The financial markets are often described as the hardest way to make easy money. The barrier to entry is deceptively low. You don’t need a license, a degree, or a boss to open a brokerage account. You just need a Wi-Fi connection and a few hundred dollars. This accessibility creates an illusion of simplicity. It leads many to believe that they can conquer the global economy by watching a few 10-minute videos and following a signal channel.

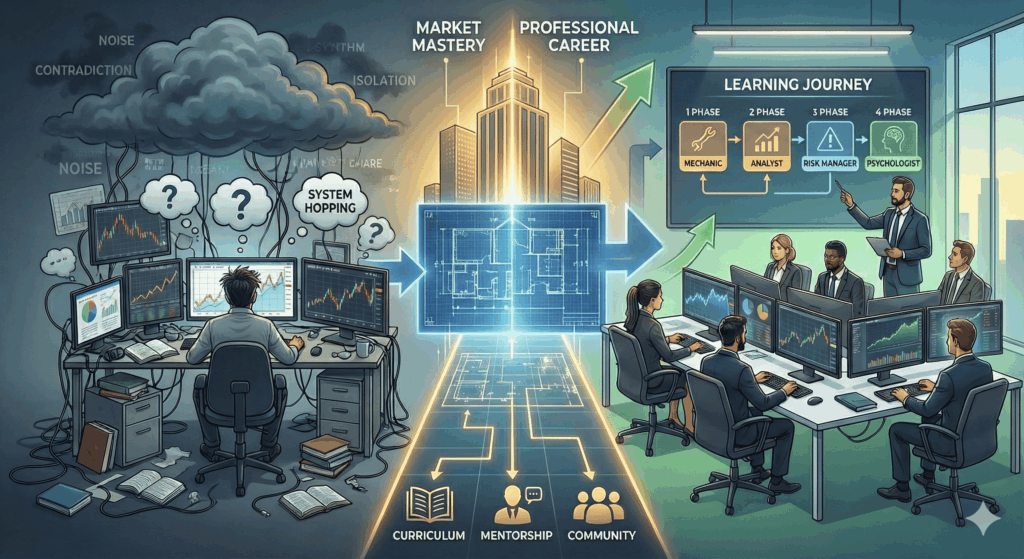

The reality, however, is brutal. The casualty rate for self-taught traders is astronomically high. This isn’t because they lack intelligence; it is because they lack structure. Attempting to piece together a professional skill set from scattered blog posts and random social media clips is like trying to build a house without a blueprint. You might lay a few bricks correctly, but eventually, the walls will collapse.

This is where the concept of a dedicated trading academy becomes pivotal. It represents the shift from “gambling” to “business.” It provides the scaffolding necessary to turn a chaotic interest into a disciplined career. In an environment designed to strip money from the unprepared, a structured educational environment is your armor.

The Chaos of Self-Education

To understand the value of a formal academy, we first have to look at the alternative. The internet has democratized information, but it has also created a noise machine.

A self-taught trader’s browser history is usually a mess of contradictions. One expert says “Scalping is the only way,” while another says “Swing trading is the only way.” One video claims “Indicators are laggy trash,” while the next video promises a “Golden Cross strategy with 90% accuracy.”

This information overload leads to “system hopping.” The trader tries a strategy for two days, takes a loss, assumes the strategy is broken, and moves to the next one. They never stick with anything long enough to master the nuance. They are stuck in a loop of perpetual novicehood.

A professional trading academy solves this by curating the information. It filters out the noise and presents a linear, logical path. It tells you what to learn first, what to learn second, and what to ignore completely.

Defining the Trading Learning Journey

Success in the markets is not an event; it is a process. It follows a specific trajectory that a good academy will map out for you. This trading learning journey typically moves through four distinct phases, and trying to skip one is usually fatal to your capital.

Phase 1: The Mechanic

In the beginning, you are just learning how the machine works. You aren’t trying to make money; you are trying to not crash.

- Curriculum Focus: Platform navigation, order types (Limit vs. Market), contract specifications, and basic terminology.

- Goal: To execute a trade without making a “fat finger” error.

Phase 2: The Analyst

Once you can drive the car, you need to learn the rules of the road. This is where you study price action.

- Curriculum Focus: Support and resistance, trendlines, candlestick patterns, and economic indicators.

- Goal: To look at a chart and identify the probability of direction.

Phase 3: The Risk Manager

This is the phase that separates the amateurs from the pros. You realize that being right about the direction is less important than how you manage the trade.

- Curriculum Focus: Position sizing, risk-to-reward ratios, drawdown management, and correlation exposure.

- Goal: To survive a losing streak without blowing up the account.

Phase 4: The Psychologist

Finally, you realize the biggest enemy is yourself. The strategy works, but you keep breaking the rules.

- Curriculum Focus: Emotional discipline, patience, journaling, and performance coaching.

- Goal: To execute the plan with robotic consistency.

A quality academy doesn’t just throw you into Phase 2. It forces you to respect Phase 3 and 4, which are often boring but essential for longevity.

The Curriculum: Depth Over Breadth

When evaluating an educational program, look at the syllabus. A generic course might offer “5 Secret Tricks.” A legitimate trading academy offers a university-style curriculum.

Technical Analysis Modules It should go beyond “Head and Shoulders.” It should teach market structure. Understanding why price stops at a certain level is more important than just seeing that it stopped. It should cover auction theory, volume profiling, and liquidity concepts. These are the tools institutional traders use to gauge where the money is hiding.

Fundamental Analysis Modules Charts tell you when to enter, but fundamentals tell you why. A robust program will teach you how to read a Central Bank statement. It will explain why the Non-Farm Payrolls report moves the US Dollar. Understanding the macro-economic machine allows you to avoid standing in front of a freight train during high-impact news events.

Proprietary Systems vs. Principles Be wary of academies that only teach a single, rigid “system.” Markets change. A system that works in a high-volatility environment might bleed money in a low-volatility range. Instead, the focus should be on principles. If you understand supply and demand, you can adapt to any market condition. You are learning to read the language, not just memorizing a few phrases.

The Role of Mentorship

You can read every book on swimming, but until you jump in the water, you don’t know if you can swim. And when you start drowning, you need a lifeguard.

In trading, the mentor is the lifeguard. The primary value of paying for an academy is access to someone who has already made the mistakes you are about to make.

The Feedback Loop Imagine you take a trade on Gold. You buy the breakout, but it reverses and stops you out., then you are frustrated. You think the market is rigged.

- Solo Scenario: You get angry, double your size, and revenge trade, losing more money.

- Academy Scenario: You post your chart in the mentor group. The mentor looks at it and says, “The entry was fine, but you ignored the 4-hour resistance level just above. You bought right into a wall.”

That single piece of feedback saves you months of trial and error. It corrects the behavior immediately. Mentorship compresses time. It allows you to borrow the experience of a 20-year veteran.

A Community That Takes Trading Seriously

Trading is a lonely profession. Sitting in a home office, staring at flickering numbers for eight hours, can be isolating. This isolation often breeds bad habits. When no one is watching, it is easy to break your rules.

This is why the social aspect of a trading academy is its hidden superpower. You need a community that takes trading seriously.

Most public forums (like Reddit or Twitter) are filled with toxicity, memes, and people gambling. They cheer when they win and disappear when they lose. That is not a serious environment.

A private academy community is different. Everyone has paid to be there. This “skin in the game” filters out the trolls. The conversation shifts from “Which crypto is going to the moon?” to “How did you calculate your risk on that Euro trade?”

Peer Accountability In a strong community, you are expected to post your trade journal. Knowing that your peers will see your trades creates a psychological pressure to follow your plan. You don’t want to be the guy posting a reckless gamble in a room full of disciplined professionals. This accountability is a powerful drug for discipline.

The Simulator: The Flight Simulator for Money

No airline allows a pilot to fly a passenger jet just because they passed a written exam. They have to spend hundreds of hours in a flight simulator first.

A top-tier trading academy will integrate simulation into its platform. They will provide a “paper trading” environment that mimics live market conditions.

The goal of the simulator isn’t just to “practice.” It is to build muscle memory. You need to be able to calculate your position size and enter the order within seconds. If you have to fumble with a calculator while the market is moving, you are too slow.

Furthermore, the simulator allows you to stress-test your strategy. You can trade through a simulated “market crash” to see how your portfolio handles it, without risking a single dollar of your actual savings.

Live Trading Rooms: Theory in Action

Static charts are easy. You can look at a chart from last week, draw a perfect line, and say “I would have bought here.” Hindsight is 20/20.

Live markets are messy. Candles wiggle. They fake out. They move fast.

This is why the “Live Trading Room” is a staple of a good academy. This is where the mentors trade their own accounts in front of the students in real-time.

What You Learn Live:

- Patience: You watch the mentor sit on their hands for two hours doing nothing because there is no setup. This teaches you that cash is a position.

- Execution: You see how they react when a trade goes against them. Do they panic? No. They accept the loss and move on.

- Nuance: The mentor might say, “Technically this is a buy signal, but volume is too low, so I’m skipping it.” That nuance is impossible to learn from a textbook.

The Psychology of Longevity

Most traders fail not because they can’t read a chart, but because they can’t manage their emotions. Fear and greed are the destroyers of capital.

A comprehensive trading academy treats psychology as a core subject, not an afterthought. They might bring in performance coaches to discuss “tilt” (emotional trading). Because they teach you how to recognize when you are entering a euphoric state (after a win) or a depressive state (after a loss).

They show you the concept of “Thinking in Probabilities.” You learn to detach your self-worth from the outcome of any single trade. A loss isn’t a failure; it’s just a business expense. A win isn’t genius; it’s just a probability realized.

Vetting the Academy: Red Flags vs. Green Flags

Not all academies are created equal. The industry is unfortunately rife with marketers masquerading as educators. Before you commit your time and money, you need to vet them.

Red Flags (Run Away):

- Lamborghinis and Beaches: If the marketing focuses on “lifestyle” rather than “skill,” it is a scam. Real trading is boring execution, not champagne on a yacht.

- Guaranteed Returns: No one can guarantee profits. The market is uncertain.

- “Secret” Indicators: There are no secrets. If they claim to have a magic algorithm that never loses, they are lying.

Green Flags (Sign Up):

- Risk Disclaimers: They are honest about the difficulty and the potential for loss.

- Track Record: The mentors trade live and show transparency.

- Focus on Process: They talk about risk management and discipline more than they talk about making millions.

- Long-Term Support: It’s not just a weekend seminar; it’s an ongoing membership with continued support.

The Technology Stack

Modern trading requires modern tools. A good academy will guide you on setting up your infrastructure. They will recommend the right brokerage, the right charting software, and the right news feeds.

They often have partnerships with software providers to give students access to professional-grade tools like:

- News Squawks: Audio feeds that broadcast breaking news instantly.

- Scanners: Software that filters thousands of stocks to find the ones moving.

- Journaling Software: Tools that automatically analyze your trading history to find your weak spots.

Using the same tech stack as the mentor allows you to be on the same page during live sessions.

From Student to Master

The ultimate goal of any academy is to make itself obsolete. They want you to graduate. They want you to reach a point where you no longer need the mentor to hold your hand.

This transition happens when you develop your own “Edge.” You take the principles you learned and adapt them to your own personality. Maybe the mentor is a day trader, but you realize you are better at swing trading. A good academy supports this evolution.

They encourage you to become an independent thinker. Eventually, you might even transition from student to moderator, helping the next generation of novices.

Investing in Yourself

In any other high-performance career, medicine, law, aviation, formal education is mandatory. You wouldn’t trust a doctor who “learned on YouTube.” Yet, in trading, people trust their life savings to their own untrained intuition.

Joining a trading academy is an investment in your human capital. It shortens the learning curve, reduces the “tuition” paid to the market in the form of avoidable losses. It places you in an environment designed for growth.

If you are tired of spinning your wheels, one step forward and two steps back, it is time to professionalize your approach. Stop treating the market like a casino and start treating it like a profession. Find a curriculum that challenges you, a mentor that corrects you, and a community that takes trading seriously. If you are ready to commit to a structured path and want to see what a professional trading environment looks like from the inside, we invite you to explore our syllabus and meet our team of mentors.

Frequently Asked Questions

How long does it take to graduate from a trading academy?

There is no fixed timeline because trading is a performance skill, not just knowledge. However, a comprehensive trading learning journey usually involves 3 to 6 months of intensive study and simulation before a student is ready to trade live capital consistently. Mastery takes years of practice.

Do I need a background in finance to join? No. Most academies are designed to take a complete beginner from zero to proficient. In fact, sometimes having no background is better because you don’t have “bad habits” to unlearn. The curriculum starts with the absolute basics of market mechanics.

Is a trading academy worth the cost? Think of the cost in terms of “saved losses.” If an academy costs $2,000 but prevents you from losing $10,000 due to rookie mistakes, the ROI is positive. Additionally, the value of networking with a community that takes trading seriously can provide intangible benefits for years.

Can I work a full-time job while attending? Yes. Most modern academies offer on-demand video modules that you can watch on your own schedule. Live sessions are often recorded for later viewing. Many students trade part-time (swing trading) while maintaining their careers until they are profitable enough to switch.

What is the difference between a course and an academy?

A course is usually a static product, a series of videos you watch once. An academy is a dynamic ecosystem. It includes the course, but also ongoing mentorship, live webinars, chat rooms, simulator access, and regular market updates. It is a membership rather than a one-time purchase.

Do academies provide capital to trade?

Some do. There is a growing trend of “Proprietary Trading” integration, where academies have partnerships with prop firms. If a student passes the educational exams and proves profitability in the simulator, they may be offered a funded account to trade with the firm’s capital.