The tickers move, calendars fill up, and it’s easy to forget the simple question: what can be traded in a commodities market? Here’s the calm version with plain-language definitions, concrete examples, and a side-by-side view you can reuse.

“A commodity futures contract is an agreement to buy or sell a particular commodity at a future date; the price and amount are fixed.”

First things first: what is commodity market

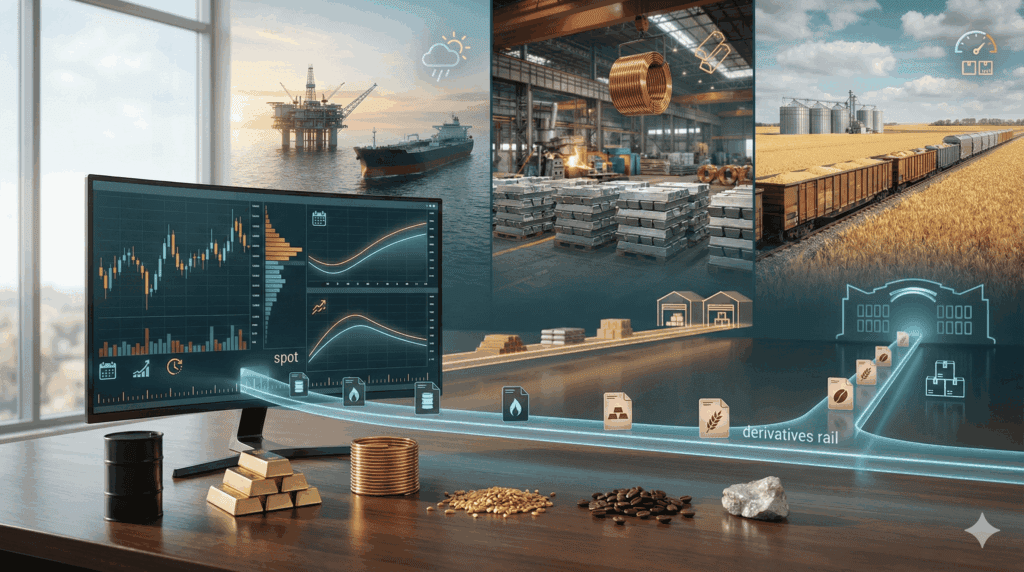

A commodity market is where raw or primary goods change hands in spot deals or via derivatives like futures and options. Think energy, metals, and agricultural products.

“The S&P GSCI is one of the most widely recognized commodity benchmarks; broad-based and production-weighted.”

The landscape at a glance: commodity markets by group

A few concrete contract examples

- WTI Crude (NYMEX CL): unit 1,000 barrels; minimum tick 0.01 dollars per barrel equals 10 dollars per tick.

- Brent Crude (ICE B): unit 1,000 barrels; minimum price fluctuation 0.01 dollars per barrel.

- Gold (COMEX GC): contract size 100 troy ounces; tick 0.10 dollars per oz equals 10 dollars per tick.

- Corn (CBOT ZC): contract unit 5,000 bushels; quoted in cents per bushel.

What exactly can you trade (and how)

| Access path | What you actually trade | Why people choose it | Watch-outs |

| Exchange futures | Standardized contracts on energy, metals, gas | Liquidity, central clearing, transparent specs | Margin and daily P/L mean discipline required. |

| Options on futures | Right, not obligation, on a futures contract | Defined risk structures | Greeks and assignment rules add complexity. |

| Spot/forwards (OTC) | Bilateral deals, customized terms | Tailored hedges for commercial users | Counterparty risk and documentation. |

| Index products & ETPs | Baskets tracking commodity indices (e.g., GSCI) | Broad exposure via securities account | Tracking and fees vs underlying futures. |

“Futures contracts are traded on organized exchanges that set standardized terms for the contracts.”

Why conditions change across commodity markets

Global supply, inventories, and policy can reshape price behavior. Recent research highlights how shocks (pandemics, wars, climate) alter energy, metals, and agriculture dynamics for years, not weeks.

Reading the curve without math headaches

Futures may trade above or below spot depending on storage, financing, and inventory (contango vs backwardation). That’s normal. What matters is your carry cost and roll timing, which differ by commodity and season.

Costs and frictions you feel on tickets

- Tick size and tick value (e.g., CL’s $10 per tick; GC’s $10 per tick) drive P/L swings.

- Slippage and spread widen around scheduled reports and thin sessions.

Quick starter map that you can actually use

- Pick one liquid benchmark (WTI, Gold, or Corn).

- Read the exchange spec sheet for size, tick, and hours.

- Put major release times on your calendar (inventories, crop reports).

“Commodity markets are integral to the global economy… understanding what drives these markets is critical.”

FAQ

Is the commodity market only for futures traders

No. Commercials hedge with futures and OTC forwards; investors use index products or producer equities. Futures are just the cleanest price-discovery rail.

Why do WTI and Brent sometimes diverge

Logistics and regional supply differences. Both are 1,000-barrel contracts but different delivery ecosystems and inventories drive spreads.

Do metals markets have different regulations?

Venues implement their own regulations and may modify their positioning or lending policies when stock levels become limited, similar to the actions taken by the LME regarding copper.

Where do I find the exact contract size and tick

Consistently refer to the exchange specifications page for the product, which details units, ticks, trading hours, and relevant codes (such as CL, GC, ZC).