A good forex MAM solution is not about shiny dashboards. It is about repeatable work. Managers make trades on a master account. Allocations determine follower sizes, and every step is logged for support and compliance.

Choose multi-account manager software that remains reliable under pressure. Build a MAM system for brokers that works well on both busy and quiet days.

“Fast prevention beats perfect postmortems.”

Who benefits when MAM is done right

- Brokers: a reliable profit center with fewer support escalations and audit ready logs

- Money managers: fair distribution, cash based allocation, and analytics that help them improve

- Investors: simple allocation choices with hard caps and a pause that works instantly

- Compliance and finance: clean statements, maker checker on payouts, and traceable fee math

The architecture that keeps rooms calm

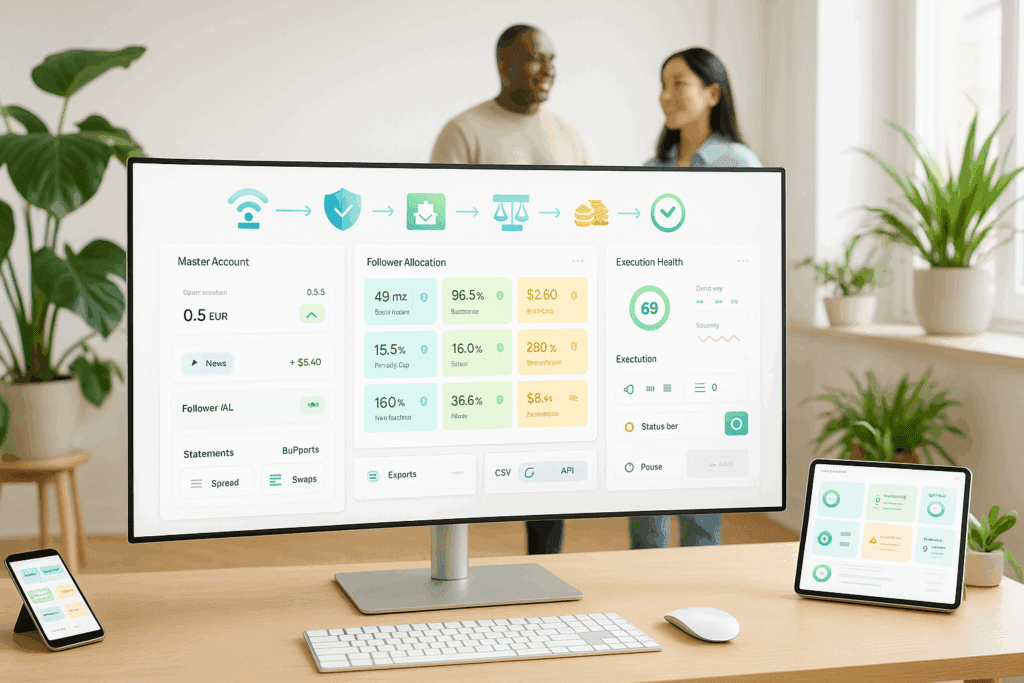

A resilient MAM system for brokers follows a clean, modular path:

- Signal intake: master account emits trade events with symbol, side, size, and time.

- Validation: permission checks, margin checks, exposure limits, symbol allow lists.

- Allocation engine: converts master size into follower sizes using the chosen method and caps.

- Execution bridge: routes orders, stamps copy delay and slippage per follower.

- Ledger and reports: fees, PnL, swaps, and overrides post to statements and exports.

Keep custom work at the edges. Let core allocation and logging stay standard so upgrades remain painless.

Allocation methods you will actually use

| Method | Idea | Best for | Watch out for |

| Equity proportional | Size scales with live equity | Active managers and frequent deposits | Feels larger during volatility |

| Balance proportional | Size from start-of-period balance | Quarter based cohorts | Mid-period deposits skew weight |

| Fixed cash allocation | Set a currency amount per investor | Small or cautious accounts | Underuse if set too low at first |

| Percentage of master | Slice of master size per investor | Cohesive cohorts | Rebalance when investors join or leave |

| Multiplier tiers | Conservative, standard, aggressive | Simple marketing and UX | Explain tier math in cash, not only percent |

“Pick one method for the month. Switching mid stream confuses everyone.”

Risk controls to enable on day one

- Equity stop per investor and per strategy

- Per day loss cap that auto pauses allocations when reached

- Max open positions and symbol filters for exotics or thin pairs

- Circuit breakers for stale quotes and abnormal spreads

- Graceful exit so investors can disconnect without disrupting open trades

Short messages reduce tickets:

“Copy paused. Per day cap reached. Resumes at 00:00 server time.”

“Order rejected. Free margin below threshold. Reduce size or deposit.”

Features that define real multi-account manager software

A dependable MAM is predictable, not flashy. Look for these non negotiables:

- Cash risk preview on the investor allocation screen

- Bracket support so managers can publish stops and targets that carry to followers

- Per symbol settings for min trade size, max exposure, and allow lists

- Delay and slippage analytics by symbol and session

- Itemized statements plus CSV or API exports for fills, fees, and swaps

- Status page with timestamps and post incident notes

“Choose platforms you can audit, not just admire.”

Cost lines that matter more than you think

Treat costs like ingredients. You will run the kitchen better.

| Cost line | Who feels it | Where it bites | Practical move |

| Spread and commission | Everyone | Each fill | Trade liquid windows and publish typical ranges |

| Swaps or funding | Investors | Overnight holds | Shorten duration or use exchange products for long carries |

| Performance or management fees | Investors and managers | Periodic or monthly | Use high water mark and show worked examples |

| Platform and bridge fees | Broker | Monthly and per million | Model tiers against realistic volume |

| Payment processing | Broker and manager | Subscriptions and payouts | Simplify plans, reduce chargebacks |

Publish a round number example inside the portal. It prevents most disputes.

Operations playbook you can run from a notebook

Daily

- Reconcile platform, PSP, and bank

- Review rejects and confirm triggered caps sent alerts

- Sample allocation logs for outliers

Weekly

- Inspect delay and slippage by symbol and session

- Share a short change log for rule tweaks and defaults

- Post a 3 line operations update: uptime, incidents, fixes

Monthly

- Close fees with statements that reconcile to exports

- Refresh education posts and onboarding screenshots

- Audit payout approvals with maker checker

“Consistency beats intensity.”

KPI dashboard that predicts retention

| KPI | Healthy signal | Why it matters |

| Onboarding completion | Over 70 percent funded | Reveals friction early |

| Time to first allocation | Under 48 hours after funding | Measures clarity of first session |

| Copy health rate | Above 95 percent inside delay threshold | Proves execution quality |

| Drawdown vs manager notes | Consistent over time | Confirms discipline |

| Tickets per 100 actives | Downtrend over 60 days | Education and product are doing the job |

| Withdrawal completion | Inside published window | Trust and referrals |

Share a trimmed scoreboard every Monday. It nudges the right behavior.

Discovery that rewards discipline, not luck

A MAM marketplace or manager catalog should make good habits obvious.

- Time weighted return with max drawdown and recovery time side by side

- Average risk per trade in cash so investors set realistic expectations

- Typical holding time and active hours to fit schedules

- Verification badges for identity and track window

- Notes cadence so managers teach, not tease

“A smooth twelve percent with a ten percent drawdown often beats a noisy forty with thirty five down.”

MAM vs PAMM vs copy: keep the differences clear

| Model | Who owns trades | Allocation style | Fee flow | Best for |

| MAM | Each investor account mirrors master | Per investor method and caps | Manager fees plus trading costs | Flexible sizing, tighter risk rules |

| PAMM | Pooled balance, pro rata results | Single equity pool | Fees at pool level | Simplicity over per investor control |

| Copy trading | Follower accounts mirror signals | Allocation and caps per follower | Provider or platform fees | Education, distribution, smaller tickets |

If you need per investor control and detailed reporting, MAM usually wins.

Two realistic rollout plans

Pilot first, scale later

- Scope: majors and gold only, one region

- Cohort: 3 managers, 50 investors

- Rules: cash allocation, equity stop 8 percent, per day cap 2 percent

- Review: two weeks of delay and slippage data before opening wider

Regional launch with guardrails

- Scope: majors, gold, and one index

- Education: one page risk guide with screenshots

- Ops: daily reconciliation and weekly change log

- Goal: support tickets drop after week two while allocations rise steadily

“Slow is smooth, smooth is fast.”

What “good” feels like on a regular Tuesday

A manager shares a brief plan before London. They take a pullback on XAUUSD with a set stop. After the session, they write a two-line recap. Investors had cash allocations, equity stops, and a small per day cap. Delay and slippage stayed inside your threshold. Statements list spreads, commissions, swaps, and fees exactly as expected. There is nothing to interpret. That is the mark of a healthy forex MAM solution.

One Last Little Push Before You Build

Write down the three controls you will use for every investor account. List the two metrics you will share each week. State the one change you will always announce to users in advance. Next, select your multi-account manager software. Enable cash allocation, equity stops, and daily caps. Finally, invite a small pilot group.If logs and fees behave for two weeks, expand calmly and let results, not slogans, do the talking.

FAQ

What is the biggest advantage of a MAM system for brokers

Per investor control. You can set cash allocations, use symbol filters, and enforce caps. You can also provide clear statements and exports that auditors trust.

How should managers present their method inside a forex MAM solution

Timeframe, two setups in one sentence each, cash risk per trade, typical hours, and weekly notes. Pair returns with drawdown and recovery time on the same card.

Which allocation method is safest for beginners

Fixed cash allocation per manager, with equity stops and per day caps. It keeps risk stable while investors learn the rhythm.

How do we keep slippage and delay under control

Trade during liquid sessions. Publish a news policy. Show delay and slippage by symbol and session. Route through bridges that clearly explain reject reasons.

Are fees going to eat investor results

Not if you measure and explain them. Use high water mark performance fees, keep management fees modest, and publish a worked example with round numbers in the app.

Is MAM the same as copy trading

No. Copy trading focuses on distribution and learning. MAM prioritizes per investor sizing and regulatory grade reporting. Many brokers offer both, but you run them with different guardrails.