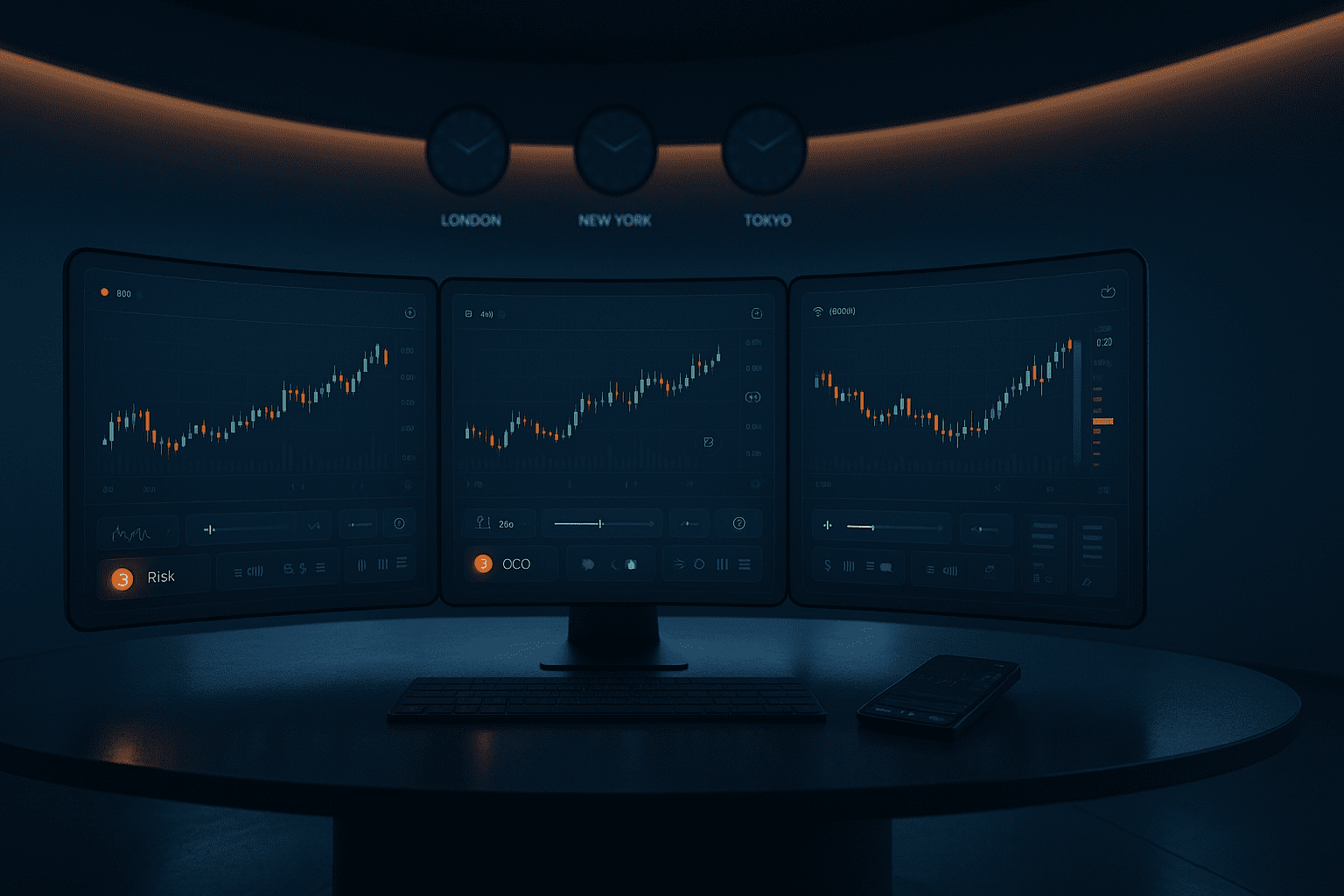

A strong multi-asset trading platform does not wow you with a crowded menu. It gives you one rhythm that travels from metals to indices to FX without changing the language on your screen. You click through symbols and nothing important moves under your feet. Tickets read the same.

Risk shows in cash. Statements match your mental invoice. That quiet sameness is what lets you trade different markets online and stay calm while doing it. Pair that with an all in one trading account and the craft becomes simpler than the brochures suggest.

The promise, minus the fog

You want breadth without chaos. A single login, one ticket grammar, and tools that behave identically on gold, the S&P micro, and EURUSD. Your day is one routine that works in two short windows, not twelve tabs and constant context switching.

“A single routine across assets beats a catalog you never touch.”

What “good” feels like in motion

- One ticket for price, size, stop, and target across every symbol

- Cash based risk preview on the ticket before you click

- Brackets by default so exits are not a debate

- Alerts that arrive in your local time before important prints

- Statements that itemize spread, commission, funding, and slippage

None of this is flashy. All of it is durable.

All in one trading account, one simple map

You do not need every instrument. You need the few that match your windows and temperament.

| Lane | Active windows* | Catalysts | Personality |

| Majors in FX | London open and early New York | Rates tone, CPI, jobs | Directional bursts with clean pullbacks |

| Metals | London morning, US macro hours | Real rates, USD tone | Trend friendly on data days |

| Equity indices | First hour and last hour of cash | Earnings, breadth, flows | Range break and retest, momentum bursts |

| Oil | Europe morning, US session | Inventories, OPEC tone | Faster swings, plan for slippage |

*Pick one or two slices you can repeat. That is where progress lives.

“Trade your window, not the whole day.”

Ticket math in plain cash

Let the platform do arithmetic. You provide a fixed cash risk per trade and let size follow from that choice.

Example A: index micro on a pullback

- Risk unit: 40 dollars

- Stop: 4 ticks on MES equals 1 point

- Tick value: 1.25 dollars per tick

- Risk per contract: 4 × 1.25 equals 5 dollars

- Position size: 40 ÷ 5 equals 8 contracts

Example B: metal CFD with 0.01 equals 1 dollar

- Risk unit: 50 dollars

- Stop: 0.50

- Risk per contract: 50 dollars

- Position size: 1 contract

“You cannot control the market. You can always control position size.”

Costs that decide more than you think

Treat costs like ingredients. You will cook better trades.

| Cost line | Where it bites | Practical move |

| Spread plus commission | Every fill | Trade liquid minutes, pick a pricing tier that fits your average ticket |

| Funding or swaps | Overnight holds on CFDs | Hold smaller or switch to exchange futures for longer carries |

| Slippage | Opens and scheduled data | Prefer retests over chasing breaks, use limits when tempted |

| Data and platform | Depth, terminals, add ons | Subscribe only to what you use, review monthly |

“Cost clarity turns uncertainty into a trade you can choose.”

Keep a tiny log of total cost per trade for 20 sessions. Your schedule will drift toward efficient hours on its own.

Features that make a platform feel like one room

A great multi asset trading platform is predictable rather than flashy.

- Cash risk preview on every order

- Brackets and OCO by default

- Symbol specs in cash: tick value, contract value, hours, funding rules

- Depth of Market or consistent fill quality

- Exportable logs and APIs for statements, fills, and events

- Status page with incident timestamps and planned reverts

If these sound boring, good. Boring survives volatility.

Trade different markets online without switching brains

If your goal is to trade different markets online, keep your definitions short enough to follow when price speeds up.

Range break and retest

Box the opening range. When the price closes outside, wait for a retest that holds. Enter with your bracket already attached. Works on indices and metals during active windows.

Pullback into value

Confirm directional intent. Use VWAP bands or a prior value zone. Enter on the first pullback that pauses. Great for majors and gold around macro hours.

Quiet session fade

When price stretches into a well tested band during calm periods, fade back toward value with small size and firm stops.

“If the entry needs a paragraph to justify it, it is not ready.”

Comparison you can actually use

| Trait | Feels average | Feels right |

| Ticket flow | New quirks per asset | One language for every symbol |

| Risk display | Percent only in a sub tab | Cash shown on the ticket before entry |

| Alerts | Loud and late | Quiet and early with local time |

| Statements | Creative fee bundles | Line items you can read aloud |

| Mobile role | Charts only | Safe for edits and exits |

| Logs and exports | PDFs and screenshots | CSV and API that rebuild results exactly |

When the right column becomes normal, you stop shopping and start improving.

A day that proves the point

Picture a Tuesday. London sets the tone. Gold pulls back into your value zone. You size by cash, click once, and the bracket attaches. Ten minutes later the S&P micro breaks its morning box and retests. You swap lanes without swapping mental models. Later, your statement matches your notes line by line. No creative labels. No guesswork. That is an all in one trading account doing the job you hired it to do.

Common mistakes and clean fixes

| Mistake | Why it hurts | Clean fix |

| Chasing first spikes | Poor fills and regret | Wait for retest or the first pullback |

| Sizing from memory | Inconsistent risk | Use cash preview and a fixed risk unit |

| Trading every hour | Decision fatigue | Two windows, close on time |

| Ignoring funding costs | Overnight drift eats gains | Choose instruments that fit your hold time |

| Believing landing page spreads | False confidence | Screenshot quotes at your hours and compare monthly |

“Progress is a series of small, boring upgrades.”

Two realistic routines, numbers included

Metals pullback with fixed risk

- Window: London morning or US macro hours

- Risk: 50 dollars per trade

- Plan: trend confirmation, first pullback into value

- Management: partial at 1R to pay costs, trail the rest

- Note: stand down ten minutes before and after top tier prints unless that is your edge

Index range break to retest

- Window: first 45 minutes of the cash session

- Risk: 40 dollars per trade

- Plan: draw a five to ten minute box, trade the retest after break

- Management: partial at 1R, structure stop for the rest

- Note: skip if the break is messy or the catalyst is due

Signals you picked the right partner

- You spend less time rearranging layouts and more time reviewing outcomes

- Alerts feel early and relevant rather than loud and late

- Your journal shrinks because the platform does the boring math

- Withdrawals land on schedule and status notes match reality

- Your mental invoice matches the statement line by line

“Trust lives in spreadsheets and status pages, not in taglines.”

FAQ

Does a multi asset trading platform really help performance

It helps focus. One ticket language, cash based risk, and consistent exits reduce mental friction. You make fewer accidental mistakes and learn faster from your own data.

Are costs higher when I add more asset classes

Not if you measure. Track total cost per trade for 20 sessions. Keep the windows and symbols that stay predictable and prune the rest.

Is mobile safe for edits and exits

Mobile is fine when size shows in cash and brackets are visible. Fast entries still belong on the desktop during the open, but clarity is the goal either way.

How do I avoid doubling risk across lanes

Watch correlation. Dollar moves echo in gold and majors. Oil strength can rhyme with energy heavy indices. When exposures overlap, pick the cleaner idea or split size.

Which features matter most on day one

Cash risk preview, brackets by default, honest spreads during your hours, and exportable logs. Everything else is a bonus.