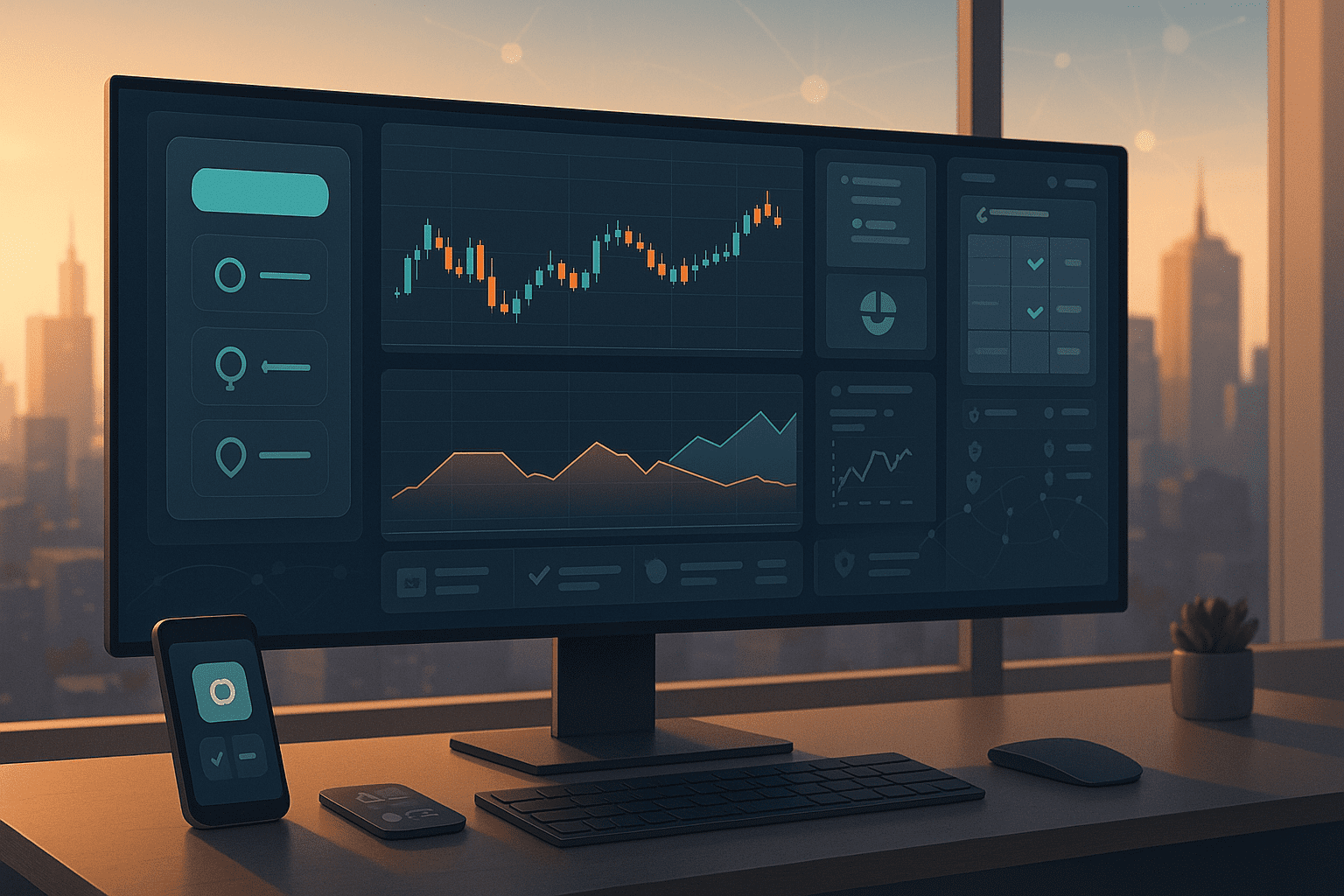

You want the best multi-asset trading broker for real life, not a glossy ad. On busy days you need quiet tools that show cash risk before you click, route orders cleanly, and produce statements that match exports line by line.

This guide gives you a practical checklist for where to trade stocks, forex, indices and more, and how to use a single account to access global markets without surprises.

The quick take

- One login, one order ticket, one cash risk number per trade

- Brackets attach by default so exits stay honest

- Costs measured for twenty sessions, not one headline

- A regulated partner that answers during your trading hours

Choose tools you can audit, not just admire.

What “best” should mean in real life

| Area | What good looks like | Why it matters |

| Order ticket | Cash risk preview, OCO brackets, market-if-touched | Prevents accidental oversizing and late exits |

| Product coverage | FX majors, key indices, gold and oil, select stocks or ETFs | Variety without overwhelm |

| Mobile parity | Same risk logic on phone and desktop | No second learning curve |

| Reporting | Statement totals equal CSV or API exports | Debates end in minutes |

| Status and incidents | Public timelines with start, fix, and planned revert | Calm communication during stress |

| Education | Setup cards, office hours, platform tours | Better behavior, lower churn |

If a demo cannot show these in ten minutes, live will not be kinder.

Where to trade stocks, forex, indices and more

You do not need everything. You need a short, liquid menu that fits your window.

| Window | Strong choices | Why |

| US hours | S&P 500, Nasdaq 100, large-cap stocks | Deep liquidity at the open and close |

| Europe hours | DAX, Euro Stoxx 50, FTSE 100 | Clear session structure and catalysts |

| FX overlaps | EURUSD, GBPUSD, USDJPY, XAUUSD | Tight spreads and cleaner fills |

| Commodity rhythm | Gold, WTI or Brent | Scheduled prints create repeatable setups |

Start with two FX pairs, one index, and one commodity. Add instruments only after two calm weeks where fills, costs, and notes behave.

Single account to access global markets, done right

A good broker lets you expand products without juggling logins or new rulebooks.

- One KYC, one wallet, unified statements

- Same cash sizing language across assets

- Symbol specs in cash terms: tick value, hours, funding

- Session filters so you can block thin hours or heavy prints

- Support that answers in your time zone

“Receipts beat reviews.” When platform and paper match, trust grows.

Sizing in plain cash

Let the platform do the arithmetic. You set dollars, it converts to size.

| Asset | Inputs | Size math |

| FX pair | Risk 30 dollars, 10 pip stop, 1 dollar per pip on a mini | 30 ÷ 10 = 0.3 mini lots |

| Index CFD | Risk 45 dollars, 9 point stop, 1 dollar per point | 45 ÷ 9 = 5 contracts |

| Gold | Risk 50 dollars, 0.50 stop, 10 dollars per 0.10 move | 50 dollars per lot risk, size = 1 lot |

“Cash language travels across assets. Keep it.”

Two simple setups that travel across markets

Opening range break and retest

Box the first minutes of your session. After a decisive break, take the first clean retest to the box edge with your bracket attached. Great for indices and active commodities like gold.

Pullback into value

Confirm direction on a higher timeframe. Mark a value band such as VWAP. Take the first measured pullback that pauses. Works well on majors, indices after the open settles, and metals.

Short definitions survive loud markets.

Costs decide more than headlines

Track real numbers for twenty sessions so your comparisons are honest.

| Cost line | What to check | Practical move |

| Spread and commission | Typical bands in your hours | Trade liquid windows, avoid chasing |

| Slippage | Fill minus expected price | Favor retests, reduce size near prints |

| Funding or swaps | Overnight holds | Match hold time to cost or use day holds |

| Data and platform fees | Bundles you actually use | Keep only what changes outcomes |

| Payments | Deposit and withdrawal timelines and fees | Write steps in your notes to avoid surprises |

“Cost clarity turns uncertainty into a choice you can live with.”

Platform checklist you can copy

Must-haves

- Cash risk shown on the ticket before submit

- Bracket presets saved as default

- Per day loss cap, max position size, symbol and session filters

- Symbol specs in cash terms for every instrument

- CSV or API export that equals the statement total without edits

Nice-to-haves

- One-click screenshot for journaling

- Alerts by price and time in your time zone

- Layouts that switch cleanly between FX, indices, and commodities

The best multi-asset trading broker is the one that wins this sheet for your routine, not a forum poll.

Daily workflow that keeps you steady

Before the window

- Check the status page and spreads

- Set your cash risk preset on the ticket

- Review the day’s prints in your time zone

During

- One setup per session, two attempts max

- Brackets on by default

- Screenshot the plan before you click

After

- Save before and after images plus two journal lines

- Export fills and confirm totals equal your statement

- Adjust weekly, not mid-session

“Progress is a series of small, boring upgrades.”

Safety habits that protect the month

- Per day loss cap pauses new orders until server reset

- Max open positions per symbol limits concentration

- Session filters skip thin hours and blackout near prints

- Two attempts per idea, then step aside

Onboarding plan for a calm first month

- Trade a demo for 7 to 10 sessions in your real hours

- Use one setup, two attempts max, brackets always on

- Record spread, slippage, and time to fill for each entry

- Export and reconcile totals, confirm parity with statements

- Move to small live size only after the checklist passes

Boring is good.

FAQ

Do I need multiple brokers for global access

Usually no. A strong partner gives you a single account to access global markets with reliable tickets, clean exports, and responsive support.

How do I verify product depth before funding

Ask for typical spreads by session, symbol tick values in cash, and sample incident timelines. Test slippage on demo during your real hours.

Is mobile safe for active trading

Yes if the app mirrors desktop logic, shows cash risk, and lets you manage brackets reliably. Prove it in a demo first.

When should I add more instruments

After two calm weeks where costs and behavior match your plan. Add one new symbol at a time and keep your per day cap.

What proves a broker is reliable

Export parity at zero errors, on time replies in your hours, and a status page with real incidents and planned reverts.

A gentle nudge before you commit

Write a one page plan with your session, cash risk per trade, two setups you will practice, and the three numbers you will track for twenty sessions: spread, slippage, export parity. Then choose the best multi-asset trading broker that shows you clearly where to trade stocks, forex, indices and more while keeping everything under a single account to access global markets.