News hits, curves shift, spreads breathe. The right commodity market analysis software turns those moving parts into a map you can actually use. Below is a calm, practical walkthrough that ties analytics to action, including how to hedge using commodity CFDs and the reality of leverage and risk in commodities trading.

“Data is noise until it changes your position size.”

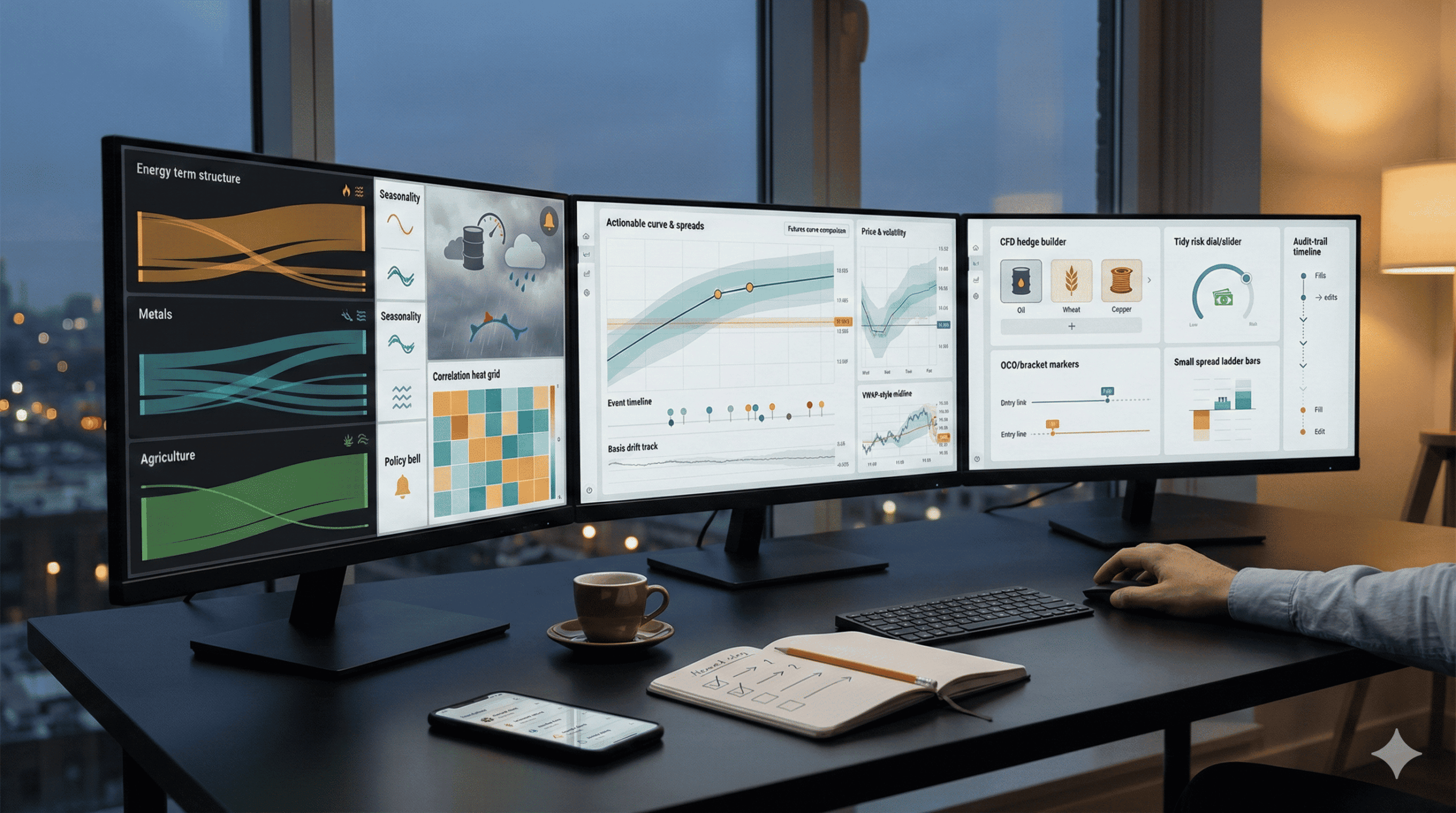

What great software actually does

You do not need a hundred widgets. You need clarity, context, and clean records.

| Capability | What it does on busy days | Why it matters |

| Cross-asset data & curves | Spot, futures, basis, seasonality, correlations | Keeps energy, metals, and gas in one lens |

| Scenario layers | Overlay weather, policy, inventory reports | Turns headlines into quantified ranges |

| Spread & curve tools | Calendar, inter-commodity, basis visuals | Helps you see carry, storage, and roll effects |

| Live alerts tied to levels | Price bands, vol bands, report times | Cuts reaction time without chasing noise |

| Ticket notes & audit trail | Tag entries with rationale and risk | Makes post-trade learning fast and honest |

“If a chart cannot change your risk, it is decoration.”

From insight to hedge with CFDs

A lot of teams begin analysis on exchange curves, then execute tactically with contracts for difference. The bridge is simple: size the exposure, choose the reference, and accept the basis you are taking.

Mapping exposure to a CFD hedge

| Economic exposure | Typical CFD reference | Fit | Watch-outs |

| Jet fuel or heating cost | Brent or WTI CFD proxy | Broad energy beta | Basis between refined vs crude benchmarks |

| Bakery wheat costs | Wheat CFD based on CBOT front | Simple passthrough | Roll effects and report-week volatility |

| Copper-heavy input basket | Copper CFD linked to COMEX/LME | Clean metal beta | Venue differences and cash vs CFD spreads |

Use the analytics to estimate beta and roll impact, then choose whether you want a single-leg CFD proxy or a small basket. This is the practical way to approach how to hedge using commodity CFDs without pretending a proxy is a perfect mirror.

“Hedges are approximations. Good ones are transparent about the basis.”

Leverage and risk, stated plainly

Leverage makes commodity products powerful and dangerous. Treat it like electricity: useful, unforgiving.

| Topic | Practical takeaway |

| Position sizing | Set risk in cash first, translate to units second |

| Volatility clusters | Spreads and slippage spike around reports, shrink size then |

| Roll and carry | Curves add or subtract P/L when you maintain exposure |

| Liquidity windows | Depth changes by hour and venue, log your worst minutes |

“Small size plus strict exits beats perfect entry when volatility jumps.”

This is the heart of leverage and risk in commodities trading.

How analytics shape the ticket

- Curve view says the front month is stretched versus the second. That nudges you toward a calendar structure instead of a directional punt.

- Seasonality panel shows a typical late-winter draw in inventories, so you prefactor wider tails in your stop distance.

- Alerts pin the report time and a pre-set band. If price gaps through the band, you skip rather than chase.

A tiny, real-world picture

A bakery models flour costs weekly. Your software shows wheat futures in contango, with a crop report tomorrow. You take a half-size long CFD on the wheat reference as a near-term hedge, mark your stop beyond last week’s structure, and set a calendar reminder to reassess after the report. Basis risk is written in the ticket notes so it is not forgotten when prices calm down.

Feature checklist you can copy into your RFP

| Question to ask vendors | Keep if the answer is |

| Can I overlay seasonality, inventories, and curve shape on one screen | Yes, without exporting to spreadsheets |

| Do alerts tie to both price and report times | Yes, with local time zone support |

| Are spreads and calendar structures first-class in charts | Yes, with saved templates |

| Can I tag tickets with hedge vs speculation and export logs | Yes, in two clicks |

| Is there a simple API for pulling my levels and notes | Yes, with rate limits that fit live use |

Bringing it together

Analytics should narrow choices, not multiply them. Start with a single dashboard that shows curve, spread, and a calendar. Let it tell you when to trade outright, when to spread, and when to wait. Then connect that view to a small, measured hedge using CFDs if the venue and account fit. Over a month, your notes will prove whether your commodity market analysis software is a partner or just a pretty screen.

Before the FAQ, one nudge. Write one rule you will obey for a month: “I will only act when curve shape, seasonality, and a level agree, and my cash risk fits the week’s volatility.” Most of the benefits flow from that sentence.

FAQ

Does analysis software replace a risk policy

No. It informs size and timing, your policy sets hard limits. The best tools make those limits visible while you trade.

Can CFDs hedge physical exposure effectively

Often, yes, if you accept basis risk and monitor rolls. That is the honest frame for how to hedge using commodity CFDs.

How much leverage is sensible for a small account

There is no magic number. Start with the smallest workable size and a fixed cash loss per idea. Let the log, not the mood, decide if you can scale.

Which features pay for themselves quickly

Curve and spread views, inventory overlays, level-based alerts, and clean ticket notes. These reduce mistakes during the busiest minutes.

Do I need multiple data vendors

Only if coverage gaps hurt decisions. For many desks, one robust feed plus a backup is enough when paired with disciplined sizing.