Most traders think “safety” means price risk: stops, leverage, and drawdown limits. In reality, a bigger risk sits underneath the chart: operational and custody risk. The market can’t take more than you put at risk. A weak setup for client funds can.

That is why True funds safety matters. It is not a slogan. It is the set of controls that protect deposits, prevent misuse, and make it difficult for a bad day, a bad actor, or a bad process to turn into a financial loss outside of normal trading outcomes.

“Price risk is expected. Operational risk is the surprise nobody planned for.” (Citation: risk committee note)

This guide breaks True funds safety into checkable components: what “A regulated operation” should look like in practice, how custody and segregation actually work, and what to verify when you trade different trading instruments for forex and related markets.

What “True funds safety” really means

True funds safety is the combination of policies, legal structures, controls, and reporting that reduce the probability of losing funds due to broker failure, misuse, or operational breakdown.

It includes:

- Licensing and supervision (A regulated operation)

- Custody structure and segregation of client funds

- Capital adequacy and financial resilience

- Controls over withdrawals, reconciliations, and access

- Auditability and transparency

- Incident response, cybersecurity, and business continuity

Notice what is not on the list: “tight spreads” or “fast execution.” Those are important, but they are performance features. True funds safety is about survivability and accountability.

“Execution is service quality. Safety is governance quality.” (Citation: ops leadership note)

A regulated operation: the useful definition

“A regulated operation” is often used casually, which makes it easy to misunderstand. Regulation is not a guarantee that nothing can go wrong. It is a framework that increases oversight, sets minimum standards, and creates enforcement pathways.

A useful way to define A regulated operation is:

- The firm holds an active license from a recognized financial regulator

- The license scope matches the products offered

- There are ongoing reporting and conduct obligations

- There are complaint and dispute channels

- There are consequences for breaches

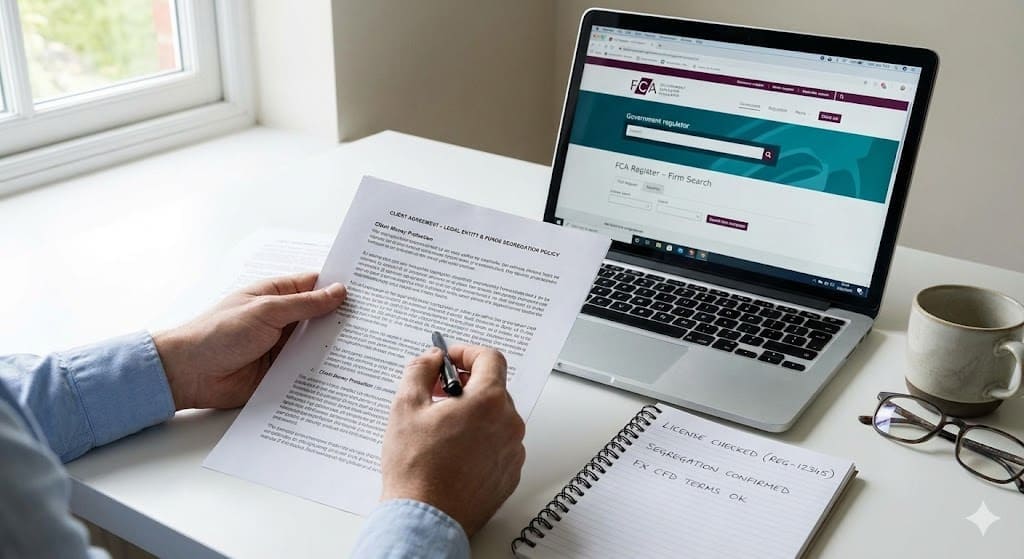

The practical checks (not the marketing checks)

When evaluating a broker or firm, verify:

- The legal entity name that holds the license

- The regulator and license number

- The products covered by the license (forex, CFDs, derivatives, etc.)

- The jurisdiction that applies to your account

- Whether your account is with the regulated entity or an offshore affiliate

This matters because many brands operate multiple entities. The same website can route clients to different legal entities depending on location or onboarding choices.

“Safety claims are only as strong as the entity that holds your account.” (Citation: compliance checklist)

Funds custody: segregation, safeguarding, and what to ask

True funds safety depends heavily on where client money sits and how it is controlled.

Segregated accounts in simple terms

Client fund segregation generally means client deposits are held separately from the broker’s own operating funds. The idea is to reduce the risk that broker creditors can claim client funds if the broker fails, depending on jurisdiction and legal structure.

However, “segregated” is not one universal standard. The details vary by jurisdiction, banking partner, and internal controls.

Questions that reveal whether segregation is real

Ask (or look for clear disclosure on):

- Are client funds held in segregated accounts, and at which type of institutions?

- Is the account in your name, pooled client accounts, or a trust structure?

- What is the broker’s policy for handling interest, fees, and shortfalls?

- How frequently are reconciliations performed? Daily is common for serious operators.

- Who has signing authority on the accounts, and what approvals are required?

If answers are vague, treat that as a meaningful risk signal.

Withdrawal controls: where safety becomes visible

A strong operator typically has:

- Multi-step approval for withdrawals above thresholds

- Automated monitoring for unusual withdrawal patterns

- Fraud controls (device checks, KYC refresh)

- Clear timelines and escalation paths

- Audit logs of all fund movements

True funds safety is not only about “where money sits.” It is about how hard it is to move money improperly.

“A safe withdrawal process is boring, consistent, and well documented.” (Citation: treasury process note)

Capital strength and resilience

Regulated firms often face capital requirements, but “meets minimums” is not the same as “resilient under stress.”

Safety-oriented questions:

- Does the firm publish financial statements or audited reports?

- Are there disclosures about capital adequacy or risk management?

- How does the firm manage extreme volatility events (margin shortfalls, liquidity gaps)?

- Is there a history of major incidents and how were clients handled?

You do not need perfect answers. You need credible, specific answers.

Trading instruments for forex: why product mix affects safety

The phrase trading instruments for forex can mean spot FX, CFDs on FX pairs, or FX derivatives offered through different structures. The more products a broker offers, the more operational pathways exist for something to go wrong.

Instrument types and typical safety considerations

| Instrument type | What you are trading | Key safety considerations |

| Spot FX via broker | FX pairs priced via liquidity feeds | Execution model, margin rules, negative balance policy |

| FX CFDs | Contract with broker referencing FX price | Broker is counterparty; terms matter |

| FX futures | Exchange-traded contract | Clearinghouse structure, margin discipline |

| FX options | Derivative on FX price | Complexity, margin and premium handling |

If your broker offers CFDs, the broker is typically the counterparty. That increases the importance of governance, disclosure, and conflict management. If your exposure is via exchange-traded futures, you often get a different risk structure through clearing and exchange oversight, but you still face broker and operational risks.

Multi-asset product stacks need stronger controls

If a broker offers FX plus indices, metals, commodities, and crypto, the firm needs broader controls:

- Different market hours and gap risks

- Different liquidity regimes and spread behavior

- Different financing and rollover rules

- Potentially 24/7 support expectations if crypto is offered

“More instruments” is attractive, but safety depends on whether the operator has multi-asset governance maturity.

The execution model and conflicts of interest

True funds safety is not only custody. It also includes integrity of execution and dealing policies, because abusive practices can produce losses that feel like “the broker took my money.”

Key areas to understand:

- Is the broker acting as principal (market maker) or agent?

- Is there a last-look policy, and is it disclosed?

- Are re-quotes and rejects possible, and under what conditions?

- Are there clear disclosures on slippage handling?

“Transparency reduces disputes. Disputes reduce trust. Trust is part of safety.” (Citation: support escalation memo)

Cybersecurity and business continuity

A regulated operation should have security controls, but you still want to see practical commitment:

- Two-factor authentication for client portals

- Clear policies on account access and device changes

- Incident communication standards

- Redundancy, backups, and disaster recovery planning

- Protection against phishing and social engineering

Even if you never experience a major incident, you want a firm that can communicate clearly and operate under stress.

A due diligence checklist you can actually use

Below is a checklist you can run in under an hour. You do not need inside access. You need clarity and documentation.

Regulatory and entity checks

- Legal entity name on your agreement matches license holder

- Regulator and license number are verifiable

- License scope covers the products you will trade

- Clear dispute and complaint pathways exist

Funds and treasury controls

- Client fund segregation disclosed clearly

- Reconciliation frequency stated

- Withdrawal process documented with timelines

- Multi-approval controls for treasury actions

Operational transparency

- Clear execution policy (slippage, rejects, last look)

- Published risk disclosures and product terms

- Audited statements or credible financial disclosures

Product and instrument scope

- Definitions for trading instruments for forex (spot vs CFDs vs derivatives)

- Margin rules, stop-out rules, negative balance policy

- Financing/rollover rules are understandable

You can score it quickly:

| Area | Pass/Needs clarity | Notes |

| A regulated operation verified | ||

| Client fund segregation | ||

| Withdrawal controls | ||

| Execution policy transparency | ||

| Financial resilience disclosures | ||

| Cybersecurity basics (2FA, alerts) | ||

| Instrument terms for forex |

Common misconceptions about True funds safety

“Regulated means zero risk”

Regulation reduces risk and increases accountability. It does not eliminate operational failure risk. Use regulation as a baseline, then verify controls.

“Big brand means safe”

Brand size helps, but it is not a substitute for entity-level verification, custody controls, and clear disclosures.

“If I can withdraw once, I am safe”

One smooth withdrawal is a good sign, but real tests happen during volatility, high ticket volumes, or system incidents.

“More instruments is always better”

More products can be useful, but they increase operational complexity. True funds safety requires mature controls when expanding trading instruments for forex and beyond.

Next step before the FAQ

If you are evaluating a broker right now, do not start with spreads or bonuses. Start with True funds safety: verify A regulated operation at the entity level, confirm client fund segregation and withdrawal controls, and read the execution policy for the exact trading instruments for forex you plan to use. If any of those areas are unclear, pause and ask for written clarification; the quality of the answer is often as informative as the policy itself.

FAQ

What is True funds safety in practical terms?

It is the combined strength of regulation, custody structure, segregation, withdrawal controls, audits, and operational resilience that reduces the chance of losing funds due to broker failure or misuse.

Does a regulated operation guarantee my funds are protected?

No, but it increases oversight and accountability. You still need to verify which entity holds your account and how client funds are handled.

How do I confirm my account is under the regulated entity?

Check the legal entity name on your account agreement and onboarding documents, then match it to the regulator’s register. Website branding alone is not enough.

Why do trading instruments for forex affect safety?

Different instruments have different structures and counterparty exposure. Spot FX, CFDs, and exchange-traded futures/options have different rules around custody, margin, and dispute handling.

What is the most important operational safety feature for clients?

Clear segregation of client funds plus a well-controlled withdrawal process with audit logs and consistent timelines.

What is a fast red flag during due diligence?

Vague answers about legal entity, segregation, reconciliation frequency, or withdrawal controls. If a firm cannot explain these clearly, support during stress is unlikely to be better.