You do not need magic features to start with copy trading for beginners. Providers trade their own live accounts. The platform mirrors those positions to followers according to each investor’s allocation and limits.

Good platforms show delay and slippage, log every decision, and make it easy to stop copying without drama.

“Fast prevention beats perfect postmortems.”

Why beginners like copy trading, and the risks to respect

Upsides

- Learn from real trades with context, not only screenshots

- Turn proven routines into a subscription you can test calmly

- Diversify without juggling many manuals

Risks

- Overconfident providers with hidden drawdowns

- Spreads and slippage around news that distort results

- All or nothing allocation that ignores your cash limits

Your fix is structure: cash allocation, hard caps, and providers who publish notes.

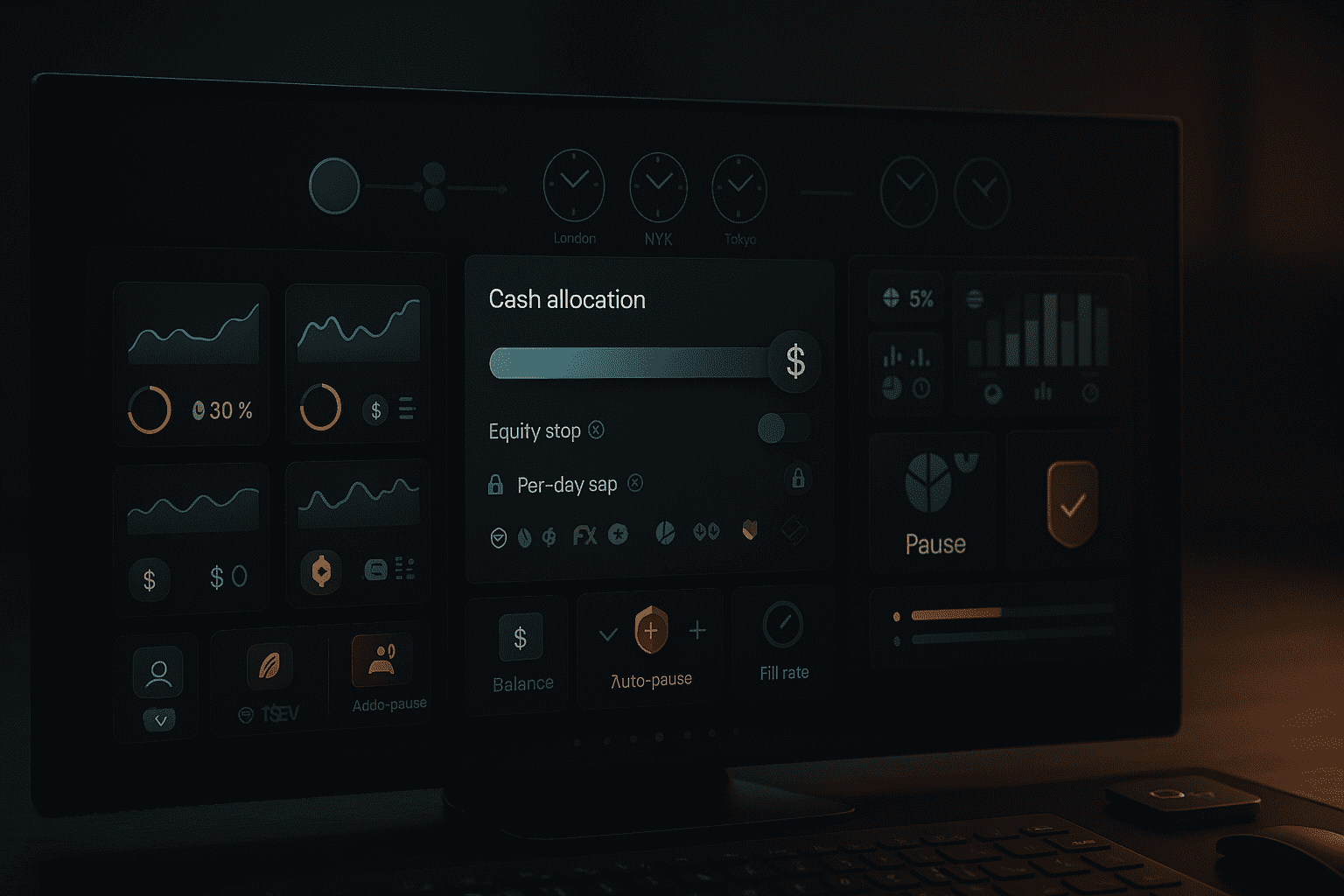

How cTrader copy works

A quick, plain flow you can trust:

- Provider trades a master account.

- Checks run for permissions, margin, and symbol rules.

- Allocation engine converts master size to your size using your chosen method and caps.

- Orders route, the system stamps copy delay and slippage per follower.

- Reports update, fees and PnL sync to statements and exports.

Keep your custom choices at the edges, like branding and defaults. Leave allocation math and logging standard so upgrades stay smooth.

Copy trading step by step

Follow this once, then repeat without thinking about it.

1) Set your guardrails

- Pick a fixed cash allocation per strategy, not a percent of your entire account.

- Turn on an equity stop for the strategy, for example 8 percent.

- Add a per day loss cap, for example 2 percent, so copy pauses automatically.

- Enable symbol filters so you begin with majors and metals before exotics.

“Risk shown in cash turns scary choices into simple math.”

2) Shortlist providers with discipline, not drama

Use a small scorecard:

| Signal | Good sign | Red flag |

| Return and drawdown | Both shown together | Percent returns alone |

| Recovery time | Measured in days or weeks | Hidden or inconsistent |

| Risk per trade | States a cash number | Vague percent bragging |

| Notes cadence | Weekly, short, honest | Rare essays, long silences |

| Typical hours | Matches your schedule | Random, all day posting |

3) Test with tiny allocation

- Start with one provider for two weeks, then consider a second.

- Keep a small journal with before and after screenshots and one line notes.

- Compare your fills to the provider’s, especially around your active hours.

4) Review the logs, not the legend

- Check copy delay and slippage by symbol and session.

- Confirm your statement’s lines for spread, commission, and funding match what you expected.

- If caps are triggered, read the message and your runbook before changing anything.

5) Adjust slowly

- Raise or lower cash allocation in small steps only after two to four weeks of steady behavior.

- Do not add a third strategy until your results and stress level agree.

Common allocation methods, with plain notes

| Method | Idea | Best for | Watch out for |

| Fixed cash | You assign a dollar amount to copy with | Beginners and small accounts | Underuse if too small, raise slowly |

| Equity proportional | Size scales with live equity | More active followers | Swings feel bigger in volatility |

| Percent of master | Fixed slices of provider size | Cohesive cohorts | Rebalance when people join or leave |

Pick one for the month. Switching mid stream confuses results.

Costs that matter more than you think

Treat costs like ingredients, you will cook better trades.

| Cost line | Where you see it | Practical move |

| Spread plus commission | Every fill | Prefer liquid session times |

| Funding or swaps | Overnight holds | Shorten duration or accept the carry |

| Provider fees | Performance or management | Use high water mark terms, keep management modest |

| Slippage | Opens and macro minutes | Stand down near prints unless that is your edge |

“Cost clarity turns uncertainty into a choice you can live with.”

Messages that prevent support tickets

Short, plain reasons help you act fast:

- “Copy paused, per day loss cap reached, resumes at 00:00 server time.”

- “Order rejected, free margin below threshold, reduce size or deposit.”

- “Symbol blocked by your filter, enable it in settings to copy this trade.”

A beginner friendly starter mix

- Provider A: Trend entries on EURUSD and XAUUSD, hourly rhythm, notes every Friday

- Provider B: Intraday S&P micro structure during the first cash hour

- Your setup: Cash allocation for each provider is set. The equity stop is 8 percent. The daily cap is 2 percent. Only major currencies and gold are enabled

- Expected feel: Shallow dips, fewer panic pauses, clearer reviews

“Small and repeatable beats big and random.”

Two real scenarios you will recognize

Scenario 1, calm win

A provider posts a plan before London, enters gold with a clear stop, and logs a recap. Your copy delay stays inside your norm, the size matches your cash allocation, and the partial take profit hits. Your statement shows a small spread and commission, exactly what you expected.

Scenario 2, healthy stop

Price reverses on a data print. Your per day cap was set, so copying pauses after the second loss. No chasing, no drama. You review notes that evening and the next day looks normal again.

Beginner FAQs

Is copy trading for beginners a smart first step

Yes, if you treat it as a structured experiment. Use cash allocation, equity stops, and per day caps. Read weekly provider notes so you learn the method, not just the result.

How cTrader copy works at a glance

The provider trades a live account. The platform checks and allocates based on your settings. It routes orders and records delays, slippage, and PnL in statements. Finally, it exports the data.You can pause or disconnect without disrupting open trades on the master.

Can I really do copy trading step by step without getting lost

Follow the five steps in this guide: guardrails, shortlist, tiny test, log review, slow adjustments. Keep each step visible in your settings, journal, and statements.

How many providers should a beginner follow

Start with one, maybe two after a couple of weeks. More than that doubles confusion without better learning.

What happens if a provider changes style

Your logs will show the shift. Read their notes and reduce allocation if the plan no longer matches your comfort. Caps stay on while you evaluate.

Are fees going to eat my results

Not if you measure. Track all in cost per trade for a month, including spread, commission, funding, and any provider fees. Keep providers and session windows that stay efficient.