You can trade forex and stocks without turning your day into a maze. The key is not a longer product list. The key is one language across charts, tickets, and statements so your thinking stays the same while the symbols change.

A good forex and stock broker makes that language obvious. A strong multi-asset broker MT5 stack keeps it consistent under pressure.

“When the software disappears, the skill appears.”

The feeling you are chasing

There is a moment when you stop noticing the platform and start noticing your decisions. You flick from gold to the S&P micro to EURUSD. The ticket never changes its grammar. Risk shows in cash before you click. Margin reads like a sentence, not a riddle. Your notes from last week match the fills you see today. That quiet alignment is the signal that your setup is doing its job.

“A single routine across assets is worth more than a catalog you never touch.”

Why one account for many lanes makes sense

Some days the clean move lives in a currency pair. Other days it shows up in metals or an index. One account that treats each lane with the same rules lets you rotate attention without switching brains. You still pick your moments. You still keep size honest. You just stop wasting energy on platform trivia and put it back into timing, levels, and exits.

A simple map of rhythms

| Lane | Typical windows* | Main drivers | What it feels like |

| Majors in FX | London open, early New York | Rates tone, CPI, jobs, PMIs | Directional bursts with clean pullbacks |

| Metals | London morning, US macro hours | Real rates, dollar tone, risk sentiment | Trend friendly around data |

| Indices | Cash sessions by region | Earnings, breadth, flows | Fast opens, rotation, late fades |

*Your venue’s hours vary. Pick the slice that fits your life.

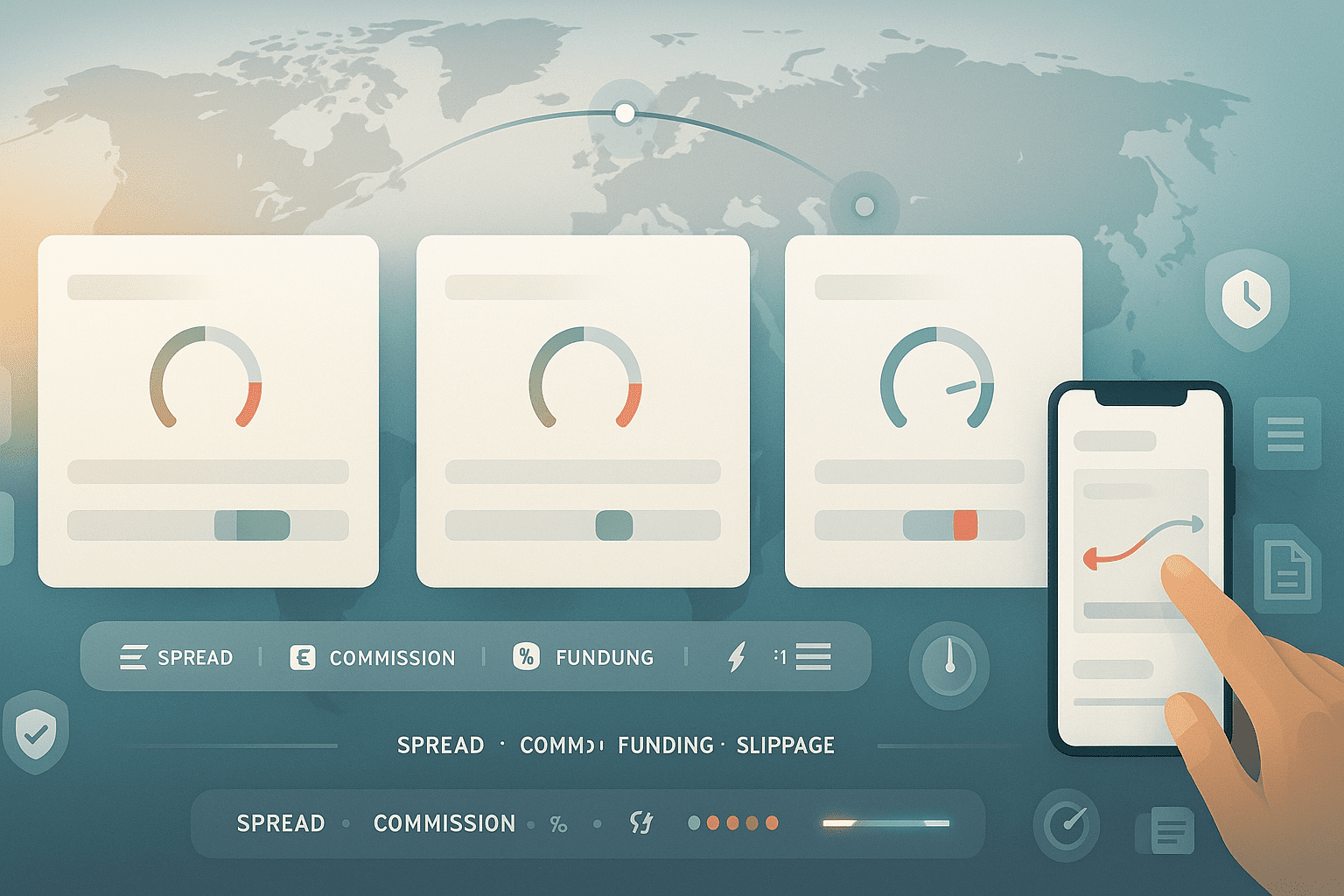

The invoice you carry in your head

Professionals keep a mental invoice that updates with every click.

- Spreads that are tight when liquidity is real

- Commissions that match your average ticket, not mythical volume

- Funding that does not turn a tidy swing into a coin flip overnight

- Slippage that stays honest at the open and around scheduled prints

You notice these costs more when you trade forex and stocks side by side. Oil can move like a rumor. Indices can move like a crowd. Metals can move like a mood. A broker who keeps cost and control legible across those rhythms earns trust the slow way, which is also the durable way.

“Cost clarity turns uncertainty into a trade you can choose.”

What a helpful forex and stock broker actually does

The best product is often a culture in disguise. You can feel it.

- Teaches with examples instead of slogans

- Publishes changes before you trip over them

- Answers in the same plain language the platform speaks

- Timestamps status notes and treats incidents like adult

- Sends statements that read like a clear list, not a puzzle

This is not glamour. It is reliability you can plan around.

Why MT5 helps when you want one tone for many charts

A multi-asset broker MT5 setup can carry your routine across metals, indices, and FX if you use the parts that matter.

- One order ticket flow for price, size, and stops

- Brackets that place stop loss and target with the entry

- Hedging or netting modes chosen on purpose, not by accident

- Symbol specs and contract values visible in cash terms

- Depth of Market to feel liquidity, not guess it

- Reports that show spread, commission, funding, and slippage as separate lines

If those pieces feel boring, you set them up right.

FX and stocks in one room, without confusion

| Topic | FX reality | Stocks and index CFDs reality | Shared habit that wins |

| Catalyst timing | Calendars and central banks | Earnings cycles and open drives | Trade your window, not the whole day |

| Position sizing | Lots and pip value | Points and contract value | Risk in cash on the ticket before entry |

| Costs to watch | Spread, commission, swaps | Spread, commission, funding | Track total cost per trade for a month |

| Common mistake | Trading through top tier prints by accident | Chasing the first spike at the open | Wait for retests unless that is your explicit edge |

“If the entry needs a paragraph to justify it, it is not ready.”

A day that proves the point

Picture a Tuesday. London sets the tone. You mark a pullback on XAUUSD, place a bracket, and step away from the impulse to babysit. Ten minutes later, the S&P breaks a tight range. You do not change tools or risk math. You swap lanes without switching minds. Later, your statement mirrors your notes. Spread, commission, a small slippage line that matches the feel of the fill. No creative labels. No guesswork.

Quiet guardrails that save loud days

You will not see them in banners. You feel them when a headline hits.

- Slippage bands widen for a few minutes then snap back with a logged timestamp

- Stale quote rejections stop off market fills without blocking valid orders

- Margin meters keep your third ticket from turning a normal pullback into a heart monitor

- Messages arrive with seven clear words: the rule, the reason, the next step

These touches are not fancy. They are table manners for multi market sessions.

The human scale of “multi asset”

A part time trader in Bogotá keeps it simple. Gold during US afternoons. A Nasdaq micro twice a week near the open. EURUSD around London lunch when the calendar allows. Three lanes. One routine. One tone across the platform. Her notes are short, risk is fixed in cash, and costs are predictable enough to ignore until month end. She does not argue about venues because her forex and stock broker has quietly removed itself from the conversation. That is the most honest compliment any platform can earn.

“Small and repeatable beats big and random.”

FAQ

Can one account cover FX, metals, and index CFDs

Yes when the venue is designed for it. The right multi-asset broker MT5 stack has one ticket flow, one risk language, and clear statements. This lets you move from chart to chart easily.

What defines a reliable forex and stock broker

You get consistent tickets, cash-based risk display, itemized costs, and exportable logs. There are predictable funding and withdrawals, plus a status page with real timestamps.Those traits outlast hype.

Will costs creep up when I combine assets

They should not if pricing is honest. You will still see spread, commission, funding, and slippage. The difference is transparency by symbol and session so your mental invoice matches the statement.

Is mobile safe for edits and exits

Mobile is fine when size shows in cash, brackets are visible, and margin meters update in real time. Fast entries still feel safer on the desktop during the open.

How do I avoid doubling risk across lanes

Watch correlation. Oil strength can rhyme with energy heavy indices. Dollar moves can echo in gold and majors. When exposure overlaps, pick the cleaner idea or split size.