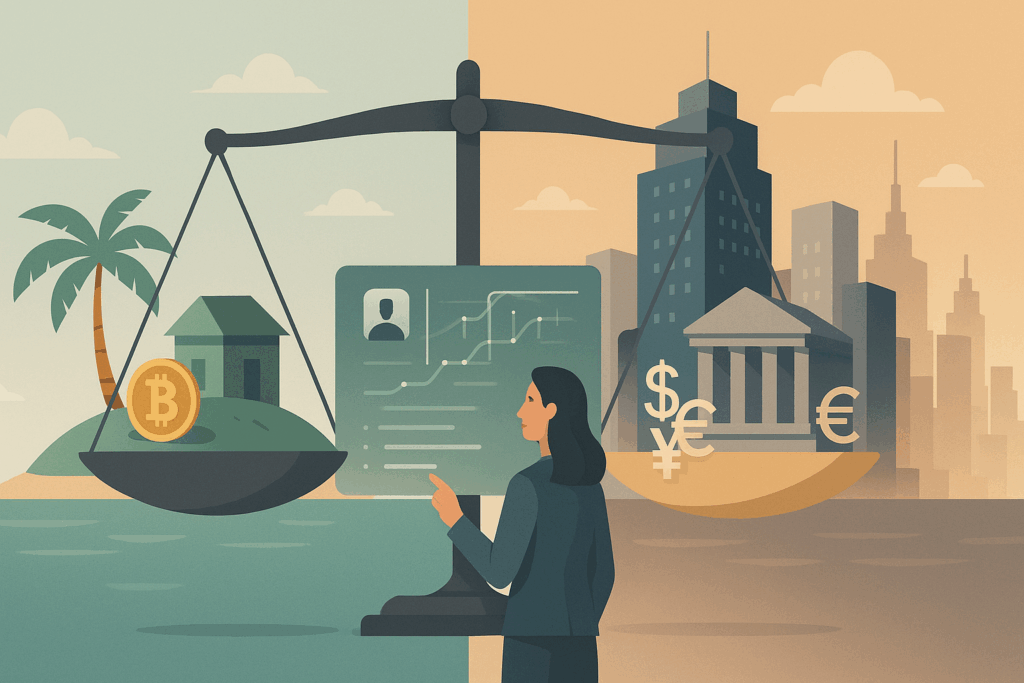

If you’re thinking of launching your own forex brokerage, chances are you’ve already asked yourself: Offshore or onshore license?

This is one of the biggest decisions any finance entrepreneur has to make early on. The license you choose will define how and where you operate, how much you’ll spend, and what kind of clients you’ll attract.

The good news? The right choice isn’t the same for everyone—it depends on your goals, your budget, and where you want to take your business.

This article isn’t a technical manual. Think of it more like an honest conversation—one that breaks down what an offshore forex license really means versus a traditional onshore license. We’ll cover real benefits, things you won’t find on government websites, and common mistakes you’ll want to avoid.

First Things First: What’s the Real Difference?

| Feature | Offshore License | Onshore License |

| Regulatory Oversight | Flexible, fewer controls | Strict, with recognized regulators |

| Startup Costs | Low ($5K–$30K) | High (starting at $100K+) |

| Approval Time | Fast (4–8 weeks) | Slow (6+ months) |

| Client Perception | Varies by jurisdiction | High trust due to global recognition |

| Market Access | Limited, mostly emerging markets | Broad access—EU, UK, Australia, etc. |

Why So Many Brokers Start Offshore

In essence, the offshore route provides a cost-effective and quick entry into the market.

Clear advantages:

- Fast setup: Jurisdictions like Seychelles or St. Vincent typically grant licenses within a couple of months, allowing businesses to launch rapidly.

- Streamlined legal requirements: These jurisdictions often don’t require a physical presence or complex legal infrastructure to get started.

- Operational freedom: Many offshore frameworks permit handling of digital assets, custom pricing structures, and minimal regulatory constraints.

- Tax efficiency: Low or zero corporate tax rates in several offshore regions can improve the financial outlook for new brokerages.

But there are trade-offs:

- Customer skepticism: More experienced traders might be cautious if they see “licensed in SVG”.

- Banking challenges: Opening accounts with traditional banks can be tricky.

- Market limitations: You won’t be allowed to advertise or take clients in places like the EU, US, or UK.

Onshore: More Expensive, More Trustworthy

An onshore license is the solid option if your goal is to build a credible, long-term brand and operate in fully regulated markets.

Key benefits:

- Client trust: Saying you’re regulated by the FCA or CySEC opens doors.

- Access to investors: If you’re planning to raise capital or scale big, this license matters.

- Banking relationships: Easier to work with payment providers and Tier 1 banks.

The downsides?

- High costs: Between minimum capital, lawyers, and time, plan on spending at least $150,000.

- Slow process: Many brokers wait 6 to 9 months for approval.

- Ongoing compliance: Expect quarterly reporting, audits, and a whole lot of paperwork.

Which Jurisdictions Are Worth Considering?

Choosing a financial jurisdiction isn’t just about the cheapest option. Reputation, turnaround time, and how easy it is to operate should all factor into your decision.

Offshore Jurisdictions

| Country | Key Advantages | Approx. Cost | Approval Time |

| Seychelles | Fast, crypto-friendly, low-cost | $20,000 – $30,000 | 4–6 weeks |

| St. Vincent & Grenadines | Super cheap, no actual forex license | $5,000 – $10,000 | 2–4 weeks |

| Belize | Simple process, legal forex structure | $25,000 – $35,000 | 6–8 weeks |

Onshore Jurisdictions

| Country | Reputation | Approx. Cost | Approval Time |

| Cyprus | EU access, strong for mid-sized brokers | €100,000+ | 6–8 months |

| UK | Global trust (FCA license) | £125,000+ | 8–10 months |

| Australia | Great for APAC, solid oversight (ASIC) | AUD 100,000+ | 6–9 months |

So, Which One Fits Your Business Strategy?

This depends 100% on your business vision and your current resources.

If you’re launching your first project:

An offshore forex license gives you speed, flexibility, and lower upfront costs.

It’s a great way to test your model without heavy regulation.

If you already have experience or funding:

Starting with an onshore license might be the smart move for building trust from day one.

A smart move if you’re well-funded or planning rapid expansion.

Two Real-Life Scenarios

1. Startup targeting Latin America

A small team launched with a Seychelles license. They accepted crypto and focused on Colombia, Mexico, and Peru. Within 14 months, they doubled their client base and applied for a CySEC license to enter the European market.

2. Institutional-focused broker from day one

Backed by €600,000 in funding, this team applied directly for an FCA license. It took 9 months, but they now work with EU banks, have a compliance team, and are signing deals with investment firms.

Hidden Costs You’ll Want to Consider

Beyond the license itself, there are ongoing expenses that many overlook:

- Monthly compliance fees: Offshore: $500–$1,500. Onshore: $2,000–$5,000.

- Annual renewals and reports: Onshore jurisdictions often require audited financials.

- Legal staff: Onshore setups usually need a full-time compliance officer.

- Tech integrations: Regulated markets may demand risk control APIs, client KYC tools, and data encryption systems.

Mistakes You Can Easily Avoid

- Not reading the fine print: Some countries let you register a company—but not actually offer forex trading.

- Thinking one license covers the world: A license in SVG won’t let you advertise in Europe or the US.

- Forgetting about perception: Clients Google everything. If your country doesn’t sound legit, you might lose their trust.

The Hybrid Path That Works for Many Brokers

Today, many forex brokers start offshore, then go onshore later. It’s a proven growth path:

- Start by obtaining an offshore license to validate your business model. As the company grows and gains momentum, consider transitioning to an onshore license for broader access and credibility.

- Build revenue and traction.

- Apply for an onshore license once your business is stable.

It balances short-term savings with long-term potential.

Before moving forward, double-check that your license fits your goals, your audience, and your budget.Make the right licensing decision—book a strategy session with our regulation experts today! We’ll help you map out a custom plan without wasting time or money.

FAQs

Can I operate in Europe with just an offshore forex license?

No. Regulated areas like the EU require a local license (e.g., CySEC) to operate legally.

Is an offshore forex license illegal?

No, but legality depends on the jurisdiction and how you use it. Not all offshore licenses authorize forex trading.

Can I hold more than one license?

Yes. Many brokers operate under multiple entities to target different markets.

How quickly can I launch with an offshore license?

In some places like SVG, you could be live in as little as 3 weeks.

What’s the cheapest option?

St. Vincent & the Grenadines is the cheapest—but it doesn’t offer an official forex license. Best only for very specific business models.