You don’t need a longer spreadsheet. You need a cleaner introducing broker list where each name comes with proof about role, controls, and economics. The goal is simple: spend less time chasing claims and more time validating partners.

“An introducing broker… does not accept any money, securities, or property to margin, guarantee, or secure any trades.”

Start with the basics: introducing broker meaning

An IB is the relationship and order-taking layer that routes client accounts to a carrying institution for execution and custody. In futures and retail off-exchange forex, those accounts are carried by a registered FCM or RFED on a fully disclosed basis.

“IBs must carry all forex and futures accounts… with a futures commission merchant (FCM) or retail foreign exchange dealer (RFED) on a fully disclosed basis.”

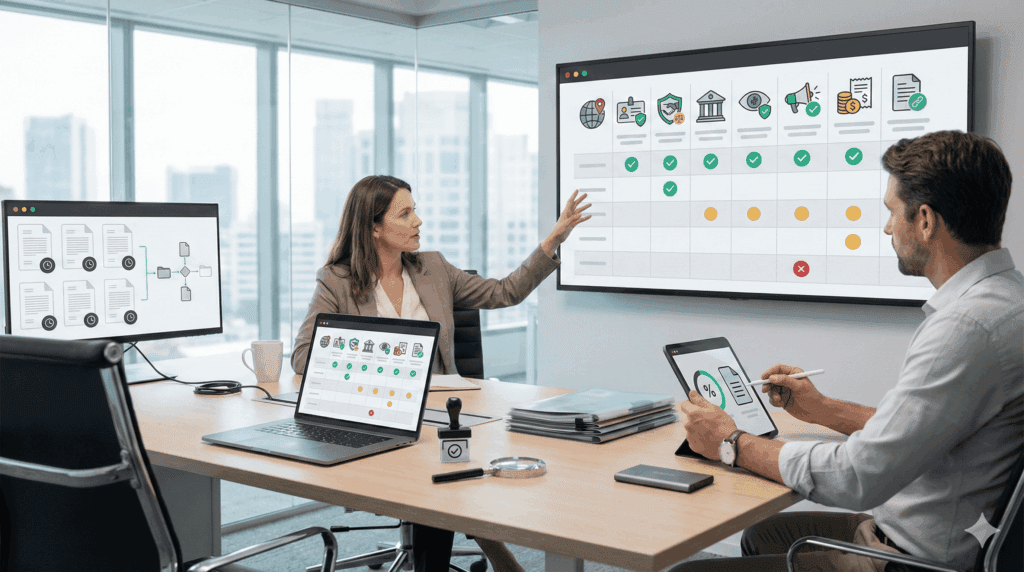

What a strong introducing broker list reveals at a glance

| Field to keep on every row | Why it matters | Green-flag evidence |

| Jurisdiction and registration ID | Confirms who oversees them | CFTC/NFA look-ups for US, others by local register |

| Model: Guaranteed or Independent | Shapes liability and capital | NFA description of GIB vs IIB attached to file |

| Carrying FCM or RFED | Shows who holds funds and sends statements | Name plus sample statement or client agreement |

| Supervision basics | Tells you who checks the checker | Reference to member supervision standards for IBs |

| Promotions standard | Avoids sales-copy trouble | “Fair, clear and not misleading” policy link |

“A firm must ensure that a communication or a financial promotion is fair, clear and not misleading.”

How do introducing brokers make money without the mystery

IB economics are straightforward and should be disclosed in writing.

- Shared commissions or spreads: the client pays the carrying firm and a portion is remitted to the IB per agreement.

“Commission revenue paid by the client to the FCM is shared with the IB.” - IB-set commissions in some futures contexts: documented in fee schedules.

“IBs set the commission fees charged to the customer.” - One-time or ongoing referral fees: less common in regulated futures, more common in some retail contracts, always documentable and jurisdiction-dependent.

- Add-on education or service packages: separate invoices, never bundled as implied returns.

If the compensation framework cannot be clearly outlined in a single paragraph and illustrated on a sample statement, remove the name from your list.

Shortlist signals that separate durable IBs from noisy ones

- Registration is current, principals are identifiable, and carrying firms are named

- Risk documentation reflects the actual product for your intended audience, incorporating leverage safeguards when relevant

- EU retail CFD measures include leverage limits, margin close-out at 50 percent, and negative balance protection.

- Complaints and supervision records are easy to obtain or already provided

- Fee math matches tickets and client statements

Your table schema for a usable directory

| Column | Example entry |

| Legal name, DBA | ABC Markets LLC |

| Registration | NFA ID 0XXXXXX, IB |

| Model | Guaranteed IB with XYZ FCM |

| Markets served | US futures and retail FX (segmented sites) |

| Compensation | Commission share per contract, schedule attached |

| Risk & marketing | Policy link uses “fair, clear, not misleading” wording |

| Contact & SLA | Partner desk email, response target 1 business day |

Keep it human. Add a final “notes” cell with what you learned from a sample statement or a test ticket.

Field notes that make the list actionable

- Ask for one volatile-hour replay that shows order acks, rejects, and statements stitched together

- Store PDFs of guarantee agreements or disclosures for Guaranteed IBs

- Record who you met, what they promised, and which proof they provided

“Evidence beats adjectives. If you can’t export it, you can’t rely on it.”

If this approach resonates, trim your introducing broker list to five candidates, request proof packs for registration, carrying firm, and fee math, then run one hour of side-by-side testing before any commercial discussion. That single pass will save weeks.

FAQ

Is an IB the same as a broker that holds client funds?

No. IBs solicit or accept orders and support clients but do not accept money or property to margin or secure trades. Funds sit with the carrying FCM or RFED.

Do all IBs have the same obligations?

No. Guaranteed IBs operate under a guarantor FCM that is liable for their acts, while Independent IBs meet their own financial and reporting duties.

What documentation should I request before adding an IB to my list?

Registration proof, identification of the carrying FCM or RFED, compensation schedules, sample statements, and marketing policies aligned with fair-clear-not-misleading standards.