You want an ib program for forex brokers that recruits fast, onboards cleanly, and pays without drama. The aim is not louder banners, it is a predictable system that turns clicks into funded accounts and long term activity, backed by receipts that match exports line by line.

Below is a practical playbook that blends the best introducing broker model choices with a tidy mt5 broker partner program integration.

“If your partner’s journey fits on one page, you are ready.”

The idea in one minute

- Track the full path from click to KYC to fund to first trade.

- Publish payout rules that are short and testable.

- Pay on the schedule you promise with receipt parity.

- Teach partners to retain clients, not to push one day bursts.

“Choose systems you can audit, not just admire.”

Program spine that scales calmly

| Layer | Job to be done | What “good” looks like |

| Links and attribution | Map click to account with no leaks | UTM presets, deep links by region, fraud checks |

| CRM and KYC | Move signups to approved status | Live capture, retry links, approval timers |

| Funding rails | Get money in and out smoothly | Local methods, clear timelines, daily reconciliation |

| Product fit | Give clients a reason to stay | Liquid symbols, fair costs, bracket templates |

| Reporting and payouts | End debates fast | Portal totals equal CSV or API exports |

| Compliance | Keep promos safe | Region filters, pre approved claims, risk wording |

| Status and incidents | Tell the truth under stress | Timestamps, cause, fix, planned revert in plain language |

When platform and paper tell the same story, partners lean in.

The best introducing broker model, decoded

Most programs thrive on two models and one hybrid. Keep them simple and public.

| Model | How it pays | Best for | Watch out for | Practical guardrail |

| CPA per funded client | One time payout on first deposit | Review sites, educators | Clawback disputes | Publish KYC quality rules and refund windows |

| Revenue share | Percent of spread or commission | Active trading communities | Volume over client safety | Cap by product, reward retention milestones |

| Hybrid | Smaller CPA plus smaller share | Mixed audiences | Hidden break even month | Show cohort break even in the portal |

Quotable: “Pay for outcomes you can measure. Publish the math next to the rate.”

Starter ladder that feels fair

- Starter: CPA 200, funded within 30 days

- Growth: CPA 250 or 25 to 30 percent share when 60 day activity clears a threshold

- Pro: Hybrid 150 plus 15 percent share with a retention bonus if churn drops

MT5 broker partner program without the headaches

Your partners love MetaTrader for familiarity. Give them a clean path while preserving attribution.

Must haves for an mt5 broker partner program

- Deep links that pass the partner tag through MT5 download or web

- Pre loaded server profiles and a one page symbol sheet in cash

- Bracket templates as default so exits are honest from trade one

- Event hooks so dashboards show click to first trade in near real time

- Export parity between MT5 statements and your affiliate portal

“If the export equals the statement, the argument ends.”

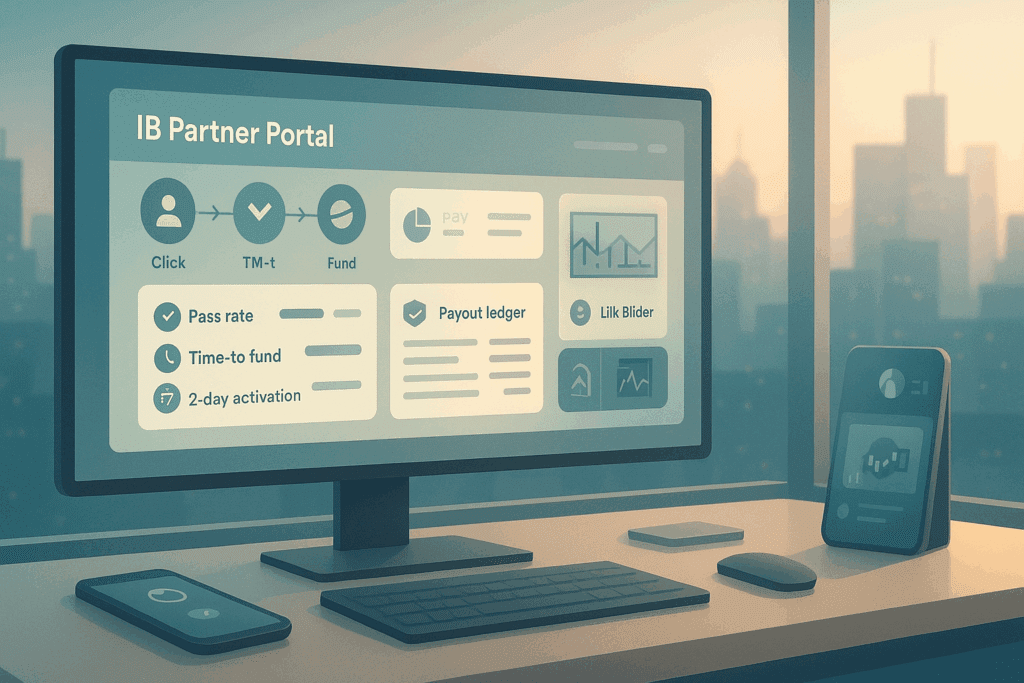

Partner journey on a single page

| Stage | Client sees | Partner action | Your promise |

| Click | Device aware regional landing | Share link with UTM preset | Correct geo and language |

| Sign up | Two minute form plus verify | Nudge with a checklist | Clear privacy and next steps |

| KYC | Live capture and doc upload | Send retry link if fail | Visible approval timer |

| Fund | Local rails with fees and timelines | Set honest expectations | Same day posting where possible |

| First trade | Bracket template and quick guide | Invite to office hours | Support that answers in minutes |

“Friction you can name is friction you can fix.”

Reporting and payouts that build trust

- Portal totals equal CSV or API exports line by line

- Payout ledger shows date range, model, client IDs anonymized, adjustments, net total

- Calendarized payout dates visible inside the portal

- Sample receipts published so new partners know what to expect

Quotable: “Receipts beat reviews.”

Education that lowers churn

A forex broker with educational tools converts better and retains longer, which improves every model above.

- Starter lessons on cash risk per trade and bracket templates

- A printable “first 5 sessions” checklist

- Weekly office hours in partner time zones with replays

- Proof posts that pair returns with drawdown and recovery days

- Short, device friendly tours of MT5 order entry and exports

KPIs that predict survival

| KPI | Healthy signal | Why it matters |

| KYC pass rate by region | Above 70 percent in target markets | Spots onboarding friction early |

| Time to first fund | Under 48 hours median | Confirms funnel clarity |

| First trade within 7 days | Above 60 percent of funded | Measures activation quality |

| 30 and 90 day active rate | Stable or rising | Proves education works |

| Refunds or clawbacks | Low and trending down | Confirms traffic quality |

| Days to payout | On time with receipt parity | Builds long term trust |

Publish a Monday scoreboard for your team and top partners.

Playbooks for three partner types

Educators

- Default CPA, small retention booster at 60 days

- Course outline, checklists, monthly Q&A

- MT5 quick start tour included

Communities

- Hybrid model with higher share after churn improves

- Require bracket templates and per day caps in content

- Cohort level analytics and drawdown dashboards

Regional reviewers

- Local language pages, deposit and withdrawal timelines

- Share KYC pass rates to set expectations

- Quarterly content review with a friendly fix first policy

Common mistakes and clean fixes

| Mistake | Why it hurts | The fix |

| Ranking partners by headline CPA | Attracts refunds and clawbacks | Show net payout by cohort and month |

| PDFs only reporting | Slow audits and long threads | CSV or API parity with statements |

| No region filters in links | Broken promises and angry tickets | Build filters into the link tool |

| Vague payout timelines | Distrust and churn | Calendarized payouts with a visible ledger |

| Promising outcomes | Compliance risk | Teach process, publish ranges, avoid hype |

“Fast prevention beats perfect postmortems.”

A day you will recognize

You open the portal. Europe shows a 72 percent KYC pass rate and a 38 hour median time to first fund. An educator runs a short office hour and five funded clients place their first bracketed trades on MT5. One payout question arrives, support replies with a link to the exact ledger line and date. The portal total matches the CSV without edits. Your weekly email goes out with a one minute tip on cash risk. That is an ib program for forex brokers working as intended, powered by the best introducing broker model choices and a reliable mt5 broker partner program.

FAQ

Which model is the best introducing broker model for a new program

Start with CPA so partners get early cash flow. Add a small revenue share for cohorts that retain the past 60 days. Publish hybrid break even by cohort inside the portal.

Can an mt5 broker partner program and other platforms live together

Yes. Keep MT5 as the default path for familiarity and add alternatives for advanced users. Preserve attribution across downloads and web terminals.

How do we prevent clawback disputes

Define KYC quality upfront, show refund windows, and display net payouts by cohort. Link every adjustment to a transaction ID and date in the ledger.

What belongs on a payout receipt

Partner ID, date range, model used, anonymized client IDs, CPA or share math, adjustments, net total, and a CSV that equals the portal number.

What metrics should partners see weekly

KYC pass rate, time to first fund, first trade within 7 days, 30 and 90 day active rate, refunds, and payout timing. Short, honest numbers beat vague promises.How do we know the program is trustworthy

Export parity, on time payouts, real incident timelines, and a public change log. If a payout can be rebuilt from raw data in five minutes, trust rises.