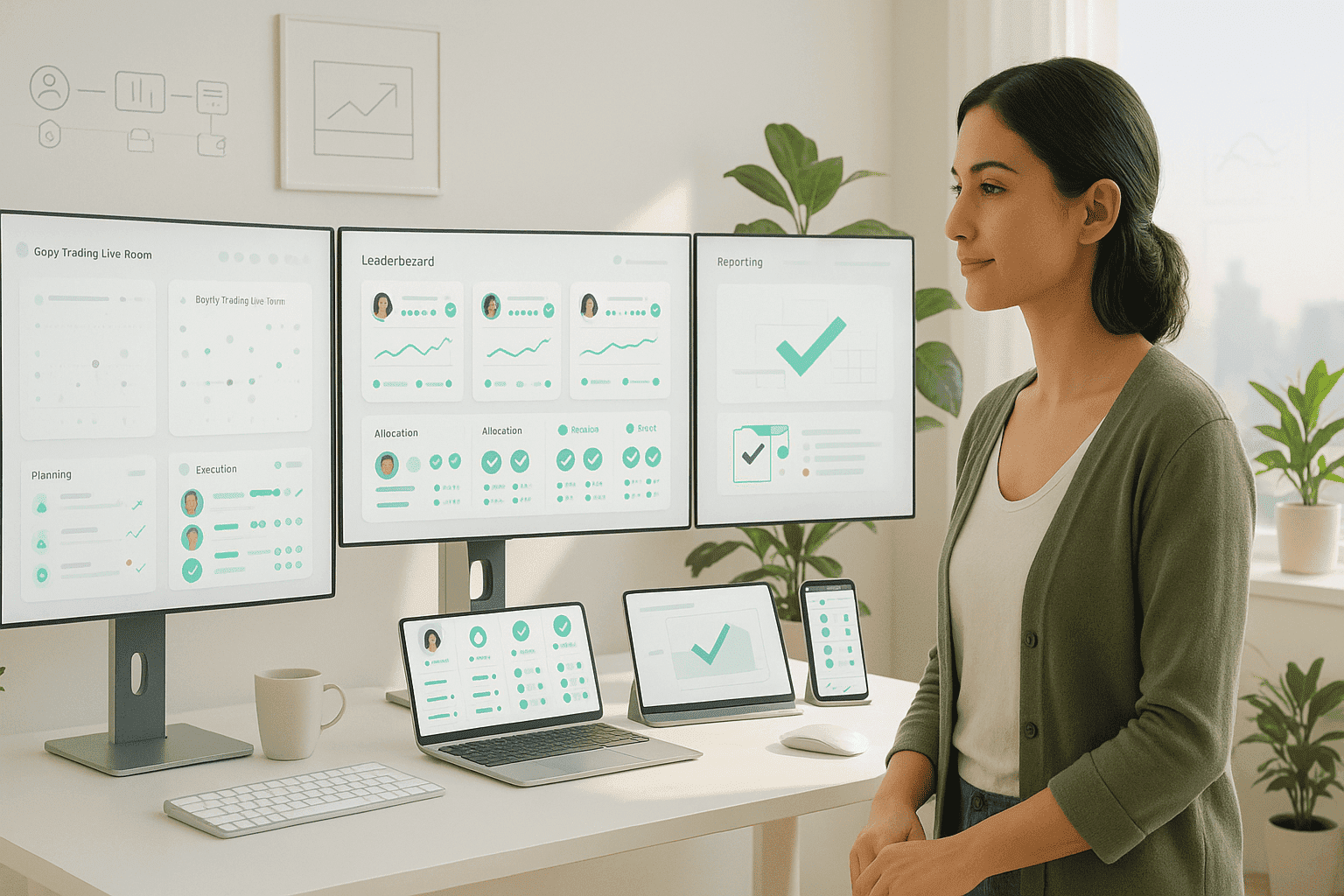

You want a social trading platform that teaches real skills and keeps wild minutes calm. The right setup blends a copy trading live room with tools that help you learn trading with professionals, all while showing cash risk before every click and generating statements that match exports line by line.

This guide gives you a clear blueprint you can use today.

The quick take

- One identity across CRM, trading, and wallets

- Leaderboard that ranks discipline, not luck spikes

- Copy engine with cash-first allocation and follower guardrails

- Exports that equal statements so debates end fast

Choose systems you can audit, not just admire.

What a solid social trading platform includes

| Area | Job to be done | What “good” looks like |

| Identity | One client ID across all systems | Create once, see everywhere |

| Leaderboard | Surface reliable providers | Return shown with drawdown and recovery time |

| Copy engine | Mirror trades safely | Fixed cash, percent of master, equity proportional |

| Guardrails | Protect followers and providers | Equity stop, per day cap, max open trades, session filters |

| Live room | Guide action in real time | Timestamped plans, entries in cash terms, post trade reviews |

| Education | Move people up the skill ladder | Short lessons, annotated charts, weekly replays |

| Reporting | End disputes quickly | CSV or API exports equal statements |

| Status page | Keep trust during stress | Timestamps, cause, fix, planned revert, all in plain language |

If a demo cannot prove each pillar in ten minutes, production will not be kinder.

Design your copy trading live room

A live room is more than chatting. Treat it like a flight deck with clear roles and repeatable steps.

Room structure

- Planning window: two line plan per provider, session bias, key levels, cash risk per idea

- Execution window: entries narrated in cash risk terms, brackets attach by default, two attempts per idea

- Debrief window: before and after screenshots, reason in, reason out, lessons that travel

Posting format providers should use

- Plan: “Bias long above 5140, risk 30 dollars to 5110, target 5162 if momentum holds.”

- Entry call: “Long 5144, risk 30, bracket attached.”

- Review: “Stopped 5139, second attempt only if value holds, pause for five minutes.”

Short, consistent messages keep the room calm and teach newcomers what matters.

Learn trading with professionals, without getting lost

A platform that helps people learn trading with professionals turns sessions into a curriculum.

Build a simple learning loop

- Before: watch a ten minute lesson tied to today’s plan

- During: follow a provider who calls risk in cash with a bracket attached

- After: review the replay and copy the provider’s markup, then add two lines of your own notes

Twelve lessons that earn their keep

- Cash risk first, size later

- Bracket exits, set and forget

- Session timing and overlap minutes

- Opening range break and retest

- Pullback into value with a simple reference like VWAP

- Measuring spread and slippage like a bill you pay

- Two screenshots and two lines, the journal that sticks

- News minutes, when to wait and how to re enter

- Two attempts per idea, then step aside

- Short watchlists, liquid symbols

- Export parity with statements

- Weekly review that changes one thing, not ten

Teach money first, signals second.

Leaderboard that rewards discipline

A leaderboard is a teacher in disguise. Rank by a composite that balances pace and pain.

| Metric | Why it belongs | Display tip |

| 60 day return | Recency with enough sample | Percent and cash side by side |

| Max drawdown | The pain you must survive | Absolute and percent on every card |

| Recovery time | Discipline after a slump | Days since trough to new high |

| Average hold | Style fit for real schedules | Minutes or hours, rounded |

| Trade count | Sample size honesty | Hide tiny samples |

Pin a “Hall of Consistency” for providers with steady equity curves and low drawdown. Newcomers should see calm role models, not just moon shots.

Copy allocation modes, explained in plain English

| Mode | Plain meaning | Best for | Watch out for |

| Fixed cash | You risk a set dollar amount per idea | New followers and small balances | Too small can feel random |

| Percent of master | You mirror a slice of provider size | Cohesive follower cohorts | Rebalance after big equity shifts |

| Equity proportional | Size scales with follower equity | Larger accounts | Swings rise with balance |

Mini math that makes sense

Provider risks 500 dollars on a 50 pip stop where 1 mini equals 1 dollar per pip. Risk per mini equals 50 dollars, provider trades 10 minis. Your fixed cash 50 dollars allocates 1 mini. Your 10 percent of master also allocates 1 mini. Same rules, predictable outcomes.

Guardrails that protect the month

- Equity stop: pause copying at a set drawdown

- Per day cap: block new orders until server reset

- Max open trades: reduce concentration

- Symbol and session filters: skip thin hours or restricted instruments

- Two attempts per idea: discipline over noise

What followers see on a good trade ticket

- Cash risk shown before submit

- Bracket presets saved as default

- Symbol specs in cash terms, tick value and hours included

- A simple toggle to limit copying to your local session

- Export button that creates a CSV that equals the statement total

If any of these are missing, expect confusion and extra tickets.

Two setups that travel across markets

Opening range break and retest

Box the first minutes of your session. After a decisive break, take the first clean retest to the box edge with the bracket attached. Works on indices, gold, and active FX pairs.

Pullback into value

Confirm direction on a higher timeframe. Mark a value band such as VWAP. Take the first measured pullback that pauses. Stops stay honest on fast markets.

Short definitions survive loud minutes.

Costs that decide more than headlines

| Cost line | Where to see it | Practical move |

| Spread and commission | Ticket preview and statements | Trade liquid minutes, avoid chasing |

| Slippage | Recaps during hot windows | Prefer retests, size down near prints |

| Subscription or performance fee | Fee ledger with high water mark if used | Post line items and dates for clarity |

| Funding or swaps | Instrument specs in cash | Match hold time to carry, or day trade early on |

| Platform or data | Pricing page and receipts | Keep only what changes outcomes |

Clarity turns uncertainty into a choice people can live with.

A simple routine for your first 14 days

Days 1 to 3

- Pick one provider with clear cash risk language

- Use fixed cash allocation at tiny size

- Attend the copy trading live room for your real session

Now to days 4 to 7

- Journal two screenshots and two lines per trade

- Track spread, slippage, and time to fill

- Watch one short lesson each day

And Days 8 to 14

- Test the second setup only if week one was calm

- Keep your watchlist short and liquid

- Export and reconcile totals, they must equal the statement

Boring is good.

FAQ

Is a social trading platform safe for beginners

Yes, if allocation starts with fixed cash, guardrails are on by default, and providers post plans and reviews in plain English.

Do I need to copy trades to learn

No. Many learners attend the live room, keep a tiny fixed cash allocation for exposure, and spend most energy on plans and reviews.

How long until I try percent of master

After two calm weeks with clean logs and exports. Move slowly and keep your per day cap.

What proves the data is trustworthy

Exports equal statements, fee ledgers with dates and IDs, and a status page that uses timestamps, cause, fix, and planned revert.

Can this work across assets

Yes. Use the same cash risk language for FX, indices, and metals. The setups and guardrails travel well.

A gentle nudge before you join or build

Write a one page plan with your session, fixed cash risk per idea, one setup you will practice, and the three numbers you will track for twenty sessions: spread, slippage, export parity. Then choose the social trading platform that makes those habits easy, offers a copy trading live room, and lets you learn trading with professionals without guesswork.