You open the terminal, depth shifts, the clock crawls toward the open, and one question matters more than the banner on the homepage. Can your futures trading platform route clean orders, show honest costs, and stay calm when volume spikes.

“A commodity futures contract is an agreement to buy or sell a particular commodity at a future date.”

What your platform must do before anything else

A good platform is quiet under stress, not flashy. Think of five jobs working together.

Core capabilities that decide outcomes

| Capability | Why it matters | What good looks like |

| Market data and depth | Context for entries and exits | Stable quotes, smooth book updates, time stamps that line up |

| Order entry and controls | Turn intent into fills | Limits, stop limits, OCO, partial close, reliable acks in busy minutes |

| Risk engine | Guardrails that act before trouble | Per order checks, margin visibility, kill switch with audit trail |

| Reporting | Learning and compliance without detective work | Per fill fees, slippage, financing lines where relevant |

| Session awareness | Correct behavior across venues and windows | Globex maintenance handled, cash market events on calendar |

“CME Globex runs Sunday 6:00 p.m. to Friday 5:00 p.m. Eastern Time with a daily maintenance period.”

Linking futures to equities through a US stock trading broker

Many traders hold equity positions and hedge or express views in index futures. That link only works if both sides respect their native hours and quirks.

- NYSE core trading session is 9:30 a.m. to 4:00 p.m. Eastern Time futures often see liquidity pulses around that window.

- Your equities broker and your futures venue can live in different systems, so reconcile symbols, contract months, and time zones in your reports.

“Core Trading Session, 9:30 a.m. to 4:00 p.m. ET.”

Specs you should actually memorize

A couple of numbers make risk math legible, which keeps decisions grounded.

| Contract | Multiplier | Minimum tick | Tick value |

| Micro E mini S&P 500, MES | 5 dollars per index point | 0.25 index points | 1.25 dollars per tick |

“Outright minimum price fluctuation 0.25 index points, equal to 1.25 dollars per contract.”

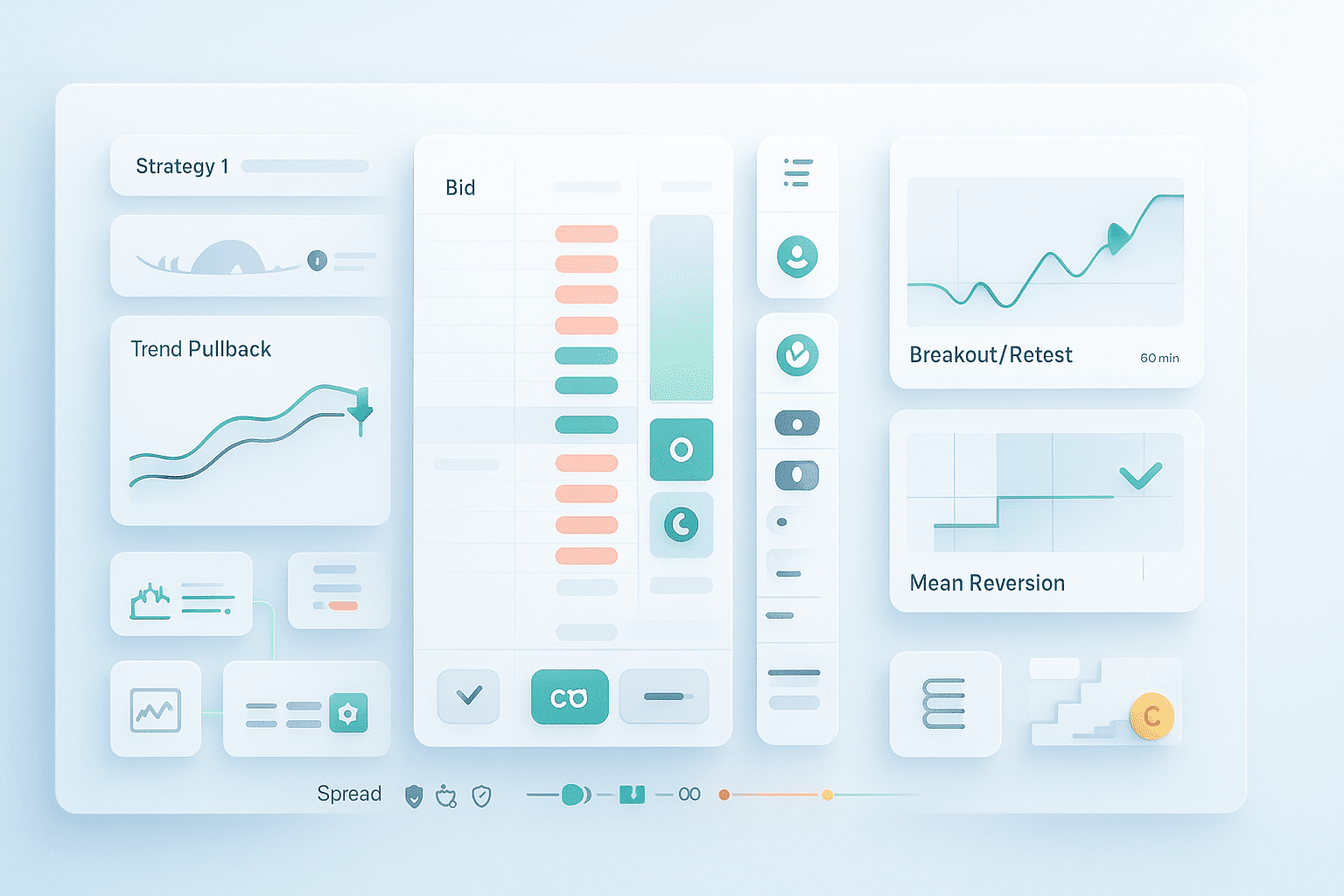

Three futures trading strategies most platforms should support

These are not secret formulas, they are structures your software must make easy to execute and review.

Trend pullback with volatility aware stops

Price advances, pulls back into a prior high that turns into support, then stabilizes. Entry near the retest, stop beyond structure with distance sized to recent volatility, first target equal to risk, trail the rest.

Breakout and retest from a well defined range

Compression builds under resistance, volume rises, price pushes through, then retests. Entry on the retest, risk capped below the range, scale out into strength if momentum persists.

Mean reversion to VWAP or a session midline

After a stretched move, price stalls and rotates back toward the reference line. Entry at an extreme, exit at the mean or on a momentum flip, smaller size when news is near.

Your platform’s value shows up in the details, for example bracket orders that fire together, a tape you can trust, and reports that show slippage by hour rather than a single average.

Costs you will feel even on good days

Headline spreads are not the full bill. Real cost blends spread, commission or venue fees, and slippage at busy minutes. For equity index futures the carry is embedded in the futures price until expiry, for many index CFDs daily financing or adjustments apply instead. Know which rail you are on and price accordingly.

“The risk of loss in trading commodity futures contracts can be substantial.”

Safety nets that are not optional

Risk controls are not a checkbox, they are habits your platform can automate.

- Pre trade checks on size and margin that block at the gate, not after the fact

- Calendar filters that warn when a high impact release is minutes away

- A visible equity and margin line so you can see the cliff before you reach it

- Exportable logs so you can reconstruct a volatile hour without guesswork

A quick lens for platform evaluation

| Question | Good sign | Red flag |

| Do order acks stay steady around the cash open | Latency percentiles stay tight on big days | Spikes, timeouts, unexplained rejects |

| Can you replay a trade with costs | Time stamped fills, per fee breakdown | Lump sum records without context |

| Is session logic robust | Globex pause handled, no surprise rejections | Orders sent during maintenance without warning |

| Does it teach through data | Slippage by symbol and hour, heat versus stop | Only P L totals, no micro detail |

Pulling the pieces together

Strong tools do not promise certainty, they reduce noise. If this direction fits, shortlist two platforms, map your hours to Globex and your US stock trading broker, and run a two week comparison at tiny size. Keep the venue where your notes say fills were steady, reports were clear, and your futures trading strategies were simple to execute without workarounds.

If you are ready to move, write one page that lists your contract specs, your preferred sessions, and one rule for exits you will not break. Then trade that page for two weeks and let the data decide which Futures trading platform you trust.

FAQ

Do I need a separate account for equities and futures

Often yes. Equities settle through your US stock trading broker, futures clear through a futures commission merchant. Many firms offer both, account structures still differ.

Are micro contracts useful for learning

Yes. The Micro E mini S P 500 uses 0.25 point ticks worth 1.25 dollars, which makes position math straightforward for small accounts.

Which hours usually feel most liquid

Liquidity clusters around the US cash open and into the close for equity index products, while Globex provides near around the clock access with a daily maintenance break.

Can a platform reduce slippage

It cannot change the market, but fast acks, proper order types, and honest depth help you choose better entries. Your sizing and timing still decide most of the outcome.

Is there a universal best strategy

No. Trend, breakout, and mean reversion each work in different tapes. Track which structure you read well, then size it modestly and review fills with real data.