A good trading community platform is not a chat room with nicer colors. It is a place where beginners can safely ask questions. Experienced traders enjoy teaching others. Everyone can turn ideas into decisions without feeling lost. The rhythm is more important than the hype. When the rooms are set up well, a watchlist feels like a gentle push. The calendar feels like a way to plan ahead. Reviews feel like a true reflection of oneself.

You can feel the difference the first week. Threads start on time. People quote key levels and show risk in cash. Recaps come with screenshots, not only opinions. A quiet culture forms around transparency, and the room becomes useful on fast days and calm days alike.

“If members know where to ask, how to act, and when to review, they stay.”

The heartbeat of a healthy platform

Communities break when every discussion lands in one noisy river. They grow when structure reduces friction.

- Channels match skill level and asset focus instead of mixing everything together

- Templates guide posts so mentors do not repeat themselves all day

- Search and tags turn last month’s lessons into tomorrow’s answers

- A small, visible team keeps tone steady and rules consistent

This is the difference between a crowd and a community. The first consumes. The second compound.

Principles that keep conversations clear

- Teach in plain language, then show it on a chart.

- Present risk in cash so size makes sense to everyone.

- Favor repeatable setups over creative impulses.

- Archive good work where search can find it in a year.

“Short rules, visible limits, clean logs. That rhythm builds trust.”

Rooms that make sense on busy days

Think in rooms, not in one endless chat. A simple architecture keeps the signal crisp.

| Room | Purpose | What members see |

| Lobby | Route new members | Buttons for Stocks, FX, Crypto, and Learn |

| Learn | Pin core knowledge | Primers on order types, risk in cash, platform tips |

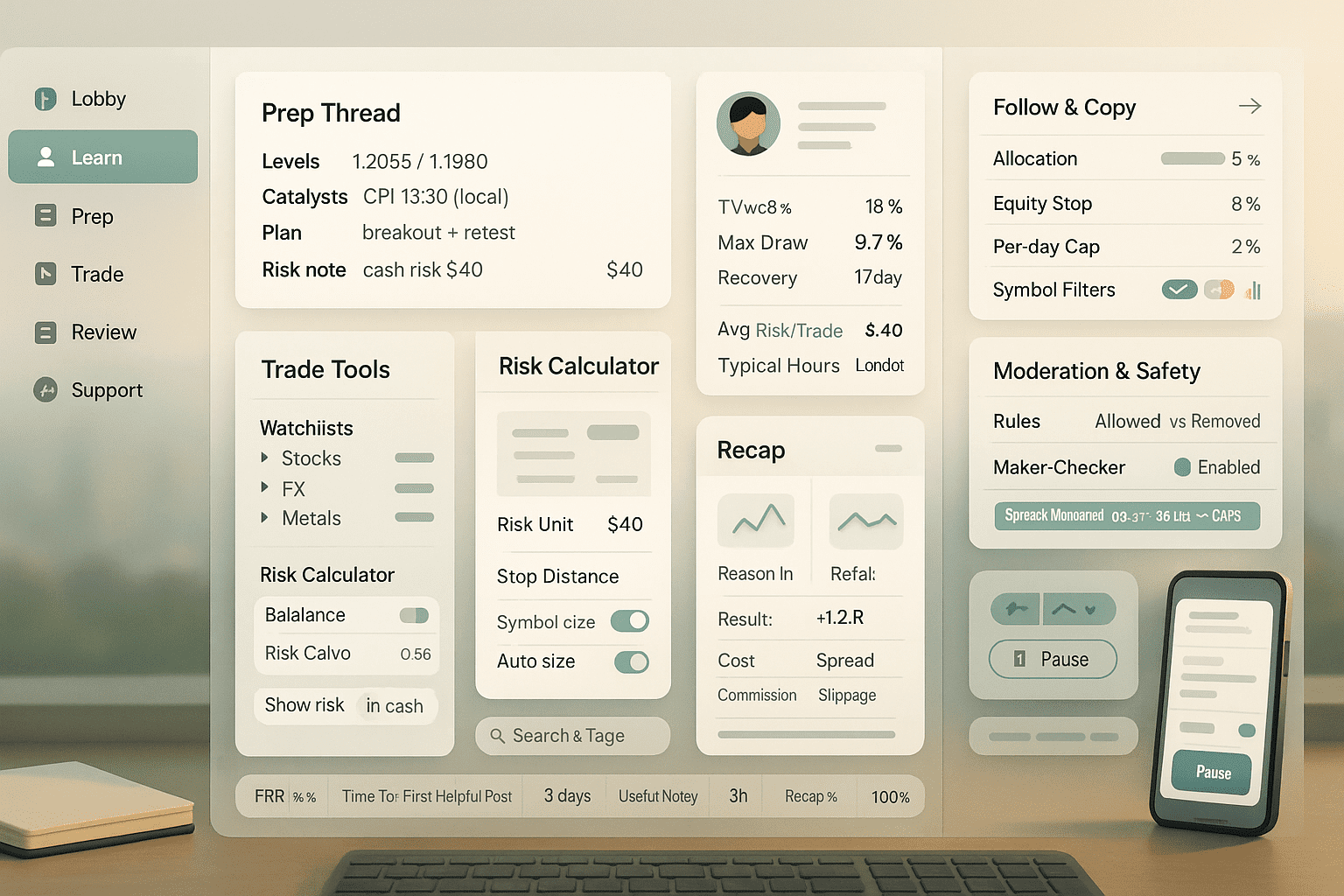

| Prep | Focus the day | Session threads with levels, catalysts, and risk notes |

| Trade | Turn plans into action | Watchlists, alerts, and one-click templates |

| Review | Capture outcomes | Recaps with before/after charts and lessons |

| Support | Handle friction | Rules, status updates, help form, known issues |

A strong trading community platform keeps these rooms familiar and repeats them every week.

The place for ambition: a leaderboard that teaches

A leaderboard of top traders is powerful when it ranks what matters. If it rewards luck or extreme leverage, it will attract noise. If it rewards discipline, it will attract teachers.

What to rank

- Time weighted returns that ignore deposits and withdrawals

- Max drawdown and recovery time shown side by side

- Average risk per trade in cash, not only percent

- Trade length and session windows for context

What to avoid

- Monthly percent only returns with no drawdown

- Hidden leverage or unclear sizing

- Rankings that penalize steady consistency

“A smooth twelve percent with a ten percent drawdown often beats a noisy forty with a thirty five drawdown.”

A sample ranking card that makes sense

| Metric | Example value | Why it helps |

| Time weighted return | 18 percent over 9 months | Compares apples to apples |

| Max drawdown | 9.7 percent | Calibrates pain tolerance |

| Recovery time | 17 trading days | Reveals resilience |

| Avg risk per trade | 40 dollars | Sets expectations |

| Typical hours | London and early New York | Helps followers match schedules |

Follow and copy without turning off the brain

Most communities include people who want to follow and copy successful strategies. Copying can be healthy when the platform insists on guardrails.

Guardrails for copy features

- Allocation in cash per strategy, never all or nothing

- Equity stop and per day loss cap set before first copy

- Symbol filters so beginners favor majors and metals over exotics

- Delay and slippage stats shown by symbol and session

- A pause button that works instantly when caps trigger

“Copying is a decision about risk, not only about returns.”

Members who copy learn faster when providers write weekly notes with one good trade and one mistake. They see the logic, not only the curve.

The content engine that keeps experts around

Experts stay when teaching is easier than silence. Use repeatable formats so good posts take minutes, not hours.

Prep thread template

- Levels: two or three key price zones

- Catalysts: two events with local times

- Plan: pullback, range break plus retest, or stand aside

- Risk note: cash risk unit and stop distance

Recap template

- Chart before and after

- Reason in: one sentence

- Reason out: one sentence

- Result: R multiple and cash cost lines

- Lesson: one line you can apply next time

Quotable lines that help search engines and humans:

“Risk shown in cash turns scary choices into simple math.”

“Trade fewer ideas, review more outcomes.”

Stock and FX threads under one roof

You can run both in the same home when rooms respect their rhythms.

Stock threads feel like

- Pre market notes on index leaders with breadth context

- Open range discussion for the first half hour

- End of day rotation notes with sector heatmaps

FX and metals threads feel like

- London prep centered on majors and the dollar tone

- New York reversal watch with gold and dollar pairs

- Risk recap with central bank quotes and next day prints

The shared ingredient is clarity. People join to learn, act, and report back.

Tools that turn talk into trades

A platform is not a classroom if it cannot help members act. The tools do not need to be complex. They need to be predictable.

| Tool | Why it matters | Minimum viable version |

| Watchlist libraries | Give structure to scanning | Lists by asset and session with tags |

| Risk calculator | Converts stops into cash | Inputs for balance, risk unit, stop distance |

| Calendar | Prevents surprise news trades | Color coded events shown in local time |

| Journal | Converts talk to lessons | Two screenshots plus one sentence in and out |

| Search | Saves expert time | Tags for symbol, setup, and timeframe |

Members do not need twenty tools. They need five that show up every day.

Safety, moderation, and brand protection

Communities fail when rules are vague. They thrive when enforcement is fair and visible.

- Publish a rules table with examples of allowed and removed posts

- Use maker checker for bans and sensitive content removals

- Keep an incident archive with short summaries

- Require context when posting trade ideas including cash risk

- Separate education from execution and disclose relationships clearly

“Good rules protect good people.”

Analytics that measure health instead of vanity

Track what you can act on. Then publish a trimmed scoreboard to moderators each week.

| Metric | Healthy signal | Why it matters |

| First month retention | 40 to 60 percent depending on niche | Shows onboarding clarity |

| Time to first helpful post | Under 7 days | Reflects safety and structure |

| Useful to noisy post ratio | 3 to 1 or better | Keeps experts engaged |

| Beginner reply time | Under 4 hours during sessions | Reduces churn from confusion |

| Recap participation rate | 25 percent of active posters weekly | Builds review habit |

| Report resolution time | Same day for scams and abuse | Protects trust and brand safety |

Numbers are not the goal. They are a compass that keeps tone steady.

Monetization that does not betray the room

You can earn without losing credibility.

- Keep core education free, charge for structure and access

- Offer partner discounts on data or tools with clear disclosures

- Run focused events with replays, not endless up-sells

- Avoid lifetime promises in courses and keep updates fresh

Members pay for clarity and access, not slogans.

A day in the life that proves the point

Picture a regular Tuesday. The London prep thread drops right on time with two levels on EURUSD and a note on gold. You skim the calendar because the events display in your local time. An alert fires, you post a plan with a screenshot, and others add context without piling on. After the session, you write a short recap with before and after images and a one line lesson. The thread gets tagged so next month’s search will surface again.

Meanwhile, the leaderboard of top traders refreshes weekly. The top card shows a nine month curve, a ten percent drawdown, and a short note on average risk. Some people read the provider’s weekly report. They choose to follow and copy successful strategies with a small cash limit each day. Nobody is chasing a mystery signal. People are choosing risk they understand.

“Small and repeatable beats big and random.”

Common mistakes and clean fixes

| Mistake | Why it hurts | Clean fix |

| One giant chat for everything | Beginners vanish and experts leave | Split by asset and session with pinned formats |

| Signals without context | False confidence, real losses | Require charts, cash risk, and a one line plan |

| Rankings that glorify volatility | Encourages gambling | Rank drawdown and recovery alongside returns |

| Vague partner promotions | Erodes trust | Disclose clearly and keep education independent |

| Silence during incidents | Rumors fill the gap | Post status notes with timestamps and reverts |

Accessibility choices that increase participation

- Write at a community college reading level

- Replace jargon with examples and annotated images

- Caption short videos and include transcripts

- Offer bilingual summaries where the audience is mixed

- Design for mobile first so people can contribute between tasks

“Plain words win. Fancy words hide confusion.”

The quiet magic of rhythm

Communities do not need novelty every day. They need a rhythm that feels safe. Daily prep threads. Live sessions tied to real calendars. Recaps that reward honesty over legend building. A trading community platform with that rhythm turns into a habit members protect.

You know the culture is working when the same names show up in Prep, Trade, and Review with the same steady tone, will see the tools are working when questions shrink in length and grow in quality. You will get to know the room is working when people quote last month’s lessons as if they wrote them themselves.

One nudge to move this from idea to action

Open a document. List two daily topics your audience would read on their own. Write down one rule you will enforce without exceptions. Also, note the cash risk unit beginners should start with.

Next, set up Prep, Trade, and Review rooms. Enable the leaderboard of top traders that shows drawdown and recovery. Turn on a simple copy option. This option lets members follow and copy successful strategies with small cash amounts and clear limits.

If that plan feels doable, you are ready to build a platform people will use next month and still respect next year.

FAQ

Is a trading community platform just a forum with charts

It can start there, yet the useful ones add structure, search, risk in cash, and a steady cadence across Prep, Trade, and Review. The goal is fewer repeats and more honest progress.

What makes a leaderboard of top traders helpful instead of harmful

Rank returns with drawdown and recovery time, show average risk per trade in cash, and require weekly notes. People learn discipline instead of chasing spikes.

Can members follow and copy successful strategies without outsourcing thinking

Yes if the platform uses cash allocation, equity stops, per day caps, symbol filters, and delay and slippage stats. Copying then becomes a controlled experiment, not blind faith.

Do stocks and FX belong in the same platform

They can live together if rooms are divided by asset and session, and if templates keep posts short and comparable. Shared Learn content ties them together.

Which tools matter most at the start

Watchlists, a risk calculator that shows cash, a calendar in local time, a journal template with screenshots, and tags that make search work. Start small and repeatable.