You do not need a sprawling tech project to open a brokerage. You need a broker startup solution that bundles the essentials, a team that follows a short checklist, and a plan you can run daily.

With the right full broker setup service, it is realistic to launch a broker in 30 days without drama. This playbook keeps the language plain and the steps practical so your first month feels steady instead of chaotic.

“Simple rules, visible limits, clean logs. That rhythm turns a launch into a business.”

What a complete full broker setup service includes

Think in layers. Keep custom work at the edges and leave engines standard so upgrades stay painless.

| Layer | Job to be done | Fast signs you picked well |

| Trading platform WL | Familiar UX, steady execution | Brackets standard, cash risk on ticket |

| Liquidity and bridge | Aggregate venues, route smart | Slippage and reject stats by symbol and session |

| CRM and KYC | Onboard, verify, track partners | Liveness checks, retries, IB trees, audit trails |

| Payments | Cards, bank rails, local methods | Daily reconciliation that matches the bank |

| Risk engine | Caps, collars, exposure bands | One screen for currency NOP and kill switches |

| Copy or MAM (optional) | Safe distribution for strategies | Cash allocation, equity stops, delay logs |

| Reporting | Statements and raw exports | CSV and API that rebuild results exactly |

| Monitoring | Status, alerts, postmortems | Incident timestamps and planned reverts |

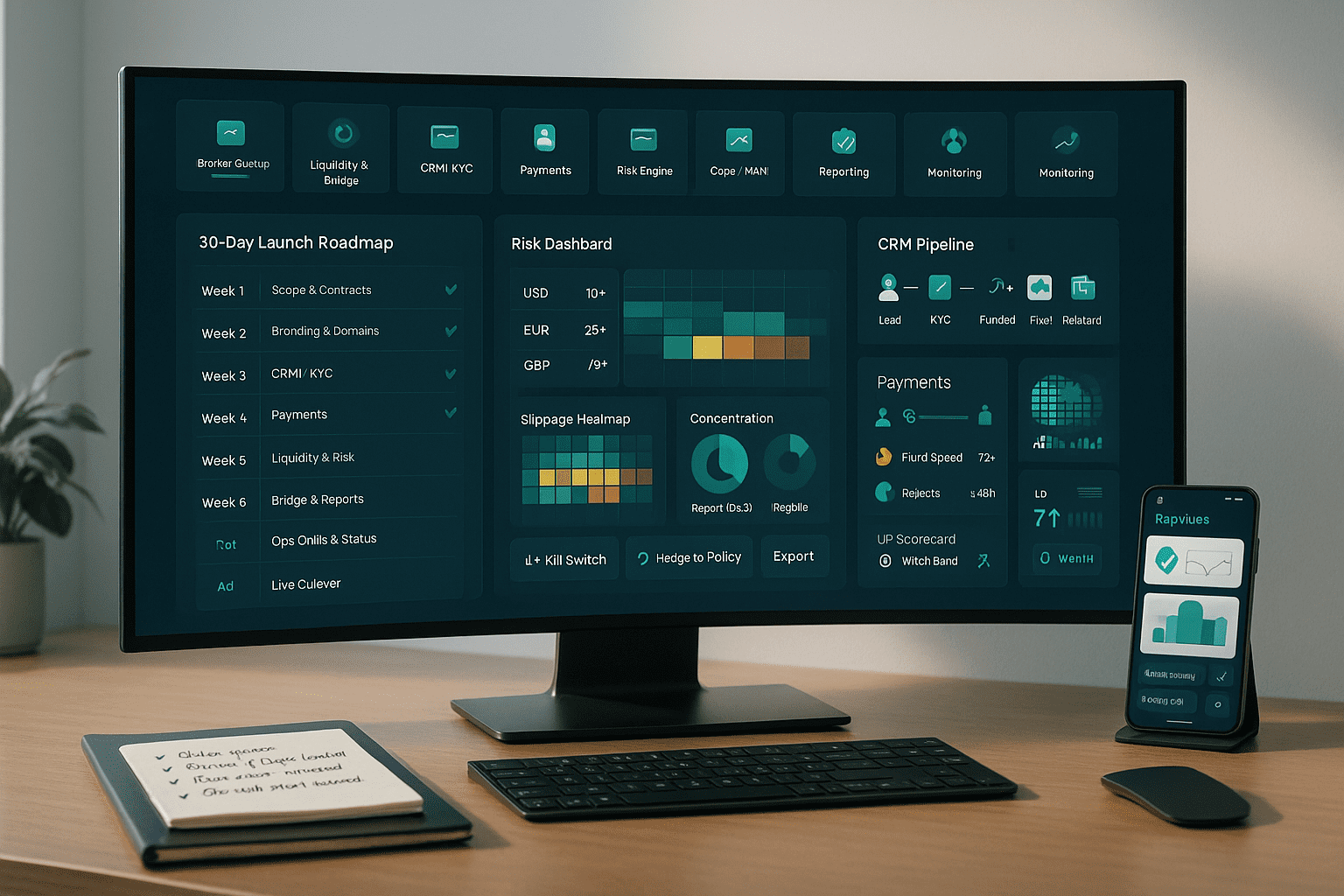

The 30 day plan that avoids fire drills

Use this week by week path. No detours.

| Week | Milestone | What must be true |

| 1 | Scope and contracts | Regions, leverage, symbols, PSP list, go live date set |

| 2 | Branding and domains | SSL, platform skins, client portal theme approved |

| 3 | CRM and KYC wiring | Flows live, liveness and retry paths tested, logs visible |

| 4 | Payments online | Sandbox to live switch, daily recon script passes |

| 5 | Liquidity and risk | Price collars, per account caps, exposure bands in writing |

| 6 | Bridge tuning and reports | Reject taxonomy clear, exports match sample statements |

| 7 | Ops drills and status | Kill switch test, incident template, on call rotation |

| 8 | Soft launch | Demo cohort, IB links live, change log posted twice |

| 9 | Live cutover | Limited invite, daily reviews, fixes only from runbook |

Yes, you can launch a broker in 30 days when the vendor is prepared and your scope stays tight.

Controls to write in one line each

Short rules invite consistent enforcement.

- Per day loss cap per client that pauses trading

- Price collars tied to recent median spread per symbol

- Max order size and velocity throttle per account or IB

- Symbol allow lists by region and experience

- Exposure bands by currency with a hedge to policy button

- Kill switch by symbol, group, or venue with a clear revert

Short messages prevent tickets:

“Order blocked. Free margin below threshold. Reduce size or fund.”

“Spread collar breached on GBPUSD. Routing moved for 3 minutes.”

“Daily loss cap reached. Trading pauses until 00:00 server time.”

Your risk dashboard at a glance

Design it for one screen comprehension.

| Widget | Purpose | Healthy signal | Action if red |

| Currency NOP bars | Book risk by currency | Inside policy bands | Hedge to band, adjust routing |

| Slippage heatmap | Quality by symbol and hour | Green in core hours | Review LP mix or widen collars briefly |

| Reject taxonomy | Reasons you can fix | Margin and stale quote lead | Tune credit, price bands, or venue |

| Concentration table | Top clients or IBs by exposure | Even distribution | Raise caps or shift book briefly |

| A or B dial | Flow mix vs policy | Stable track | Toggle hybrid for a symbol with notes |

| Alerts inbox | Human readable rules firing now | Short, timestamped | Click to run playbook or pause symbol |

Cost model in round numbers you can defend

Plan for setup, base, and usage. Buy only what you will use in the next quarter.

| Cost line | Typical pattern | Notes to check |

| WL platform setup | One time | Branding, servers, initial training |

| Monthly platform | Tiered by account count | Step up only when metrics justify |

| Bridge and LP | Fixed plus per million | Model real volumes, not dreams |

| CRM and KYC | Per seat and per check | Negotiate per region and expected pass rates |

| PSP fees | Percent and fixed per transaction | Blend rails to lower effective rate |

| Risk and analytics add ons | Module fee | Buy only what shortens tickets or audits |

| Copy or MAM | Module fee | Turn on after steady execution |

Cost clarity turns uncertainty into a choice you can live with.

Operations rhythm that keeps rooms calm

Daily opening checklist

- Status page green, quotes fresh

- Collars, caps, and kill switches loaded

- Prior day PSP reconciliation matches bank

- LP scorecard within band for your session

- Alert test delivered to on call devices

Weekly

- Slippage and rejects by symbol and hour

- Top 10 tickets with fixes documented

- Change log mailed to staff and partners

Monthly

- Recalibrate policy bands from realized volatility

- Playbook drill for outages and forced A book windows

- Fee and payout audit with maker checker

Consistency beats intensity.

CRM that moves accounts without friction

Your CRM is the front door and the ledger of promises.

- Liveness checks and retry links reduce drop offs

- Pipelines map your journey: Lead, KYC, Funded, First Trade, Retained

- IB and affiliate trees with promo links and payout ledgers

- Event based emails and push, not calendar spam

- Role permissions so sales cannot change limits and risk cannot change pricing

KYC health metrics

- Pass rate above 70 percent in target regions

- Time to first fund under 48 hours

- Abandon reasons tagged and fixed weekly

Optional copy trading that teaches and protects

Turn on managed features only after execution is steady.

- Allocation methods you can explain: fixed cash, equity proportional, percent of master

- Follower guardrails on day one: cash allocation, equity stop, per day cap, symbol filters

- Delay and slippage per follower visible by session

- Verification badges for provider identity and track window

- CSV and API that reconcile results

“If a follower can explain the risk in one sentence, the feature is ready.”

People and roles you truly need in month one

- Ops lead: owns runbooks, status notes, and weekly change log

- Risk dealer: watches exposure, approves hedges, tunes collars

- CRM owner: unblocks KYC and owns pass rate and TTF metrics

- Payments and finance: reconciles PSP to bank, picks mismatches fast

- Support lead: closes the loop with example links instead of essays

Start learning. Hire once tickets per 100 actives trend down and volume justifies it.

KPIs that predict a quiet month

| KPI | Healthy signal | Why it matters |

| KYC pass rate | Above 70 percent | Reveals onboarding friction early |

| Time to first fund | Under 48 hours | Confirms funnel clarity |

| Execution health | Delay and slippage inside threshold | Keeps promises honest |

| Exposure inside policy | 95 percent of hours green | Matches rules to reality |

| Tickets per 100 funded | Downtrend over 60 days | Docs and product are teaching |

| Withdrawal window | Inside published timeline | Trust and referrals |

Publish a trimmed scoreboard every Monday. Radical clarity improves judgment.

Common pitfalls and clean fixes

| Pitfall | Why it hurts | Clean fix |

| Buying every module at once | Cost bloat and staff overload | Phase features behind metrics |

| Percent only marketing claims | Churn and disputes | Pair returns with drawdown and recovery |

| PDFs as the only report | Slow audits | Offer CSV and API with statement parity |

| Silence during incidents | Rumors beat truth | Status notes with timestamps and reverts |

| Vague risk policies | Dealers improvise | One page bands, caps, and hedging routes |

Write one page that lists regions, symbols, leverage, and policy bands. Ask vendors to demo cash risk on the ticket, itemized costs, exports that rebuild statements, and a status page with real incidents. If they can show those four in five minutes, you probably found a full broker setup service. This service will help you launch a broker in 30 days and feel good after the ribbon cutting.

FAQ

Can a small team really launch a broker in 30 days

Yes with a tight scope, a prepared vendor, and a week by week plan that defers non essentials. Stability first, features second.

Which controls matter most on day one

Price collars, per account caps, currency exposure bands, and a kill switch. Write them clearly and test weekly.

What should I demand from reporting

Statements in the portal plus CSV and API that rebuild results exactly. If platform and paper disagree, keep walking.

How important is CRM in the first quarter

Critical. CRM drives KYC pass rate, time to first fund, and IB payouts. It is the hub for operations, not just a contact list.

When should I enable copy or MAM

After a quarter of steady execution. Start with providers who post weekly notes and operate inside delay and slippage bands.

How do I keep costs under control

Model real volume, track cost per funded account and cost per active, and buy modules that reduce tickets or speed audits. Cut the rest.