If you are buying Apple to hold for ten years, your choice of broker barely matters. Any free app will do. But if you are scalping pennies from volatility, your infrastructure is everything.

In active markets, lightspeed trading is not just a name; it is a necessity. Retail apps are built for comfort. Platforms like Lightspeed are built for raw performance. One is a sedan; the other is a stripped-down race car.

What Is Lightspeed Trading?

So, what is lightspeed trading? It is a high-performance brokerage service designed specifically for day traders and hedge funds.

Unlike “discount brokers” that route orders to wholesalers, Lightspeed provides Direct Market Access (DMA). This means your order skips the middleman and goes straight to the exchange.

For a scalper, this cuts out latency (lag). Getting filled in milliseconds rather than seconds is often the difference between a profit and a loss.

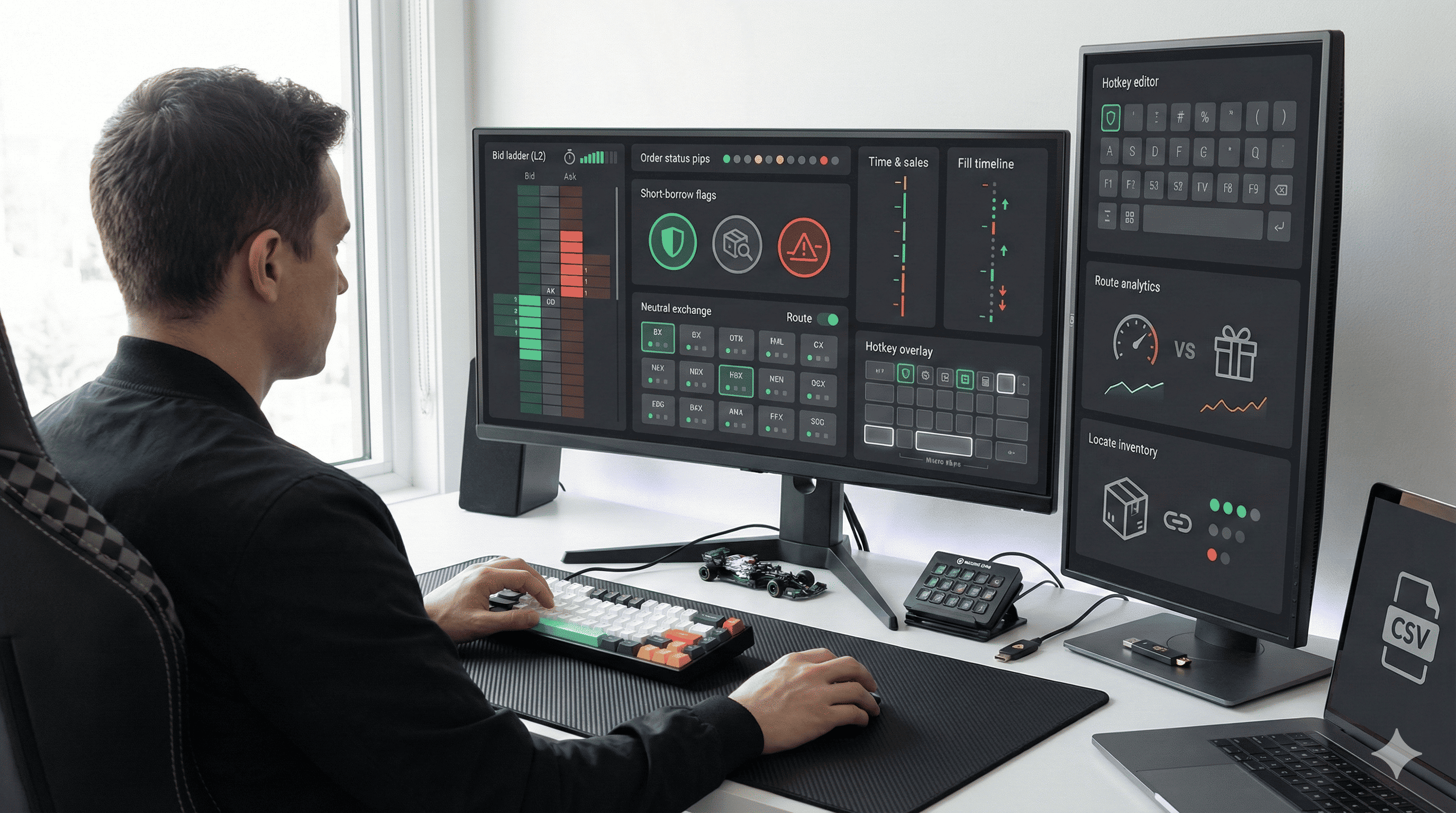

The “Black Box” Design

New users often find the interface intimidating. It lacks cartoons or confetti. It looks like a complex spreadsheet.

This “black box” aesthetic is intentional. Every pixel is dedicated to data. The platform allows you to strip away anything that doesn’t make money, leaving only raw price action.

The Power of Hotkeys

The defining feature of lightspeed trading is automation via hotkeys. In a fast market, using a mouse is too slow.

Lightspeed allows for scripted hotkeys. You can program a single key to: “Buy 1,000 shares at the Ask + $0.01, and immediately place a Sell limit + $0.20 higher.”

This happens instantly. It allows traders to react to news faster than human reflexes would normally allow.

Decoding the Interface: What Are Labels on Lightspeed Trading Platform?

The software is full of cryptic codes. If you are asking what are labels on lightspeed trading platform, they usually fall into three categories.

1. Short Borrow Flags (E, L, T)

Found in the Order Entry window, these are vital for short sellers.

- Green “E” (Easy to Borrow): You can short this immediately.

- Grey “L” (Locate Required): You must ask the broker to find shares first.

- Red “T” (Threshold): The stock cannot be shorted right now.

2. Market Maker IDs

On the Level 2 screen, you will see four-letter codes like NSDQ or ARCA. These tell you who is buying or selling. NSDQ is the Nasdaq exchange; NITE is a wholesale market maker. Pros watch these to see if big institutions are active.

3. Order Status Colors

- White: Open (Waiting).

- Green: Filled (Done).

- Red: Canceled.

- Yellow: Partial Fill.

The Cost of Speed

Lightspeed is not free. In an era of zero commissions, this can be a shock. However, pros view it as the cost of doing business.

They typically charge per share (e.g., $0.0045).

- The Upside: You get cleaner fills.

- The Math: If a “free” broker gives you a bad price that costs you $20 in missed profits, paying a $4.50 commission to Lightspeed for a perfect price is actually cheaper.

Is It Right For You?

Lightspeed is specialized gear. It is not for the casual investor.

It is built for Day Traders, Short Sellers, and Capitalized Traders (usually with $25k+ balances). If you treat trading as a hobby, the learning curve will be steep. If you treat it as a business, this is the tool you need to compete.

Frequently Asked Questions

1. What is the minimum deposit for Lightspeed?

For the flagship desktop software, the minimum is $25,000. This ensures you bypass Pattern Day Trader (PDT) restrictions. They do offer a web-only account for $10,000.

2. Does Lightspeed work on Mac?

Natively, it is Windows-only. However, they recently released a version for newer Macs with Apple Silicon (M1/M2/M3). Older Intel Macs must use virtualization software like Parallels.

3. Are there monthly fees?

Yes. The software fee is typically $130/month, plus data fees. However, if you generate enough commissions in a month (usually over $130), the software fee is waived.

4. Does it have a mobile app?

Yes, Lightspeed Mobile is available. It is great for monitoring positions or closing trades on the go, but most execution happens on the desktop.

5. Can I demo the platform?

Yes, they offer a 10-day free trial. You can practice with virtual money and set up your hotkeys before funding an account.

6. Why pay commissions?

Free brokers often sell your order flow, leading to slower execution. Lightspeed charges a commission to route your order directly to the exchange, ensuring the fastest possible fill.