A social trading platform solution lets investors follow skilled traders, copy their strategies, and learn by doing. Your mission is simple. Give leaders the tools to share and manage risk, give followers clear controls, and connect both sides through smooth onboarding, funding, and support. Do that with care and you create a trusted place where ideas and results flow together.

A Snapshot Story

Jamal ran a lively trading community but growth had stalled. He launched a social trading platform solution with clean leader profiles, transparent stats, and one click copy. He kept fees simple and added a weekly Q and A to build trust. In just two months, leaders wanted to rank higher. Followers stayed longer, and support tickets decreased because the product was easy to understand.

Where to start a social trading platform

Begin with a simple map. It keeps you focused when choices pile up.

- Audience: beginners who want hand holding, active traders who want tools, or money managers who want scale

- Assets: forex, indices, commodities, crypto, or a narrow set you can do well from day one

- Compliance: KYC and AML checks, disclosures, leader eligibility rules, and clear risk warnings

- Monetization: spread share, performance fee, fixed subscription, or a mix with caps and guardrails

- Distribution: community influencers, educator partnerships, and referral programs for steady growth

Write this on one page before you compare vendors or start coding.

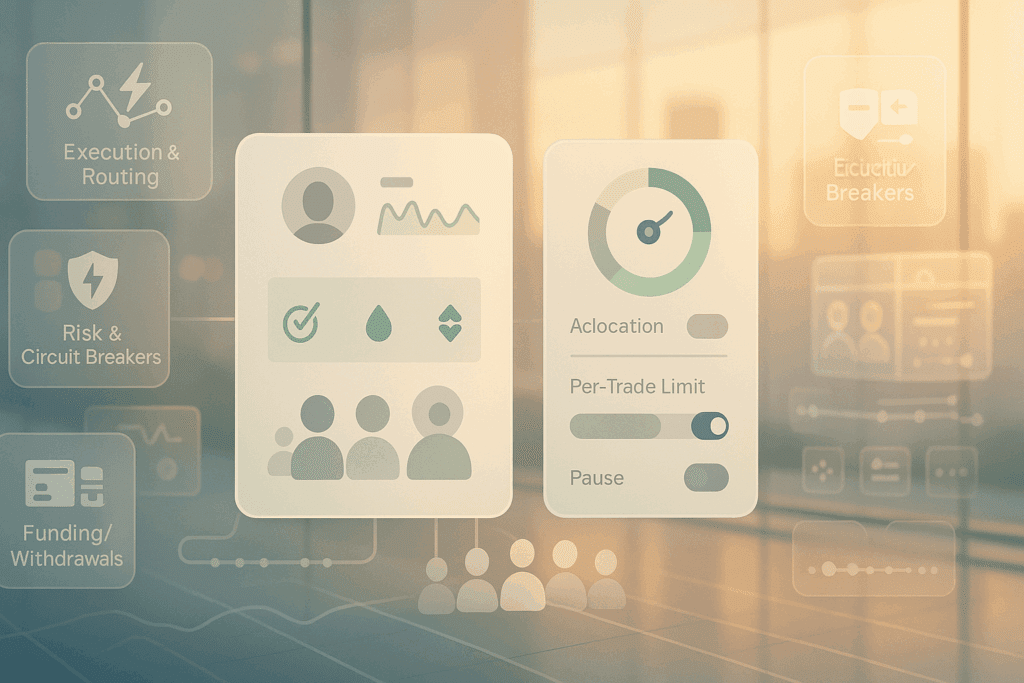

Core features every social trading platform solution needs

- Leader discovery: searchable profiles, verified identity, strategy descriptions, and risk tags

- Performance transparency: time weighted returns, drawdown, win rate, average trade duration, equity curve, and fees paid

- Copy controls for followers: allocate by percentage or fixed amount, set max loss per day, equity stop, per trade limits, and a pause switch

- Risk tools for leaders: max open positions, symbol limits, and equity protection that cannot be disabled

- Execution quality: fast routing, slippage reporting, and clear rules for partial fills

- Back office: deposits, withdrawals, statements, and tax friendly exports

- Compliance and safety: KYC, sanctions screening, audit trails, two factor authentication, and role based permissions

- Community features: chat with filters, announcements, badges, and a code of conduct

- Education: short videos, strategy notes, and community platform tips that show up in context

Build, buy, or blend a custom copy trading solution

Choose the path that fits your timeline and budget.

- Buy a ready platform: fastest to market, lower upfront cost, vendor handles uptime and upgrades

- Create a custom copy trading solution: You will have full control over the roadmap and data. This option costs more and takes longer. It also needs a dedicated team

- Blend both: start with a white label for speed, then add custom modules through APIs and webhooks

Questions to guide your choice:

- Do you need a unique fee model or rare asset coverage

- Will you require deep data science, such as leader ratings that account for risk and market regimes

- Can you staff a 24 by 7 on call rotation and security reviews

- How fast do you need to ship version one

Data you must calculate the same way every time

- Net returns: after all fees and costs

- Max drawdown: per strategy and per follower

- Risk adjusted returns: Sharpe or a simple return over drawdown metric for plain language

- Slippage and copy delay: average by symbol, session, and account size

- Copy health: percent of follower trades matched to leader trades, rejects, cancels, and disconnects

Publish definitions inside the app so trust grows with every session.

Execution and routing that protect followers

- Align leader and follower environments to reduce mismatches

- Use symbol filters and leverage caps for copied trades

- Add circuit breakers for extreme volatility and news spikes

- Log every step of the copy chain: signal time, route, fill, and price difference

When followers feel protected, leaders can focus on strategy, not support tickets.

Pricing that feels fair

Keep it simple and predictable.

- Free to try: demo mode with simulated copy

- One paid plan: includes core features, transparent fees, and fee caps

- Optional add ons: advanced analytics, priority leader access, or multi account copying

Show estimated monthly costs before users confirm. No surprises.

Growth engines that do not burn trust

- Showcase verified leaders with clear risk labels

- Reward education with badges and placement

- Encourage weekly recaps from leaders that explain wins and losses

- Run seasonal challenges that focus on discipline, not just return

Quality beats hype. Your brand depends on it.

A safe playbook for leader onboarding

- Verify identity and trading history

- Test latency and fills in a sandbox before going live

- Start leaders on conservative caps that expand with clean performance

- Require a plain language strategy page that any follower can understand

30, 60, 90 day launch plan

Days 1 to 30: Foundation

- Finalize the one page plan and target assets

- Select a vendor or scope a custom copy trading solution with milestones

- Set KYC rules, disclosures, and leader eligibility requirements

- Design the leader profile, stats, and follower copy controls

- Integrate payments and a basic help center

To days 31 to 60: Build and test

- Connect trading, routing, and risk controls end to end

- Back test the performance pipeline and confirm numbers match definitions

- Run a private pilot with three leaders and fifty followers

- Measure slippage, copy delay, rejects, and support load

- Adjust fee model, caps, and defaults based on data

Days 61 to 90: Pilot to public

- Publish education paths for beginners and advanced users

- Add referral tracking and a clear ambassador program

- Open carefully with waitlist waves to protect service levels

- Hold weekly office hours and post transparent status updates

- Review outcomes and plan version two

FAQs

What does a social trading platform solution do that a regular platform does not

It links leaders and followers. Leaders share strategies and performance. Followers copy with controls that protect their capital.

Where to start a social trading platform if I have a small team

Begin with a ready platform to validate demand. Keep branding, fees, and risk settings simple. Add custom features later as revenue grows.

When should I build a custom copy trading solution

Build when you need unique features or data models, you can fund a dedicated team, and you want total control over the roadmap.

How do I keep data honest

Use fixed definitions, automate calculations, and expose methodology inside the product. Audit samples each month and publish results.

How do I protect followers during volatile events

Set equity stops, per day loss limits, symbol filters, and circuit breakers. Communicate rules clearly and enforce them automatically.

To sum up

Choose a social trading platform that fits your audience. It should keep risk clear and make copying easy. If you are unsure where to start, begin with a simple package. Prove that your product works well, then decide if a custom copy trading solution is needed. Keep trust at the center, and momentum will follow.