You do not need fancy secrets to make cTrader copy trading work for you. You need a clean process, honest risk limits, and the habit of checking the same metrics every week. This guide shows the essentials of the cTrader copy platform, plus a step-by-step path for safe social trading with cTrader.

“Simple rules, clear stats, and steady discipline beat a lucky streak.”

The big picture in two minutes

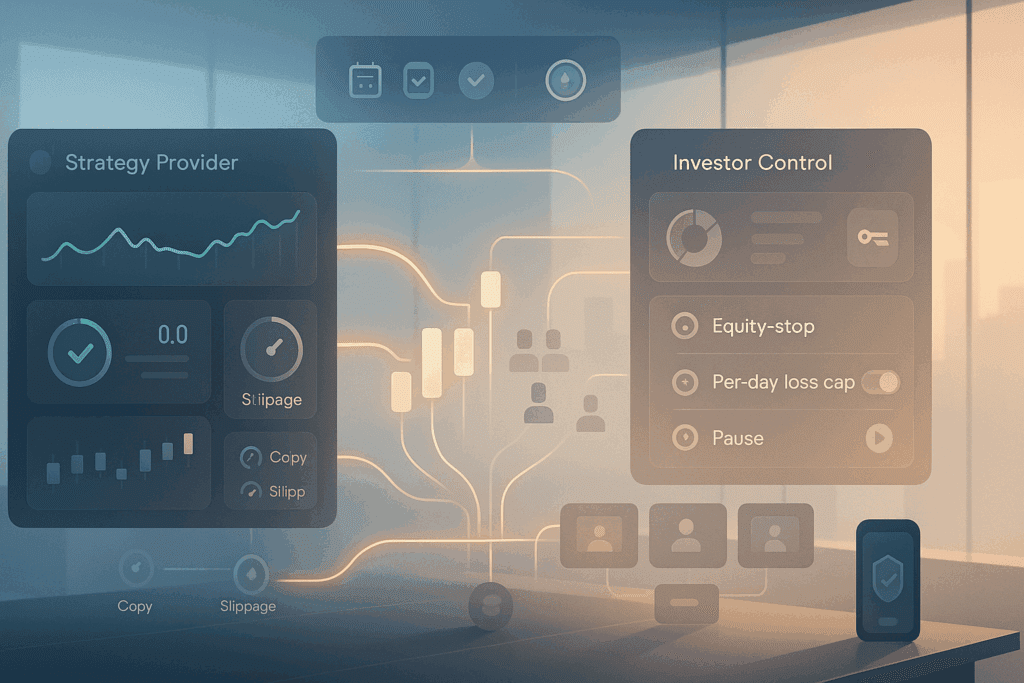

Think of copy trading as a bridge. On one side are strategy providers who place real trades. On the other side are investors who want exposure without micromanaging entries. The bridge passes signals, sizes positions, and logs every fill so results are easy to review.

“Transparency matters most when markets move fast.”

Roles at a glance

- Strategy Providers place trades on their own accounts and publish track records.

- Investors pick providers, set risk controls, allocate funds, and can pause anytime.

- Platform handles copying, risk rules, fees, and performance reporting.

Key advantages of the cTrader copy platform

| Area | What you get | Why it helps |

| Transparent stats | Time-weighted returns, drawdown, win rate, equity curve | Lets you compare providers on apples-to-apples terms |

| Risk controls | Allocation by cash, equity stop, max daily loss, quick pause | Prevents small mistakes from becoming big problems |

| Execution health | Copy delay and slippage visibility | Keeps expectations realistic across symbols and sessions |

| Funding and custody | Segregated allocation, clean deposits and withdrawals | You always know where funds sit and how they are used |

| Communication | Notes from providers, strategy descriptions, recent trades | Context lowers anxiety during choppy periods |

“If a platform can show risk in cash before you click, your future self will thank you.”

Before you copy: a quick checklist

- Define your allocation in cash, not just percentage of equity.

- Set a personal equity stop and a per-day loss limit.

- Decide the maximum number of strategies you will follow this month.

- Write a one-line goal for each strategy. For example, say “steady trend-following on major pairs” or “intraday momentum with small size.”

How cTrader copy trading fits different styles

For steady investors

- Pick one trend-following provider and one mean-reversion provider.

- Set conservative equity stops and a per-day cap.

- Review monthly, not hourly.

For active learners

- Allocate a small amount to one fast intraday provider.

- Keep a larger amount with a slow swing provider.

- Compare slippage and copy delay in different sessions to learn the rhythm.

“You will learn faster by funding two different styles than by chasing one hot curve.”

Social trading with cTrader: making communities useful

Communities are helpful when they favor process over hype. Look for:

- Public, repeatable rules from providers.

- Weekly wrap-ups that explain a good trade and a bad trade.

- Screenshots or short clips showing entries, exits, and risk in cash.

- Respectful moderation and no promise of guaranteed returns.

A simple scoring model for picking strategies

Use this table to score providers from 1 to 5 in each row. Favor steady, comprehensible risk over flashy returns.

| Filter | 1 | 3 | 5 |

| Track record length | < 3 months | 3–9 months | 9+ months |

| Max drawdown | > 30% | 15–30% | < 15% |

| Return consistency | Spiky, erratic | Mixed | Smooth, compounding |

| Risk per trade | Unclear | Sometimes stated | Clear cash risk each time |

| Leverage use | High and variable | Moderate | Low and consistent |

| Provider notes | Rare | Occasional | Clear, frequent, plain language |

“A smooth 12 percent with 10 percent drawdown often beats a noisy 40 percent with 35 percent drawdown.”

Fees and costs without the fog

| Cost type | Where it shows | Tip to manage |

| Performance fee | Charged on profits, often with high-water mark | Prefer clear formulas and monthly cadence |

| Management fee | Small monthly percent | Keep modest to avoid fee drag |

| Spread and commission | Inside each trade | Favor liquid sessions and symbols |

| Slippage | Fast markets, thin books | Expect small gaps; diversify providers and hours |

Short rule: test with a small allocation first, then scale if net returns after fees remain stable.

Practical examples you can copy today

Example 1: Steady two-strategy blend

- Provider A trend-follows EURUSD and XAUUSD on the 1-hour chart.

- Provider B trades US indices intraday.

- Allocation: 70 percent A, 30 percent B.

- Equity stop: 12 percent at the account level, 8 percent per provider.

- Per-day loss cap: 2 percent.

- Review cadence: weekly dashboard check, monthly reweight.

Example 2: Small account guardrails

- Allocate a fixed cash amount per provider, not full equity.

- Turn on partial pause after a per-day cap triggers.

- Stick to majors and metals for the first month.

“Small and repeatable beats big and random.”

Risk controls to set on day one

- Equity stop per provider to prevent one bad week from erasing months.

- Per-day loss cap that triggers an automatic pause.

- Symbol filters if you prefer majors over exotics.

- Max open positions to keep exposure understandable.

- Pause button on the favorites bar for quick reactions during news.

Reading provider pages without getting lost

Focus on these five zones:

- Equity curve that grows with shallow dips rather than dramatic V-shapes.

- Drawdown chart that shows recoveries in weeks, not months.

- Average trade length to ensure it fits your lifestyle.

- Top symbols to avoid accidental concentration.

- Notes and updates that reveal the provider’s discipline.

“If a provider cannot summarize the approach in one short paragraph, skip it.”

Common pitfalls and easy fixes

| Pitfall | Fix |

| Chasing top monthly returns | Filter by drawdown and track record length first |

| Copying too many providers | Cap at 2–4; quality beats quantity |

| Ignoring fees and slippage | Track net results after all costs |

| Changing risk rules mid-drawdown | Hold your prewritten plan; review after recovery |

| Copying exotics on day one | Start with majors and metals, then expand |

Platform tips that save time

- Pin favorite providers for fast access to pause and allocation edits.

- Turn on email or push alerts for equity stop triggers.

- Use tags in your journal like “trend”, “mean-rev”, “news-day” to spot patterns.

- Export monthly statements and keep them in a dated folder.

Mini-glossary so conversations stay clear

- High-water mark: performance fees apply only to new profits over the last peak.

- Copy delay: time between provider’s fill and your fill.

- Slippage: difference in price between provider and follower fills.

- Equity stop: threshold that pauses copying to prevent deeper losses.

“Definitions prevent arguments. Agree on terms before debating results.”

One small push to get moving

Open your platform and shortlist three providers with at least nine months of history and drawdowns under 15 percent. Allocate a small amount to two of them, set a per-day cap, and write a one-line goal for each strategy. Check net results after fees in four weeks. If the curves behave and the notes read like a plan, scale gently. That is the quiet way to make cTrader copy trading a steady part of your portfolio.

FAQ

Is the cTrader copy platform suitable for beginners?

Yes, if you use small allocations, stick to liquid symbols, and set equity stops. The dashboards make risk more visible than traditional signal services.

Does social trading with cTrader mean I never need to learn?

Copying can save time, but basic literacy still matters. Learn position sizing in cash, how fees work, and the difference between trend and mean-reversion so provider choices make sense.

Can I pause copying during news?

You can pause anytime. Many investors set a temporary pause around key releases that affect their providers’ symbols, then resume once spreads normalize.

What is a healthy drawdown for copy strategies?

Under 15 percent is a common comfort zone for steady styles. Faster intraday strategies might swing more, so size smaller and use tighter equity stops.

Will slippage ruin results?

Normal slippage is small on liquid pairs during active hours. Avoid thin sessions and be cautious during major news where spreads can widen.

How fast should I scale allocations?

Only after 60–90 days of stable behavior and clear communication from providers. Increase in small steps and keep your original risk rules intact.