Screens light up, ladders tick, and spreads breathe. The job is to turn motion into decisions. The right trading futures platforms make that easier with fast routes, clean risk tools, and logs you can actually trust.

“A futures contract is an agreement to buy or sell a specific quantity … at a specified price on a particular date in the future.”

“The risk of loss in trading commodity futures contracts can be substantial.”

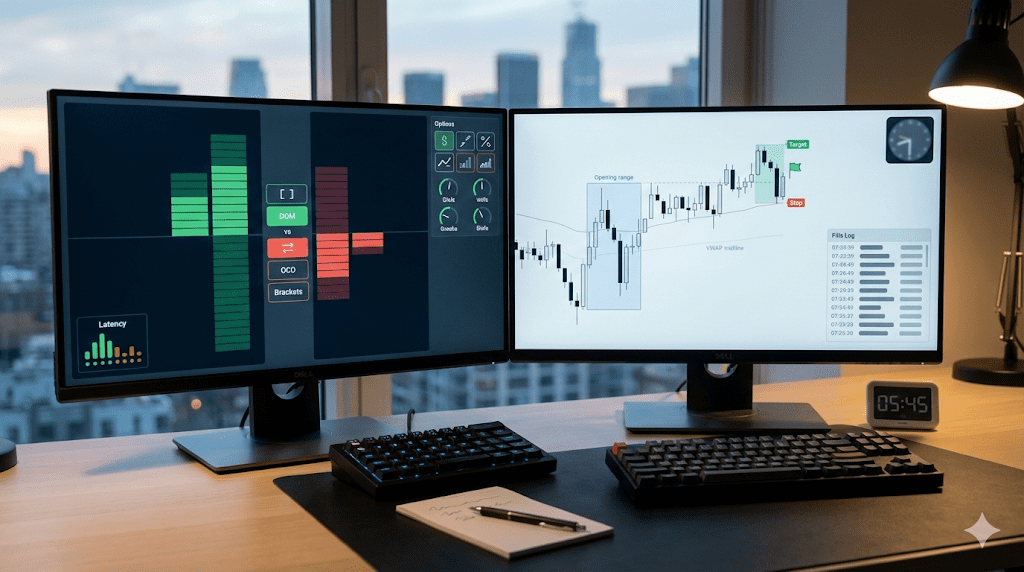

The platform landscape in one view

| Use case | What it prioritizes | Keep when you see |

| Core trading futures platforms | Stability, routing, near-24/7 access | Fast order-acknowledge times, maintenance windows documented |

| Best options trading platform companion | Multi-leg tickets, greeks, OCC docs one click away | Native complex orders, ODD delivery links |

| Intraday trading platform mode | One-click brackets, depth, hotkeys | Timestamps, slippage stats, sensible default stops |

“Rule 5310 requires firms to use reasonable diligence to find the best market so the price is as favorable as possible.”

What matters on loud days

Connectivity and uptime

CME’s electronic venue runs essentially around the clock with brief maintenance. Your platform should mirror that rhythm and show it in-app.

“Typical 24/7… Daily market maintenance (4:00–4:01 p.m. CT).”

Execution clarity

You want venue, time, and any price improvement visible on every fill. Slippage by symbol and hour should be exportable so you can avoid your worst minutes.

Risk that prevents, not reacts

Pre-trade checks for product, credit, and leverage. Hard caps that stop the next click, not a warning that nobody reads.

Futures first, options nearby

Plenty of traders route index or rates futures and keep an options workstation open for hedges or income. A strong pair is a futures engine plus the best options trading platform you can find for multi-leg control and OCC resources. Keep the handoff smooth: shared watchlists, consistent symbols, and a single risk view.

Small bridge you’ll actually use

- Futures ladder defines bias

- Options ticket frames defined-risk adjustments

- Best-execution review checks speed and likelihood, not just price

Intraday reality without the drama

An intraday trading platform earns its keep with one-click brackets, depth-of-book where it matters, and latency that stays tame when the bell rings.

| Intraday habit | Why it helps | Platform signal |

| Brackets on by default | No improvising risk | OCO templates per product |

| Level map visible | Faster decisions | Prior H/L, opening range, midline |

| Slippage log | Cuts bad minutes | CSV export by symbol and hour |

A simple evaluation table you can copy

| Question | Keep the platform if the answer is |

| Can I see product hours and maintenance in the UI | Yes, aligned to my time zone |

| Do fills show venue, time, and improvement | Yes, and reports export cleanly |

| Are pre-trade checks enforceable | Yes, with per-account rules |

| Does the options side deliver ODD and complex orders | Yes, with native multi-leg routing |

| Are best-execution reviews part of the routine | Yes, using Rule 5310 factors |

Costs and frictions you will feel

- Explicit: exchange, clearing, commission tiers

- Implicit: spread and slippage, worst around scheduled data

- Operational: outages and maintenance; plan around the known windows and keep alerts sane rather than spammy

A tiny two-week plan that teaches fast

- Pick one liquid contract and one hour you can always trade.

- Log order-back times and slippage daily.

- Add the options platform only when your futures routine is quiet.

- Keep what your notebook confirms, drop what only your memory likes.

If you want a quick next move, shortlist two trading futures platforms, run a week of micro-size side by side, then keep the stack with steadier P99 latency, cleaner fills, and risk controls you barely notice until they save you.

FAQ

Do I need a separate workstation for options

Not if your platform pairs solid futures routing with a capable companion for multi-legs and ODD access. Many desks run a linked view so hedges take seconds.

Are futures really available almost all week

Yes, with brief maintenance windows. Good platforms display those cuts so you are not surprised mid-session.

What proves best execution beyond price

Speed and likelihood of execution also count in reviews. Ask for the firm’s Rule 5310 process and reports.

What single risk reminder should stay on screen

The CFTC disclosure: losses can be substantial in futures. Size in cash, not ego.