Screens glow, the bell approaches, and opinions multiply. This is live stock trading without the noise, with clear language on the difference between stocks and shares, habits that improve fills, and the role of portfolio diversification so one bad idea does not sink your week.

“Past performance is not a promise. Process is.”

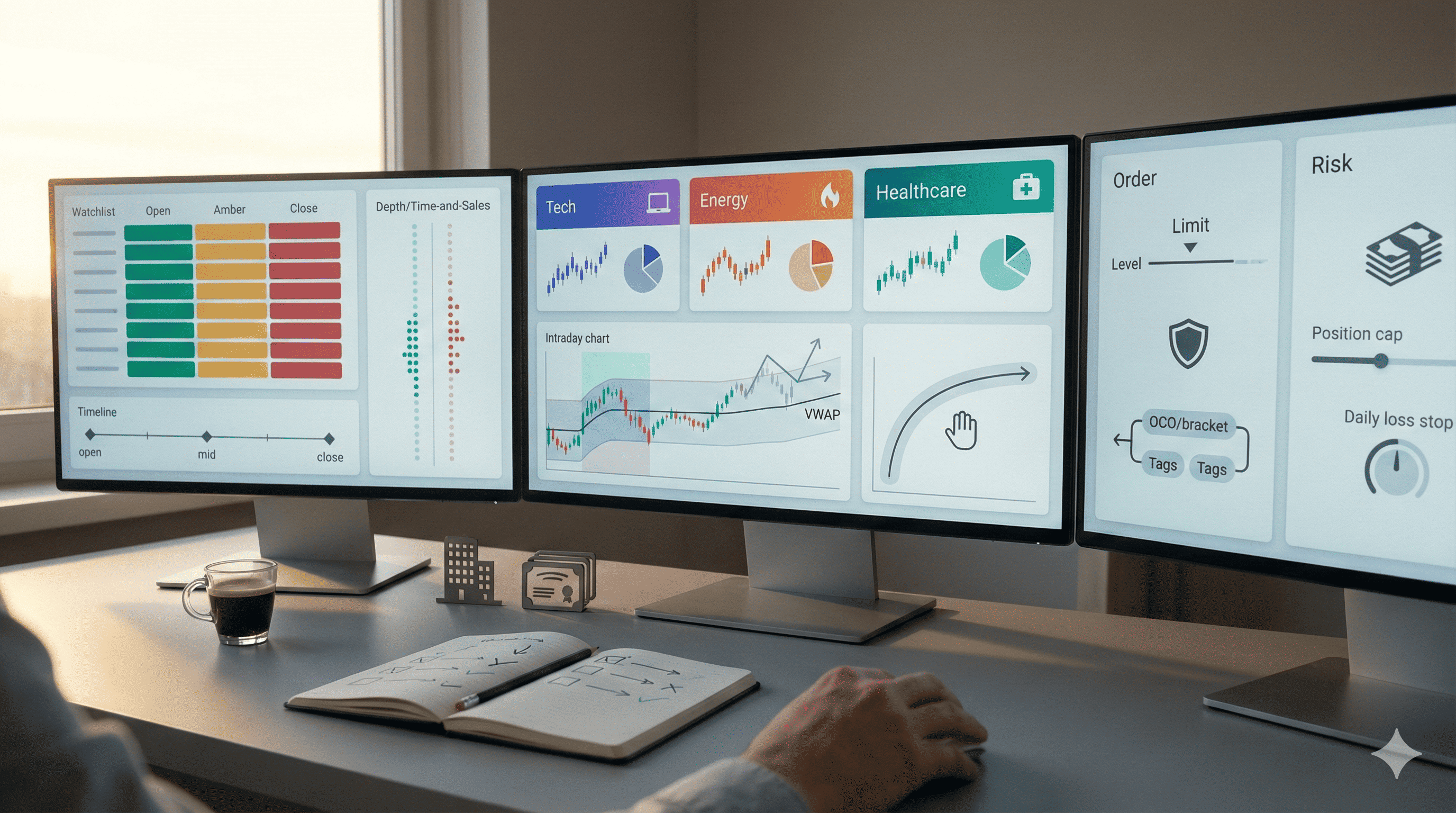

A quick map of the live session

Live trading is a choreography of timing, orders, and discipline. Liquidity and spreads change by minute, not just by day.

| Window | What usually happens | How to adapt |

| Opening 15–30 min | Volume bursts, fast gaps | Use smaller size, prefer planned limit orders near levels |

| Mid-session | Smoother tape, rotations | Let setups mature, avoid chasing |

| Last hour | Rebalancing, headlines | Return to smaller size, keep exits mechanical |

Order types worth keeping simple

- Limit for entries near planned levels

- Stop loss set when you enter

- OCO or brackets for one-click exit logic

“Decide risk in cash before the click. The chart only tells you where to place it.”

The difference between stocks and shares in plain English

People use the words interchangeably. The nuance is simple: a stock refers to the equity of a specific company, while shares are the individual units of ownership you hold.

| Term | Think of it as | Example on a ticket |

| Stock | The company’s equity as a whole | “I trade ABC stock” |

| Shares | Countable units of that equity | “I bought 100 shares of ABC” |

Why it matters: clarity helps when you size, talk through risk, or compare positions across names.

Tools that actually help during live moves

- One editable watchlist with sessions and catalysts

- A clean level map: prior day high/low, opening range, premarket pivots

- Time-and-sales or a lightweight depth view for the first 15 minutes

- A screenshot journal to measure spread and slippage versus your plan

“If you can’t explain the setup in one sentence, skip it.”

Position sizing and portfolio diversification without the fluff

Diversification is not more names for the sake of it. It is choosing exposures that do not all react the same way to the same headline.

| Idea | What to do | Why it helps |

| Position cap | Set a max cash risk per idea (e.g., 0.5–1.0 percent of account) | Keeps single-trade damage limited |

| Sector mix | Avoid stacking three high-beta tech longs at once | One turn in the sector won’t hit every line item |

| Time-frame mix | Pair an intraday name with a swing candidate | Not all P/L depends on the open |

“Diversification is protection from being exactly wrong at the wrong time.”

Intraday templates you can test today

Breakout and retest

Price clears a premarket level, then returns to test it. Enter near the retest, stop just beyond structure, first target equals your cash risk, trail the remainder.

Mean reversion to the session midline

A stretched move stalls, pace slows, and price rotates back toward VWAP or opening range mid. Trade smaller near scheduled data.

Keep the rules identical for ten sessions before you tweak anything.

Real-time execution habits that pay you back

- Place the stop with the entry so you do not have to improvise

- Avoid market orders at the exact open unless your size is tiny

- Track slippage by name and by hour for two weeks, then avoid your worst minutes

“Your edge is not the entry. It is the way you leave.”

Bringing the pieces together

If this rhythm fits, pick one setup and one hour, trade it small for ten sessions, and keep a log of spread at entry, slippage on exit, and heat against your stop. If the notes look calmer and results steadier, expand slowly. If not, refine the setup or the time window before you add more names. Treat live stock trading as a repeatable routine, not a race.

Before the questions, one nudge to move you forward today: write a one-page rule sheet with your cash risk per trade, a max daily loss that ends your session, and a short list of three names that diversify by sector. That single page will do more than any new indicator.

FAQ

Do I need a premium scanner to trade live

Not at first. A basic watchlist, levels, and a calendar for catalysts get you 80 percent of the way. Add tools only when your log shows a clear gap.

Is it better to buy strength or weakness

Both can work. What matters is structure and risk math. Define the level, set the stop beyond structure, and accept the cost of testing your idea.

How many names should I trade in a day

Fewer than you think. One to three liquid names with a clear catalyst and clean levels are enough for most intraday plans.

Does portfolio diversification help if I only day trade

Yes, by avoiding identical exposures at the same time. Mixing sectors, beta profiles, or even time frames reduces correlated mistakes.