A dependable forex broker technology provider does more than spin up servers. The right partner provides a daily routine for you. This includes fast onboarding in CRM. It has clear risk controls. There are strong copy trading systems. The infrastructure for online brokers is reliable and stays steady when markets are busy.

This field guide keeps the language human and the steps practical so your first month feels steady instead of chaotic.

“Simple rules, visible limits, clean logs. That rhythm turns launches into businesses.”

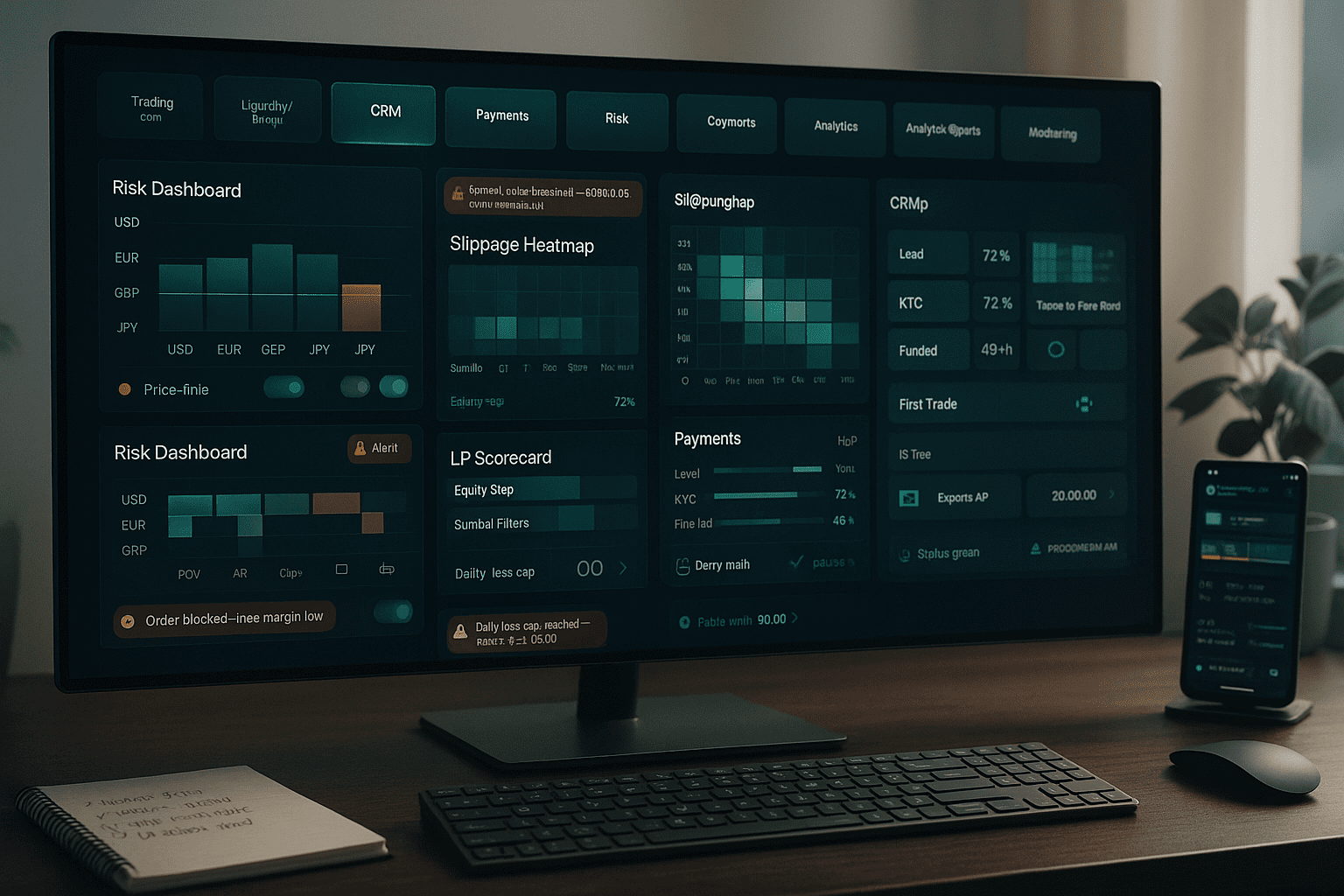

What a technology provider actually does

Think in layers. Keep custom work at the edges and leave core engines standard so upgrades stay painless.

| Layer | Job to be done | Proof you chose well |

| Trading core | Stable execution and order lifecycle | Uptime history, bracket orders, cash risk on ticket |

| Liquidity and bridge | Route flow, handle rejects, aggregate venues | Fill speed and slippage by symbol and session |

| CRM | Leads, KYC, approvals, IB payouts | Onboarding metrics, audit trails, role permissions |

| Payments | Cards, bank rails, local methods, reconciliation | Match PSP and bank daily without drama |

| Risk engine | Pre trade checks, live exposure, hedging | Currency NOP, price collars, caps, kill switch |

| Copy and MAM | Allocation and follower safety | Cash allocation, equity stops, delay and slippage logs |

| Analytics and reports | Statements, exports, webhooks | CSV and API that rebuild results exactly |

| Monitoring | Status page, alerts, postmortems | Timestamps, planned reverts, honest notes |

“Choose platforms you can audit, not just admire.”

CRM that moves accounts without friction

Your CRM is the front door and the ledger of promises. Aim for speed, clarity, and receipts.

- KYC workflows with liveness checks, retries, and clear error messages

- Pipelines that mirror your real operations: Lead, KYC, Funded, First Trade, Retained

- IB and affiliate trees with promo links, tiers, and maker checker on payouts

- Email and push that trigger on events, not calendar guesses

- Permissioning so sales cannot change limits and risk cannot move pricing

KYC metrics to watch

- Pass rate above 70 percent for targeted regions

- Time to first fund under 48 hours

- Abandon reasons tagged in CRM with quick fixes posted weekly

“Friction you can name is friction you can fix.”

Risk that prevents fires instead of fighting them

A believable risk engine lives in three moments: before, during, and after.

Pre trade

- Credit and margin checks

- Max order size per symbol

- Price collars tied to recent median spread

- Velocity throttle per account or IB

At trade

- Slippage bands by symbol and session

- Venue fallback for stale quotes or timeouts

- Circuit breaker for abnormal spreads

Post trade

- Net open position by currency with policy bands

- Auto hedge suggestions and route logging

- Stress tests in cash with one click scenarios

- Statements that separate fees, swaps, and PnL

Short, human messages reduce tickets:

“Order blocked. Free margin below threshold. Reduce size or fund.”

“Spread collar breached on GBPUSD. Routing moved for 3 minutes.”

“Daily loss cap reached. Trading pauses until 00:00 server time.”

Copy trading systems that teach and protect

Great copy trading systems are quiet and predictable. They make good behavior easy for providers and safe for followers.

- Allocation methods you can explain: fixed cash, equity proportional, percent of master

- Follower guardrails on day one: cash allocation, equity stop, per day cap, symbol filters

- Delay and slippage metrics visible by symbol and session

- Verification badges for provider identity and track window

- CSV and API so provider results reconcile to raw logs

“If a follower can explain the risk in one sentence, the feature is ready.”

Infrastructure for online brokers, without the mystery

Your infrastructure for online brokers should read like a flight checklist, not a thriller.

- Redundant regions, managed upgrades, and clear maintenance windows

- Observability for quotes, order lifecycle, and bridge health

- Status page with incident timelines and planned reverts

- Backups tested by restore drills, not just policies

- Least privilege across teams with time boxed elevation

Opening checklist you can run in five minutes

- Status page all green, quotes fresh

- Price collars, caps, and kill switches loaded

- PSP reconciliation matched to bank yesterday

- LP scorecard within band for your session

- Alert test sent to on call devices

Consistency beats intensity.

Implementation timeline that avoids fire drills

| Week | Milestone | What must be true |

| 1 | Scope and contracts | Regions and leverage defined, migration plan agreed |

| 2 | Branding and domains | SSL, client portal theme, platform skins approved |

| 3 | CRM and KYC wiring | Flows live, retries tested, audit logs ready |

| 4 | PSP connections | Sandbox to live switch, daily recon scripts pass |

| 5 | Risk and bridge rules | Price collars, caps, and routing written down |

| 6 | Copy trading systems pilot | Two providers, 50 followers, metrics visible |

| 7 | Status and runbooks | Incident templates, on call rotation, alert tests |

| 8 | Soft launch | Demo cohort trading, change log posted weekly |

| 9 | Live cutover | Limited invite, daily reviews, fast fixes only |

“Add one new variable at a time. Measure it. Keep it or cut it.”

Cost model in round numbers

Plan for setup, base, and usage. Buy only what you will use in the next quarter.

| Cost line | Typical pattern | Notes to check |

| Platform setup | One time | Branding, servers, basic training |

| Monthly base | Tiered by account count | Step up when metrics justify it |

| Bridge and LP | Fixed plus per million | Model real volume, not wishful charts |

| CRM and KYC | Per seat and per verification | Negotiate region by region |

| PSP fees | Percent and fixed per transaction | Blend rails to lower effective rate |

| Copy trading systems | Module fee | Turn on after you stabilize execution |

| Add ons | Risk plugins, analytics | Buy only what shortens tickets or speeds audits |

Cost clarity turns uncertainty into a choice you can live with.

KPIs that predict a quiet month

| KPI | Healthy signal | Why it matters |

| KYC pass rate | Above 70 percent for target regions | Reveals onboarding friction |

| Time to first fund | Under 48 hours | Confirms funnel clarity |

| Execution health | Delay and slippage inside thresholds | Keeps promises honest |

| Copy health rate | Above 95 percent inside delay band | Follower trust |

| Tickets per 100 funded | Downtrend over 60 days | Docs and product are teaching |

| Withdrawal window | Inside published timeline | Brand trust and referrals |

Publish a trimmed scoreboard every Monday. Radical clarity improves judgment.

Security and compliance that stay out of the way

- Enforce least privilege and maker checker on payouts

- Record client state at decision time for audits

- Keep risk warnings readable everywhere funds move

- Localize leverage, symbols, and disclosures by country

- Run quarterly drills on incident notes and withdrawal flows

“Auditors love receipts. So will your future self.”

Two launch plays that actually work

Lean entry with strong fundamentals

- MT5 or cTrader WL, majors and gold to start

- CRM with KYC and IB basics, two PSP rails

- Price collars and per account caps in writing

- Goal: fast trust, fast lessons, quiet ops

Scale and diversify after the first quarter

- Add indices and selected stocks, not the whole catalog

- Turn on copy trading systems for proven providers only

- Expand PSPs to cover local rails in growth regions

- Goal: depth before breadth, then thoughtful breadth

Common pitfalls and clean fixes

| Pitfall | Why it hurts | Clean fix |

| Buying every module at once | Cost bloat, staff overload | Phase features behind metrics |

| Percent only performance claims | Churn and disputes | Show drawdown and recovery beside returns |

| PDFs as the only report | Slow audits | Offer CSV and API parity with statements |

| Silence during incidents | Rumors beat truth | Status page, timestamps, planned reverts |

| Vague risk policies | Dealers improvise | One page bands, caps, and hedging routes |

“Progress shows up as small, boring upgrades.”

London opens. CRM shows overnight KYC passes with a short queue. Risk dashboard flags mild GBP concentration and nudges a hedge to policy. Copy feed runs with two verified providers, each using cash allocation and equity stops. Finance reconciles PSP and bank by lunch with zero mismatches. Support closes three tickets using links to status notes and clear rules. Nothing dramatic. Everything is traceable. That is a healthy forex broker technology provider doing the job you hired it to do.

FAQ

What should I expect from a forex broker technology provider on day one

Stable execution, usable CRM flows, clear risk controls, and exports that match statements. If you cannot rebuild results with raw data, keep looking.

How important is CRM in the first quarter

Critical. CRM drives KYC pass rates, time to first fund, IB payouts, and transparency. It is the hub for your operations, not just a contact list.

What risk controls matter most at launch

Price collars, per account caps, daily loss limits, exposure bands by currency, and a kill switch. Write them in one page and test them weekly.

Do we need copy trading systems from the start

Not necessarily. Stabilize execution first. Add copy when you have providers willing to post weekly notes and operate inside delay and slippage bands.

How do we test infrastructure for online brokers without breaking things

Run drills. Kill switch by symbol for 5 minutes. Simulate an LP outage. Reconcile PSP with fake mismatches. Perform a full restore test from backups.

How do we keep costs from creeping up

Track cost per funded account and cost per active. Buy modules that reduce tickets, shorten audits, or increase verified deposits. Cut the rest.