You want the best forex trading platform for currency pairs for real life, not a glossy ad. On busy days you need a quiet ticket that shows cash risk before you click, routes orders cleanly, and produces statements that match exports line by line.

This guide defines what “best” should mean, shows how to start forex trading with low deposit safely, and explains what to expect from platforms to trade USD, EUR, GBP and JPY pairs without surprises.

Quick take

- One login, one order ticket, one cash risk number per trade

- Brackets attach by default so exits stay honest

- Costs measured for twenty sessions, not one headline

- A broker layer that answers during your trading hours

Choose tools you can audit, not just admire.

What “best” looks like in real life

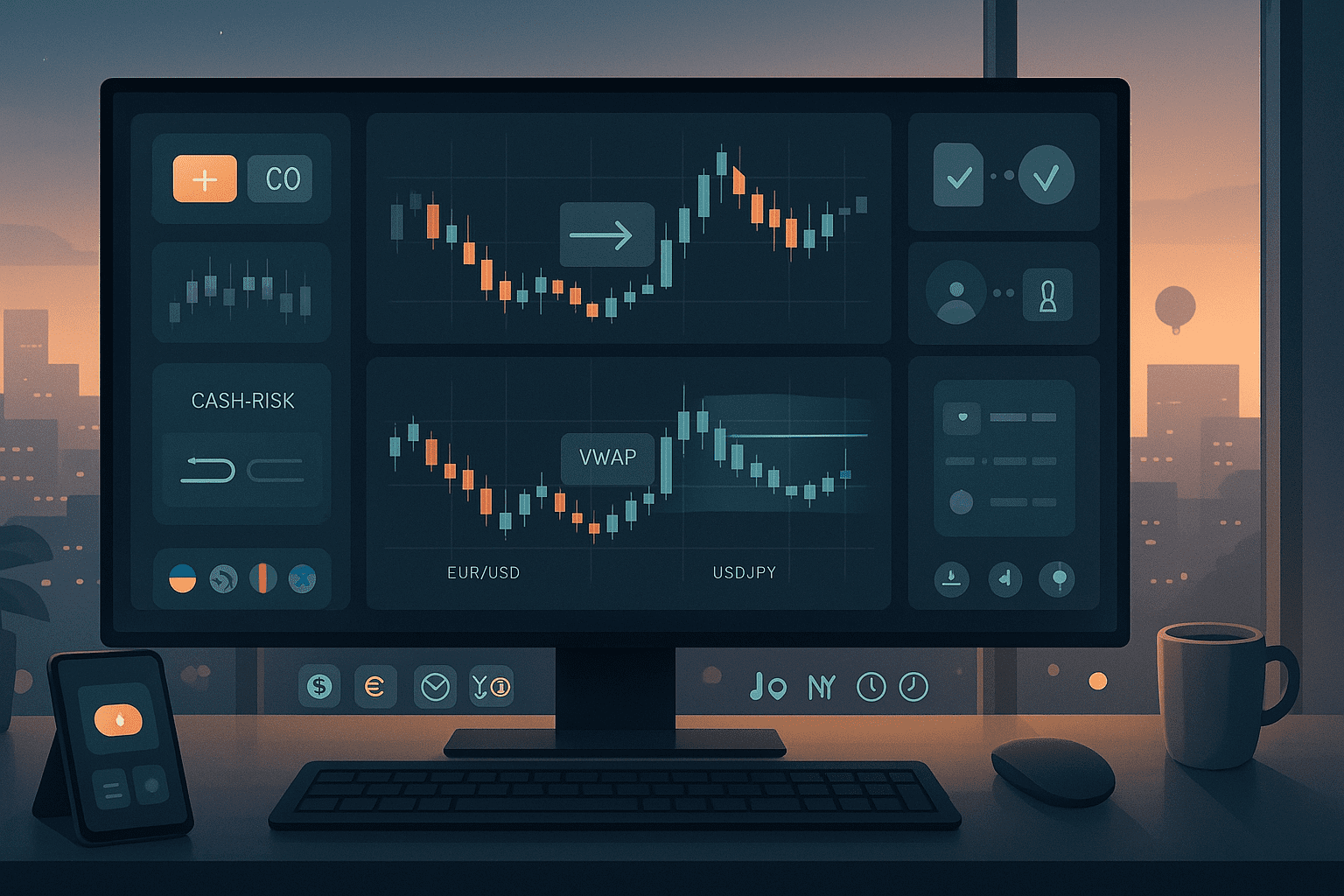

| Area | Must-have behavior | Why it matters |

| Order ticket | Cash risk preview, OCO brackets, market-if-touched | Prevents accidental oversizing and late exits |

| Charting | Sessions, VWAP, price and time alerts | Context beats indicator noise |

| Risk controls | Per day loss cap, max size, symbol and session filters | Small mistakes stay small |

| Mobile parity | Same ticket logic on phone and desktop | No second learning curve |

| Reporting | Statement totals equal CSV or API exports | Debates end in minutes |

| Status and incidents | Public timelines with start, fix, and planned revert | Calm communication during stress |

If a demo cannot show these in ten minutes, live will not be kinder.

Platforms to trade USD, EUR, GBP and JPY pairs

The majors are your workhorses. You need a platform that treats them like first class citizens.

| Pair group | Liquidity rhythm | Ticket features to demand | Notes that help |

| USD majors (EURUSD, GBPUSD, USDJPY) | Best during London and New York overlap | Cash risk on ticket, bracket presets, quick partial close | Tight spreads when sessions overlap |

| EUR crosses (EURGBP, EURJPY) | Strong in Europe into early US | Price collars, session filters, clear tick values | Watch news prints and rolls |

| GBP crosses (GBPJPY, EURGBP) | Volatile around UK releases | Per day cap, max position size, clean slippage reports | Reduce size on hot minutes |

| JPY crosses (USDJPY, EURJPY) | Asia session plus overlap hours | One click hedge or flat, alert templates | Respect Tokyo lunch lull and US prints |

Checklist for majors support

- Symbol specs in cash terms for USD, EUR, GBP, JPY pairs

- Typical spread bands by session, not just averages

- Slippage stats in overlap hours and during prints

- CSV export that equals the statement without edits

How to start forex trading with low deposit

Small capital can work when the rules are simple and visible.

- Pick two pairs from USD, EUR, GBP, JPY groups that match your hours

- Lock a fixed cash risk per trade such as 10 to 30 dollars

- Use the smallest contract size your platform allows and avoid leverage creep

- Attach brackets by default so stops and targets are automatic

- Trade only your real session for 7 to 10 days before adding size

- Journal two lines after each trade with a marked screenshot

- Export and reconcile fills so totals equal your statement

“Cash sizing first, direction second.”

Micro sizing example

- Risk per trade: 20 dollars

- Planned stop: 10 pips

- Dollar per pip at micro size: 0.10

- Position size = 20 ÷ (10 × 0.10) = 20 micro lots

Two simple setups that travel across majors

Opening drive pullback

In your active window, mark the first directional push on EURUSD or GBPUSD. Wait for a shallow pullback that pauses at a nearby level and enter with a bracket attached. This avoids chasing the first burst.

Pullback into value

Confirm direction on a higher timeframe for USDJPY or EURJPY. Mark a value band such as VWAP. Take the first measured pullback that pauses. Stops stay honest on fast JPY crosses.

Short definitions survive loud markets.

Costs decide more than headlines

Track real numbers for twenty sessions so your comparison is honest.

| Cost line | Where to look | Practical move |

| Spread and commission | Ticket preview and actual fills | Trade overlap windows, avoid chasing |

| Slippage | Fill minus expected price | Favor retests, size down near prints |

| Funding or swaps | Overnight holds on majors and crosses | Match hold time to cost or use day holds early on |

| Data and platform fees | Bundles you actually use | Keep only what changes outcomes |

| Payments | Deposit and withdrawal timelines and fees | Write the steps in your notes to avoid surprises |

“Cost clarity turns uncertainty into a choice you can live with.”

Daily workflow that keeps you steady

Before the window

- Check the status page and spreads on your two pairs

- Set your cash risk preset on the ticket

- Review the day’s prints in your time zone

During

- One setup per session, two attempts max

- Brackets on by default

- Screenshot the plan before you click

After

- Save before and after images and two journal lines

- Export fills and confirm totals equal your statement

- Adjust weekly, not mid session

“Progress is a series of small, boring upgrades.”

FAQ

What is the single most important feature for beginners

Cash risk displayed on the order ticket before submit. If you cannot see dollars, everything else is guesswork.

Can I trade majors with a very small balance

Yes if you use micro sizing, fixed cash risk, and strict per day caps. Focus on EURUSD or USDJPY during liquid minutes.

How long should I stay on demo

Seven to ten sessions in your real hours reveal spread behavior, slippage, and export quality. Extend if conditions were unusually quiet.

Do platforms to trade USD, EUR, GBP and JPY pairs differ much

The core tools are similar, but reporting quality and support speed vary. Prioritize export parity and human support in your hours.

When should I scale

After two calm weeks where costs, rules, and your notes match the plan. Increase slowly and keep the per day cap.

A gentle nudge before you commit

Write a one page plan with your session, fixed cash risk, two setups, and the three numbers you will track for twenty sessions: spread, slippage, export parity. Then pick the best forex trading platform for currency pairs that helps you run that plan with quiet consistency.