MetaTrader 5 (MT5) is often described as “the next step” after MT4, but that framing misses the point. The real value is that MT5 is built for broader market coverage, richer order handling, and a platform architecture that supports more complex workflows. If you’re weighing the advantages of a MetaTrader 5, it helps to judge it the same way you’d judge any trading tool: does it match your style, your markets, and the way you like to manage risk?

MT5 can make a lot of sense if you want trading in multiple markets from a single environment and you care about workflow consistency. That said, the platform itself doesn’t grant market access. Whether you can do trading real stocks and futures depends on your broker, the products they offer, and the regulatory setup behind your account. MT5 is the interface and tooling layer, not the permission slip.

“A platform improves your process. It does not replace your process.”

This guide covers what MT5 does well, where it can frustrate people, and how to decide if it fits your goals.

MT5 in plain language

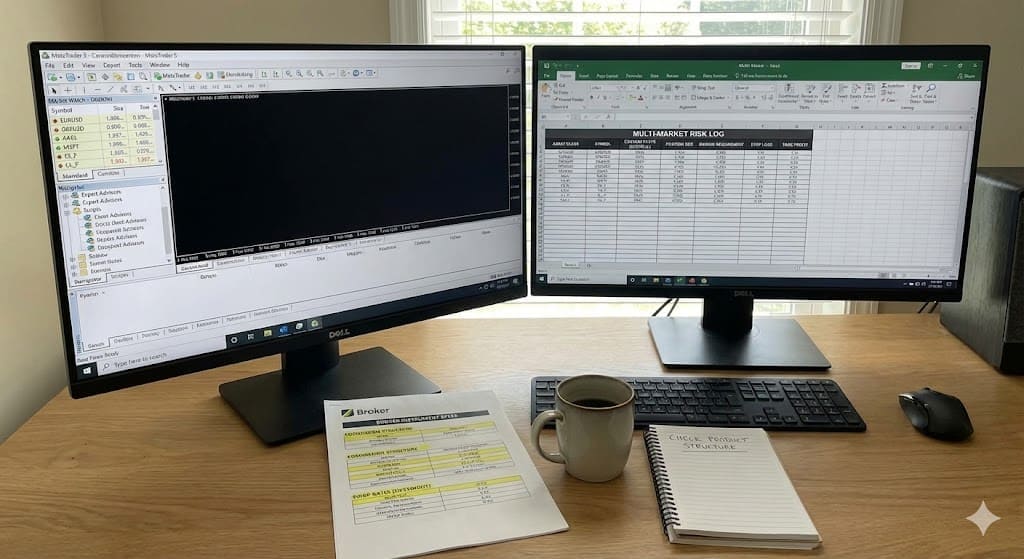

MT5 is a trading platform that brokers can offer as the front-end for placing orders, managing positions, charting, and running automated tools. Most traders interact with:

- The desktop terminal

- Reb terminal

- Mobile apps

- Custom indicators and scripts

- Expert Advisors (automation)

The platform is widely used in FX and CFDs, and it is designed to support broader asset coverage and exchange-style workflows compared to MT4. What that means in practice depends on the broker’s configuration.

The advantages of a MetaTrader 5 that actually show up day to day

Many feature lists are long but not very meaningful. Below are the advantages that tend to matter in real workflows.

1) A stronger base for trading in multiple markets

One of the most practical advantages of a MetaTrader 5 is that it is structured to handle a broader range of instruments and market structures. It supports a more “multi-asset” mindset than earlier MetaTrader versions, which is useful if your plan includes trading in multiple markets.

In day-to-day terms, this can look like:

- Consistent interface across instrument types

- Unified watchlists and alerts

- Centralized account monitoring and history

- The ability to apply similar risk routines across markets

Important detail: market availability depends on the broker. MT5 can display an instrument only if the broker provides it.

2) Order types and trade handling that fit active workflows

Execution workflows are where a platform either helps or gets in the way. MT5 supports a range of order types (market, limit, stop, and variants depending on broker configuration), and it is built to handle more exchange-style behaviors.

Practical benefits:

- Clearer control over pending orders

- Easier management of multiple open positions

- Better alignment with strategies that use layered entries and exits

If your approach includes staging entries or using conditional logic, MT5’s trade management can feel more flexible than simpler interfaces.

3) Better internal structure for automation and tooling

A big reason traders choose MT5 is automation, whether that means:

- Running Expert Advisors (EAs)

- Using scripts for repetitive tasks

- Building indicators and utilities

Automation is not for everyone, but if you trade systematically, MT5 can support:

- More structured strategy code

- Backtesting workflows (quality varies by data and broker feeds)

- Logging that helps review performance

“Automation is useful when it enforces your rules, not when it invents them.”

4) Charts and analysis tools that cover most needs

Most traders don’t need exotic charting. They need:

- Stable charts

- Multiple timeframes

- Templates they can reuse

- Alerts that work reliably

MT5 gives you a solid charting set for most approaches, especially if you keep your environment clean and avoid overloading it with indicators. It’s often “enough,” and that matters more than being flashy.

5) A consistent desktop + mobile experience

Many traders monitor on mobile even if they execute on desktop. MT5’s ecosystem makes it easier to keep watchlists and basic workflows consistent across devices, though the best experience is still on desktop for multi-window work and automation.

Trading real stocks and futures: where MT5 fits and where it doesn’t

This is where expectations can get messy. MT5 as a platform can be used to trade many product types, but you are always limited by:

- The broker’s product offering

- The account type you open

- The jurisdiction and regulatory rules

So when people say MT5 supports trading real stocks and futures, it’s more accurate to say:

- MT5 can be used by brokers that offer those products through MT5

- Many MT5 offerings in the wild are CFDs rather than “real” exchange-traded shares or futures contracts

If your goal is genuine exchange-traded products, you should verify:

- Whether the instrument is a CFD or the real exchange product

- The contract specifications

- Fees and financing rules

- How corporate actions are handled (for stocks)

- Margin and liquidation rules (for futures)

A quick “real vs derivative” checklist

| Question | Why it matters | What to confirm |

| Is it a real stock or CFD? | ownership and financing differ | instrument description and account docs |

| Is it a real futures contract? | contract specs and fees | exchange, symbol, tick value |

| Are there commissions? | cost model | fee schedule |

| Are there financing charges? | holds cost money | swaps/financing rules |

| How are corporate actions processed? | stock adjustments matter | dividends/splits handling |

The platform won’t answer these by itself. Your broker’s instrument specs and legal docs will.

“Platform access is not product structure. Always read the contract specs.”

MT5 for trading in multiple markets: workflow tips that reduce confusion

If you want trading in multiple markets to feel manageable, the biggest improvement is routine, not tools.

Keep one workspace per market type

Create separate profiles for:

- FX and indices

- Stocks

- Futures or futures-like products (if offered)

This prevents clutter and reduces the chance you apply the wrong assumptions (like trading session hours and volatility behavior).

Standardize risk rules across markets, then adjust carefully

Use the same core framework:

- Fixed risk per trade

- Portfolio heat limit

- Daily stop

Then adjust per market based on:

- Volatility regime

- Session behavior

- Typical spread and slippage

Log costs by market

Your performance can look great until costs are counted. Track:

- Average spread at entry

- Commissions

- Swaps/financing (if relevant)

- Slippage tail events

Multi-market trading is often a cost-management game as much as a strategy game.

Common pain points with MT5

MT5 is not perfect, and it’s useful to know what tends to frustrate traders.

Data quality in backtests can mislead

Backtesting results are only as good as the data and modeling assumptions. If spreads, commissions, and slippage are unrealistic, backtests can look better than live performance.

Broker implementations vary a lot

Two brokers offering MT5 can feel very different because:

- Symbol lists differ

- Execution quality differs

- Pricing model differs

- Server stability differs

Over-customization can turn into clutter

Because MT5 supports many indicators and add-ons, it’s easy to create a workspace that slows you down. Clean layouts usually outperform fancy ones.

A simple decision framework: is MT5 the right tool for you?

Use this quick rubric:

MT5 is a strong fit if you:

- Want a single environment for multiple instruments

- Use structured trade management (pending orders, layered entries)

- Plan to use automation or at least strong alerts/templates

- Value a broad ecosystem of tools and scripts

MT5 may be a weak fit if you:

- Want the simplest possible interface

- Trade infrequently and don’t need advanced tools

- Require a specific exchange product that your MT5 broker doesn’t offer

- Rely heavily on specialized platform features (like certain equity-specific routing tools)

A short, practical setup routine

If you decide to use MT5, this setup reduces mistakes.

- Start with a demo account and confirm symbol specs

- Build a clean workspace: 1 primary chart + 1 context chart

- Create templates for your most-used order types

- Set alerts at levels that trigger preparation, not impulse

- Export and review trade history weekly in risk units (R)

This makes the platform serve your process instead of pulling you into constant tweaking.

The real advantages of a MetaTrader 5 show up when you use it as a consistent workflow hub: clean chart templates, reliable order handling, and the ability to manage routines while trading in multiple markets. If your broker supports it, MT5 can also be a practical interface for trading real stocks and futures, but the key is verifying product structure and contract specs so you know exactly what you’re trading. If you tell me which markets you want to trade (FX, indices, stocks, futures) and your timeframe (day vs swing), I can outline a minimalist MT5 workspace layout plus a checklist to validate instrument specs and costs before you commit capital.

FAQ

What are the biggest advantages of a MetaTrader 5 compared to simpler platforms?

A broader multi-asset structure, more flexible order handling, and a stronger ecosystem for automation and custom tooling, depending on broker implementation.

Can I trade real stocks and futures on MT5?

Sometimes, depending on the broker. Many offerings are CFDs rather than real exchange-traded products. Verify instrument type, contract specs, fees, and disclosures.

Is MT5 good for trading in multiple markets?

It can be, especially if you use separate profiles per market type, standardize risk rules, and track costs by instrument group. Broker product coverage still determines what’s available.

Does MT5 automatically improve execution?

No. Execution depends on broker infrastructure, liquidity, routing, and server stability. MT5 provides the interface and tooling, not guaranteed fill quality.

Is automation in MT5 suitable for beginners?

It can be, if you start with simple automation like alerts and templates. Fully automated strategies should be tested carefully with realistic costs and strict risk limits.

What should I check before switching to MT5 for multi-market trading?

Instrument availability, whether products are real or derivatives, fee structure, spreads and slippage behavior during your trading hours, and the quality of trade logs and reporting.