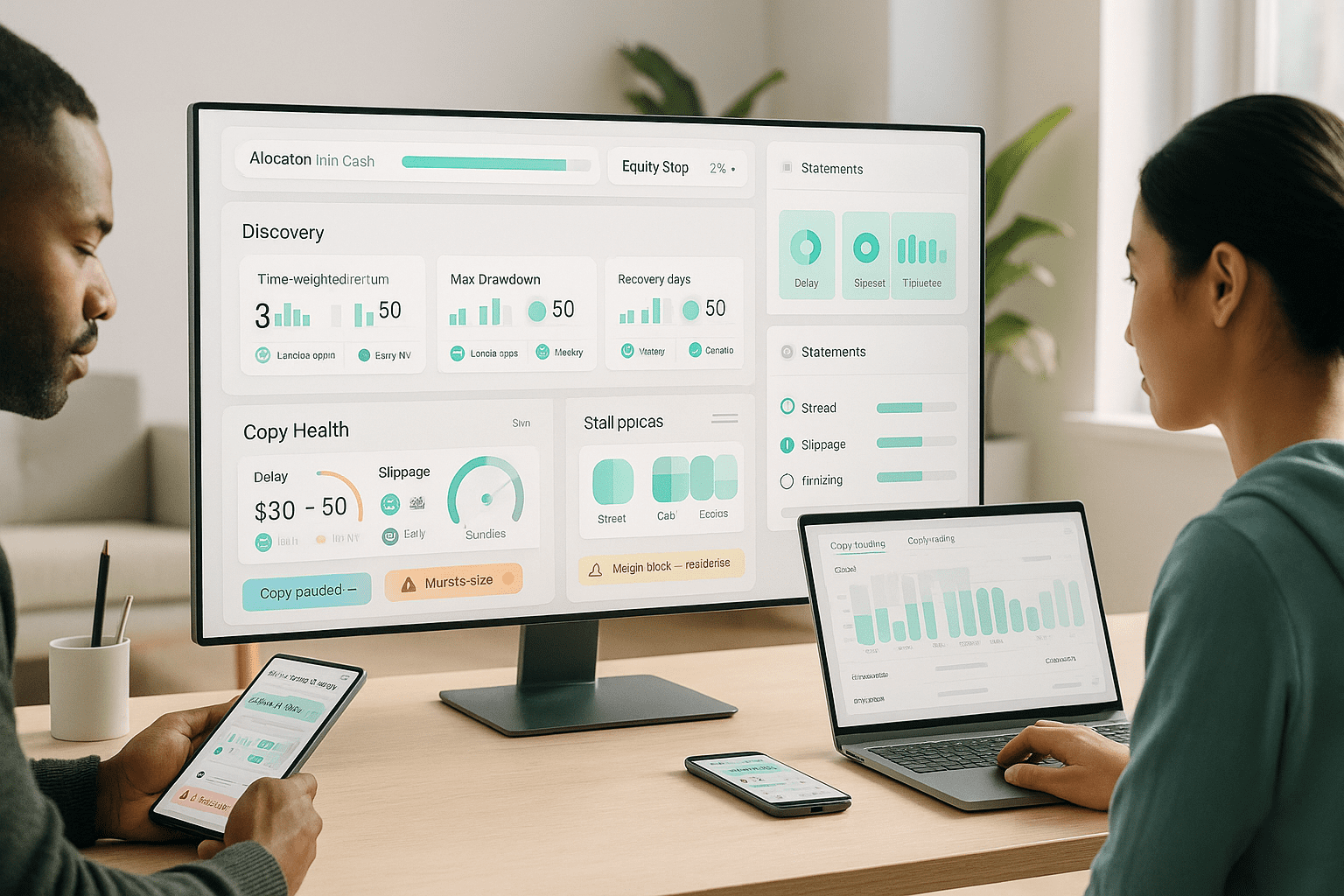

Copy trading links a provider’s live account to your account. When the provider places a trade, your account mirrors the action according to your allocation and caps. Good platforms stamp each event with copy delay, slippage, and cost lines, so your statement matches your mental invoice.

“When the platform and paper tell the same story, trust grows.”

What a forex copy trading platform must get right

| Area | Must have | Nice to have | Red flag |

| Risk controls | Cash allocation, equity stop, per day loss cap | Symbol filters and max open trades | One big on or off switch |

| Visibility | Delay and slippage by symbol and session | Venue choice by asset | Marketing claims without stats |

| Discovery | Returns shown with drawdown and recovery | Filters by method and hold time | Percent returns alone |

| Reporting | Statements plus CSV or API exports | Webhooks for your data stack | PDFs only |

| Status | Incident timestamps and reverts | Postmortems | Silence during stress |

“Choose platforms you can audit, not just admire.”

Copy forex strategies online, step by step

1) Set guardrails before browsing

- Allocation in cash per strategy, not a percent of your whole balance

- Equity stop per strategy, for example 8 percent

- Per day loss cap per strategy, for example 2 percent with auto pause

- Symbol filters that start with majors and gold

Short messages avoid panic:

- “Copy paused. Per day cap reached. Resumes at 00:00 server time.”

- “Order rejected. Free margin below threshold. Reduce size or deposit.”

2) Build a shortlist in five minutes

Use the quick scorecard below. If a profile hides any of these, move on.

| Signal | Good sign | Red flag | Why it matters |

| Return with drawdown | Both visible together | Percent alone | Pairs reward with pain |

| Recovery time | Measured in days or weeks | Hidden or endless | Shows resilience |

| Risk per trade | Stated in cash | Vague percentage | Sets expectations |

| Typical hours | Posted clearly | “Anytime, anywhere” | Aligns with your schedule |

| Notes cadence | Weekly and short | Rare essays | Teaches the method |

3) Start tiny and review weekly

- Copy a single strategy for two weeks

- Compare your fills to the provider’s during your active hours

- Track total cost per trade, delay, and slippage

4) Adjust slowly

- Only scale allocation after two to four steady weeks

- Add a second strategy only when the first behaves in your real window

“Progress is a series of small, boring upgrades.”

Finding the best forex traders to follow

Look for behavior you can live with, not just a great month.

- Stated cash risk per trade that stays consistent

- Drawdown and recovery shown beside returns

- Notes with one good trade, one mistake, one improvement each week

- Stable session hours that match your day

- Clean execution with normal delay and slippage in your window

Fast filter phrases you want to see on a profile

- “Risk per trade 30 to 50 dollars”

- “Active London open and early New York”

- “Pullback into value and range break plus retest”

- “Auto pause after two losses in a day”

Allocation methods in plain language

| Method | Idea | Best for | Watch out for |

| Fixed cash | You set a dollar amount to follow with | Beginners and small accounts | Underuse if set too low at first |

| Equity proportional | Size scales with live equity | More active followers | Swings feel bigger in volatility |

| Percent of master | Fixed slice of provider size | Cohesive cohorts | Rebalance when many join or leave |

Pick one method for the month. Switching mid stream muddies your data.

Costs that matter more than you think

Treat costs like ingredients. You will cook better trades.

| Cost line | Where it appears | Practical move |

| Spread and commission | Every fill | Prefer liquid sessions and avoid chasing breaks |

| Funding or swaps | Overnight holds | Shorten duration or accept carry explicitly |

| Provider fees | Performance or subscription | Favor high water mark for fairness |

| Slippage | Opens and macro minutes | Stand down near prints unless that is your edge |

“Cost clarity turns uncertainty into a choice you can live with.”

Two beginner friendly mixes

Calm starter blend

- Provider A: Trend entries on EURUSD and XAUUSD, hourly rhythm

- Provider B: First hour S&P micro structure for diversification

- Your defaults: Cash allocation per strategy, equity stop 8 percent, per day cap 2 percent, majors and gold only

Expected feel: shallow dips, simple reviews, fewer panic pauses.

Tight risk micro blend

- Fixed cash allocation per strategy

- Symbol filters block exotics

- Auto pause after two failed attempts per day

- Weekly review of delay and slippage by session

Result: steadier curves and predictable costs.

Example day you will recognize

A provider shares a brief plan before London. They trade a gold pullback with a set stop. After the session, they write a two-line recap. Your allocation was small, equity stop set, and the per day cap ready. Copy delay and slippage stayed inside your normal thresholds. That evening your statement lists spread, commission, and funding as expected. This is a forex copy trading platform doing the job you hired it to do.

“Small and repeatable beats big and random.”

Common mistakes and clean fixes

| Mistake | Why it hurts | Clean fix |

| Ranking by percent alone | Encourages leverage and luck | Pair returns with drawdown and recovery |

| All or nothing copying | Oversized risk on day one | Cash allocation with caps and filters |

| Chasing hot streaks | Whiplash and churn | Two week test windows, then decide |

| Ignoring news windows | Slippage and regret | Calendar alerts in local time |

| PDFs only reporting | Slow audits | Use exports or webhooks for raw logs |

Quick checklist to tape near your screen

- Cash allocation set per strategy

- Equity stop and per day cap on

- Symbol filters favor liquid pairs and gold

- One provider to start, journal ready

- Delay and slippage widgets pinned

- Two screenshots and two sentences per week

FAQ

Is a forex copy trading platform only for beginners

No. Beginners gain structure and visibility. Experienced traders use it to diversify or to publish a strategy with transparent fees and logs.

Can I copy forex strategies online and still stay in control

Yes. Set allocation in cash, equity stops, per day caps, and symbol filters before copying starts. Automation should obey your limits.

How do I spot the best forex traders to follow quickly

Check for cash risk per trade, drawdown with recovery time, weekly notes, and session hours that match yours. If any are missing, move on.

How long should the first test last

Two weeks minimum in your real window. Keep size small and track total cost per trade, delay, and slippage before scaling.

Will fees and slippage eat all my returns

Not if you measure and trade liquid hours. Favor high water mark performance fees and avoid chasing during prints.

What is the safest daily rule set

Two attempts per idea, a per day loss cap that pauses copying, and a fixed cash risk per strategy. Those three rules protect your month.

One quiet nudge before you fund

Write a cash number you can accept for each strategy. Set equity stops and a daily cap. Then, choose one disciplined provider who shares weekly notes. If your next two weeks of logs, fills, and statements behave, raise size a little or add a second provider. If not, adjust calmly and let your rules do the heavy lifting.