There is a fundamental disconnect in the way most people attempt to learn financial speculation. Imagine trying to learn how to box by reading a textbook. You memorize the names of the punches, the jab, the cross, the uppercut. You study the physics of force and the geometry of the ring. You might even watch slow-motion replays of Muhammad Ali from fifty years ago. But until you actually step into the ring, feel the adrenaline spike, and react to a fist flying toward your face in real-time, you do not know how to box.

Trading is identical. For years, beginners have relied on static PDFs, delayed YouTube videos, and “hindsight” chart analysis. They look at a chart from last week, draw a line, and say, “I would have bought here.” Everyone is a genius in hindsight. The static chart doesn’t show the panic, the hesitation, or the sudden shift in liquidity that happens in the live market.

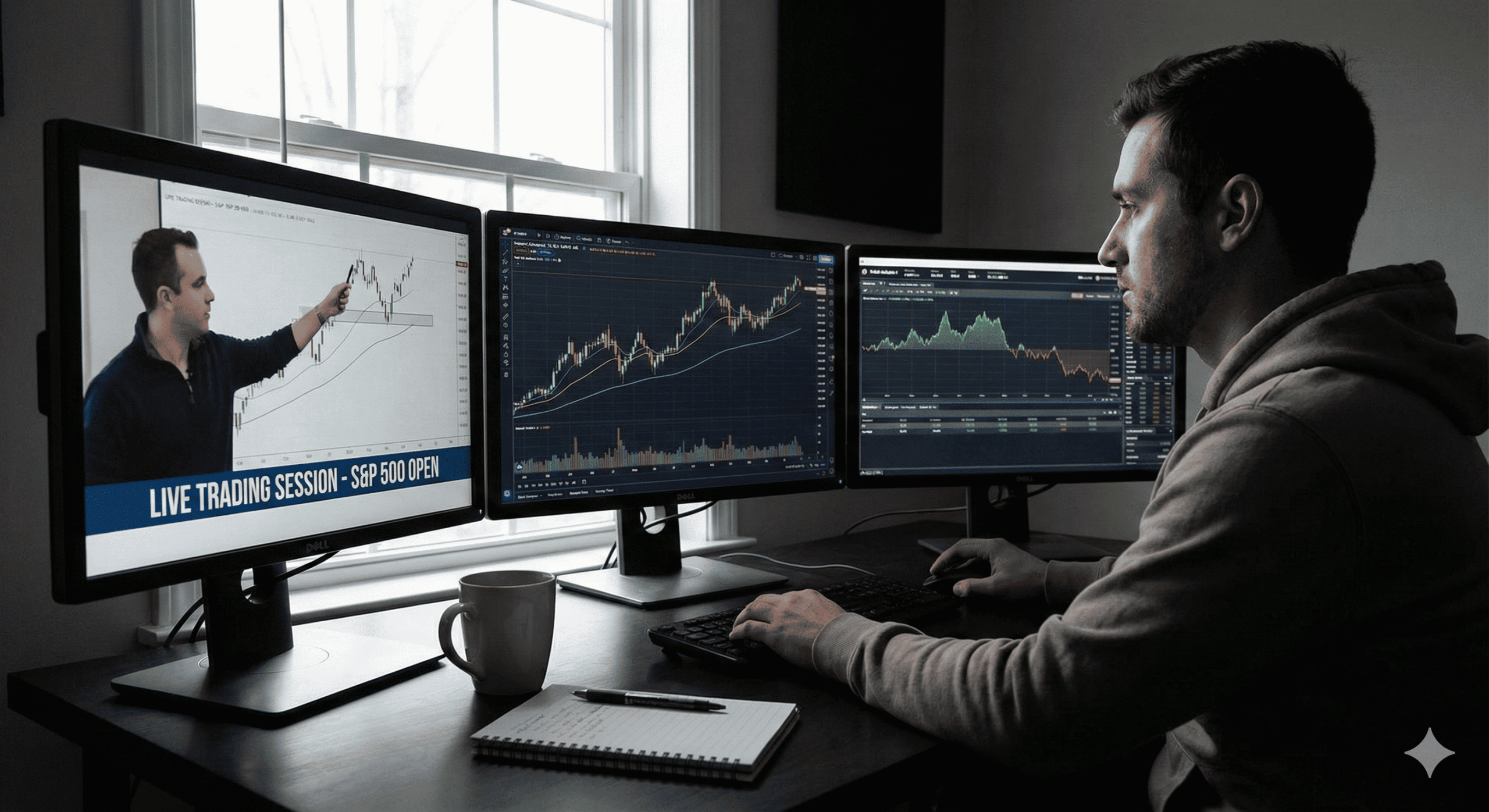

To truly bridge the gap between theory and profitability, the modern student must shift their focus to the present tense. The most effective way to absorb the rhythm of the market is to watch it unfold raw, unedited, and live. Fortunately, the digital age has ushered in a new era where you can learn trading live free trading education online, granting you access to the screens of veterans as they navigate the chaos of the opening bell.

The Limitation of Static Theory

Before we dive into where to find these resources, we must understand why the old method fails. Static learning, books and pre-recorded courses, teaches you “setups.” It teaches you that if A happens, then B will happen.

However, the market is not a computer program; it is a biological entity made up of millions of human decisions. It is messy. A “perfect” Head and Shoulders pattern might form, and then fail immediately because a Federal Reserve member made a surprise comment.

In a pre-recorded video, the educator often edits out the losses. They show you the three times the strategy worked and ignore the seven times it failed. This creates a false sense of security. You enter the market expecting perfection, and when you encounter the messy reality of slippage and whipsaws, you freeze.

This is why live education is superior. In a live environment, you see the hesitation. You hear the mentor say, “I don’t like the price action here, I’m staying out.” Learning when not to trade is often more valuable than learning when to trade. This nuance is completely lost in static textbooks.

The Digital Trading Floor

In the 1990s, if you wanted to learn live, you had to get a job as a runner on the floor of the Chicago Board of Trade or find a mentor at a proprietary firm. Today, streaming technology has democratized this experience.

The “Digital Trading Floor” exists across various platforms, Zoom, Discord, Twitch, and specialized broker software. These are environments where professionals share their screens in real-time. You see their mouse moving. You see their order flow. You see their P&L (Profit and Loss) swinging up and down.

When you seek out opportunities to learn trading live free trading education online, you are essentially looking for a digital apprenticeship. You are looking to sit “side-by-side” with a pro, digitally speaking.

Unpacking the Webinar Experience

So, what actually happens when you log in? If you have never attended one, the first five minutes can be overwhelming. There is a specific language and pace that you need to adjust to.

The Pre-Market Prep

The best sessions begin before the market opens. This is the briefing. The host will pull up the economic calendar and the overnight charts. They aren’t guessing; they are preparing scenarios.

- Scenario A: “If the S&P 500 breaks 4500, we look for longs.”

- Scenario B: “If it rejects 4500, we fade it back to 4480.”

Watching a professional build a thesis before the price moves is a critical lesson in planning. It teaches you that trading is 90% preparation and 10% execution.

The Opening Bell Chaos

When the market opens (for example, 9:30 AM New York time), the pace accelerates. This is where you see emotional control in action. Prices might whip violently. A novice would panic-buy. The pro on the live stream sits on their hands, waiting for the dust to settle. Seeing this discipline live is far more impactful than reading about “patience” in a book.

The Trade Management

This is the gold mine. Entering a trade is easy; managing it is hard.

- When do they move the stop loss to breakeven?

- Why did they take half the profit off the table just now?

- Why did they exit early before the target was hit?

In a live webinar, the mentor explains these decisions in the heat of the moment. “I’m getting out because the volume is drying up on the tape.” That specific insight, reading the real-time volume, can only be taught live.

Why You Should Join Live Trading Webinars

The internet is flooded with “gurus” selling signals. A signal is useless for your development. It gives you a fish but doesn’t teach you to fish. The goal of live education is independence.

When you join live trading webinars, you are there to steal the mentor’s brain, not just their trades. You are there to absorb their decision-making matrix.

Benefits of the Live Format:

| Feature | Static Course | Live Webinar |

| Market Condition | Historical / Selected | Real-time / Random |

| Psychology | Hidden | Exposed |

| Mistakes | Edited Out | Visible & Corrected |

| Interaction | None | Q&A in Chat |

| Adaptability | None | High |

One of the most underrated aspects is the “Q&A.” In a live room, you can type, “Why didn’t you take that short on Apple?” The mentor can instantly flip to the Apple chart and explain, “Because the sector is bullish, and I don’t want to short a strong stock in a strong sector.” That specific, contextual answer closes a knowledge gap instantly.

The Anatomy of a Live Trade

Let’s visualize a scenario often seen in these educational sessions. The mentor is watching EUR/USD. The price approaches a major resistance level.

- The Setup: The mentor highlights the level on the screen. “Watch 1.1000. Big psychological number.”

- The Trigger: Price hits 1.1000 and stalls. The mentor points out the “Level 2” data. “See those big sell orders stacking up? Buyers are hitting a wall.”

- The Entry: The mentor clicks sell. You see the execution speed.

- The Adversity: Suddenly, the price ticks against them. They are down 5 pips. They don’t panic. They explain, “My stop is at 1.1015. Unless it hits that, the thesis is valid. Noise is normal.”

- The Resolution: The price rolls over and drops 20 pips. The mentor scales out.

This sequence teaches you that drawdown is normal. In a textbook, the chart goes straight down. In reality, it wiggles. Seeing a pro sit calmly through the “wiggle” rewires your brain to accept risk.

Choosing the Right Mentor

Not all live trading webinars are created equal. The industry is rife with marketers pretending to be traders. If you are going to invest your time, you need to vet the source.

Red Flags to Watch For:

- Demo Accounts Hiding as Real: Look for “Real” or “Live” markers on the broker platform, though these can be faked. More importantly, look at the execution. Do they get slippage? Do they pay commissions? Real trading has friction.

- The “Perfect” Record: If the host never loses a trade on the live stream, be suspicious. Professional traders lose about 40-50% of the time; they just manage risk so their wins are bigger. A host who claims 100% accuracy is likely trading a “delayed” feed or faking it.

- High Pressure Sales: If 50% of the webinar is them trying to sell you a $5,000 course, it’s a sales funnel, not an educational session.

Green Flags:

- Transparency: They show their losses. They admit when they are wrong. “I misread that, I’m out for a loss.” That is the sound of a professional.

- Process over Profits: They talk about risk more than money. “I’m risking $100 to make $300” is better than “We are going to make a million dollars today!”

Technical Analysis in Motion

Static charts are easy to draw on. You can draw a trendline that touches three points perfectly because the chart isn’t moving. In a live session, you learn how to draw dynamic levels.

You will see how a mentor adjusts a trendline as new candles form. You will see them switch between timeframes, from the 1-hour chart to see the big picture, down to the 1-minute chart to time the entry. This “multi-timeframe analysis” is a dynamic skill. It is like driving a car; you look at the horizon (long term) and the bumper in front of you (short term) simultaneously.

Furthermore, you learn the interplay of indicators. A moving average crossover might look like a “buy” signal in a vacuum, but the mentor might ignore it because the RSI is overbought. Seeing how they weigh conflicting evidence is the essence of the craft.

The Psychology of the “Boring” Days

Here is a secret about professional trading: it is often boring.

When you join live trading webinars, you might log in on a day when the Federal Reserve is speaking later in the afternoon. On days like this, the market often does nothing. It sits in a tight range.

A novice would get bored and force a trade just to feel something. The mentor on the stream will say, “There is no edge today. We sit on our hands.”

Watching a professional not trade for two hours is one of the most valuable lessons you can learn. It teaches you that cash is a position. It teaches you discipline. If you can sit through a boring live stream without clicking a button, you are developing the patience required to survive.

Tools of the Trade

To fully participate in this free trading education online, you need the right infrastructure. You don’t need a six-monitor setup, but you do need screen real estate.

Ideally, you want two monitors.

- Monitor 1: The live stream (Zoom/Webinar).

- Monitor 2: Your own charting platform (TradingView/MetaTrader).

You should be replicating what the mentor is doing on your own charts. If they draw a support line, you draw it too. This kinesthetic learning, actually doing the action, reinforces the memory.

You also need a stable internet connection. Live streams are bandwidth-heavy. If your connection lags by 5 seconds, the price on the stream will be different from the real market price. In trading, 5 seconds is an eternity.

From Observation to Action

The ultimate goal of attending these sessions is to eventually stop needing them. You are using the training wheels to learn balance, but eventually, you must ride the bike alone.

The Progression Path:

- The Shadow Phase: For the first month, just watch. Don’t trade. Listen to the language. Understand the rhythm.

- The Simulator Phase: Open a demo account. When the mentor calls out a setup, try to execute it in your simulator. See if you can match their entry price.

- The Micro Phase: Start trading with the smallest possible size (real money). See if you can manage the emotions when real risk is on the table, using the live stream as a guide.

- The Independence Phase: Start formulating your own ideas before the mentor speaks. If your idea matches theirs, you are ready.

The Community Effect

Beyond the mentor, live trading webinars offer a secondary benefit: the chat room. Trading is a lonely profession. Sitting alone in a home office can lead to isolation and echo chambers.

The chat room in a live webinar puts you in a room with hundreds of other people on the same journey. You can see that others are struggling with the same issues you are. “Did anyone else get stopped out on Gold?” seeing five people say “Yes” validates that it was a tough market move, not necessarily a personal failure.

However, be careful of “groupthink.” Just because everyone in the chat is buying Tesla doesn’t mean you should. Always rely on the mentor’s analysis and your own plan over the noise of the crowd.

Taking the Leap

The transition from passive learner to active participant is the most significant step in your trading career. The resources are there. The barriers to entry have crumbled. You no longer need to be on Wall Street to see how the sausage is made; you just need a Wi-Fi connection.

If you are tired of looking at static charts and wondering why your results don’t match the theory, it is time to change your classroom. Stop looking at the past and start looking at the present. Find a reputable host, open your charts, and immerse yourself in the flow of the live market. If you are ready to witness professional execution in real-time and want to see exactly how we navigate the opening bell volatility, we invite you to register for our upcoming session and see the difference for yourself.

Frequently Asked Questions

Do I need special software to watch live trading webinars?

Usually, no. Most educators use standard platforms like Zoom, GoToWebinar, or YouTube Live. You can watch these in your web browser. However, having your own charting software (like TradingView or MetaTrader) open simultaneously is highly recommended so you can follow along.

Are these webinars truly free?

Many legitimate brokers and educators offer free sessions as a way to demonstrate value or attract clients to their platform. While there are premium “inner circle” rooms that charge a monthly fee, there is a vast amount of high-quality free trading education online available if you know where to look.

Can I trade along with the host?

You can, but you should do so with extreme caution. There is often a delay (latency) between the host’s screen and yours, ranging from 1 to 20 seconds. In fast-moving markets, this means you might get a much worse price. It is better to use the sessions for learning the strategy rather than trying to copy the exact trades.

What asset classes are best for live learning?

Forex and Futures are the most popular for live streams because they are highly liquid and move 24 hours a day. However, there are plenty of stock trading rooms that focus specifically on the US Market Open (9:30 AM EST).

How do I know if the mentor is actually trading real money?

It can be hard to tell for sure. Look for transparency. Do they show the broker’s withdrawal logs? Do they show the “Account History” tab? Ultimately, focus on whether their analysis makes sense and helps you learn, rather than just their claimed P&L.

Is live trading risky for beginners?

Watching is not risky. Attempting to replicate high-speed scalping strategies with real money before you are ready is very risky. Always start in a simulator (paper trading) until you have proven to yourself that you can execute the strategy profitably over several months.