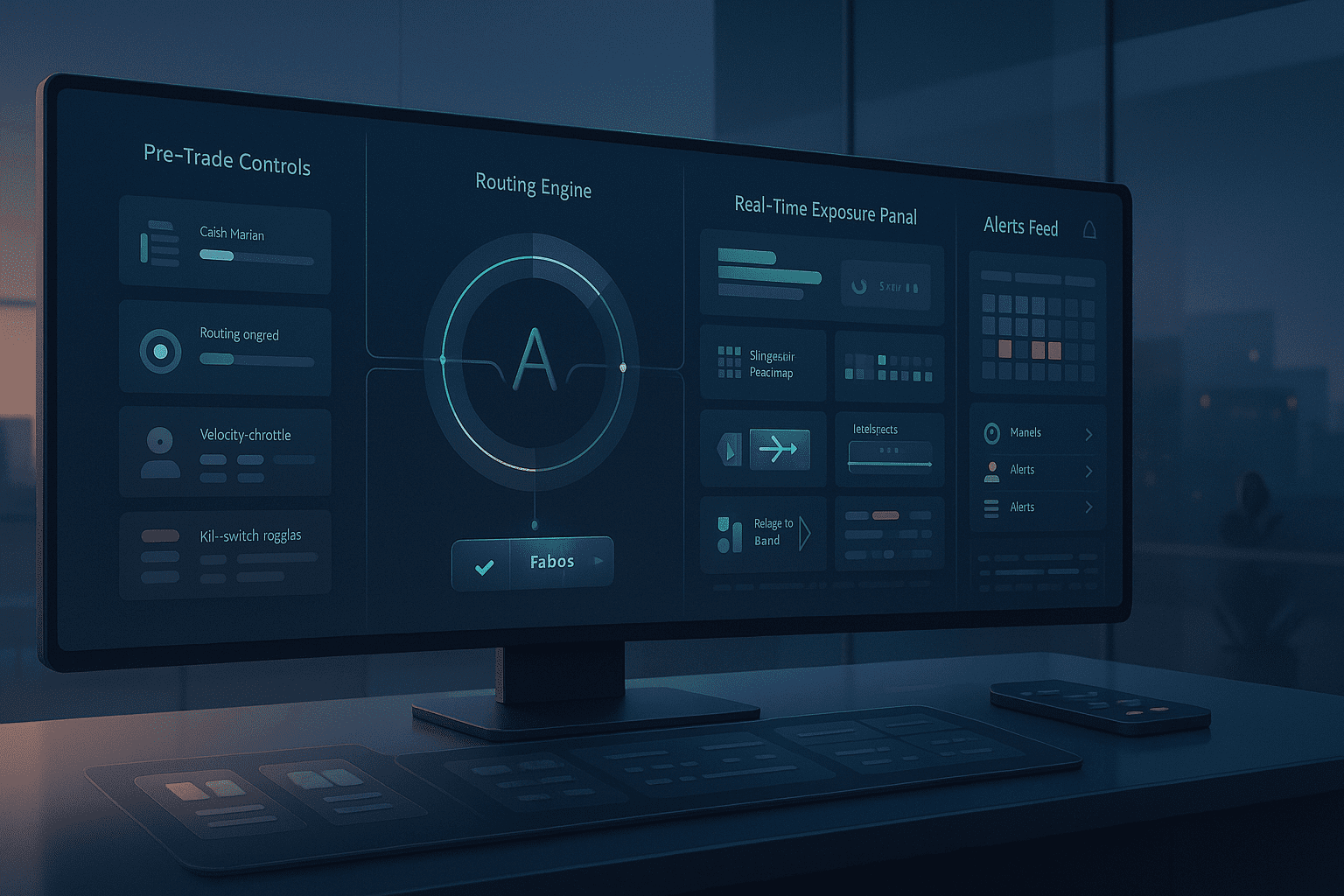

A dependable risk management software for forex brokers is not a pile of dashboards. It is one workflow where pre-trade checks block trouble, routing follows written policy, and reports reconcile to the penny.

Pair a real-time exposure monitoring tool with an a-book / b-book flow control system, and your rooms stay quiet even when markets go loud.

“If dealers can explain a route in one minute, the rule is ready.”

The idea in one minute

Risk has three beats. Say no to bad tickets before they hit the market. Route good tickets to the right venue at the right time. Prove decisions with receipts that match exports. Keep the rules short, testable, and visible to the people who use them.

“Choose systems you can audit, not just admire.”

Architecture you can run and upgrade

| Layer | Core job | What “good” looks like |

| Ticket guardrails | Block or shape risky orders before submit | Cash margin checks, price collars, per account caps |

| Routing engine | Decide internal vs external by rule | Session aware paths with timed fallbacks and reverts |

| Exposure controls | Keep currency and symbol risk inside bands | NOP dials, policy bands, one click hedge to band |

| Real-time exposure monitoring tool | Show risk and quality now | Latency, slippage, NOP, concentration, margin buffers |

| A-book / b-book flow control system | Route flow without drama | Rule based switches, timers, clear notes |

| Reporting and audits | End debates fast | Statements equal CSV or API totals line by line |

| Status and incidents | Truth under stress | Timestamps, cause, fix, planned revert in human language |

When platform and paper tell the same story, trust grows.

Pre-trade, at-trade, post-trade rules

- Pre-trade: Ticket must show cash risk and margin headroom. Price collars per symbol block outliers.

- At-trade: Brackets attach on entry. Route is session aware with a revert timer.

- Post-trade: Statement totals equal CSV or webhook exports exactly. Store client state at decision time.

Attach rule IDs to support replies so tickets close quickly.

Real-time exposure monitoring tool, built for reality

Your team needs one screen that blends quality and exposure.

| Widget | Purpose | Healthy signal | Action if red |

| Currency NOP bars | Net open by currency | Inside policy bands | Hedge to band or nudge routing |

| Symbol ladder | Top symbols by risk and PnL velocity | Even distribution | Raise caps or flip symbol route |

| Slippage heatmap | Execution quality by symbol and session | Green in core windows | Adjust LP mix, widen collars briefly |

| Margin and leverage panel | Accounts near soft or hard thresholds | Buffers above limits | Auto size cut or pause with clear message |

| Concentration table | IB or cohort exposure | No single group dominating | Raise per group caps, apply filters |

| Alerts feed | Rules firing now | Short, timestamped, human | Apply playbook and post a revert time |

“Friction you can name is friction you can fix.”

A-book / b-book flow control system without the drama

Routing is not a vibe. It is a rule you can explain in a hallway.

| Signal | Plain meaning | Route action | Why it helps |

| New client, small size, calm session | Still proving behavior | Start internal where policy allows | Lower cost while you learn |

| News minute or thin liquidity | Depth matters most | Externalize to best venue for that hour | Honest fills when spreads breathe |

| Currency band near limit | Book tilting one way | Hedge to band or flip symbol external for a timer | Keeps you inside policy |

| Strategy flagged latency sensitive | Speed over spread | Target lowest delay venue | Clean fills for fast methods |

| Region or product restriction | Rules say no | Block and show a human message | Avoids manual exceptions later |

Margin and leverage monitoring that prevents fires

Leverage is a tool, not a target. Surface it in cash language.

Show on the panel

- Free margin in cash and percent

- Effective leverage per account and by symbol

- Time in breach and actions taken automatically

Automatic actions that help

- Soft breach: force brackets, reduce max size, post a timer

- Hard breach: auto pause with a resume clock and clear reason

Price collars and throttles that block the dumb stuff

- Base collars on recent median spreads by symbol and session

- Tighten around liquid windows, relax around known prints

- Log every breach with symbol, quote source, action, and revert time

- Velocity throttles limit tickets per minute per account or IB

Engineers and auditors will thank you.

Costs and quality lines to track for a month

Treat costs like ingredients. You will cook better trades.

| Line | Where it shows | Practical move |

| Spread plus commission | Every fill | Prefer liquid windows and honest LPs |

| Slippage | Opens and data minutes | Favor retests, reduce size during hot minutes |

| Liquidity access fees | Monthly tiers | Pay for venues that win your hours |

| Dispute time | Support queue length | Use state snapshots and rule IDs |

| Technology incidents | Status page | Publish timestamps, causes, and reverts |

“Cost clarity turns uncertainty into a choice you can live with.”

Runbook the whole team can keep

Opening

- Status green, quotes fresh

- Collars, caps, and kill switches loaded

- Yesterday’s reconciliation matches bank totals

- LP scorecard inside bands for your session

- Alert pings reach on-call devices

During session

- Watch NOP bars and the margin panel

- Apply playbooks, then post a short note with a revert timer

- Keep all changes inside the change log

Closing

- Export statements and match totals

- Tag outlier fills and assign an owner

- Update policy bands weekly from realized volatility

Common mistakes and clean fixes

| Mistake | Why it hurts | Fix that lasts |

| Percent-only marketing of returns | Attracts leverage and luck | Pair return with drawdown and recovery time |

| One LP for all hours | Unreliable fills in volatile windows | Add a second venue and session aware routing |

| PDFs as the only report | Slow audits and disputes | CSV or API parity with statements |

| Dealer improvisation under pressure | Inconsistent routing and risk | Write rules, set timers, log reverts |

| Hidden leverage creep | Batch margin calls | Surface effective leverage and auto size cuts |

Frankfurt opens. Collars tighten on EUR pairs and the a-book / b-book flow control system flips EURUSD external for eight minutes during a scheduled print. The real-time exposure monitoring tool shows currency NOP edging toward the top of policy, so the desk taps hedge to band and the dial settles. Two accounts drift into soft margin breach and the system reduces max size while posting polite, timestamped notices. By lunch, reconciliation equals the bank. Support links rule IDs to close two tickets in minutes. That is risk management software for forex brokers doing its job.

FAQ

What is the single most important feature on day one

Cash based margin checks before submit plus price collars per symbol. If the ticket shows dollars and collars block outliers, everything else gets easier.

How many venues should we connect at launch

Two is sensible. Aggregation with a quick fallback timer protects fills and keeps spreads honest during hot minutes.

Can routing change by session automatically

Yes, and it should. Liquidity quality shifts across time zones. Session aware routes reduce rejects and messy fills.

How do we measure the value of a real-time exposure monitoring tool

Track response time to breaches, slippage stability in core windows, and dispute resolution time. If those improve, the tool earns its keep.

How do we keep dealers from improvising

Write routing rules in short sentences, publish revert timers, and force all changes through a change log. Clarity beats heroics.

What proves compliance after the fact

Itemized statements, exports that equal portal totals, and client state snapshots at decision time. Receipts end debates.