Multi-account manager forex tools allow a money manager to place one main order. This order can then be shared across many investor accounts. You can set rules in advance for how this works. Instead of handling many tickets, you define the strategy once.

Then, the allocation engine takes care of the rest.The goal is not only efficiency. The goal is consistency, auditability, and protection for each participant in the chain.

“If the allocation rule is explainable on a napkin, it is probably sustainable during a volatile session.”

Core ideas behind multi account manager forex

Why teams adopt MAM

- One trade action fans out to many linked accounts

- Position sizing aligns with each investor’s balance or equity

- Risk rules and fees are applied automatically and logged

- Reconciliations are faster, so monthly reports arrive on time

Who benefits

- Money managers simplify execution and stay focused on strategy

- Investors gain transparency into sizing, performance, and fees

- Brokers reduce manual errors and improve compliance readiness

The MAM account management system explained

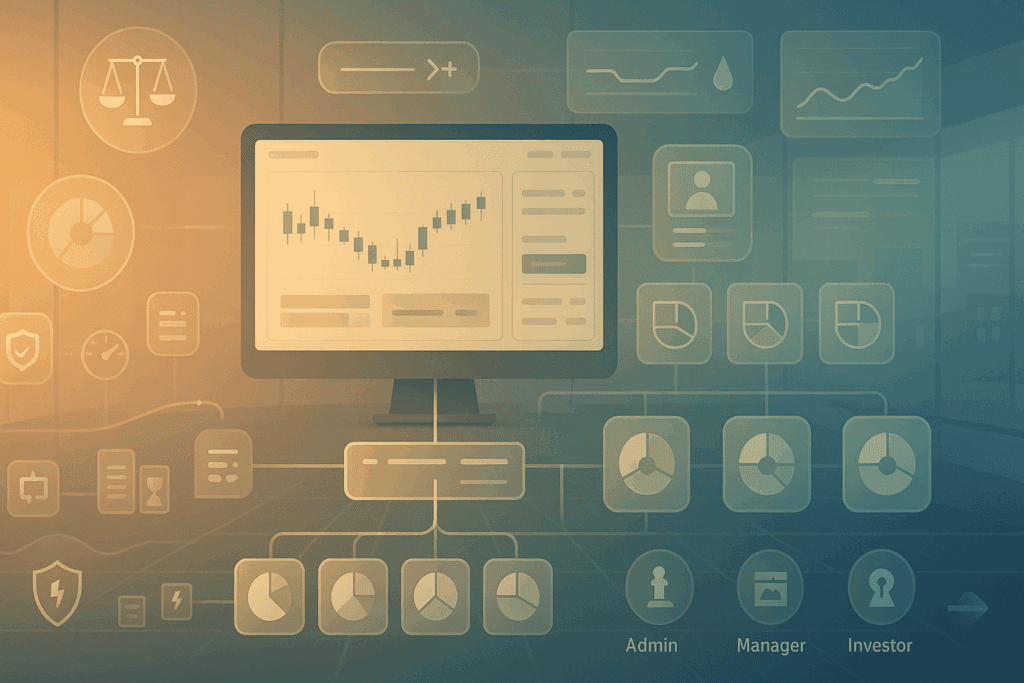

A MAM account management system connects the manager’s main account to the investor sub-accounts. It listens for trades, calculates allocations, enforces risk rules, and writes a clear trail for audits and client reports. Think of it as a traffic controller that never blinks.

Allocation methods you will encounter

| Method | How sizing works | Good fit | Watch out for |

| Proportional by balance | Trade size distributed by each account’s balance | Most general cases | Big balance swings after deposits or withdrawals |

| Proportional by equity | Uses real-time equity for sizing | Fast-moving strategies | Equity whipsaws during high volatility |

| Fixed lot per account | Each account gets the same lot size | Small, uniform accounts | Mismatch in risk across investors |

| Multiplier per account | Each account has a custom multiplier | Tiered risk profiles | Complex to explain if tiers change often |

| Percent allocation | Pre-set percentages per account | Discretionary groups | Rebalancing after new accounts join |

“Choose one method, document it in plain language, and avoid switching mid-month.”

Permissions you should define early

| Role | Can open/close trades | Can change allocation | Can add or remove accounts | Sees investor details |

| Broker admin | Yes | Yes | Yes | Optional, usually masked |

| Money manager | Yes | With approval workflow | Request only | Pseudonymized by default |

| Investor | No, follows manager | Can pause or set limits | Can join or exit with notice | Full visibility into own account |

Clear permissions prevent awkward moments during audits and investor calls.

MAM for managed accounts: practical safeguards

When you implement MAM for managed accounts, put safety rails in the foreground. If guardrails are invisible, confidence erodes fast.

- Equity stops per investor and at the strategy level

- Per-day loss caps that reset on server midnight

- Symbol filters to block exotics or illiquid pairs

- Max open positions and max total exposure per strategy

- Circuit breakers that pause copying during abnormal spreads or outages

- Graceful exit so investors can disconnect without disrupting active trades

“A strong risk policy is a retention tool. Clients stay longer when they understand the limits before the storm arrives.”

Technology stack that keeps you sane

Essential components

- Trading terminals for the manager with reliable one-click execution

- Allocation engine that supports multiple methods and live edits with logs

- Risk layer to enforce stops, caps, and circuit breakers automatically

- Back office for deposits, withdrawals, fees, and statements

- Reporting with time-weighted returns, drawdown, and fee breakdown

- APIs and webhooks so you can integrate analytics or dashboards later

- Audit trails that timestamp every decision and change

Nice-to-have extras

- Strategy pages with verified stats and plain-language notes

- Investor dashboards showing open exposure and recent fills

- In-app education that explains position sizing with examples

- Status page with uptime history and maintenance windows

Setup blueprint you can follow this quarter

Phase 1: Define the promise

- Write a one-paragraph strategy description anyone can understand

- Pick one allocation method and one fee model for the pilot

- Draft a simple execution policy and investor disclosure

Then the phase 2: Configure the MAM account management system

- Create the master account and a small investor cohort

- Add equity stops and per-day loss caps before any live trading

- Map deposit and withdrawal workflows so balances stay in sync

- Turn on full logging for allocations, edits, and overrides

Phase 3: Run a contained pilot

- Start with three to five investors across small and medium balances

- Trade through at least one news-heavy session to test slippage and spreads

- Compare manager fills and investor fills for copy delay and rejects

- Hold a postmortem with the team and update defaults once

“Slow is smooth, smooth is fast. A tight pilot saves months of cleanup later.”

Fee models that make sense to normal people

- Performance fee with a high-water mark so wins stick and losses are respected

- Management fee as a small monthly percent to keep lights on

- Zero hidden costs with a clear statement showing spreads, swaps, and commissions

- Pause without penalty so investors can step back during busy seasons

A transparent fee line wins more trust than a flashy return line.

Everyday operations that prevent headaches

Daily checklist

- Reconcile platform, payment provider, and bank records

- Review overnight rejects and any off-market fills

- Check equity stops and loss caps that triggered

- Verify that new deposits or withdrawals rebalanced allocations

Weekly rhythm

- Inspect slippage by symbol and session

- Audit a sample of allocation logs against the chosen rule

- Update the investor FAQ with any new edge cases you handled

- Confirm backups and test a restore on a non-production environment

Real-world examples to keep it grounded

- A manager running a low-volatility strategy uses proportional by balance. An investor deposits midweek, and the system rebalances at the next trade, not retroactively. The dashboard shows the change and the date it took effect.

- Another manager uses multipliers to create conservative, standard, and aggressive tiers. Investors switch tiers at month-end to avoid midstream confusion. Allocations shift only after a confirmation email and timestamped log entry.

- During an unexpected data outage, circuit breakers pause copying. The master account can still trade, but followers do not receive new positions until connectivity is stable. A banner explains the pause and the time it began.

“Transparency beats perfection. Own the edge cases in public and investors will give you grace.”

Metrics that matter more than last month’s return

- Copy health rate: percentage of follower positions matched within your target delay

- Average slippage by symbol and session, manager vs follower

- Allocation drift: difference between intended and realized sizing after deposits and withdrawals

- Trigger count for equity stops and per-day caps, with reasons

- Withdrawal processing time against your published standard

Use these to guide conversations with managers and investors. Keep the scoreboard short and honest.

Communication habits that build trust

- Publish your execution policy and allocation method in plain language

- Use short emails with one topic each: fees, risk settings, or performance notes

- Host a monthly Q and A where managers explain a good trade and a bad trade

- Add tooltips inside the platform showing how lot sizes become allocations

“People forgive losses they understood. They rarely forgive surprises.”

Security and compliance without the drama

- Enforce two-factor authentication for staff and managers

- Use role-based access so no one holds admin and trader permissions at once

- Store investor documents with encryption and clear retention rules

- Keep a change-control log for every setting tied to allocation or risk

- Prepare a simple packet for auditors: policy docs, sample logs, and reports

Compliance is not a separate project. It is the same careful habit you apply to trading and reporting.

Integration tips for the long run

- Start with the vendor’s native reports before building custom dashboards

- If you add analytics, pull data through supported APIs and respect rate limits

- Keep customization at the edges so platform updates do not break your work

- Document any formula you change from the default, then add a tooltip where users see the number

Small documentation investments save hours of support time later.

Common mistakes to skip

- Switching allocation methods mid-month without investor consent

- Running a pilot with too many investors and no exit plan

- Hiding performance definitions deep in a PDF instead of in the app

- Ignoring copy delay during volatile sessions

- Letting fee complexity creep until even staff cannot explain it

A good rule of thumb: if a new hire cannot explain the system in five minutes, it is too complex.

Quick comparison: PAMM vs MAM in everyday language

| Feature | PAMM feel | MAM feel |

| Account structure | Pooled funds, one performance line | Individual accounts, shared trades |

| Sizing control | Less granular per investor | Highly granular per investor |

| Reporting | Pool-oriented | Investor-specific and strategy-specific |

| Flexibility | Simple for a single strategy | Better for varied strategies and tiers |

Plenty of teams start with MAM because it offers stronger control and cleaner investor-level reporting from day one.

Final nudge before you go live

You do not need twenty features to start. Pick one strategy, one allocation method, one fee model, and a small pilot group. Turn on logs, set equity stops, and write your policy in plain language. When your team can recite the rules without peeking at a manual, you are ready.

If you are mapping your rollout now, draft your strategy note, list your allocation choice, and invite two investors to a one-week pilot. Use the results to adjust your multi account manager forex settings. Check your MAM account management system settings. Decide on the next group for MAM for managed accounts so you can grow with confidence.

FAQ

How are fees handled inside a MAM account management system

Performance and management fees are calculated by the engine on a schedule you set. Use high-water marks and show the math in reports.

What happens during slippage or partial fills

The system allocates based on realized fills, not intended size. Good platforms display any copy delay and the small differences it creates.

Can I run multiple strategies under one manager

You can if your platform supports strategy groups. Keep risk caps per group and separate reporting so investors see a clean picture.

Is MAM for managed accounts suitable for beginners

Yes with guardrails. Offer conservative tiers, publish a simple policy, and make pause or exit options easy to find.