Screens glow, the bell draws near, and a dozen takes fight for attention. You do not need louder alerts. You need a place where ideas turn into clear plans you can test, review, and keep. That is the promise people want from CommuniTraders when they ask, “What’s CommuniTraders?”

“A message becomes a plan only when it names the level, the stop, and the first target.”

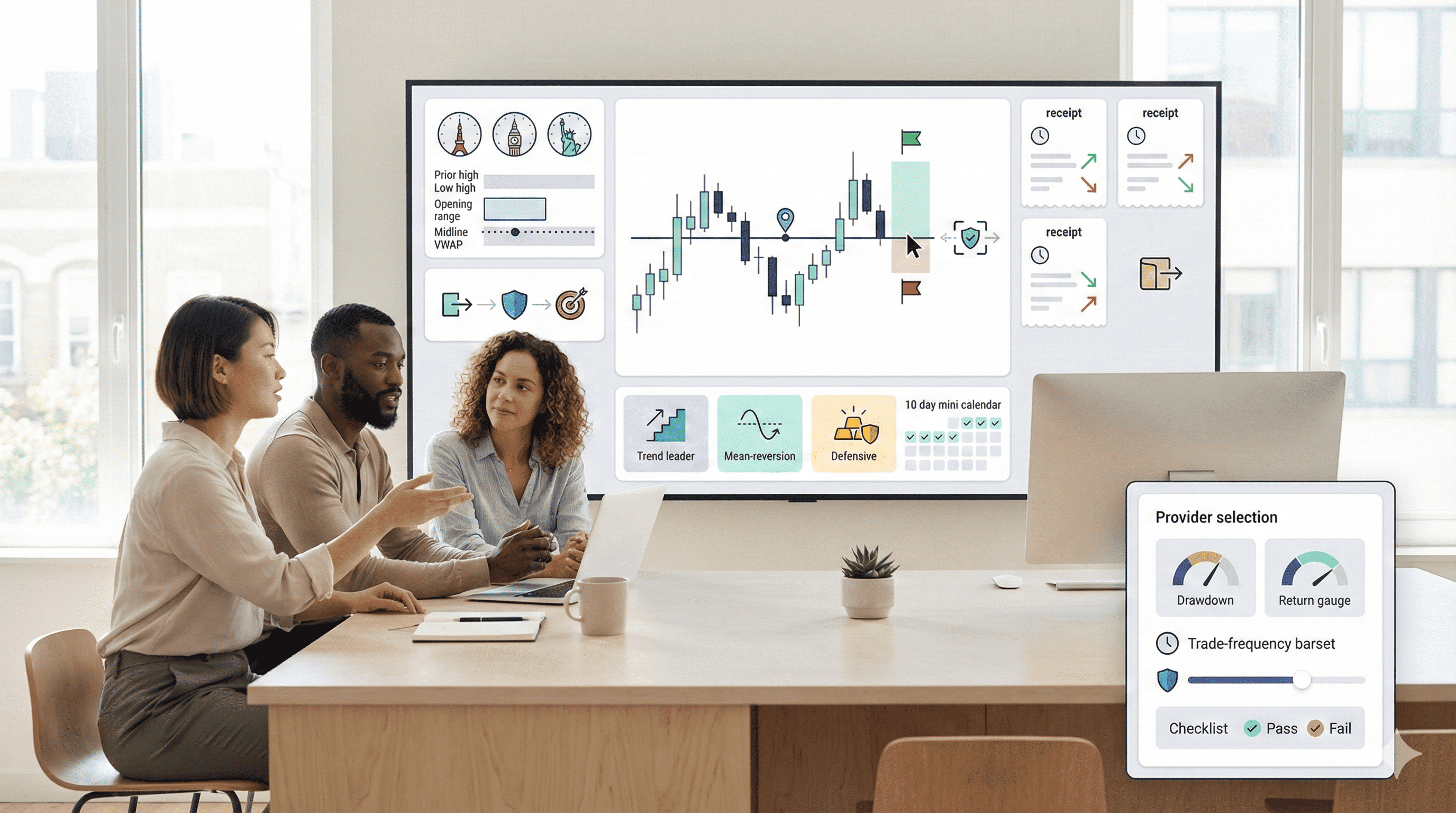

A plain-English picture of the platform

Think community first, tools second. Members share setups, annotate charts, and post results with timestamps, which turns chat into evidence. You keep your permissions, your sizing rules, and your journal. The goal is not to copy trades blindly, it is to compress research and reduce regret.

What you should expect to see

| Element | What it looks like in practice | Why it matters |

| Session framing | One page with key levels, catalysts, likely scenarios | You start from structure, not mood |

| One-line plans | Entry, stop, first target in a single sentence | Decisions become testable |

| Post-trade receipts | Screenshot plus slippage note | Learning survives the close |

| Culture of restraint | “Pass” is normal when structure is messy | Fewer impulse trades, steadier stats |

“Consistency beats intensity. Small, repeatable actions compound.”

How to Select a Signal Provider without guesswork

You are not choosing a hero, you are choosing a behavior pattern to pair with your rules.

- Read drawdown next to return, not in a footnote.

- Check holding time and trade frequency so the rhythm matches your day.

- Compare your own slippage versus the provider’s fills for five sessions.

- Favor people who post rules and debriefs, not just highlight reels.

Quick checklist

| Question | Keep if the answer is “yes” |

| Does the provider post entry, stop, first target up front | Yes |

| Are losses shown with the same clarity as wins | Yes |

| Can you export leader vs follower fills to measure slippage | Yes |

| Is there a simple equity stop for your copy allocation | Yes |

“Follow clarity, not charisma.”

Diversify your trading portfolio inside a community

Diversification is not “more tickers.” It is exposure that does not move for the same reason at the same time.

- Mix time frames, for example one intraday setup and one swing idea.

- Mix drivers, for example a tech momentum name plus a defensive miner.

- Mix roles, for example one signal provider for levels and another for news pacing.

Tiny table to spark ideas

| Bucket | Add one name that fits | Role it plays |

| Trend leader | Strong name holding above prior highs | Growth engine |

| Mean-reversion | Liquid ETF that respects a midline | Balance and timing |

| Defensive | Gold or utilities exposure | Shock absorber |

A two-week workflow you can run today

- Pick one provider whose holding time matches your schedule.

- Copy at minimum allocation with an equity stop.

- Trade one of your own setups beside it at a tiny size.

- Log three numbers per trade or copy event: spread at entry, slippage on exit, heat against stop.

- Keep only what your notebook confirms.

“If your notes get calmer, you are on the right track.”

Common questions answered fast

Is CommuniTraders only for short-term traders

No. Intraday and swing routines can live side by side if plans are posted the same way and reviews are consistent.

Can beginners benefit

Yes, if they copy small, read the debriefs, and stick to one setup for ten sessions before changing anything.

What if two providers conflict

Great. That is a prompt to rely on your rule sheet. Your plan decides entries and size, the room provides context.

If this approach fits, choose one strategy to follow, allocate the smallest amount, and pair it with one setup of your own for two weeks. Write a one-page rule sheet with your cash risk per trade and a daily stop you will obey. That is the quiet way to use CommuniTraders to diversify your trading portfolio while you refine How to Select a Signal Provider that truly matches your rhythm.

FAQ

Is CommuniTraders a copy service or a learning room

It is a community interface where copying can be a feature, but the emphasis is on plans and receipts. Treat every alert as information, not instruction.

How many providers should I follow at once

Usually one, two at most with different time frames. More voices increase noise and blur your rules.

What is the best first safeguard

Set an equity stop on any copy allocation and a fixed cash loss per self-directed trade. Review slippage by hour for five sessions.

Can I truly Diversify your trading portfolio here

Yes, if you mix time frames, drivers, and provider styles rather than piling into similar momentum names at the same hour.

Any red flags when evaluating providers

No clear stop logic, no drawdown chart, and no post-trade receipts. If results cannot be exported and reviewed, walk away.