Picture a portfolio manager placing one order and dozens of accounts updating in sync. That is the promise of a mam trading platform when it is built with sensible controls, clear reporting, and fair allocation. Below is a straightforward look at mechanics, guardrails, and the small details that make multi account management feel calm instead of chaotic.

“Copy trading that functions as portfolio management must meet suitability duties under MiFID II.”

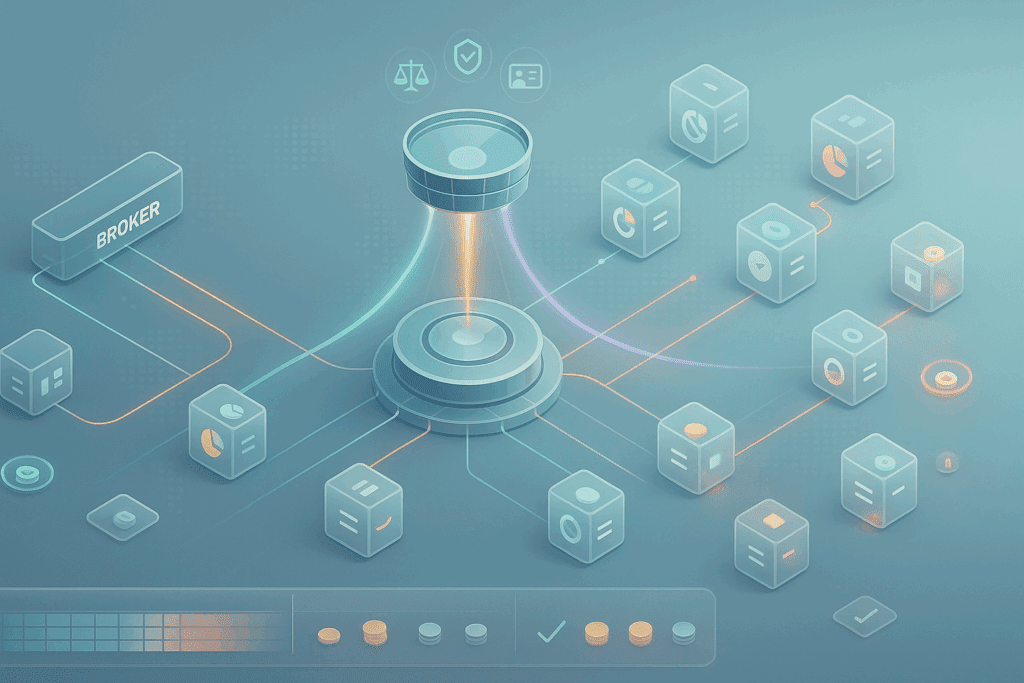

What a forex mam account really is

MAM stands for Multi Account Manager. A licensed money manager sends a trade from a master, and the system allocates fills to many linked investor accounts based on predefined rules. The manager does not take custody inside the platform, allocations are book entries in client accounts at the broker.

“MAM lets managers trade from a master while allocating to sub accounts using flexible methods.”

Core moving parts

| Part | Role | Notes that matter |

| Master account | Where the manager places trades | Trades are routed once, allocations fan out to followers |

| Sub accounts | Investor accounts linked to the master | Each keeps its own balance, leverage and reports |

| Allocation engine | Decides who gets how much | Methods include equity percent, lot, fixed or equal risk |

| Broker bridge | Connects platform to venues and pricing | Needs stable sessions and replayable logs for audits |

How does MAM trading work day to day

- The manager defines allocation rules for each sub account.

- An order is placed on the master.

- The allocation engine replicates the position across sub accounts according to the chosen method.

- Fills, fees and swaps are booked per account with timestamps and identifiers so reports reconcile.

“Allocation by equity percent and equal risk are common MAM methods, with safeguards when margin limits are reached.”

Popular allocation methods at a glance

| Method | What it does | Good fit | Watch out for |

| Equity percent | Pro rata by each investor’s equity | General multi client books | Equity changes shift sizing mid campaign |

| Fixed lot | Same lot per account regardless of size | Uniform training cohorts | Can over size small accounts |

| Proportional by balance | Tracks deposit ratios | Simple static books | Deposits and withdrawals change ratios |

| Equal risk | Targets a set risk per account | Risk aware allocations | Requires robust margin checks |

MAM, PAMM, copy trading in one table

| Feature | MAM | PAMM | Copy trading layer |

| Control | Manager trades one book, flexible allocation | Pool based, profits split by share | Follower mirrors leader decisions |

| Ownership of funds | In client accounts at broker | Often pooled accounting model | In client accounts at broker |

| Customization | Per account risk or lot rules | Primarily percent based | Per follower size or block size |

| Typical platforms | MT4 MT5 plugins and broker modules | Broker side PAMM modules | Platform or app that connects to broker |

| Oversight lens | Portfolio management process | Pooled performance accounting | Often assessed like advice or management when automated |

“When copy services amount to portfolio management or advice, firms must apply information, product governance, and suitability rules.”

Costs, frictions and real risks

- Execution spread and slippage affect every sub account. Managers should monitor leader versus follower fills, especially in fast tapes.

- Swaps and financing accrue per account and can differ by symbol or day.

- Deposits and withdrawals mid strategy change allocation math, which can tilt results between investors.

- Reporting quality decides if audits are easy or painful. You want per-fill timestamps, allocation IDs, and fee lines.

“Best execution for retail clients weighs price, costs, speed and the likelihood of execution and settlement.”

Platform traits that actually help

| Capability | Why it matters | What good looks like |

| Stable allocation engine | Prevents desync between master and subs | Idempotent fills and clear reject codes |

| Per account risk caps | Stops a single spike from cascading | Equity stop and margin guardrails at follower level |

| Transparent fee logic | Reduces billing disputes | Management and performance fees itemized with periods |

| Live audit trail | Speeds investigations and reviews | Master order ID maps to all child allocations |

| Pause and resume | Handles events and maintenance | Manager pause broadcasts to subs in real time |

Tiny scenario you can visualize

A manager runs a trend strategy across ten sub accounts. Equity percent allocation sizes each follower proportionally. Two investors withdraw mid week, so the engine recalculates their share on the next trade. Equal risk followers hit a margin threshold, so new allocations to those accounts pause automatically until equity recovers. The master keeps trading, and reports show who received what and why.

Practical guardrails for investors and managers

- Put allocation rules in writing before the first trade.

- Publish max drawdown criteria and a review cadence.

- Track follower slippage against master fills by hour.

- Keep suitability records if you are in a regime where MAM is treated like management or advice.

“Suitability under Article 25 requires that recommended or invested instruments match the client’s profile and mandate.”

Bringing it together

Multi account management works when transparency beats theatrics. If this approach fits your workflow, shortlist two vendors, run a four week paper test with live pricing, then a small funded cohort. Keep the forex mam account stack that gives cleaner allocation logs, steadier follower fills, and simple controls. That is the quiet way to use a mam trading platform without drama.

If you are ready to move, draft one page that names your allocation method, the events that trigger a pause, and the exact metrics you will publish weekly. Clear rules will answer most questions about how does MAM trading works long before support tickets do.

FAQ

Is MAM the same as PAMM

No. MAM emphasizes flexible per account allocation rules, while PAMM is typically a pooled percent model that splits results by contribution. Platform specifics vary.

Who holds the money in a MAM setup

Client funds remain in individual accounts at the broker. The platform allocates trades and results across those accounts rather than moving cash to the manager.

Are there special compliance duties

When a service amounts to portfolio management or advice, firms must apply information, product governance, and suitability requirements under MiFID frameworks. Keep records.

Which allocation method is safest

No single method is universally safest. Equity percent is simple, equal risk can align with margin limits, fixed lot is easy but can over size small accounts. Match the method to your mandate.

What reports should investors expect

Per fill timestamps, allocation IDs linking master to subs, fee lines, and a clear breakdown of swaps and commissions by symbol and day.