You want the best futures trading platform for real use, not just a glossy ad. The right choice feels quiet. Orders route fast. Risk shows in cash before you click. Reports match exports line by line.

In this guide you will map features that matter, build a test plan, and shortlist the best platform to trade futures for your routine, including futures trading platforms with a demo account so you can prove it before you fund.

What “best” actually means

Best is not the longest feature list. Best is the platform that lets you repeat a safe workflow every day.

- You can size positions in dollars, not guesses.

- Brackets attach automatically, so exits are honest.

- Latency and slippage stay inside a band you can accept.

- Statements equal your CSV export without detective work.

“Choose tools you can audit, not just admire.”

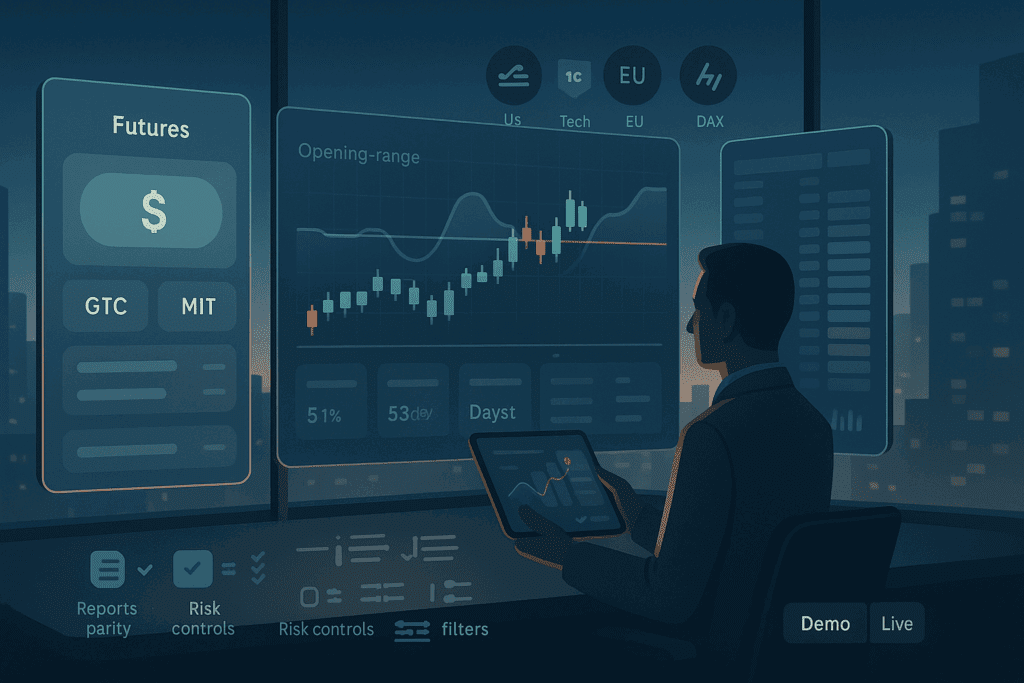

Feature checklist you can copy

| Area | Must-have | Why it matters |

| Order ticket | Cash risk preview, good-till-cancel, market-if-touched | Prevents accidental oversizing and late exits |

| Bracket presets | Stop and target attach by default | Discipline without hesitation |

| Depth and tape | DOM, last trade, best bid/ask | Confirms pace and liquidity at the open |

| Charting | Sessions, VWAP, custom alerts | Aligns entries with structure, not noise |

| Risk controls | Per-day loss cap, max size, symbol filters | Protects the month, not just a trade |

| Reporting | Statement totals equal CSV or API | Ends disputes in minutes |

| Status | Public uptime page with incidents | Trust during loud markets |

| Support | Real-time chat during the session | Solves issues while opportunity is live |

If any line feels fuzzy on a platform, it will feel painful during a spike.

Costs decide more than headlines

Treat costs like ingredients and measure them for twenty sessions.

| Cost line | What to check | Practical move |

| Commissions | Per contract side, tiers, exchange pass-throughs | Log actual paid commission per trade by product |

| Spread and slippage | Opens, news, thin hours | Prefer retests, size down around prints |

| Data fees | Level 1 or depth, US and EU bundles | Only pay for feeds you trade today |

| Platform fees | Monthly vs volume rebates | Calculate breakeven month for your pace |

| Funding and withdrawals | Methods, timelines, fees | Avoid surprises when you scale up |

“Cost clarity turns uncertainty into a choice you can live with.”

The workflow that keeps you sane

Before the window

- Status page green, data feeds synced

- Cash risk number typed into the ticket

- Calendar checked in your time zone

During

- One setup per window, two attempts max

- Brackets on by default

- Favor retests over first bursts

After

- Two screenshots, two lines in the journal

- Export fills and match statement totals

- Decide changes weekly, not mid-session

“Progress is a series of small, boring upgrades.”

Futures trading platforms with demo account: run this plan

A demo is not a video game. Treat it like a rehearsal with rules.

- Pick two markets you will actually trade, for example S&P 500 and DAX.

- Lock a cash risk per trade and keep it fixed for the whole demo week.

- Trade your real session only. No midnight experiments.

- Record three numbers per entry: spread at click, slippage, and time to fill.

- Export and reconcile. If the demo can’t produce clean exports, live will not be easier.

After seven sessions, rank platforms by all-in cost, fill quality, and export parity. Only then consider aesthetics.

Two setups that travel across futures

Opening range break and retest

Box the first minutes after the bell. When price breaks with force, wait for the first clean retest to the box edge and enter with brackets attached. This leverages liquidity while avoiding the first burst.

Pullback into value

Define direction with a higher timeframe. Mark a value zone, such as VWAP or a fair mean band. Take the first measured pullback that pauses. This reduces chase and keeps stops honest on fast markets.

Short definitions hold when price speeds up.

Product coverage you actually need

You do not need every contract on earth. You need a short, useful menu.

| Region | Common index futures | Liquid commodity examples | Tip |

| US | S&P 500, Nasdaq 100, Dow | Crude oil, Gold, Silver | Start with one index and one commodity |

| EU | DAX, Euro Stoxx 50, FTSE 100 | Brent, German Power contracts via CFDs or venues | Respect local open and news rhythm |

Pick the window you can watch. Add contracts only when your notes, fills, and costs behave for two straight weeks.

Risk controls that save the month

- Per-day loss cap that auto pauses new orders until server reset

- Max open positions per product to prevent overexposure

- Symbol filters so you avoid thin or unfamiliar contracts

- Plain messages when rules fire, for example:

“Order blocked. Free margin below threshold. Reduce size or fund.”

If the platform supports these natively, you will notice fewer regret trades.

Ticket math in plain cash

Let the system do the arithmetic. You set risk in dollars, the platform converts to size.

- Risk per trade: 45 dollars

- Planned stop: 9 points

- Dollar per point: 1 dollar

- Contracts = 45 ÷ 9 = 5

“Cash language travels across markets. Keep it.”

Shortlist like a pro

- Eliminate anything without cash risk on ticket or bracket presets.

- Keep only futures trading platforms with a demo account and a clean export.

- Run your seven-session test in real hours.

- Pick the platform that makes your journal boring and your reporting exact.

“Receipts beat reviews. When statements equal exports, debates end.”

FAQ

What is the single trait that defines the best futures trading platform

Cash risk on the ticket before submit. If you cannot see dollars, everything else is guesswork.

How long should I test a demo

Seven to ten sessions in your real window is enough to see slippage, fills, and export quality. Extend if conditions were unusually quiet.

Is the best platform to trade futures the same for everyone

No. Daytime scalpers favor DOM speed and slippage controls. Swing traders prefer bracket flexibility, alerts, and reporting. Score for your style.

Do I need depth of market to succeed

Depth helps at the open and around prints, but most gains come from sizing discipline and honest exits. Get DOM if you will use it daily.

How do I compare all-in cost

Record commission plus spread plus slippage for each product you trade. Average by session. A platform with lower variance can beat a lower headline fee.

What proves a platform is reliable long term

Export parity, fast support, and a public status page with real incident timelines. If a day’s ledger can be rebuilt from raw data in minutes, trust rises.