Trading can sometimes feel like you’re on an island, staring at endless charts and trying to make sense of unpredictable markets. Copy trading is where CommuniTraders comes in. It is a platform that many people use to learn while they trade in the market.

Instead of sitting alone trying to figure everything out, copy trading with CommuniTraders connects you to a community. You’re not just following trades. You’re talking to people, asking questions, and watching real strategies in action. Think of it as a classroom where the lessons come from live market activity.

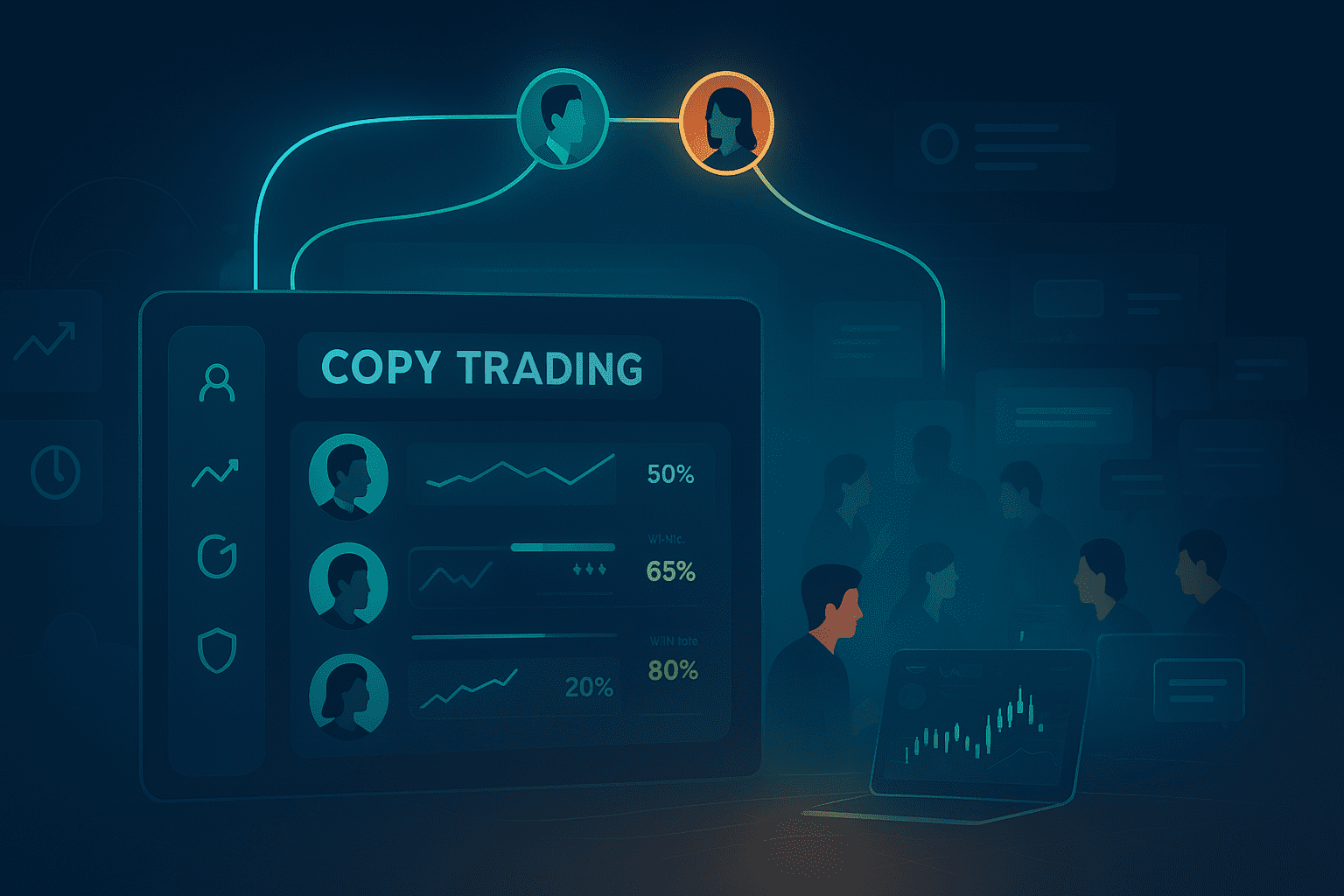

Copy Trading Made Simple

Copy trading is exactly what it sounds like: your account mimics the trades of another person. But it’s not blind following, you decide who to copy, how much to allocate, and when to stop.

“Copy trading acts as a bridge between learning and doing.”

The easiest way to picture it is this: imagine sitting beside a chess master. You’re not inventing moves from scratch; you’re watching them play and applying the same logic. You’ll still need to adapt and understand, but you’re not starting from zero.

Why CommuniTraders Feels Different

Plenty of platforms claim to offer copy trading, but not all of them create a supportive environment. CommuniTraders leans heavily into the community aspect. Instead of just showing you numbers, it opens the floor for conversations.

Some highlights include:

- Clear track records: You can review each trader’s past performance, not just recent wins.

- Community chat: Spaces to ask questions, share opinions, and learn why a trade was made.

- Flexible control: You decide how much to invest when copying.

- Transparency: You can see the strategies and results, which helps build trust.

“Transparency is not just a feature. It is the foundation of trust in social trading.”

The Social Side of Trading

When people discuss social trading features, they usually mean tools that help traders connect. In CommuniTraders, these tools are designed to reduce the isolation of trading.

| Feature | Purpose | What It Means for You |

| Leaderboards | Highlight traders with strong track records | Makes it easier to choose who to follow |

| Discussion boards | Community-driven Q&A and debates | Learn from real conversations, not just stats |

| Custom allocation | Set your own budget per copied trader | Protects you from overexposure |

| Performance breakdowns | Track win rates and risk levels | Informed decision-making |

| Pause/stop anytime | Full control of copying activity | Flexibility if markets shift |

These aren’t just technical tools, they’re conversation starters. They turn trading from a solitary effort into something more interactive.

Learning by Copying

One of the main benefits of copying other traders’ strategies with CommuniTraders is that you learn by doing. Instead of reading theory or waiting for years of trial and error, you see strategies applied in real time.

Benefits include:

- Learning curve shortcut: Real trades help you connect theory with practice.

- Exposure to different methods: Day traders, swing traders, long-term investors, all in one place.

- Time saver: You don’t need to live glued to charts.

- Emotional control: Structured strategies can reduce the panic that often leads to bad decisions.

“Copy trading doesn’t mean skipping the learning process. It means learning faster by watching professionals in action.”

Common Styles You Might Copy

Traders on CommuniTraders come with their own unique approaches. Here are a few styles you’ll see:

Trend Followers

They ride market momentum, entering trades when a price moves clearly in one direction.

Swing Traders

They aim for medium-term moves, holding trades for a few days or weeks.

Day Traders

They open and close trades within the same day, focusing on short-term opportunities.

Risk Managers

These traders prioritize small, consistent wins rather than big swings.

For many, copying a mix of these strategies is the safest route, giving them balance across different market conditions.

Comparing CommuniTraders with Other Platforms

| Platform | Strength | Weakness |

| CommuniTraders | Strong social features, transparency | Still growing global reach |

| eToro | Very large user base | Fees can be higher |

| ZuluTrade | Variety of traders to copy | Complex interface for beginners |

| NAGA | Social feed like a timeline | Lacks advanced analysis tools |

The difference with CommuniTraders is that it emphasizes community as much as results. It’s not only about numbers; it’s also about connection.

Risks to Keep in Mind

No matter how skilled the trader you follow is, risk is always present. Markets change in unexpected ways, and every strategy can have losses.

Here are some practical tips to manage risk:

- Don’t put all your money into one trader.

- Use stop-loss settings to protect your balance.

- Regularly check who you are copying.

- Join discussions to learn why decisions are made.

“Copy trading works best when you see it as part of your journey, not as a shortcut to guaranteed profits.”

A Simple Example

Let’s say you have a small budget. You decide:

- Trader A, who focuses on day trading stock indices.

- Trader B, who uses swing strategies on forex pairs.

By splitting your funds, you’re not betting everything on one approach. If one has a tough week, the other may offset the losses. That balance is what makes copy trading appealing for many.

Trading Feels Less Lonely

Perhaps the biggest advantage of CommuniTraders is psychological. Trading can be stressful when you are alone. You might second-guess every move you make. But when you join a group, things change. You can ask questions and see strategies in action. This makes the pressure feel lighter.

People often find that talking about mistakes helps them grow. The community acts like a safety net for impulsive choices.

Pulling It Together

Copy trading isn’t about handing over control. It’s about learning in a real environment with the safety of guidance. CommuniTraders makes this happen by combining tools, community, and openness.

If you have ever thought trading was too hard or lonely, joining a group platform could help. With CommuniTraders, you don’t just make trades. You share knowledge, compare strategies, and grow with others.

Frequently Asked Questions

Is copy trading with CommuniTraders safe?

It has risks like any trading. However, the platform offers tools to help manage these risks. These tools include allocation limits and risk metrics.

Can beginners use CommuniTraders?

Yes, beginners often find it helpful since they can observe and learn from more experienced traders.

Do I need a large account to start?

No, you can begin with smaller amounts and build up as you gain confidence.

Can I stop copying a trader whenever I want?

Absolutely. You’re always in control of your activity.

Does copying guarantee profits?

No. Even skilled traders lose sometimes, so it’s best to treat it as a learning tool rather than a guaranteed strategy.