A strong risk management tool for forex brokers is not a flashy screen of blinking numbers. It is a clear set of controls that work before, during, and after each trade. It also includes real-time exposure monitoring that turns noise into action. The goal is a broker trade risk dashboard that any dealer, supervisor, or auditor can understand at a glance.

What “good” feels like in motion

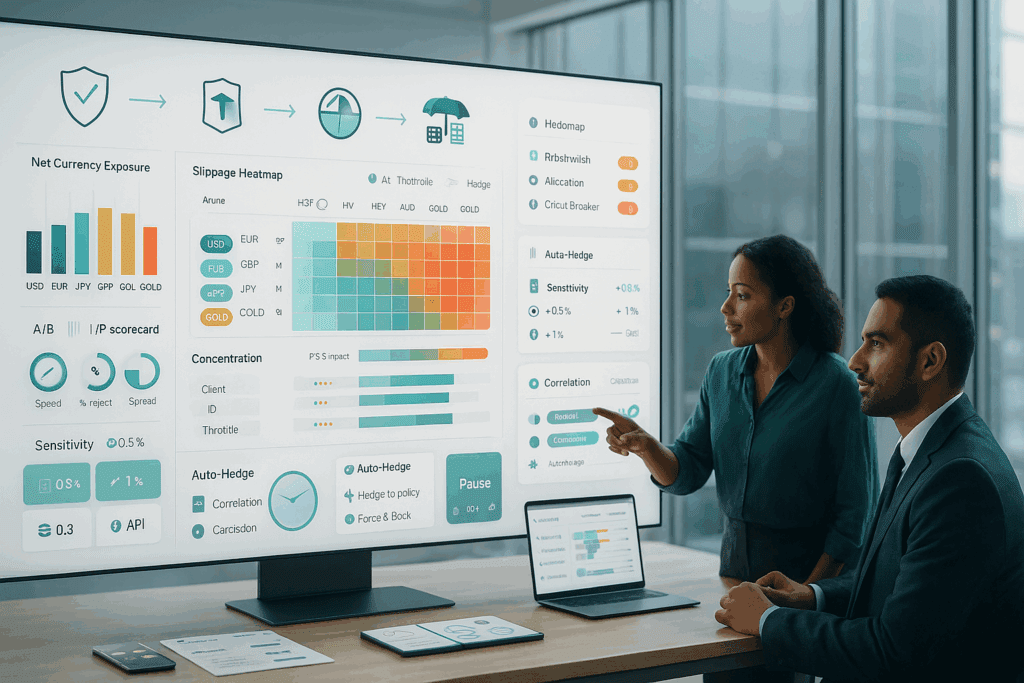

You open the desk. The dashboard shows net currency exposure by USD, EUR, JPY, GBP, and Gold. A concentration alert is yellow on GBP because a few IBs sent flow in the London open. Routing rules are visible, kill switches are armed, and the slippage heatmap looks normal for your session. When a spike hits, pre trade price collars and margin checks do their job, and the post trade hedge suggests a small top up with your primary LP. Logs match the story line by line.

“When the platform and paper tell the same story, trust grows.”

Architecture that brokers can actually run

Think in three layers: controls, telemetry, and reporting.

- Pre trade controls

- Credit and margin check

- Max order size and price collars

- Symbol permissions and throttle per client or IB

- A/B routing rules by symbol and session

- At trade safeguards

- Slippage bands by symbol and hour

- Venue fallback if LP is stale or rejects spike

- Circuit breaker on abnormal spread or quote age

- Post trade monitoring

- Net open position by currency and symbol

- Auto hedge suggestions against rules

- Stress tests and scenarios in cash terms

- Real time PnL with fees and swaps separated

Keep custom work at the edges. Leave allocation math, logging, and timestamps standard so upgrades remain painless.

Real-time exposure monitoring that tells you what to do

Goal: show risk by factor, not just by instrument.

| View | What it shows | Why it matters |

| Currency NOP | Net exposure in USD, EUR, JPY, GBP, CHF, AUD, CAD | Hedging decisions happen at the currency level |

| Symbol exposure | Top 10 pairs by notional and direction | Finds concentration and crowded lanes |

| Client cohort | Exposure by book, IB, or region | Spots source of drift quickly |

| Sensitivity panel | PnL impact of a 0.5% and 1% move per base currency | Makes stress tangible in cash |

| Correlation radar | Overlap across USD and risk assets | Prevents double counting in busy hours |

“Measure by factor first, then drill into instruments.”

The broker trade risk dashboard, explained

Design for one-screen comprehension. If a new dealer cannot read it within five minutes, simplify.

| Widget | Purpose | Healthy signal | Action if red |

| Net currency exposure bars | See total directional risk | Inside policy bands | Hedge to policy or tighten routing |

| Slippage heatmap by symbol x hour | Surface quality issues by time | Green in core hours, amber at edges | Review LP mix or widen bands briefly |

| Reject taxonomy pie | Classify margin, permission, market, throttle, technical | Margin and stale quote dominate | Tune price collars or credit lines |

| Concentration table | Top clients, IBs, or strategies by exposure | Even distribution | Raise per account caps temporarily |

| A/B book dial | Distribution of flow | Stable against policy | Toggle hybrid or increase A book share |

| LP scorecard | Fill speed, reject rate, spread by symbol | Consistent with history | Switch venue or escalate with LP |

| Alerts inbox | Human readable rules firing now | Short, timestamped entries | Click to run playbook or pause symbol |

Short, plain messages reduce tickets:

“Order blocked. Free margin below threshold. Reduce size or fund.”

“Pause active. Daily limit reached. Resets at 00:00 server time.”

“Spread collar breached on GBPUSD. Routing forced me to read a book for 3 minutes.”

Controls to write in one line each

- Max order size per symbol: hard ceiling, updates by session.

- Price collars: reject quotes outside recent median spread x multiplier.

- Per day loss cap by client: auto pause when limit hits.

- Symbol allow lists: exotics off for new or small accounts.

- Velocity throttle: X orders per Y seconds per account.

- Kill switch: pause by symbol, group, or venue with clear revert.

“Short controls invite consistent enforcement.”

Multi level stress testing, in cash

Keep stress in amounts people feel.

- Shock by currency: apply ±1% to base currencies and show PnL impact on the book.

- Session replay: load last month’s CPI or NFP minute and simulate fills with current rules.

- LP outage scenario: remove one venue for 5 minutes, show rejects, slippage, and hedge gap.

- Correlation break: assume weaker USD correlation and reprice cross pairs.

Export these scenarios to PDF and CSV with inputs up top and results in cash lines.

Hedging playbook that never changes on a fast day

- Hedge to the policy band on the main currency first.

- Neutralize crowded symbols next if concentration exceeds limit.

- Use the cheapest path: internalization, secondary LP, or exchange future.

- Log route, size, timestamp, and reason in one sentence.

“Hedge the book you have, not the book you wish you had.”

Data you need, nothing you do not

- Tick and trade logs with source venue, quote age, and mark at decision

- Client state snapshots at decision time for audit

- LP telemetry: last look, hold times, fill speed, reject codes

- Normalized fees: spread, commission, swap, rebate

Store raw, render simple. The audit trail is your shield.

Daily, weekly, monthly rhythms

Daily opening checklist

- Status page all green, quotes fresh, caps loaded

- A/B rules confirm for your session, alerts test fired

- Prior day reconciliation matched across platform, PSP, bank

Weekly

- Slippage review by symbol and hour

- Top 10 reject reasons with fixes assigned

- LP scorecard mailed to vendor contacts

Monthly

- Policy bands recalibrated from real volatility

- Playbook drill on kill switch and forced A book routing

- Fee audit with random sample of statements

Consistency beats intensity.

KPIs that predict smooth weeks

| KPI | Healthy signal | Why it matters |

| Copy of exposure within policy | ≥ 95% of hours green | Shows rules match reality |

| Reject mix | Margin and stale quote lead | Predictable, tunable issues |

| LP fill speed vs last month | Stable within band | Confirms venue health |

| Slippage per symbol in core hours | Down or flat | Execution quality improving |

| Alert resolution time | Under 3 minutes median | Reduces compounding errors |

| Reconciliation breaks | Zero unresolved daily | Avoids end of month chaos |

Publish a trimmed scoreboard every Monday. Radical clarity improves judgment.

Cost lines that decide more than you think

| Cost line | Who feels it | Practical move |

| Spread and commission | Clients and broker | Route to best venue in live hours, publish typical ranges |

| Swaps or funding | Clients | Teach hold costs in cash on tickets and statements |

| LP market impact | Broker | Stagger hedges and diversify execution paths |

| Chargebacks and disputes | Broker | Clear rules on tickets, logs, and worked fee examples |

“Cost clarity turns uncertainty into choices people can live with.”

Implementation checklist for your team

- One page policy for exposure bands and caps

- Dashboard with currency NOP, concentration, slippage, and rejects

- Pre trade: credit, collars, throttle, permissions

- At trade: slippage bands, venue fallback, circuit breaker

- Post trade: auto hedge suggestion and stress in cash

- Exports and APIs that rebuild statements exactly

- Status page with timestamps and planned reverts

When this list is normal, the room stays quiet on loud days.

One nudge before you build

Write down the three rules you will always follow. List the two KPIs you will share every Monday. Also, include the one message format you will use for any outage. Then wire up real-time exposure monitoring, ship your first broker trade risk dashboard, and tune only what the logs ask you to tune. Small, boring upgrades win.

FAQ

What makes a risk management tool for forex brokers effective

Clear pre trade checks, live exposure by currency, simple stress in cash, and a dashboard that points to one obvious next action. If new dealers understand it in minutes, you did it right.

How detailed should real-time exposure monitoring be

Show currency NOP, top symbols, cohort concentration, and a quick sensitivity panel for 0.5% and 1% moves. Depth beyond that belongs in reports, not the main screen.

How do we keep slippage under control during volatile prints

Use price collars and slippage bands, prefer retests over chases, and route to venues with predictable last look. Consider a short forced A book window when spreads blow out.

Which controls matter most for client protection

Per day loss caps, equity stops, symbol allow lists for thin pairs, and velocity throttles. Pair these with clear messages and instant pauses.

How often should policy bands change

Monthly is typical. Recalibrate using realized volatility and actual hedging performance, not only opinions.