You are weighing Tradeview forex broker for your routine. Good call to slow down and check the boring but crucial parts first. Below is a practical Tradeview Markets review that focuses on regulation, platforms, costs, and fit.

You will also get a straight answer to the big question: is Tradeview a regulated broker.

Quick answer: regulation and entities

Tradeview operates through multiple regulated entities. Regulation depends on which branch you open the account with.

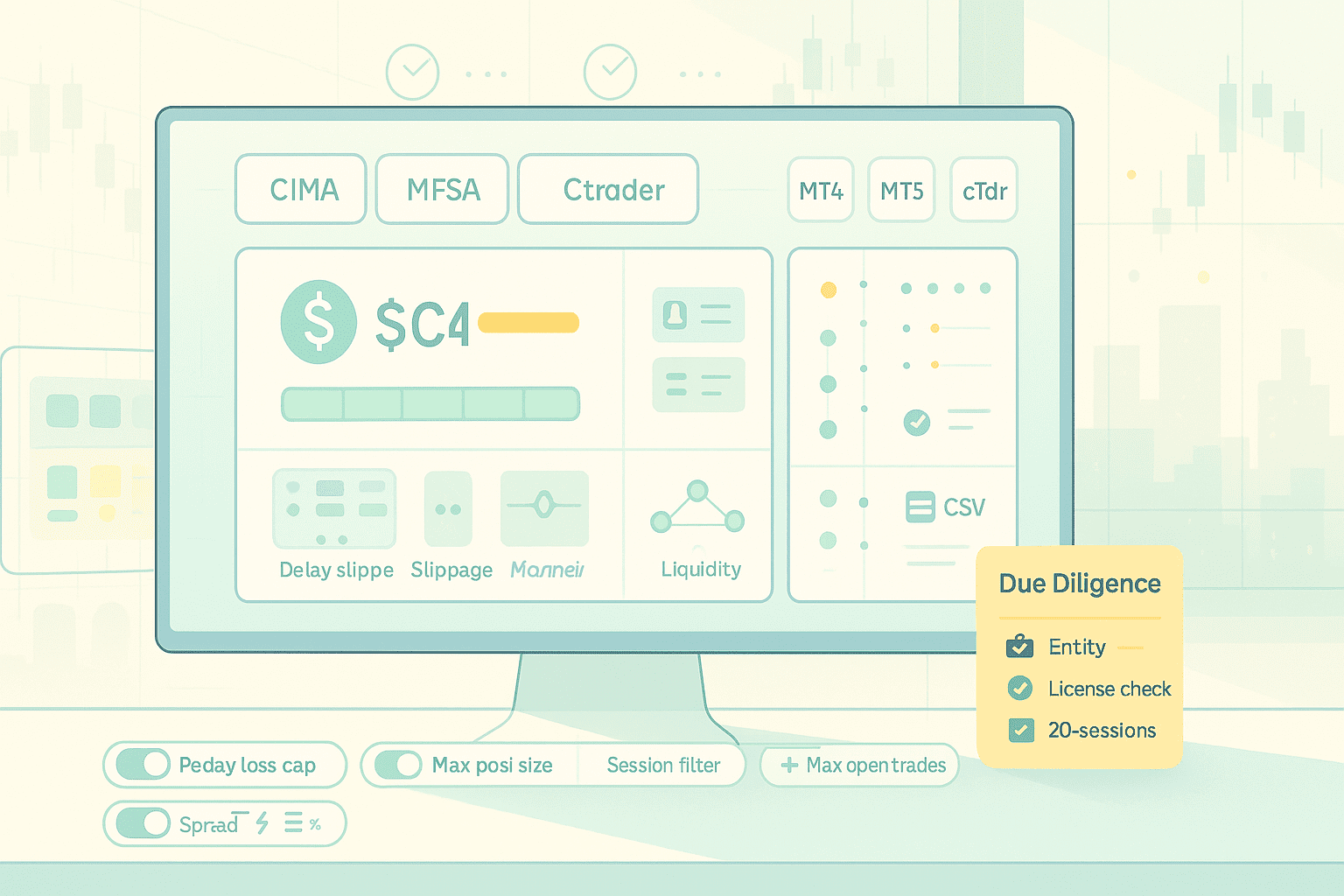

- Tradeview Ltd. in the Cayman Islands is licensed as a full securities broker dealer by the Cayman Islands Monetary Authority (CIMA). The site lists license number 585163 and notes oversight under the Securities Investment Business Law.

- Tradeview Europe Ltd. is authorized by the Malta Financial Services Authority (MFSA) under MiFID II, with Malta registration details published on the company site.

- TVM Global Ltd. is supervised by the Labuan Financial Services Authority (FSA) in Malaysia

So, is Tradeview a regulated broker? Yes, through the above entities. Always verify which entity will hold your account and which rulebook applies to you.

Tradeview Markets review at a glance

“If you can explain the account’s rulebook in one sentence, you picked the right entity.”

Platforms and markets

Tradeview advertises access to forex, stocks, indices and more through MetaTrader 4, MetaTrader 5, and cTrader. If you already chart or automate on those platforms, the migration path is straightforward. Confirm your exact market list and trading conditions with the entity that will onboard you.

Costs and execution, the practical lens

Marketing pages highlight liquidity aggregation and low spreads. That is encouraging, yet your actual cost depends on your symbols and session. The Malta and Cayman sites describe an internal aggregator called the Innovative Liquidity Connector designed to show best bid and offer from multiple providers. Treat that as an implementation detail and still measure your own slippage and all-in cost per trade.

Checklist to self test:

- Track spread, commission and slippage per symbol for 20 sessions

- Compare volatile minutes vs calm minutes on your pairs

- Export fills and confirm statement totals match your CSV

Safety notes that matter more than ads

- Regulation differs by entity. EU clients with Tradeview Europe Ltd. fall under MFSA and MiFID II. Cayman and Labuan entities fall under their local regimes. Jurisdiction changes investor rights and disclosures.

- Confirm the exact name on your agreement and verify that license on the regulator’s site if possible. The company pages publish license references to start that check

- Third party review sites on any broker can be noisy. Use them to find questions to ask, not as a sole decision tool. If you browse forums, look for moderator notes around conflict of interest.

“Receipts beat reviews. Export parity and clean statements end debates.”

Who Tradeview may suit

- Traders who want MT4, MT5 or cTrader under a single brand

- EU clients who prefer a MiFID II framework via Malta authorization

- Experienced users comfortable measuring their own execution quality and cost

Who should pause: anyone who cannot clearly repeat which entity will hold the account, or who needs local protections that only a home regulator provides.

A simple due diligence flow you can copy

- Identify the entity on your application. Write it down exactly.

- Open the regulation page and match license details to that entity.

- Confirm platforms and symbols for your region.

- Run a 2 week demo or tiny live test during your real session. Measure spread, commission, slippage and export parity.

- Save your notes. If anything feels fuzzy, ask support to answer in writing.

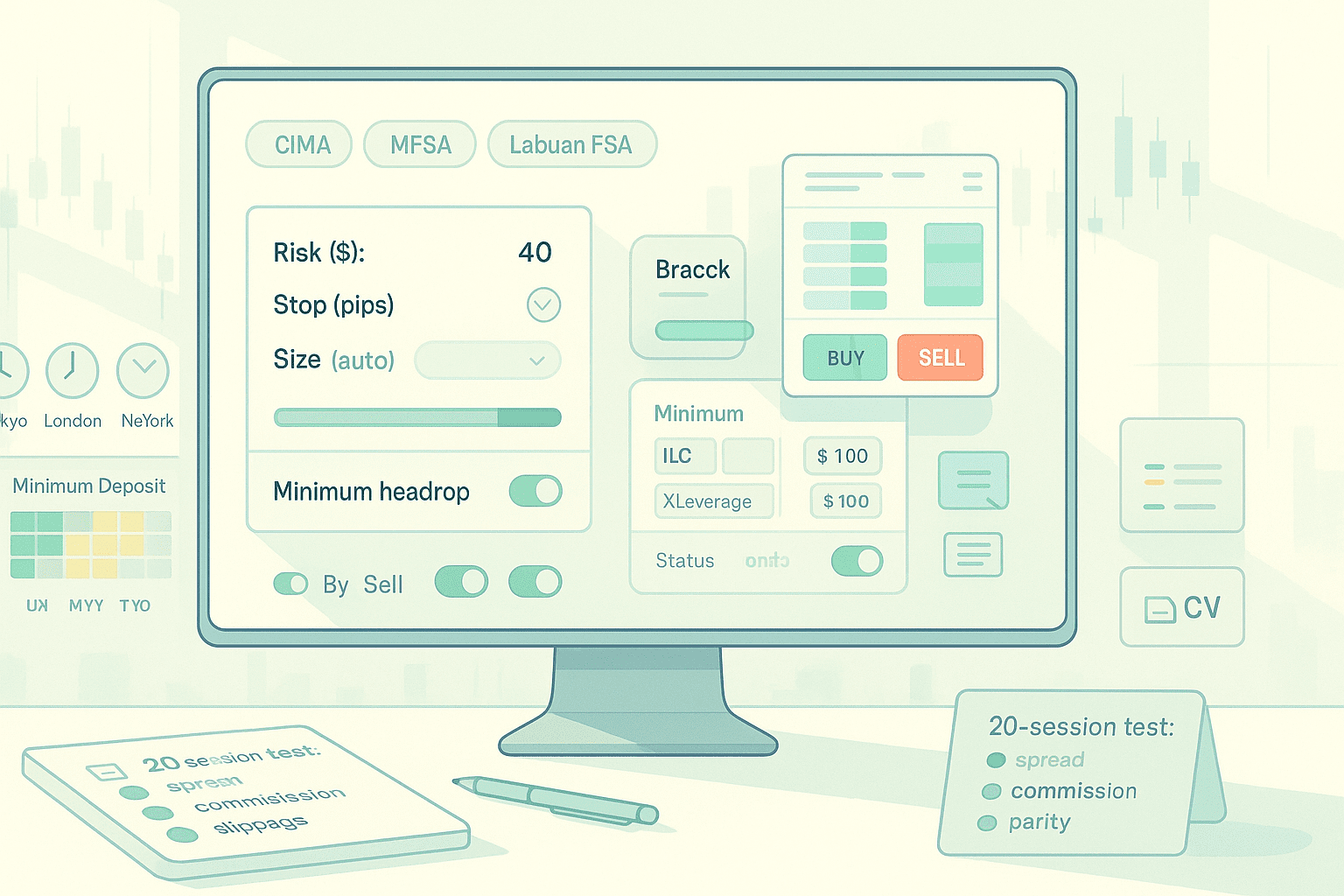

Example day you will recognize

You open your session and trade one liquid pair on MT5. Your ticket shows cash risk before submit. After a clean retest, you enter with a bracket attached. Spreads sit inside your normal band, and slippage stays small. After the window closes, you export fills and confirm that statement totals match your CSV. No detective work. That is what a calm day with a Tradeview forex broker account should feel like.

FAQ

Is Tradeview a regulated broker

Yes, through multiple licensed entities. Tradeview Ltd. is regulated by CIMA in the Cayman Islands. Tradeview Europe Ltd. is authorized by the MFSA in Malta under MiFID II. TVM Global Ltd. is supervised by Labuan FSA. Your protections depend on which entity holds your account.

Which platforms does Tradeview support

MetaTrader 4, MetaTrader 5 and cTrader are available according to the official site’s platforms page. Confirm availability per entity and region.

What about pricing quality

The company promotes its Innovative Liquidity Connector to aggregate quotes. That can help, but the only result that counts is your recorded spread, slippage and execution during your hours. Measure it for 20 sessions before scaling.

Where can I find an official Tradeview Markets review

There is no single official review. Use the firm’s regulation pages to verify licenses, then combine your own 2 week execution test with a skim of independent coverage. Be cautious with unverified forums and ads.

Does Tradeview serve every country

Coverage varies by entity and regulation. Check eligibility with the specific branch handling your application and verify any country restrictions on the site.