There is a distinct lifecycle in the career of a retail trader. It almost always begins in solitude. You start by watching YouTube videos, reading PDFs, and perhaps browsing public forums like Reddit or Twitter. In this early phase, the noise is deafening. You are bombarded with conflicting advice: “Buy the dip,” “Short the rip,” “Indicators are useless,” “Price action is king.”

For most, this phase ends in burnout. The isolation of sitting in front of a screen for eight hours a day, fighting algorithms and institutional capital, is psychologically draining. When you lose, you have no one to correct your mistakes. When you win, you have no one to validate if it was skill or just luck.

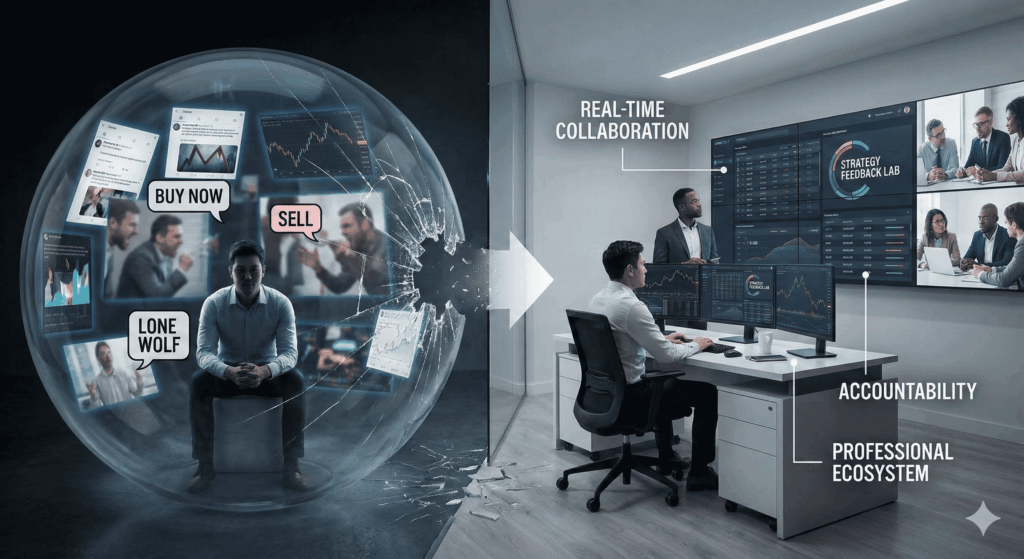

This is where the transition happens. The traders who survive the initial “churn” often find their way into a private trading hub community. This is not a signal group where you blindly copy alerts. It is a professional ecosystem designed to replicate the environment of an institutional prop desk. It is about moving from a “lone wolf” mentality to a “wolf pack” structure, where resources, data, and psychological capital are pooled for the benefit of the group.

The Problem with the Public Square

To understand the value of a private hub, you first have to understand the toxicity of the public square. Public trading forums are often plagued by two things: hindsight bias and anonymity.

In a public forum, users post their winning charts after the move has happened. They claim they “called it,” but there is no accountability. If they are wrong, they simply delete the tweet. This creates a false reality for the observer, who wonders why everyone else is making money while they are struggling.

A private trading hub community operates on transparency. Entry usually requires a subscription or a vetting process (like passing a prop firm challenge). This creates a barrier to entry that filters out the trolls and the tourists. Everyone inside has “skin in the game.” The conversation shifts from “Which crypto is going to the moon?” to “How did you manage your risk on that NFP release?”

The Mechanics of Real-Time Collaboration

The defining feature of a modern hub is real-time collaboration. We aren’t talking about a slow-moving message board where you post a question and wait three days for an answer. We are talking about live, synchronous execution environments.

In a top-tier private hub, the trading day starts with a “Squawk Box” or a live voice room (often hosted on Discord or proprietary software). Traders log in, share their screens, and talk through the pre-market data.

“Trading is 90% waiting and 10% execution. Real-time collaboration fills the waiting period with high-value data processing.”

Imagine a scenario where you are watching the S&P 500 (ES) futures. You are bearish. But a trader in your hub, who specializes in the Nasdaq (NQ), mentions that Big Tech earnings are acting as a floor. Another trader, who watches the bond market, notes that yields are dropping.

Suddenly, your bearish thesis is invalidated by data you weren’t looking at. This real-time collaboration saves you from a bad trade. You aren’t just relying on your own eyes; you are borrowing the eyes of fifty other specialists.

The Science of Strategy Feedback Labs

One of the most innovative components of these private communities is the concept of Strategy feedback labs.

In the academic world, before a paper is published, it undergoes peer review. Scientists tear it apart to find flaws in the logic. In trading, we rarely do this. We trade in a vacuum.

Strategy feedback labs formalize the peer review process. In this section of the hub, a trader submits their playbook.

- The Thesis: “I trade breakouts on the 15-minute chart using VWAP.”

- The Data: “Here is my backtest over the last 6 months.”

- The Problem: “I am profitable in the morning but giving it back in the afternoon.”

The community then dissects the strategy. They act as an external risk manager, might spot that the strategy fails during low-volume lunch hours (12:00 PM – 1:00 PM NY time). They might suggest a “time filter” to fix the afternoon bleed.

This feedback loop is impossible to replicate alone. You are too emotionally attached to your system to see its flaws. Your peers in the lab, however, are objective. They help you iterate and refine the edge until it is robust.

Psychological Capital and Accountability

Trading is a performance sport. And like any sport, you can go into a slump. When a solo trader hits a drawdown, they often spiral. They revenge trade. They double down.

A private hub acts as a psychological safety net. When you post a “loser” in the chat, the community doesn’t mock you. They ask, “Did you follow your plan?”

If the answer is “No,” the accountability stings, but it corrects the behavior. If the answer is “Yes,” the community reminds you that losses are part of the probability distribution. This validation, that you did the right thing even though you lost money, is crucial for maintaining confidence.

The Technology Stack

A private hub is more than just a chat room. It is usually a tech stack. The best communities pool their resources to buy institutional-grade tools that are too expensive for a single retail trader.

Common Shared Resources:

- News Squawk: A professional audio feed (like Financial Juice or Benzinga) broadcasted to the group.

- Options Flow Scanners: Tools like Cheddar Flow or Unusual Whales that track institutional block orders.

- Custom Algos: Proprietary indicators or scripts built by the community’s developers.

By sharing the cost, the private trading hub community gives the individual trader access to an institutional-grade dashboard for a fraction of the price.

Finding Your Tribe

Not all hubs are created equal. The industry is rife with “signal services” masquerading as communities. A signal service makes you dependent; a trading hub makes you independent.

When vetting a community, look for these green flags:

- Transparency: Do the mentors show verified broker statements?

- Education First: Is there a library of content, or just a channel for “Buy Alerts”?

- Active Voice Rooms: Is the community talking during the session, or is it dead silence?

The goal is not to find a guru to follow. The goal is to find a group of peers running at the same pace as you, pushing you to execute better, risk smarter, and think deeper.

Taking the Professional Leap

If you are tired of talking to yourself in an empty room, or getting drowned out by the noise of Twitter, it is time to professionalize your environment. The transition from amateur to pro often coincides with the decision to join a structured environment.

The market is too complex to conquer alone. You need the strategy feedback labs to refine your edge and the real-time collaboration to protect your capital. If you are ready to stop playing the lone wolf and start hunting with the pack, we can help you identify the right ecosystem for your specific asset class and experience level.

Frequently Asked Questions

What is the difference between a signal group and a trading hub?

A signal group tells you what to trade (e.g., “Buy Apple now”). It creates dependency. A trading hub teaches you how to trade through collaboration, analysis, and feedback, fostering independence.

Are private trading communities worth the monthly fee?

If the community prevents you from taking one bad trade or helps you size up properly on one good trade, the subscription usually pays for itself. The value lies in the shared resources (scanners, news feeds) and the accountability.

Do I need to be an experienced trader to join?

Not necessarily, but most private hubs have “tiers.” Some are for beginners focusing on education, while “Inner Circles” or “War Rooms” might require proof of profitability or a funded account to join.

What technology do these communities use?

Most modern hubs run on Discord or Slack due to their ability to host live voice stages, screen sharing, and organized text channels. Some high-end groups use proprietary web platforms.

Can a trading community help with psychology?

Yes. Peer pressure is a powerful tool. Knowing that you have to post your trade journal to the group at the end of the day makes you less likely to take a stupid, impulsive trade during the session.

What are “Strategy Feedback Labs”?

These are dedicated sections within a community where traders submit their trading plans and backtesting data for peer review. Other members critique the logic, suggest improvements, and help stress-test the strategy before it goes live.