You do not need a maze of platforms to make futures CFD trading work. You need one routine that travels from indices to metals to energy while the ticket keeps the same language.

If your goal is to trade futures online with retail friendly size and predictable costs, a good setup looks boring in the best way. The right habits and the right partner help more than any exotic feature when markets speed up.

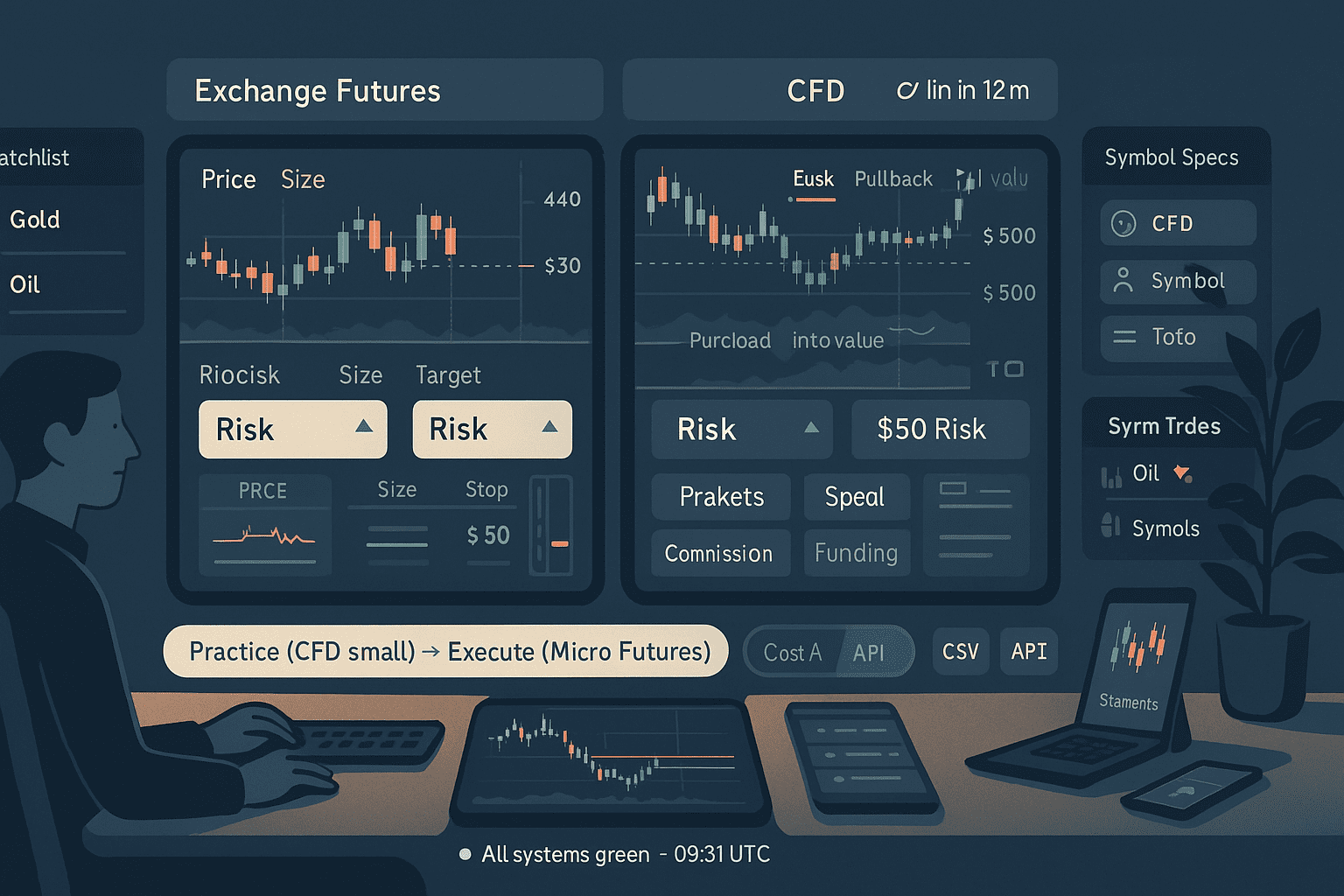

Futures vs CFDs, side by side

| Dimension | Exchange Futures | CFDs mirroring futures |

| Venue | Central order book on exchange | Broker routed OTC instrument |

| Sizing | Standard and micro contracts | Fractional sizing available |

| Hours | Exchange schedule, extended sessions | Often mirrors futures hours, confirm |

| Costs | Commission, exchange, clearing, data | Spread, commission, funding |

| Transparency | Depth and time and sales | Broker quotes with quality metrics |

| Best for | Multi day carries, deep liquidity | Small sizes, quick tests, learning the rhythm |

Choose the lane that keeps your behavior repeatable and your invoice predictable. You can blend the two. Many retail traders practice entries with CFDs and run bigger, longer holds on exchange futures once the edge is proven.

Ticket math in plain cash

Let the platform do arithmetic. You set the cash risk per trade and let size follow.

Index micro example

- Risk unit: 40 dollars

- Planned stop: 4 ticks equals 1 point

- Tick value: 1.25 dollars per tick

- Risk per contract: 4 × 1.25 equals 5 dollars

- Position size: 40 ÷ 5 equals 8 contracts

Metal CFD example with 0.01 equals 1 dollar

- Risk unit: 50 dollars

- Stop: 0.50

- Risk per contract: 50 dollars

- Position size: 1 contract

“You cannot control the market. You can always control position size.”

Costs that quietly decide more than you think

Treat costs like ingredients. You will cook better trades.

| Cost line | Where it bites | Practical move |

| Spread plus commission | Every fill | Trade liquid minutes and avoid chasing breaks |

| Slippage | Opens and macro minutes | Prefer retests, use limits when speed tempts you |

| Funding or swaps | Overnight on CFDs | Shorten holds or use exchange futures for multi day carries |

| Exchange and data | Exchange products | Subscribe only to what you use and review monthly |

Track total cost per trade for 20 sessions. Your schedule will drift toward efficient hours on its own.

A simple way to trade futures online without drama

Keep definitions short enough to follow when price speeds up.

Range break and retest

Box the opening range on your contract. After a decisive break, enter on the clean retest with a bracket order already attached. Works well on index futures and liquid CFDs.

Pullback into value

Confirm momentum on a higher timeframe, then buy or sell the first pullback that pauses near a value area or VWAP band. Great for gold, crude, and micro indices.

Quiet session fade

During calmer stretches, fade extensions back toward value with small size and firm stops. Targets are tighter. This protects your month when volatility dips.

“If the entry needs a paragraph to justify it, it is not ready.”

Platform traits that make both lanes feel like one room

Whether you use exchange products or CFDs, aim for the same feeling.

- Cash risk preview on every order ticket

- Brackets and OCO by default so exits are automatic

- Symbol specs in cash terms for tick value, contract value, trading hours, and funding rule

- Delay and slippage widgets by symbol and session

- Exportable logs and, ideally, an API for statements and fills

- Status page with incidents and reverts you can cite

When the boring parts are good, your learning speeds up.

How to pick the best futures broker for retail traders

Use a scorecard. Evidence beats slogans.

| Category | Weak | Acceptable | Strong |

| Stability | Frequent freezes | Occasional blips | Uptime with public history |

| Ticket clarity | Percent only in a sub tab | Cash view hidden | Cash risk in plain sight on the ticket |

| Orders | Market and basic stop | Brackets available | Brackets standard, OCO, and ladder for futures |

| Costs | Bundled, vague | Partial breakdown | Itemized commission, exchange, clearing, data |

| CFD quality | Unknown | Typical spreads listed | Live spread snapshots by session and symbol |

| Reports | PDFs only | CSV download | API or webhooks to rebuild statements |

| Support tone | Canned replies | Named contact | Fast, example driven answers with timing targets |

When “Strong” becomes your everyday, you stop tinkering and start improving.

Two realistic routines with numbers

Metals pullback with fixed risk

- Window: London morning or US macro hours

- Risk: 50 dollars per trade

- Plan: trend confirmation, first pullback into value

- Management: partial at 1R to pay costs, trail the rest

- Note: stand down ten minutes before and after top tier prints unless that is your edge

Index range break and retest

- Window: first 45 minutes of the cash session

- Risk: 40 dollars per trade

- Plan: draw a five to ten minute box, take the retest after a decisive break

- Management: partial at 1R, structure stop on the rest

- Note: skip messy breaks and trade the next clean one

Futures CFD trading, blended on purpose

You can run a hybrid routine.

- Practice timing with small CFD size in your less active hours

- Move the same setup to exchange micros when the window is truly liquid

- Keep one risk unit across wrappers so that every trade feels the same

- Track cost per trade separately for CFDs and futures to see where each shines

“Same setup, same cash risk, different wrapper. Let the data tell you what to keep.”

Common mistakes and clean fixes

| Mistake | Why it hurts | Clean fix |

| Chasing the first spike at the open | Poor fills and regret | Wait for retest or first pullback |

| Sizing from memory | Inconsistent risk | Use cash preview and a fixed risk unit |

| Trading every time zone | Decision fatigue | Pick two windows and close on time |

| Ignoring funding or exchange fees | Surprise drag | Log full cost per trade for 20 sessions |

| Believing landing page spreads | False confidence | Screenshot quotes in your hours and compare monthly |

Progress is a series of small, boring upgrades.

A day you will recognize

Picture a Tuesday. London sets a direction. Gold pulls back into value. You size by cash, click once, and the bracket attaches. Thirty minutes later, the micro S&P breaks its morning box and retests. Same ticket, same math. You take a partial at 1R and trail the rest. In the evening your statement matches your notes line by line. No creative labels. No guesswork. That is futures CFD trading doing the job you hired it to do.

Quick checklist before you click

- One cash risk number taped near your screen

- Two setups you can describe in a sentence

- Two fixed session windows on your calendar

- Brackets turned on by default

- A journal template with two screenshots and two sentences

“Trust lives in spreadsheets and status pages, not in taglines.”

One quiet nudge before you fund

Write a cash risk number you can live with, choose one index and one metal that trades clean in your window, and screenshot spreads twice a day for a week. If those pictures match your fills and your statement matches your mental invoice, you probably found the best futures broker for retail traders. This is a routine worth keeping.If not, change the window, reduce size, or keep walking until the platform and paper tell the same story.

FAQ

Is futures CFD trading right for small accounts

Often yes. CFDs allow fractional sizing and quick testing. When your routine proves itself in liquid hours, moving to exchange micros can make longer holds cheaper and clearer.

Can I trade futures online from one platform alongside CFDs

Yes if the broker treats cash risk, brackets, and reports the same way across wrappers. One grammar across instruments reduces accidental mistakes.

How do I avoid oversizing during volatility

Fix a dollar risk per trade and let size float. Use brackets and two attempts per idea, then stand down for the session if both fail.

Are data fees worth it for exchange futures

Buy only what you use. If depth informs entries or exits, pay for it. If your method relies on levels and closing logic, you may not need the extra spend.

How do I keep costs from eating results

Trade liquid minutes, prefer retests over chases, track total cost per trade, and match wrapper to hold time. Let the numbers nudge your schedule.