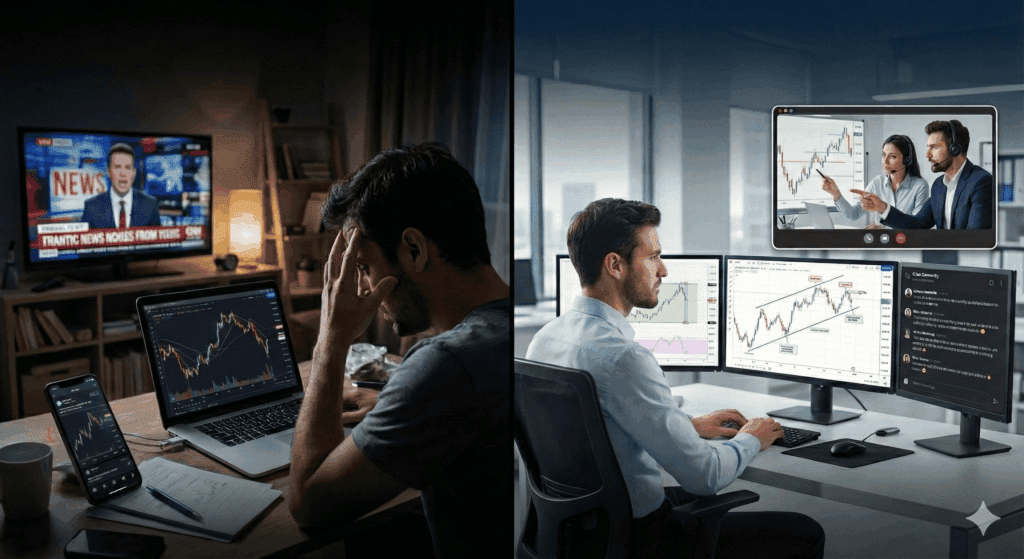

Trading is one of the few professions where amateurs are thrown directly into the ring with heavyweights. When you open a brokerage account and click “buy,” you aren’t playing a simulation. You are stepping onto a field occupied by Goldman Sachs, high-frequency algorithms, and central banks. These entities have unlimited capital, faster data feeds, and armies of PhD mathematicians. You have a laptop and a gut feeling. It is not exactly a fair fight.

For the independent retail trader, the gap between “guessing” and “executing” is often filled with expensive losses. This is why the lone wolf model of trading is dying. The smart money is moving toward a collaborative model, centered around the guidance of professional trading Academy analysts.

These aren’t just teachers who recite textbook definitions of support and resistance. They are active market participants who act as your copilots. They filter the noise, interpret the data, and provide the psychological anchor needed to survive the inevitable storms of volatility. In an ocean of infinite variables, they are your lighthouse.

The Role of the Modern Analyst

So, what exactly does an analyst inside a top-tier academy do? There is a misconception that their job is to simply tell you what to buy. That is a signal service, and signal services breed dependency. A true analyst breeds independence.

Trading Academy analysts are essentially translators. The market speaks a complex language of price action, volume, macroeconomics, and sentiment. The analyst translates this chaotic stream of data into actionable intelligence.

They wake up hours before the opening bell,digest the overnight moves in Asia and Europe, then read the central bank minutes. By the time you log in with your coffee, they have already built a thesis for the day. They aren’t guessing where the market might go; they are identifying the probabilities of where it should go based on the current structure.

The Importance of the “Pre-Game”

The difference between an amateur and a pro is often determined before the market even opens. Amateurs turn on their screens at 9:29 AM. Pros have been working since 6:00 AM.

Within online trading communities, the analyst leads the “Morning Call” or “Pre-Market Prep.” This is a crucial ritual. It is where the day’s roadmap is drawn.

- Macro Review: “The dollar is up because bond yields just spiked. This means Gold might be under pressure.”

- Key Levels: “The S&P 500 is approaching 4500. This is a major psychological wall. We expect a reaction here.”

- News Hazards: “The Fed Chair speaks at 2:00 PM. Do not open new positions at 1:55 PM.”

This preparation allows the student to trade reactively, not emotionally. When the price hits 4500 and bounces, the student isn’t surprised. They were expecting it because the analyst flagged it three hours ago.

The Toolset: The Trader Workstation

You cannot build a house with a plastic hammer, and you cannot analyze institutional flow with a phone app. Professional analysts rely on robust technology, often referred to as a Trader workstation.

This isn’t just a physical desk with six monitors (though it often looks like that). It refers to the software ecosystem. An analyst teaches you how to configure your platform to see what they see.

A professional setup includes:

- Level 2 Data: Seeing the pending buy and sell orders, not just the current price.

- News Squawks: An audio feed that shouts out headlines instantly, faster than they appear on Twitter.

- Volume Profiles: Tools that show where the most volume was traded, indicating hidden support and resistance.

The analyst bridges the gap between the tool and the user. They show you that the flashing lights on the Trader workstation aren’t just noise, they are the heartbeat of the market. Learning to interpret this data prevents you from buying at the exact moment a massive sell wall appears on the tape.

The Classroom of Real-Time

Static textbooks are fine for history, but trading is a “now” activity. The price of Oil doesn’t care what happened in a textbook chapter from 1999; it cares about the geopolitical tension happening right now in the Middle East.

This is why trading Academy analysts operate in live rooms. They share their screens. You watch their mouse cursor.

The “Why” Behind the Trade When an analyst takes a trade live, or marks up a chart, they narrate their internal monologue.

- “I am looking for a long time here because we swept the liquidity at the lows.”

- “I am waiting for a candle to close because the volume is too light.”

- “I am staying out because the risk-to-reward ratio is poor.”

This narration is the most valuable education you can get. It teaches you how to think. It teaches you risk management in real-time. You see them take losses. You see them get stopped out, shrug it off, and move to the next opportunity. This destroys the illusion of perfection and replaces it with the reality of probability.

Analyzing the Macro vs. The Micro

One of the biggest struggles for new traders is connecting the big picture (Macro) with the chart in front of them (Micro).

You might see a perfect “Buy” signal on the 5-minute chart of the EUR/USD. But if the US economy just released incredible employment numbers, the Dollar is going to skyrocket, and your Euro buy signal is going to get crushed.

Trading Academy analysts specialize in this synthesis. They act as the filter.

- The Fundamental Analyst: Looks at interest rates, GDP, and inflation.

- The Technical Analyst: Looks at trendlines, Fibonacci levels, and moving averages.

In a good academy, these two collaborate. The fundamental analyst says, ” The direction is Down.” The technical analyst says, “Okay, the trend is down, so let’s look for the best price to Sell.” This alignment keeps you trading with the wind at your back, rather than trying to swim upstream against global economic forces.

The Psychology of the “Second Opinion”

Trading is lonely, and isolation breeds doubt. When you are in a drawdown, you start to question everything. Is your strategy broken? Are you just bad at this?

Having access to trading Academy analysts provides a crucial psychological safety net. It allows for a “second opinion.”

Imagine you are about to short Tesla. You feel confident. But before you click the button, you check the academy’s daily report. The analyst notes that Tesla has strong support at this level and high options volume on the call side.

You pause. re-evaluate, realize you missed something. You don’t take the trade. The stock rallied 5%. The analyst just saved you money. This verification loop builds confidence. It stops you from taking impulsive, “boredom” trades and keeps you focused on high-quality setups.

Community: The Echo Chamber vs. The Think Tank

There is a massive difference between a random Reddit thread and professional online trading communities.

Public forums are often echo chambers of unverified opinions, fear-mongering, and “pump and dump” schemes. They are noisy and often toxic.

A community curated by professional analysts is a think tank. The tone is set from the top down. If the analyst is disciplined, calm, and data-driven, the community tends to mirror that behavior.

The Hive Mind Advantage In these private groups, the analysts can’t watch every ticker. But the students can. A student might spot a setup on a currency pair the analyst wasn’t watching. They post it. The analyst reviews it: “Good eye. The structure looks solid. Let’s add it to the watch list.”

This collaborative environment turns trading from a solo struggle into a team sport. You leverage the eyes and ears of hundreds of people, all filtered through the quality control of the lead analysts.

Differentiating Between Gurus and Analysts

The internet is plagued by “gurus” renting Lamborghinis and promising 100% win rates. It is vital to distinguish a marketer from a true market analyst.

The Marketer:

- Talks about money, lifestyle, and “financial freedom.”

- Hides losses.

- Claims their strategy never fails.

- Uses urgency (“Join now before the price goes up”).

The Analyst:

- Talks about risk, probability, and market structure.

- Shows losses openly and discusses what went wrong.

- Admits when the market is confusing or messy.

- Focuses on skill acquisition.

True trading Academy analysts are humble because the market humbles everyone eventually. They don’t promise you a yacht; they promise you a process. They focus on survival first, knowing that profit is just the byproduct of surviving long enough to get lucky.

The Evolution of the Student

The goal of following an analyst is not to follow them forever. It is to internalize their brain.

Stage 1: Imitation You copy their lines. You set up your Trader workstation exactly like theirs, then enter when they enter. You are learning by mimicking.

Stage 2: Understanding You start to know why they entered. You recognize the setup before they even mention it. You start to ask better questions in the online trading communities.

Stage 3: Independence You find your own trades. Sometimes, you even disagree with the analyst, and you turn out to be right. This is the moment of graduation. You have developed your own edge.

A great analyst is proud when you no longer need them. They have successfully cloned their competence into you.

Metrics That Matter

How do you measure the value of an analyst? It isn’t just P&L. A lucky idiot can make money in a bull market.

Look at their “drawdown management.” How do they handle a losing streak? Do they tilt and get angry? Or do they reduce their position size and become more conservative? Watching an analyst navigate a rough month is often more educational than watching them navigate a winning month. It teaches you resilience.

Also, look at their communication clarity. Can they explain complex concepts simply? If an analyst uses jargon just to sound smart, they aren’t a good teacher. The best analysts can explain a complex options hedge to a five-year-old.

Getting Plugged In

If you are currently trading in a vacuum, relying on free YouTube videos and your own intuition, you are playing the game on “Hard Mode.” You are ignoring the massive resource that is professional guidance.

Connecting with a team of vetted trading Academy analysts changes the trajectory of your career. It provides structure to your day, logic to your trades, and a safety net for your psychology. It turns the chaotic noise of the global markets into a coherent musical score that you can actually dance to.

If you are ready to stop guessing and start operating with institutional-grade intelligence, it is time to upgrade your environment. We can help you integrate into a workflow where professional analysis leads every decision, ensuring your Trader workstation becomes a command center rather than a casino.

Frequently Asked Questions

Do trading Academy analysts trade with real money?

Legitimate ones do. They should have a “live” account where they demonstrate their execution. However, for educational purposes, they often use a simulator to demonstrate concepts without the distraction of P&L swings, but their track record should be based on real market performance.

Can I talk directly to the analysts?

In premium online trading communities, yes. There is usually a chat function or a Q&A session during live webinars where you can ask specific questions about charts or strategies. This direct access is the primary value proposition of joining an academy.

What if I have a different trading style than the analyst?

Most academies employ a roster of analysts with different specialties. You might have one who specializes in Scalping (fast trades), one in Swing Trading (slow trades), and one in Macro/Options. You simply follow the one that aligns with your personality and schedule.

How much technology do I need to follow an analyst?

You don’t need a NASA computer. A decent laptop and an external monitor are enough. The term Trader workstation refers more to the software setup than the physical desk. You need the ability to run the charting platform and the community chat/stream simultaneously.

Do analysts provide buy and sell signals?

They provide “trade ideas” or “setups.” A signal is “Buy Now.” A setup is “If price hits X, and validates with Y, then we look to buy.” The difference is subtle but important. They teach you to fish; they don’t just hand you the fish.