You do not need a maze of screens to make commodities CFD trading work, but one routine that works for both metals and energy. You also need a ticket that shows cash risk before you click. Finally, you want statements that match your mental invoice.

If you want to trade gold and oil online calmly, the key is a simple plan and a reliable platform.

“If you can explain the risk in one sentence, the trade is ready.”

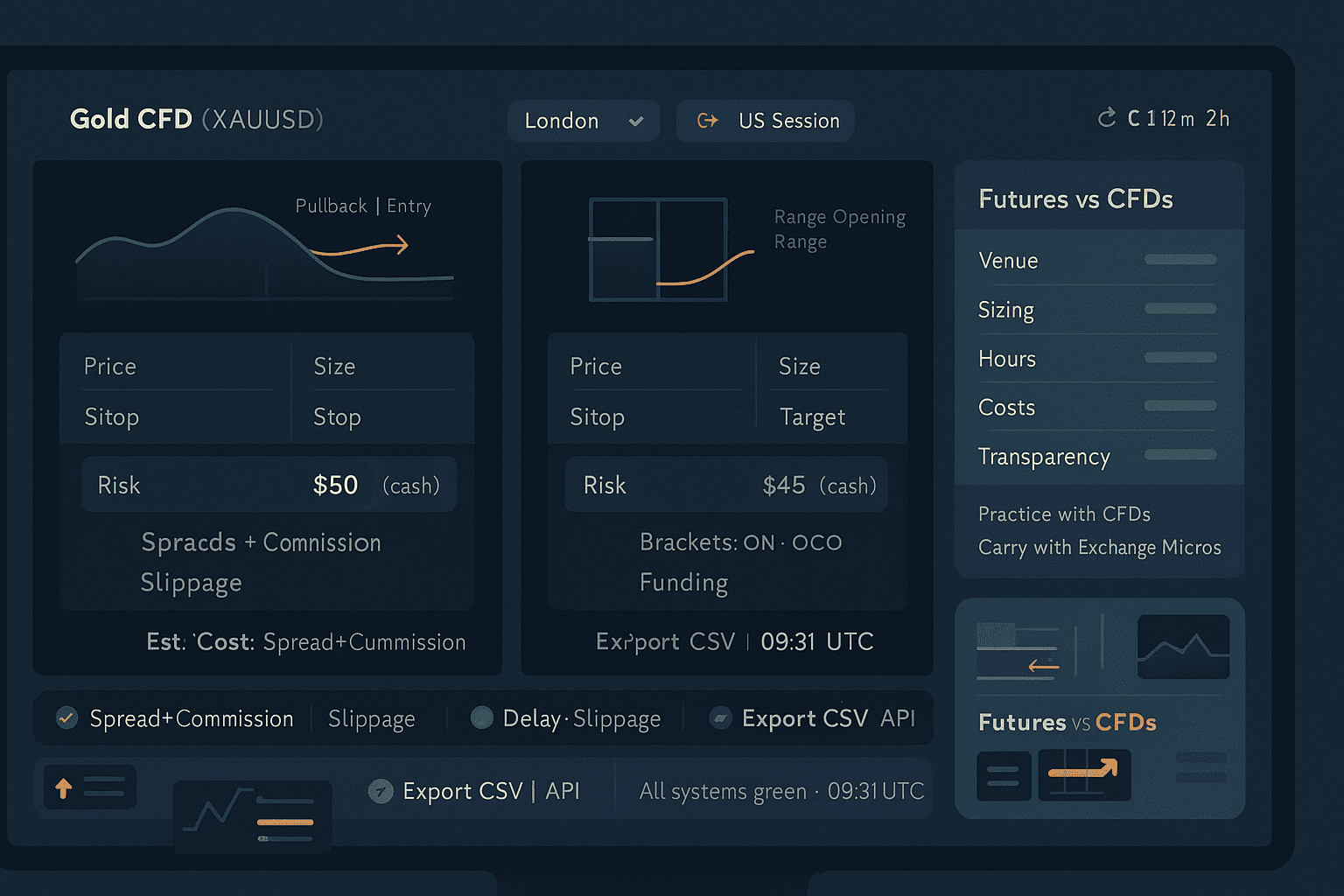

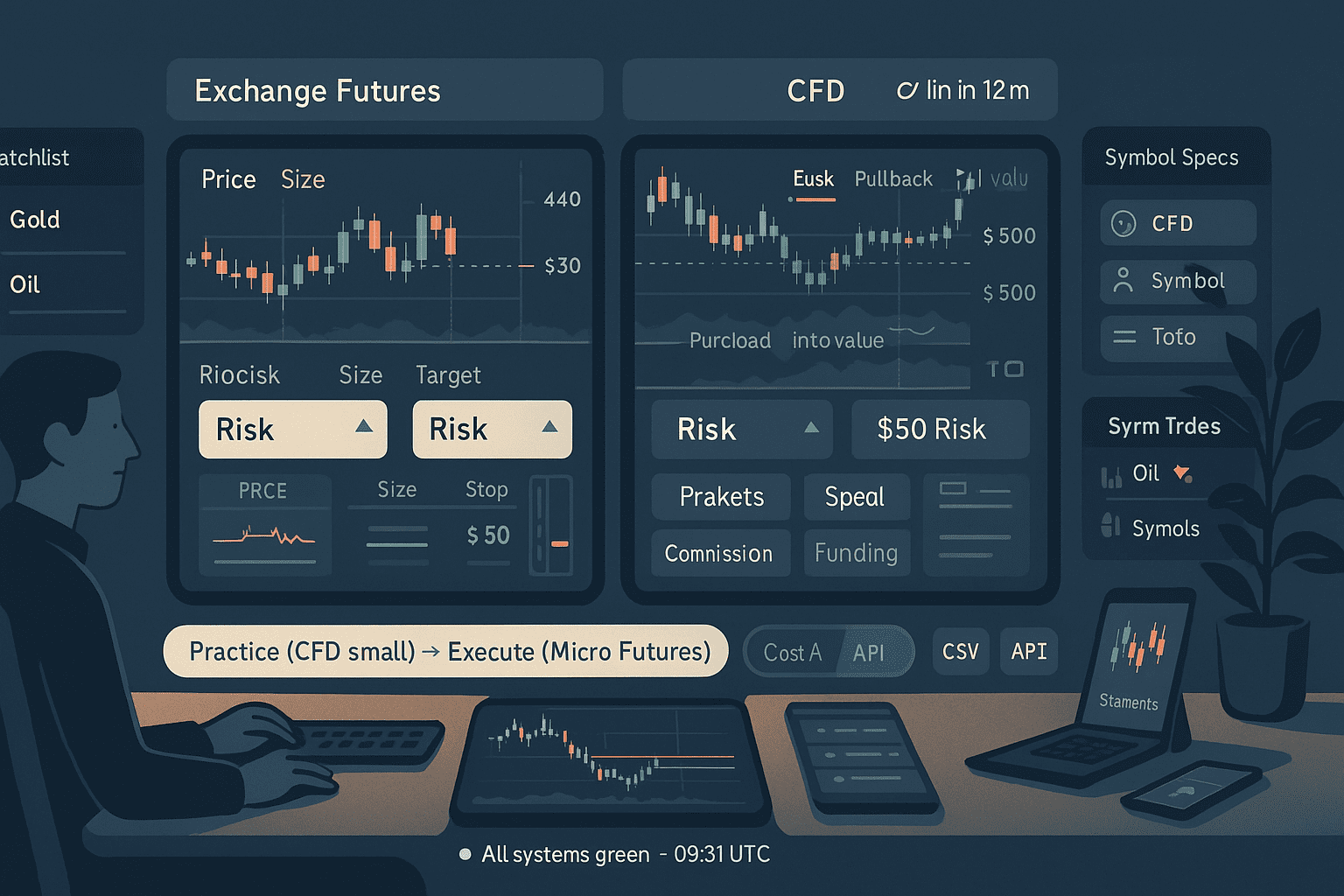

Futures vs CFDs for commodities, side by side

| Dimension | Exchange futures | Commodity CFDs |

| Venue | Central order book | Broker routed instrument |

| Sizing | Standard or micro contracts | Fractional sizing possible |

| Hours | Exchange schedule with extended sessions | Often mirrors futures hours, confirm |

| Costs | Commission, exchange, clearing, data | Spread, commission, funding |

| Transparency | Depth and tape | Broker quotes with quality metrics |

| Best fit | Multi day carries and deep book | Smaller accounts and quick tests |

You can mix the two. Many traders practice timing with CFDs, then carry longer moves on exchange micros once behavior is proven.

How to trade gold and oil online without drama

Keep definitions short so they hold up when price speeds up.

Range break and retest

Box the first minutes. If the price closes outside the box, wait for a clean retest. Enter with a bracket already attached. This travels well on XAUUSD and US oil CFDs during active hours.

Pullback into value

Confirm direction on a higher timeframe, mark a value zone or VWAP band, and take the first pullback that pauses. Works on gold around macro prints and on oil after inventories settle.

Quiet session fade

When the tape gets calm, the fade stretched moves back toward value with small size and firm stops. Tighten targets. Protects the month when volatility dips.

“If the entry needs a paragraph to justify it, it is not ready.”

Ticket math in plain cash

Let the platform do arithmetic. You set the dollar risk and let size follow.

Gold CFD example where 0.01 equals 1 dollar

- Risk unit: 50 dollars

- Stop distance: 0.50

- Risk per contract: 50 dollars

- Position size: 1 contract

Oil CFD example

- Risk unit: 45 dollars

- Stop distance: 0.30

- Tick value example: 0.01 equals 1 dollar

- Risk per contract: 30 dollars

- Position size: 45 ÷ 30 equals 1.5 contracts

“You cannot control the market. You can always control position size.”

Costs that decide more than you think

Treat costs like ingredients. Measure them for twenty sessions and better habits will follow.

| Cost line | Where it bites | Practical move |

| Spread plus commission | Every fill | Trade liquid minutes and avoid chasing breaks |

| Slippage | Opens and macro minutes | Prefer retests and use limits when speed tempts you |

| Funding or swaps | Overnight CFD holds | Shorten duration or use exchange futures for carries |

| Data or tools | Extras you rarely use | Keep only what changes outcomes |

“Cost clarity turns uncertainty into a trade you can choose.”

Track total cost per trade for gold and oil separately. Your schedule will drift toward efficient hours on its own.

Traits of the best platform for commodity trading

A great venue is predictable rather than flashy. If you want the best platform for commodity trading, check these boxes.

- Cash risk preview on every order ticket

- Brackets and OCO by default so exits are automatic

- Symbol specs in cash terms for tick value, contract value, hours, and funding rules

- Delay and slippage widgets by symbol and session

- Exportable logs and, ideally, an API to rebuild statements

- Status page with incident timestamps and reverts

When those feel normal, your platform fades and your process shines.

A short routine that travels across gold and oil

Before your window

- Mark yesterday’s high and low plus overnight extremes

- Note two catalysts in local time

- Write your cash risk per trade on a sticky note

During

- Two attempts per idea, then stand down

- Use brackets so stops and targets place with the entry

- Screenshot before and after, write one line reason in and one line reason out

After

- Tag the trade by setup and session

- Log spread, commission, any slippage, and funding if held

- Close on time

Consistency beats intensity.

Two realistic mixes for your first month

Gold first, oil second

- Windows: London morning for gold, early US session for oil

- Risk: 50 dollars on gold, 45 dollars on oil

- Plan: pullback into value on gold, box to retest on oil after the first burst

- Why it works: clear windows, distinct rhythms, one ticket logic

Oil first, gold confirmation

- Windows: Europe morning on oil, US macro hour on gold

- Risk: 40 to 50 dollars per trade

- Plan: range break and retest on oil, quiet session fade on gold when pace drops

- Why it works: avoids overlapping exposures while keeping the rules identical

Common mistakes and clean fixes

| Mistake | Why it hurts | Clean fix |

| Chasing the first spike on inventories or CPI | Poor fills and regret | Wait for the retest after the print |

| Sizing from memory | Inconsistent risk | Use cash preview and fixed risk per trade |

| Trading every minute of every session | Decision fatigue | Two windows only, then close |

| Ignoring funding costs overnight | Slow edge erosion | Know the funding schedule and match hold time |

| Believing landing page spreads | False confidence | Screenshot quotes in your hours and compare monthly |

“Progress is a series of small, boring upgrades.”

A day you will recognize

Picture a Tuesday. London sets a tone and gold pulls back into value. You size by cash, click once, and the bracket attaches. Ninety minutes later the US pre market wakes up, oil breaks a small box and retests. Same ticket, same math, smaller size. By evening your statement lists spread, commission, and any funding exactly how you expected. No creative labels. No guesswork. That is commodities CFD trading doing the job you hired it to do.

FAQ

Is commodities CFD trading suitable for small accounts

Often yes. Fractional sizing lets you practice a routine without oversizing. As confidence grows, you can keep the same rules on exchange micros for longer carries.

Can I trade gold and oil online from one login

Yes if the venue keeps one ticket grammar, shows cash risk on the ticket, and supports brackets by default. That makes rotation calm.

What is the safest daily rule set

Two attempts per idea, a per day loss cap, and fixed cash risk per trade. Those three rules protect the month.

Will funding costs ruin overnight trades

They can if you ignore them. Match instrument to hold time and log funding lines for a month. If carries do not pay their keep, shorten duration or change wrapper.

Do I need depth of market for CFDs

Only if your method depends on it. Many CFD routines work fine with clean charts, value zones, and bracket orders. Buy tools that change outcomes, not decoration.