Curious about how to trade commodities without owning assets like physical gold bars or oil barrels. Good news. You can participate in price moves using derivative products that track underlying markets.

Here we’ll explain the practical path, the real benefits of CFD trading in commodities, and how to use technical analysis for commodities with a simple routine you can keep.

The quick take

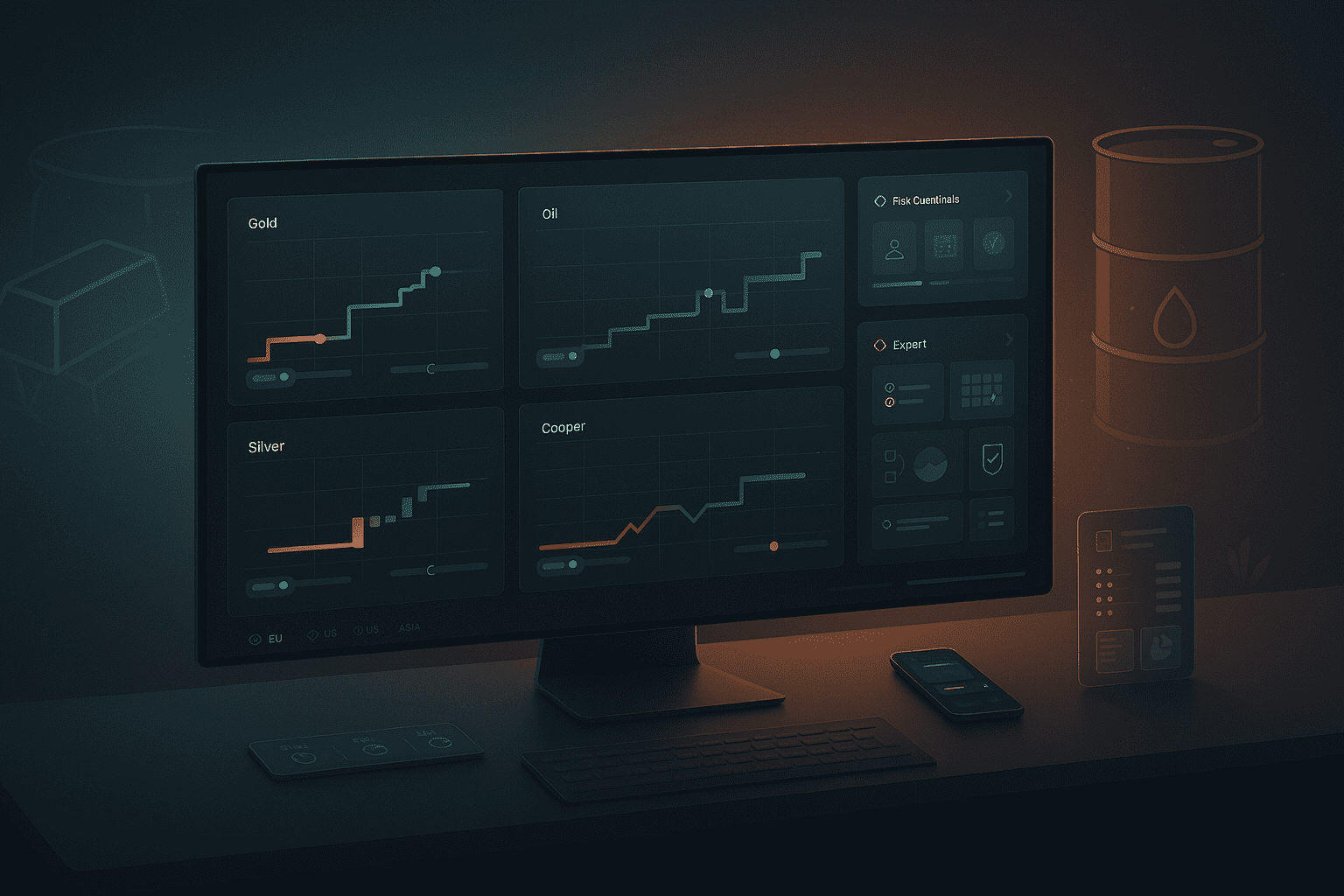

- You can access gold, oil, silver, copper and more through CFDs that mirror price changes

- Use cash-first sizing, default bracket exits, and a short product list

- Track spread, slippage, and funding for twenty sessions before scaling

Choose tools you can audit, not just admire.

What “trading without owning” really means

You are speculating on price direction through a contract that references the commodity, not holding the metal or the barrel.

| Product | Do you own the asset | Typical account needed | Suited for | Trade offs |

| CFDs on commodities | No | Margin account with CFD broker | Small steps, flexible sizing | Financing costs, regional availability |

| Futures | No physical by default | Futures enabled account | Deep liquidity, standardized rules | Exchange margins, steeper learning curve |

| ETFs tracking futures | No physical commodity | Securities brokerage | Simpler onboarding, defined structure | Management fees, tracking differences |

If you want flexible sizes and fast setup, CFDs can fit, need exchange standardization, look at futures. If you prefer a securities account, ETFs work.

Benefits of CFD trading in commodities

| Benefit | Why it matters in real life |

| Small position sizes | Begin with tiny risk per idea instead of large contract blocks |

| Long and short access | Participate in up and down cycles without extra paperwork |

| Unified workflow | Same ticket logic across gold, oil, silver, copper |

| Cash-first control | Set dollar risk and let the platform convert to size |

| No storage or delivery | You focus on price behavior, not logistics |

“Cash sizing first, direction second.”

How to set up a calm CFD routine

1) Pick a short, liquid menu

Gold plus one index-like commodity move such as oil. Add silver or copper later.

2) Lock cash risk per trade

Decide dollars at risk before you click. Keep it small for two weeks.

3) Use a default bracket

Stops and targets are attached automatically so exits are honest.

4) Trade your liquid window

For metals, focus on Europe and US overlaps. For oil, respect inventory days and core US hours.

5) Reconcile daily

Export fills and confirm the totals equal your statements line by line.

Sizing in plain English

Let the platform do the arithmetic. You set dollars, it converts to size.

- Gold CFD example

Risk per trade: 50 dollars

Stop distance: 0.50

Dollar per 0.10 move: 10

Dollars at 0.50 distance = 50

Size = 1 lot risks 50 dollars - Oil CFD example

Risk per trade: 60 dollars

Stop distance: 0.60

Dollar per 0.10 move: 10

Dollars at 0.60 distance = 60

Size = 1 lot risks 60 dollars

“Cash language travels across assets. Keep it.”

How to use technical analysis for commodities

Commodities respond to structure, time, and scheduled catalysts. Keep the tools simple and repeatable.

Your two core setups

Opening range break and retest

- Box the first minutes of your session

- Wait for a decisive break

- Enter on the first clean retest to the box edge with the bracket attached

- Great for gold and oil during active windows

Pullback into value

- Confirm direction on a higher timeframe

- Mark a value band such as VWAP or a fair mean zone

- Take the first measured pullback that pauses

- Excellent for trend days on gold, silver, and copper

Your minimal chart toolkit

- Sessions on chart so you see your liquid window

- VWAP or a clean moving average for value reference

- Price alerts at key levels in your local time

- No more than two indicators at once

Costs you must measure for twenty sessions

| Cost line | Where to look | Practical move |

| Spread and commission | Ticket preview and fills | Trade core minutes, avoid chasing |

| Slippage | Fill minus expected price | Prefer retests over first spikes |

| Funding or swaps | Instrument specs in cash terms | Match hold time to cost or stay with day holds early on |

| Data or platform fees | Only pay for what you use | Keep your toolset lean |

| Payments | Deposit and withdrawal timelines and fees | Document steps to avoid surprises |

Clarity turns uncertainty into a choice you can live with.

Risk controls that protect the month

- Per day loss cap that pauses new orders until server reset

- Max open positions per symbol to prevent concentration

- Session filters to skip thin hours and blackout around scheduled reports

- Two attempts per idea, then stand down

- Plain messages when rules fire

Platform checklist you can copy

Must-haves

- Cash risk shown on ticket before submit

- Bracket exits saved as default

- Symbol specs in cash terms, including tick value, hours, funding rules

- Export that equals statement totals without edits

- Price collars or rejection messages that explain blocks in human language

Nice-to-haves

- One click screenshot for journaling

- Session templates for US, Europe, and Asia

- Alerts by price and time in your time zone

Common mistakes and clean fixes

| Mistake | Why it hurts | Fix that lasts |

| Trading every headline | Slippage and whipsaw | Trade the first clean retest after prints |

| Oversized stops on small accounts | Inconsistent outcomes | Set cash first, let size float |

| Adding too many symbols | No depth of learning | Two instruments until your logs are calm |

| Ignoring funding costs | Death by a thousand cuts | Read carry in cash and adapt holds |

| PDFs only for reporting | Slow audits and confusion | Demand CSV parity with statements |

Fast prevention beats perfect postmortems.

Mini guides for popular commodities

Gold

- Watch dollar and rates tone

- EU and US overlaps are your best windows

- Pullback into value is your bread and butter

Oil

- Inventory day and OPEC headlines drive bursts

- Size down or wait for the retest after data

- Avoid thin late sessions

Silver and Copper

- Silver has higher beta than gold

- Copper tracks growth tone and can trend quietly

- Trade your session, not your mood

FAQ

Is trading commodities through CFDs the same as owning them

No. You are speculating on price changes without holding the physical asset. Costs, rules, and tax treatment differ.

What are the main benefits of CFD trading in commodities

Small sizes, long and short access, and a unified ticket across several products. You control risk in cash and avoid storage or delivery complexities.

How to use technical analysis for commodities without overloading charts

Two setups, one value reference like VWAP, session markings, and alerts at key prices. Keep it light so you can act quickly.

Can I swing trade with CFDs

Yes, but read funding or swap costs in cash terms first. Many traders start with day holds until they understand carry.

How do I reduce slippage around major reports

Size down, avoid the first spike, and trade the first clean retest with bracket exits ready.

Now Before You Go

Write a one page plan with your session, fixed cash risk, two setups, and the three numbers you will track for twenty sessions: spread, slippage, export parity. Then pick the platform that helps you apply how to trade commodities without owning assets while keeping your journal boring and your reporting exact.