A dependable introducing broker program is more than a banner and a link. It is a small operating system where you attract the right clients, prove value with honest analytics, and get paid on time.

If you want to become an IB forex brand or grow your trading community, the quickest way is to partner with regulated broker teams. They provide clear tracking, easy tiering, and support you can reach on busy market days.

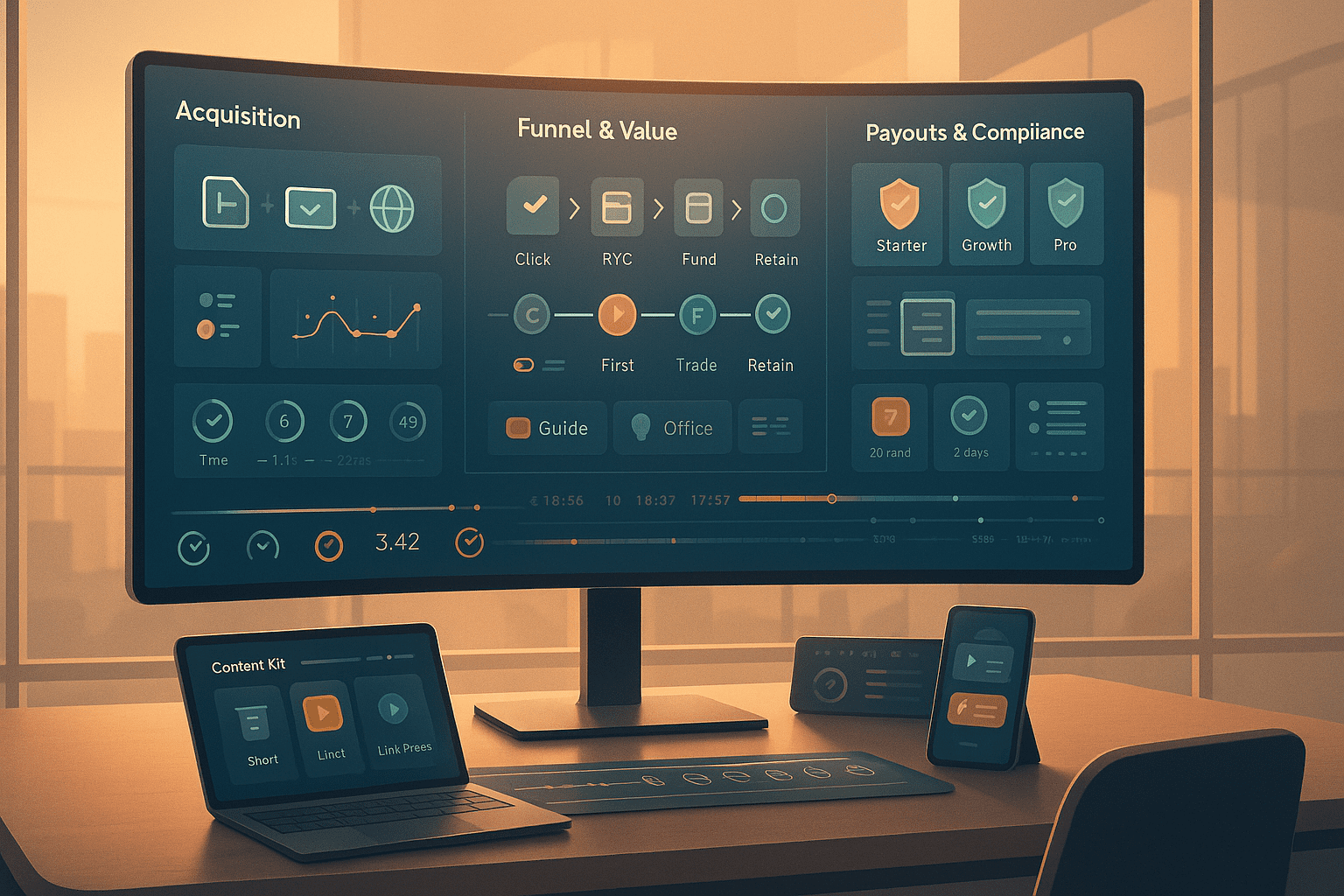

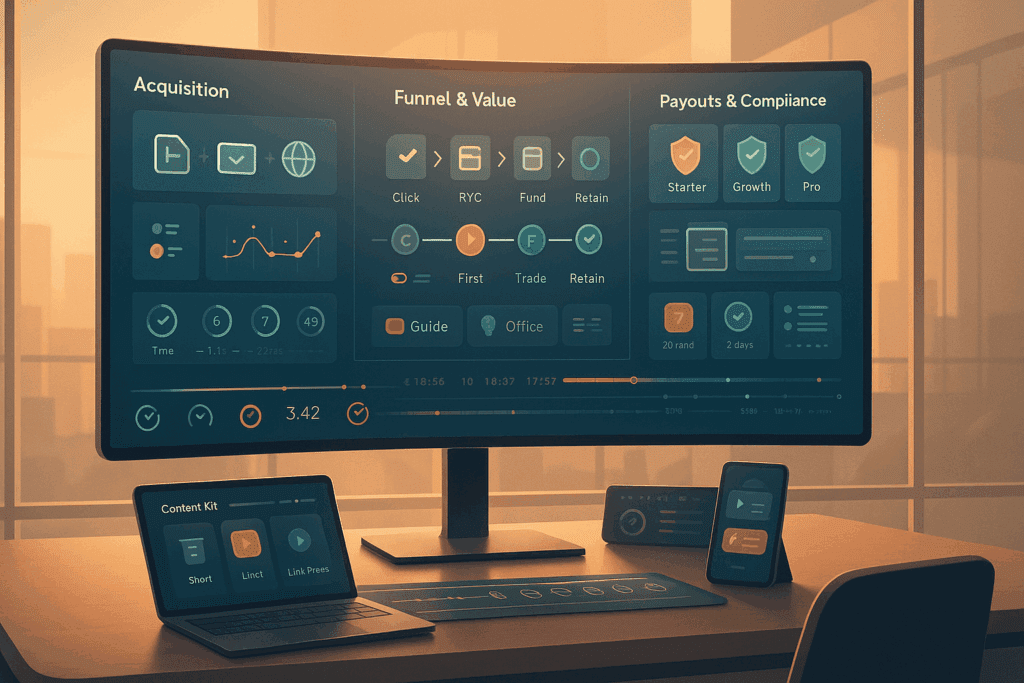

What a healthy introducing broker program includes

Think in layers. Keep custom flair in your content and let the engine stay standard so it scales.

| Layer | Job | Evidence you chose well |

| Links and tracking | Attribute clicks to accounts | UTM tags, deep links by region, live dashboards |

| CRM and KYC | Move leads to funded status | Liveness checks, retry links, audit trails |

| Product and pricing | Give clients a reason to stay | Liquid symbols, fair spreads, clear fees |

| Education and support | Reduce avoidable churn | Starter guides, office hours, plain answers |

| Reporting and payouts | End debates fast | CSV parity with portal totals, maker checker |

| Compliance guardrails | Keep promos safe | Region filters, risk warnings, banned claim checker |

When these pieces align, your referrals turn into retained traders instead of quick tickets.

Ways you actually get paid

Keep the math honest and the rules short. If you cannot explain the plan in 60 seconds, it will not scale.

| Model | What it pays on | Best for | Watch outs |

| Spread or commission share | Per trade cost line | Day traders and frequent learners | Avoid promoting cost over risk control |

| CPA per funded client | One time milestone | Education-first communities | Verify KYC quality to protect clawbacks |

| Hybrid CPA plus revenue share | Upfront plus recurring | Mixed traffic with long-tail activity | Track break-even month by cohort |

“Fair payouts are simple to explain and easy to verify.”

Client journey you can run every week

| Stage | Your action | Broker help you should demand | Metric to report |

| Click | Deep link by region with UTM | Geo redirects and device friendly pages | CTR by channel |

| KYC | Short checklist and retry link | Liveness check, approval timers | Pass rate and time to approve |

| Fund | Explain methods and minimums | Local rails, clear timelines | Time to first fund |

| First trade | 2-page starter guide and office hours | Demo to live switch, bracket defaults | Percent of funded who trade in 7 days |

| Retain | Weekly email with one lesson and calendar | Status page, fair spreads | 30 and 90 day active rate |

“Friction you can name is friction you can fix.”

Commission tiers you can defend

Design tiers that reward real value, not spam.

| Tier | Monthly actives or volume | Share example | Perks that matter |

| Starter | 10 actives or low volume | 20 percent | Fast support lane and templates |

| Growth | 50 actives or medium volume | 30 percent | Co-branded webinars, quarterly plan review |

| Pro | 150 actives or high volume | 40 percent | Custom reports, dedicated manager, regional events |

Never chase a higher rate if it comes with messy tracking or delayed payouts. Clarity pays more than percentage points.

Tool stack that makes you look bigger than you are

- Link builder: preloads UTM, region, and landing destination

- Content kit: short videos, plain-language checklists, and a sample risk plan

- Office hours: a weekly 45 minute Q&A slot on the same day and time

- Analytics: clicks to approved KYC to funded to first trade, by channel

- Payout ledger: CSV export that matches platform totals line by line

Names and logos are nice. Receipts are better.

Partner with regulated broker teams

Regulation does not guarantee perfection. It does guarantee better playbooks when stress hits.

- Region filters prevent restricted promotions

- Proper statements simplify tax season for you and your clients

- Postmortems and status pages reduce rumor-driven churn

- Clear escalation paths replace inbox roulette

If a partner cannot show a real incident timeline with timestamps and a revert plan, keep looking.

Education that actually helps clients survive

Offer short, repeatable lessons that map to behavior.

- Cash risk per trade, explained in dollars

- Brackets by default so exits are automatic

- Two-session window rule to prevent fatigue

- A simple journal template with two lines and two screenshots per trade

- Cost tracking for spreads, commissions, and slippage

“Teach habits that reduce tickets, not tricks that inflate volume.”

Honest promotion examples you can copy

- “Free starter guide and weekly office hours. Learn to size by cash and avoid news minutes. Open your account when you can repeat the rules.”

- “We work only with regulated partners. Expect transparent statements, CSV parity, and support you can reach.”

- “Results vary. Protect the month with fixed risk per trade and a per-day loss cap.”

These lines are quotable and compliant-friendly.

KPIs that predict staying power

| KPI | Healthy signal | Why it matters |

| KYC pass rate | Above 70 percent for chosen regions | Reveals onboarding friction early |

| Time to first fund | Under 48 hours | Signals funnel clarity |

| First trade in 7 days | Above 60 percent of funded | Measures activation quality |

| 30-day active rate | Above 50 percent of first-week actives | Proves value beyond bonuses |

| Refunds or clawbacks | Low and trending down | Confirms compliance and fit |

| Days to payout | On time with receipt parity | Builds trust with your team and tax prep |

Publish a trimmed scoreboard monthly. Clarity keeps everyone honest.

Mistakes that drain time and clean fixes

| Mistake | Why it hurts | Fix that lasts |

| Selling percent returns without context | Attracts churn and complaints | Pair returns with drawdown and recovery time |

| Promoting unregulated venues | Higher short term clicks, long term pain | Only partner with regulated broker teams |

| Hiding fees and timelines | Creates ticket storms | Show ranges for spreads, funding times, withdrawals |

| Overloading channels | Burnout, weak follow through | Pick two channels and post on a schedule |

| No CSV parity | Audit stress | Demand exports that equal statement totals |

Write a one-page plan that lists your regions, channels, weekly schedule, risk disclaimers, and the payout model you can explain in a minute. Partner with regulated broker teams that offer clean tracking and on-time payouts. When the boring parts are good, referrals become relationships.

FAQ

Is it hard to become an IB forex partner

It is systematic, not hard. Pick a regulated partner, build a simple journey, and teach risk in cash. If your funnel fits on a page and your schedule is consistent, you can scale.

Do I need a big audience to start

No. Ten engaged clients with strong retention can outperform one hundred transient clicks. Focus on conversion and education before reach.

What payout model should I choose first

Start with CPA or a modest revenue share, then move to a hybrid when you have predictable cohorts. Keep clawback rules clear in writing.

How do I keep my marketing compliant

Use region filters, stick to educational claims, show risk warnings, and avoid promising outcomes. Let the broker’s compliance team review key pages.

How fast should I expect payouts

On the published schedule. If the portal totals do not match CSV exports, pause promotions until they do.

Can I run multiple partners at once

Yes, but only if your tracking is airtight and disclosures are clean. Most new IBs do best with one regulated partner for the first 90 days.