You do not need magic features to launch a credible white label copy trading platform. Use the right fit for your assets and areas. You also need a clear plan for onboarding leaders and followers. Plus, you need a product that shows cash risk before anyone clicks.

This guide explains how to assess a copy trading solution for brokers. It covers what to expect from customizable copy trading software. It also discusses processes that can lower support needs from the start.

“Simple rules, visible risk, and clean reporting turn copy trading from hype into a habit.”

Who benefits and why

- Brokers add a new acquisition and retention engine without rebuilding core trading infrastructure.

- Strategy providers gain distribution, clear analytics, and a fair payout model.

- Investors get a clean way to follow methods they understand with equity stops and daily loss caps.

Clarity drives trust, trust drives retention, retention lowers acquisition costs. That is the real flywheel.

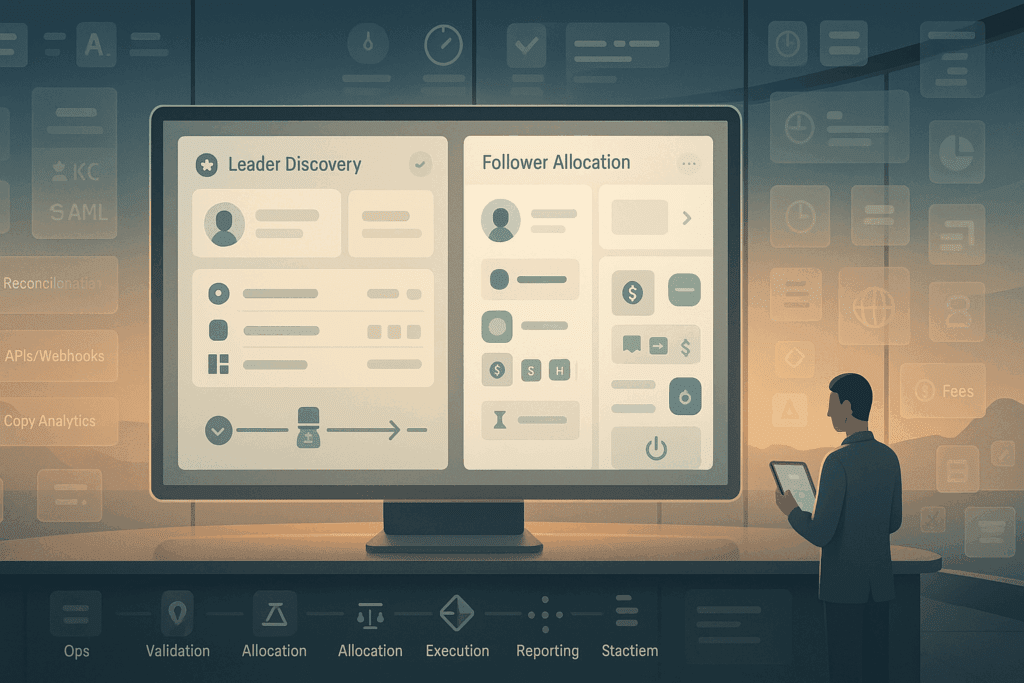

Non-negotiable features for a white label copy trading platform

| Area | Must have | Good to have | Red flag |

| Leader discovery | Verified profiles, strategy notes, risk labels | Filters by drawdown, trade length, asset mix | Top lists with no context |

| Performance | Time weighted returns, max drawdown, equity curve | Return over drawdown or Sharpe lite | Percent-only returns with no risk |

| Risk for followers | Allocation by cash, equity stop, per day loss cap | Symbol filters, max open positions | All or nothing copy, no caps |

| Execution | Copy delay and slippage metrics by symbol and session | Route selection per asset | No visibility into delay or rejects |

| Reporting | Exportable logs and investor statements | API and webhooks | PDFs only, no raw data |

| Moderation | Notes review, identity checks, rule enforcement | In-app education and templates | Anyone can publish anything |

“If you cannot export raw logs, you cannot solve disputes fast.”

What makes a copy trading solution for brokers stand out

A strong copy trading solution for brokers does more than mirror trades. It simplifies life for ops, compliance, and support.

- Ops friendly: reconciliation across platform, PSP, and bank, plus status pages and incident notes

- Compliance ready: KYC, AML screening, audit trails, and role-based access

- Support aware: human readable reject reasons and a known issues page

- Scalable: APIs to integrate CRM, analytics, and payout systems, versioned and documented

- Global fit: localization, multi-currency statements, and local time calendars for data and earnings

Customizable copy trading software: where to tailor and where to leave alone

Customize at the edges so upgrades stay easy.

Smart places to customize

- Branding, language packs, and navigation

- Onboarding flows, disclosures, and education modules

- Filters and badges in leader discovery

- Fee models and payout cadence

- Data exports and dashboards

Best left standard

- Allocation engine and risk checks

- Logging, reconciliation, and audit trails

- Incident workflows and status reporting

“Customize what clients see, not the parts that keep you out of trouble.”

How copying actually works, step by step

- Signal creation

Provider opens or closes a position on the master account. The platform records symbol, side, size, and time. - Validation

Pre trade checks confirm symbol permissions, margin, and exposure. If a rule fails, the system rejects the signal with a short reason. - Allocation

The engine translates master size into follower size using the investor’s allocation method and caps, excluding paused accounts. - Execution and logging

Orders route, fills return, copy delay and slippage are stamped per investor, and dashboards update in real time. - Post trade reporting

PnL, fees, and any overrides surface in investor statements and provider analytics.

“Fast prevention beats perfect postmortems. Clear rules avoid messy tickets.”

Risk controls you should turn on day one

- Equity stop per strategy and per follower

- Per day loss cap that auto pauses copying when hit

- Max open positions and symbol filters to limit concentration

- Circuit breakers that pause copying during abnormal spreads or stale quotes

- Graceful exit so followers can disconnect without disrupting open trades

Publish these controls in plain language where users choose allocation.

Pricing and payouts without the fog

| Fee type | Where it applies | Typical setup | Notes |

| Performance fee | Provider on new profits | High water mark, monthly | Show a worked example in the app |

| Management fee | Provider fixed percent | Monthly or quarterly | Keep modest to reduce drag |

| Platform fee | Broker revenue share | Percent of provider fees | Make it invisible to investors |

| Trading costs | Spread and commission | Per symbol, per account type | Display typical ranges by session |

Short, in-app examples stop most fee disputes before they start.

Onboarding flows that cut churn

For strategy providers

- Verified identity, demo then micro live pilot

- One page playbook that names setup, timeframe, risk per trade, and pause rules

- Weekly notes with one good trade and one mistake

For followers

- Allocation in cash with presets and warnings

- Equity stop and per day cap set before first copy

- Symbol filters with defaults that favor liquid pairs and metals

- A short simulation showing how size turns into positions

“If a user sets risk once and understands it, they do not need hand holding later.”

Vendor scorecard you can reuse

Score each vendor from 1 to 5 and add comments.

| Category | 1 | 3 | 5 |

| Uptime and incidents | No history | Sparse notes | Public status, clear postmortems |

| API maturity | Unstable | Partial | Versioned, examples, sandbox |

| Copy analytics | None | Delay only | Delay, slippage, rejects by symbol and session |

| Reporting | PDFs only | CSV exports | Full log export and webhooks |

| Localization | English only | Few languages | Full locale support with time zones |

| Support | Unclear contacts | Named CSM | 24×5 or 24×7 with SLAs |

Run a two week pilot using your real session times and top symbols. Let data decide.

Real examples that keep it grounded

Example A: Two provider blend for beginners

- Provider 1, trend on EURUSD and XAUUSD, hourly rhythm

- Provider 2, intraday momentum on US indices

- Follower defaults, allocation in cash, equity stop 8 percent, per day cap 2 percent

- Result, shallow dips and simple reviews, fewer panic pauses

Example B: Tight risk for small accounts

- Allocation set as a fixed number per provider

- Symbol filters to majors, gold, and top index CFDs only

- Auto pause after two failed attempts per day

- Result, steadier curves and nearly no support tickets about surprise size

“Small and repeatable beats big and random.”

Compliance and brand safety without drama

- Clear risk warnings on every strategy page and the copy ticket

- No promises of returns or implied guarantees

- Audit ready logs for every signal, rejection, and pause

- Maker checker for withdrawals and fee payouts

- Public status page that shows incidents and timelines

Good rules protect good people, including your staff.

Success metrics that actually predict retention

| Metric | Target or trend | Why it matters |

| Onboarding completion rate | Over 70 percent from signup to funded | Reveals friction and gaps in education |

| Time to first copy | Under 48 hours after funding | Measures clarity of the first session |

| Copy health rate | 95 percent fills within your delay threshold | Keeps expectations realistic |

| Drawdown depth vs notes | Consistent with stated rules | Proves provider discipline |

| Withdrawal completion time | Within the published window | Builds trust and referrals |

| Support tickets per 100 actives | Trending down over 60 days | Shows product and education quality |

Share a trimmed scoreboard with the team every Monday.

Common mistakes and quick fixes

| Mistake | Why it hurts | Fix |

| Letting anyone publish strategies | Spam and risky behavior creep in | Vet providers and enforce notes and rules |

| Percent only returns in listings | Hides drawdown and risk | Show drawdown and trade length first |

| Too many symbols by default | Confusion and poor fills | Start with majors, gold, and top indices |

| No copy delay visibility | Unrealistic expectations | Publish delay and slippage stats by symbol |

| Vague fees | Disputes and churn | Show formulas and worked examples in app |

Your rollout in four focused phases

- Scope

Define regions, assets, fee models, and must have risk controls. Draft the one page execution and disclosure pack. - Pilot

Onboard three providers and fifty friendly investors. Measure copy delay, slippage, rejects, support load, and withdrawal timing. - Tune

Adjust defaults, filters, and caps based on pilot data. Record the change log and update leader notes templates. - Open

Add a help center with screenshots and short videos. Publish a status page. Expand in waves so support quality holds.

One quiet nudge before you start

List your regions, assets, and the three controls you will enforce on every account. Shortlist two vendors for a white label copy trading platform, ask for sandbox access, and run a two week pilot with real sessions. If copy health, fees, and withdrawals behave, scale gently and keep your education simple. This is a practical way to create a copy trading solution for brokers. It uses customizable copy trading software that can handle real users without failing.

FAQ

Is a white label copy trading platform only for large brokers

No. Smaller teams launch faster with white label, larger teams pilot there, learn what users need, then extend with custom modules.

What makes a good copy trading solution for brokers

Clear risk controls, exportable logs, strong APIs, localized UX, and a status page with real incident history. If it helps ops and support, it helps clients.

How customizable should copy trading software be

Customize branding, onboarding, filters, fees, and dashboards. Leave the allocation engine, logs, and compliance frameworks standard so upgrades stay smooth.

How many providers should new followers copy

Two to four is practical. More than that doubles risk without better learning. Encourage allocation in cash, equity stops, and per day caps.

Will slippage ruin copied results

Normal slippage is modest on liquid pairs during active hours. Publish delay and slippage stats by symbol, and advise smaller size around major news.

Can I migrate later if the vendor falls short

Yes if you own domains and data, have full log exports, and keep custom work at the edges. Run a migration drill once per quarter to stay ready.