A good broker referral program is not a banner and a wish. It is a small operating system that turns trust into tracked signups, then into active clients with honest receipts. The goal is simple. Give partners clear links, low friction onboarding, and payouts that arrive when you say they will.

Do that, and anyone who wants to refer and earn with trading platform tools will keep sending qualified traffic. Add transparent partner rewards for client acquisition, and your brand becomes the safe place to scale.

The idea in one minute

Referrers invite prospects. The broker handles KYC, funding, and support. Everyone sees the same numbers. Your advantage is not louder ads. It is a clear path from clicking to approved KYC. Then, you move to your first fund and first trade. Payouts match your CSV export line by line.

“Choose systems you can audit, not just admire.”

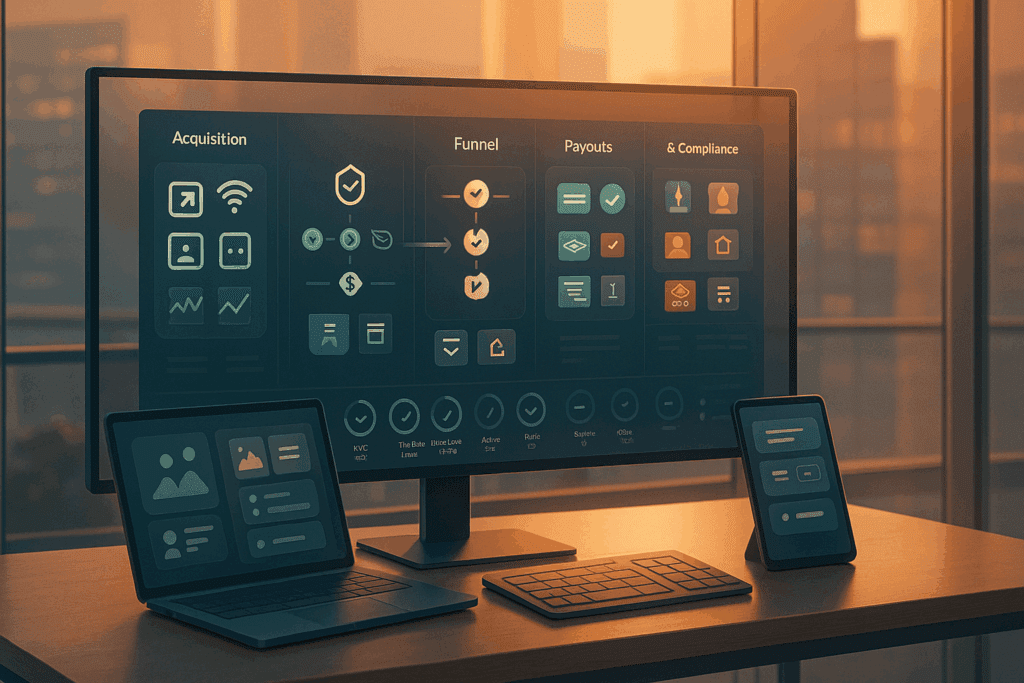

What a healthy broker referral program includes

Think in layers. Keep your promises short and measurable.

| Layer | Job to be done | What “good” looks like |

| Links and attribution | Track from click to account | UTM tags, regional deep links, anti-fraud checks |

| CRM and KYC | Move signups to approved status | Liveness checks, retry links, approval timers |

| Funding rails | Get money in and out smoothly | Local methods, clear timelines, daily reconciliation |

| Product fit | Give clients a reason to stay | Liquid symbols, fair spreads, transparent fees |

| Education flow | Reduce avoidable churn | Starter guides, office hours, small win checklists |

| Reporting and payouts | End debates fast | Portal totals equal CSV or API exports |

| Compliance guardrails | Keep promotions safe | Region filters and plain risk warnings |

When every row works, your partners focus on content and your support inbox goes quiet.

How partners refer and earn with trading platform tools

Referrers need useful assets, not noise. Give them:

- Link builder that preloads UTM, region, and landing destination

- Co branded landing pages with client stories and truthful cost ranges

- Starter content kit with a 10 minute setup video and two printable checklists

- Live dashboards that show click to KYC to fund to first trade, by channel

- Receipt grade payout ledger with dates, rates, and clawback rules in plain English

Put these five in place and anyone can refer and earn with trading platform support that feels professional.

Payout models that partners understand in one minute

Keep math honest. If a plan needs a spreadsheet to explain it, it will fail at scale.

| Model | What triggers the payout | Best for | Watch out for |

| CPA per funded client | First approved deposit | Education first creators | Agree on KYC quality to avoid clawbacks |

| Revenue share | Share of spread or commission | Day trading communities | Do not push volume over client safety |

| Hybrid CPA plus revenue share | Upfront payment plus recurring share | Mixed audiences with long tail activity | Track break even month by cohort |

| Tiered bonuses | Milestones per month or quarter | Agencies and networks | Keep tiers simple and public |

“Fair rewards are simple to explain and easy to verify.”

Partner rewards for client acquisition, designed to last

Use targeted boosters that reward real outcomes.

- Fast start bonus: extra CPA for the first 10 funded clients in 30 days

- Retention boost: add 5 to 10 percent revenue share if 60 day activity hits a goal

- Education grant: small cash or ad credit when a partner hosts a live Q&A or posts a verified how to guide

- Regional multiplier: improved rates where your KYC pass rates are strong

These are real partner rewards for client acquisition that nudge behavior you want without inflating risk.

The client journey you should publish

A single diagram or table turns confusion into conversion.

| Stage | What the client sees | What the partner does | What you promise |

| Click | Regional page that matches device | Deep link with UTM | Accurate geo and language |

| Sign up | Two minute form and email verify | Share a checklist | Data privacy and clear next steps |

| KYC | Liveness check and doc upload | Send retry link if needed | Approval timer visible |

| Fund | Local rails with fees shown | Explain minimums and timing | Same day posting where possible |

| First trade | Simple bracket template and guide | Office hours invite | Support that answers in minutes |

“Friction you can name is friction you can fix.”

Four week launch plan you can keep

Week 1: Foundations

- Approve copy, risk disclosures, and region filters

- Wire link builder and set up sandbox dashboards

- Record the 10 minute first trade video

Second Week: Funnels

- Publish co branded landing pages per region

- Turn on PSP rails with daily auto reconciliation

- Add KYC retry links and approval timers

Third Week: Reporting and payouts

- Make portal totals equal CSV or API exports

- Post a sample payout receipt with dates and line items

- Pick two KPIs for a Monday scoreboard

Week 4: Soft launch

- Invite a small partner cohort

- Fix one friction per day based on real tickets

- Post a public change log twice a week

Consistency beats intensity.

Tracking and attribution that end arguments

- Deep links by region and device that land inside the correct product page

- Duplicate click protection and basic fraud scoring

- Postback URLs for large partners

- A sandbox that mirrors production fields

- A single truth table that maps click ID to KYC to funding to trade IDs

If you cannot reconstruct a payout from raw data in five minutes, you do not have tracking. Fix it.

What partners need from support

Referrers want speed and receipts.

- Response timers in the portal for payout questions

- Public status page with incident timelines and planned reverts

- Template answers with links to docs rather than long paragraphs

- Named contacts for top tier partners so nothing gets stuck

Small teams win when answers are short and visible.

KPI scoreboard that predicts survival

Publish a trimmed view every Monday. Hide nothing.

| KPI | Healthy signal | Why it matters |

| KYC pass rate by region | Above 70 percent in target markets | Reveals onboarding friction early |

| Time to first fund | Under 48 hours median | Confirms funnel clarity |

| First trade in 7 days | Above 60 percent of funded | Measures activation quality |

| 30 and 90 day active rate | Stable or rising | Proves education works |

| Refunds or clawbacks | Low and trending down | Confirms traffic quality |

| Days to payout | On time with receipt parity | Builds long term trust |

Compliance checklist that travels

- Region filters and banned claim checker in your link builder

- Risk warnings on every partner landing page

- No promises of guaranteed profit

- Clear ranges for spreads, funding times, and withdrawal windows

- A quarterly review of screenshots and copy that partners actually use

“Honest claims save more time than high promises.”

Partner playbooks for different creators

Education creators

- Give them a starter course outline and a Q&A schedule

- Reward retention milestones instead of only first deposits

Signal communities

- Require bracket templates and daily loss limits in content

- Pay more when churn goes down, not when tickets go up

Regional reviewers

- Offer co branded pages in local language

- Share KYC pass rate data so they set expectations correctly

You open the dashboard. Overnight clicks tagged to Latin America show a 74 percent KYC pass rate and a median time to first fund under 36 hours. A partner hosts a short office hour and five new clients place their first bracketed trade. One payout question arrives and is answered with a link to the exact line item and date.

The portal total matches the CSV export without edits. Your next email goes out with a single lesson and a small bonus for June signups. That is a broker referral program doing its job.

FAQ

How do I recruit quality partners fast

Start with creators who already teach position sizing and risk in cash terms. Offer clear reporting and a live sandbox before you talk rates.

Can partners refer and earn with trading platform tools from day one

Yes, if you ship a link builder, a co branded landing page, and a live dashboard with click to first trade tracking. Keep the first kit small and reliable.

What makes partner rewards for client acquisition feel fair

Bonuses tied to funded accounts and 60 day activity with clean rules. Publish the math and the timelines right next to the rate.

How do I reduce clawbacks

Screen regions, show realistic funding timelines, and coach partners to avoid hype. Track KYC quality by source and share feedback weekly.

What breaks trust fastest

Payout totals that do not match exports, missing status notes during incidents, and vague answers. Fix parity, publish timelines, speak plainly.

Do I need a revenue share or is CPA enough

Start with CPA when you are new. Add a small revenue share once retention improves and your data shows a predictable break even month.