You do not need a maze of screens to handle index and commodity futures trading. You need one routine that travels from indices to energy to metals while the ticket keeps the same language.

If you want to trade crude oil and S&P 500 futures – Dow Jones, FTSE futures CFD smoothly, follow these tips. Use a simple plan, cash-based sizing, and a platform that works the same for all symbols.

“When the software disappears, the skill appears.”

“Small and repeatable beats big and random.”

Lanes, windows, and what drives them

Pick two windows you can repeat. Consistency lives there.

| Lane | Typical windows* | Drivers | Personality |

| S&P 500 and Dow Jones | First and last cash hour | Earnings, breadth, flows | Range break then retest, momentum runs |

| FTSE futures CFD | London morning to midday | UK earnings, FTSE sector tilt, GBP tone | Gradual trends with mean reversion pockets |

| Crude oil | Europe morning, US session | Inventories, OPEC tone, risk appetite | Faster swings, plan for slippage |

| Gold as a cross check | London morning, US macro hours | Real rates and USD tone | Trend friendly around data |

*Choose slices you can repeat, not the entire day.

“Trade your window, not the whole day.”

Ticket math in plain cash

Let the platform do arithmetic. You set a fixed dollar risk per trade and let size follow.

S&P micro example

- Risk unit: 40 dollars

- Planned stop: 4 ticks equals 1 point

- Tick value: 1.25 dollars per tick

- Risk per contract: 4 × 1.25 equals 5 dollars

- Position size: 40 ÷ 5 equals 8 contracts

Crude oil CFD example

- Risk unit: 45 dollars

- Stop distance: 0.30

- Tick value example: 0.01 equals 1 dollar

- Risk per contract: 30 dollars

- Position size: 45 ÷ 30 equals 1.5 contracts

“You cannot control the market. You can always control position size.”

Three setups that travel across indices and commodities

Keep definitions short so they hold up when price speeds up.

Range break and retest

Box the opening range. After a decisive break, wait for a clean retest. Enter with a bracket already attached. Works on the S&P, Dow Jones, and on oil after the first burst.

Pullback into value

Confirm direction on a higher timeframe. Mark a value zone or VWAP band. Take the first pullback that pauses. Great on gold during macro prints, on FTSE futures CFD during London.

Quiet session fade

When pace slows, fade stretched moves back toward value with small size and firm stops. Tight targets protect the month when volatility dips.

“If the entry needs a paragraph to justify it, it is not ready.”

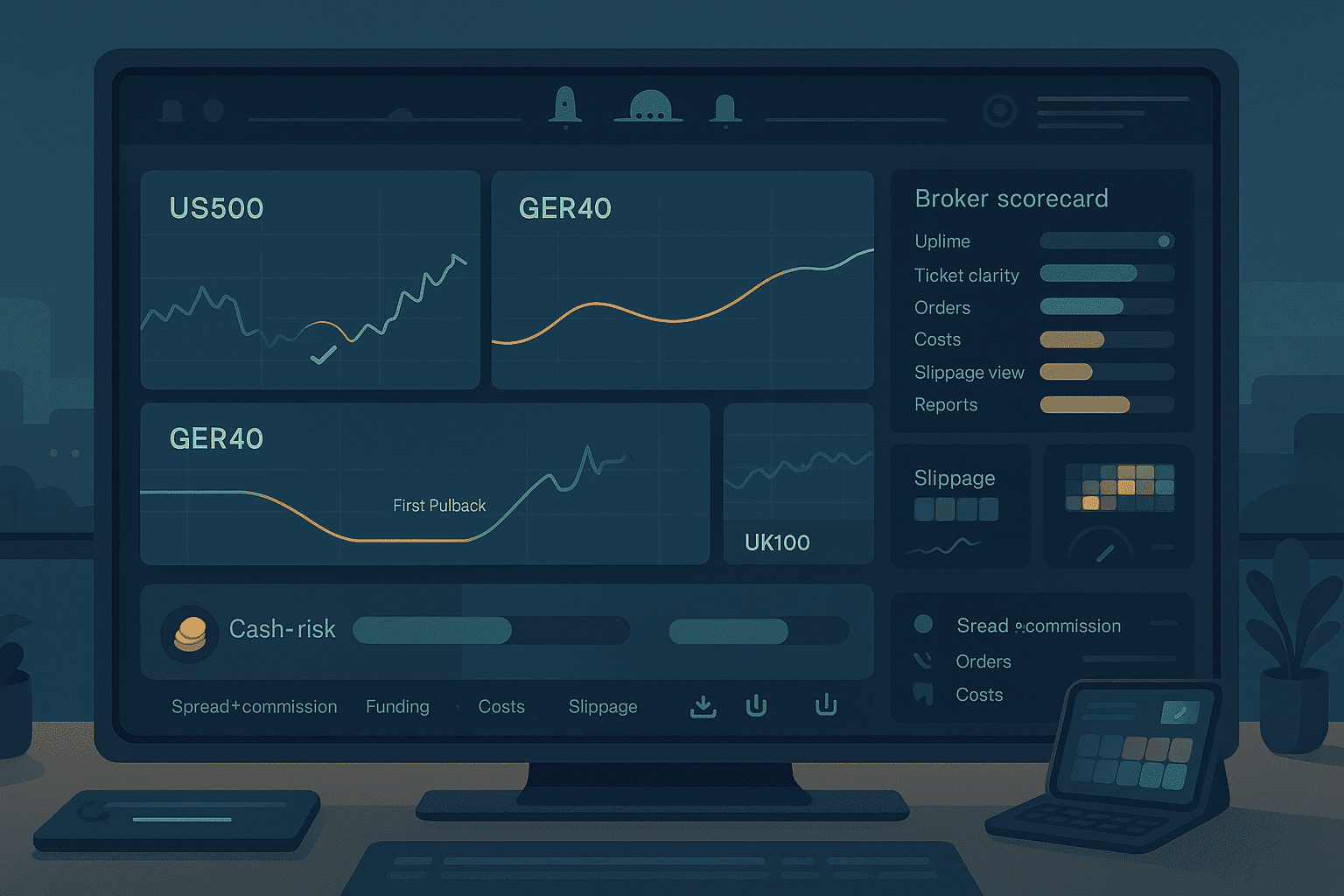

Costs that decide more than you think

Treat costs like ingredients. You will cook better trades.

| Cost line | Where it bites | Practical move |

| Spread plus commission | Every fill | Trade liquid minutes, avoid chasing breaks |

| Slippage | Opens and macro minutes | Prefer retests, use limits when speed tempts you |

| Funding or swaps | Overnight CFD holds | Shorten holds or use exchange futures for carries |

| Exchange and data | Exchange products | Buy only what you use, review monthly |

Track total cost per trade for each lane for 20 sessions. Your schedule will drift toward efficient hours on its own.

Platform traits that make many contracts feel like one room

If you want a calm routine for index and commodity futures trading, look for these behaviors:

- Cash risk preview on every ticket

- Symbol specs in cash for tick value, contract value, hours, and funding rules

- Delay and slippage widgets by symbol and session

- Exportable logs and, ideally, an API to rebuild statements

- Status page with incident timestamps and reverts

When the boring parts are good, your learning speeds up.

Two realistic routines with numbers

Indices first, oil second

- Windows: first 45 minutes of US cash for S&P and Dow Jones, then early US session for oil

- Risk: 40 dollars per index trade, 45 dollars per oil trade

- Plan: box the open and trade the retest on indices, pullback into value on oil

- Why it works: distinct rhythms, one ticket logic

London tilt with FTSE futures CFD

- Windows: London morning for FTSE, US macro hour for gold as confirmation

- Risk: 35 to 45 dollars per trade

- Plan: quiet fade during calm FTSE sessions, trend pullback on gold when data hits

- Why it works: avoids overlapping exposures while keeping the rules identical

Common mistakes and clean fixes

| Mistake | Why it hurts | Clean fix |

| Chasing the first spike at the open | Poor fills and regret | Wait for a retest or the first pullback |

| Sizing from memory | Inconsistent risk | Use cash preview and a fixed risk unit |

| Trading every time zone | Decision fatigue | Choose two windows and protect them |

| Ignoring funding or exchange fees | Slow drag on edge | Track full cost per trade for 20 sessions |

| Believing landing page spreads | False confidence | Screenshot quotes in your hours and compare monthly |

“Progress is a series of small, boring upgrades.”

A day you will recognize

Picture a Tuesday. The bell rings and the S&P micro breaks its box. You let it retest, size by cash, and the bracket attaches. Twenty minutes later Dow Jones offers a clean echo and you take a smaller, second idea. After lunch, crude oil pulls back into value and gives you a patient entry. Same ticket, same math, smaller size. By evening your statement lists spread, commission, and any funding exactly as expected. No creative labels. No guesswork. That is index and commodity futures trading doing the job you hired it to do.

FAQ

Is index and commodity futures trading suitable for small accounts

Yes, when you keep risk in cash and use micros or CFDs. Start with small tickets, then scale as your routine proves itself in your real windows.

Can I trade crude oil and S&P 500 from one platform

Yes if the venue keeps one ticket grammar, shows cash risk on the ticket, and supports brackets by default. That makes rotation calm.

How does FTSE futures CFD fit into a US focused routine

Use FTSE during London for a morning rhythm, then flip to US indices for the open. The rules stay identical while the symbols change.

How do I avoid oversizing during volatility

Fix a dollar risk per trade and let size float. Two attempts per idea, then stand down. If spreads blow out, prefer retests and reduce size.

Will costs eat my edge

Not if you measure. Trade liquid minutes, track total cost per trade, and match wrapper to hold time. Use exchange futures for longer carries, CFDs for flexible size.

Do I need depth of market for these setups

Only if your method depends on it. Many routines work with clean charts, value zones, and bracket orders. Buy tools that change outcomes, not decoration.

Quick checklist before you click

- One cash risk number taped near your screen

- Two setups you can describe in a sentence

- Two fixed session windows on your calendar

- Brackets turned on by default

- A journal template with two screenshots and two sentences

“Trust lives in spreadsheets and status pages, not in taglines.”