You do not need a massive budget to run an effective online trading community platform. You need clear rules, the right features in the right order, and a steady cadence that rewards helpful behavior.

One is for stock trading, and the other is for forex trading. You can do this without making your team full-time moderators.

The big idea in one minute

A trading community succeeds when members can learn, act, and report back without friction. That means channels matched to skill levels, content that solves real problems, live events tied to market calendars, and tools that make risk visible. Get those right and engagement becomes predictable.

“If members know where to ask, how to act, and when to review, they will stick around.”

Core jobs your platform must do

- Enable fast, structured Q and A so beginners are not afraid to ask and experts do not repeat themselves all day.

- Turn research into action with watchlists, alerts, and simple risk templates.

- Track outcomes so wins and losses feed back into the next conversation.

- Keep the room safe with sane rules, transparent moderation, and clear disclosures.

Feature map at a glance

| Area | Must have features | Nice to have | Red flags |

| Onboarding | Role selection, interests, markets of focus | Guided tour, welcome checklist | One big general chat with no structure |

| Channels | Separate spaces for stocks and FX, plus archives | Strategy rooms by timeframe and experience | Mixed asset chatter in a single feed |

| Content | Pinned primers, calendar with earnings and macro prints | Short courses, annotated playbooks | Promotions with no educational value |

| Tools | Read only watchlists, risk calculators in cash | Paper trading links, broker connections | Unverified signals with no context |

| Analytics | Post quality voting, cohort retention, reply times | Topic heatmaps, cohort journeys | Vanity metrics with no actionability |

| Safety | Clear rules, profanity and scam filters, audits | Escalation paths, public incident notes | Vague policies and silent moderation |

“Choose features that lower confusion before features that raise excitement.”

Stock vs forex communities inside one roof

A single platform can support both a stock trading community and a forex trading community. However, you need to know the differences between them.

Stock trading community platform needs

- Earnings and news calendar integrated into daily threads

- Gap and open play channels for index and single name flows

- Broker mechanics for short borrow, PDT rules, and corporate actions

- Longer holding examples for swing traders using ETFs and options

Forex trading community platform needs

- Session based structure for London, New York, and Asia

- Economic calendar focus on CPI, NFP, central banks, and PMIs

- Risk in cash templates for pips, lots, and margin clarity

- Symbol hygiene to prefer majors and gold for beginners

“Different clocks, same clarity. Stocks revolve around openings and earnings. FX revolves around sessions and prints.”

Architecture you can sketch in a minute

- Lobby routes new members to Stocks, Forex, or Both

- Learn houses pinned primers and step by step playbooks

- Discuss splits by asset, timeframe, and experience level

- Act offers watchlists, calendars, and risk templates

- Review collects trade recaps with charts and outcomes

- Support provides platform help, rules, and incident updates

This spine keeps conversations findable years later.

Content that educates instead of hyping

Design content as small, reusable blocks.

- Primers: Order types, bracket logic, and cash risk sizing

- Playbooks: Pullback, breakout plus retest, quiet session fades

- Calendars: Earnings weeks for stocks, central bank weeks for FX

- Recaps: One good trade and one mistake with screenshots

Quotable lines that search engines love:

“Risk shown in cash turns scary decisions into simple math.”

“Trade fewer ideas, review more outcomes.”

“If a setup needs a paragraph to justify it, it is not ready.”

Onboarding that lowers noise

- Pick your lane: Stocks, Forex, or Both.

- Choose your rhythm: Intraday, swing, or long term.

- Set your tools: Watchlists and alerts, not notifications for everything.

- Agree to rules: No promises of returns, risk in cash, respect others.

- First task: Post a one sentence plan for the week with a chart.

Members who complete this path usually participate again within 72 hours.

Moderation that feels fair

- Publish a rules table with examples of allowed and disallowed posts.

- Use maker checker for bans and content removals with short notes visible to staff.

- Archive incident summaries so you can point to precedent.

- Promote a code of conduct that rewards teaching and discourages FOMO bait.

“Firm lines and quick explanations create the calm tone your community needs.”

Engagement loops you can run forever

- Daily thread: one stocks, one FX, both pinned before each session

- Two charts Tuesday: members post one win and one lesson in images

- Office hours: weekly Q and A for beginners with live charting

- Recap Friday: link to three member posts that taught something specific

The key is rhythm, not novelty.

Metrics that actually predict health

| Metric | Good signal | Why it matters |

| First month retention | 40 to 60 percent depending on price and niche | Shows your onboarding and content fit |

| Time to first helpful post | Under 7 days | Indicates safety and clarity |

| Useful to noisy post ratio | 3 to 1 or better | Keeps experts engaged |

| Response time to beginner questions | Under 4 hours in session windows | Reduces churn from confusion |

| Recap participation rate | At least 25 percent of active posters weekly | Builds the review habit |

| Report resolution time | Same day for scams and abuse | Protects trust and brand safety |

Track these weekly and publish wins inside the community.

Monetization without killing trust

| Model | Works best for | Guardrails |

| Free with pro tier | Broad audiences entering the craft | Keep core education free, put premium on structure and access |

| Course bundles | Niches with clear outcomes | Keep updates fresh, avoid lifetime promises |

| Partner offers | Tool and data discounts | Disclose relationships, never gate withdrawals or custody |

| Events | Focused regions and time zones | Archive replays, post notes for no shows |

“Members pay for clarity and access, not for hype.”

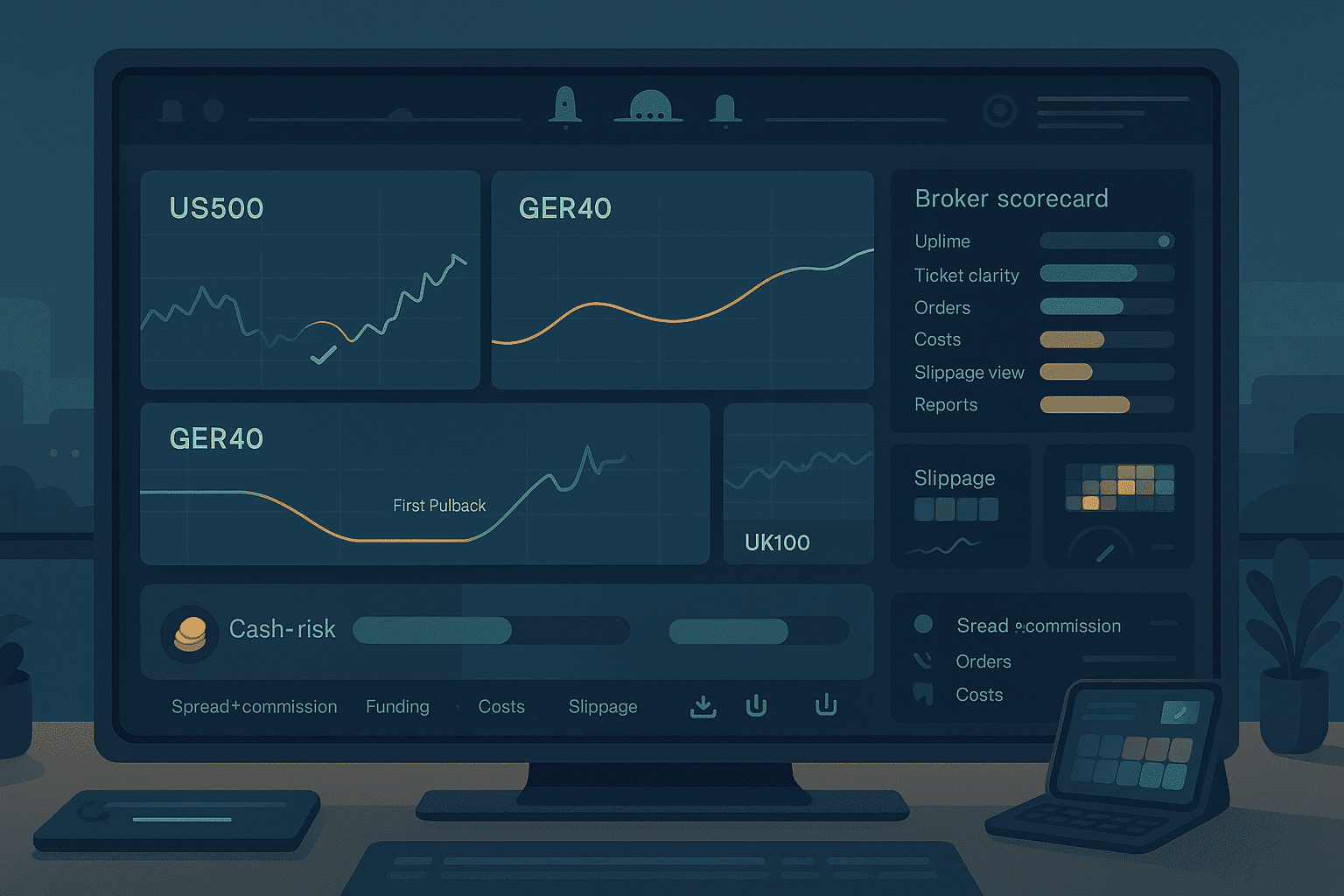

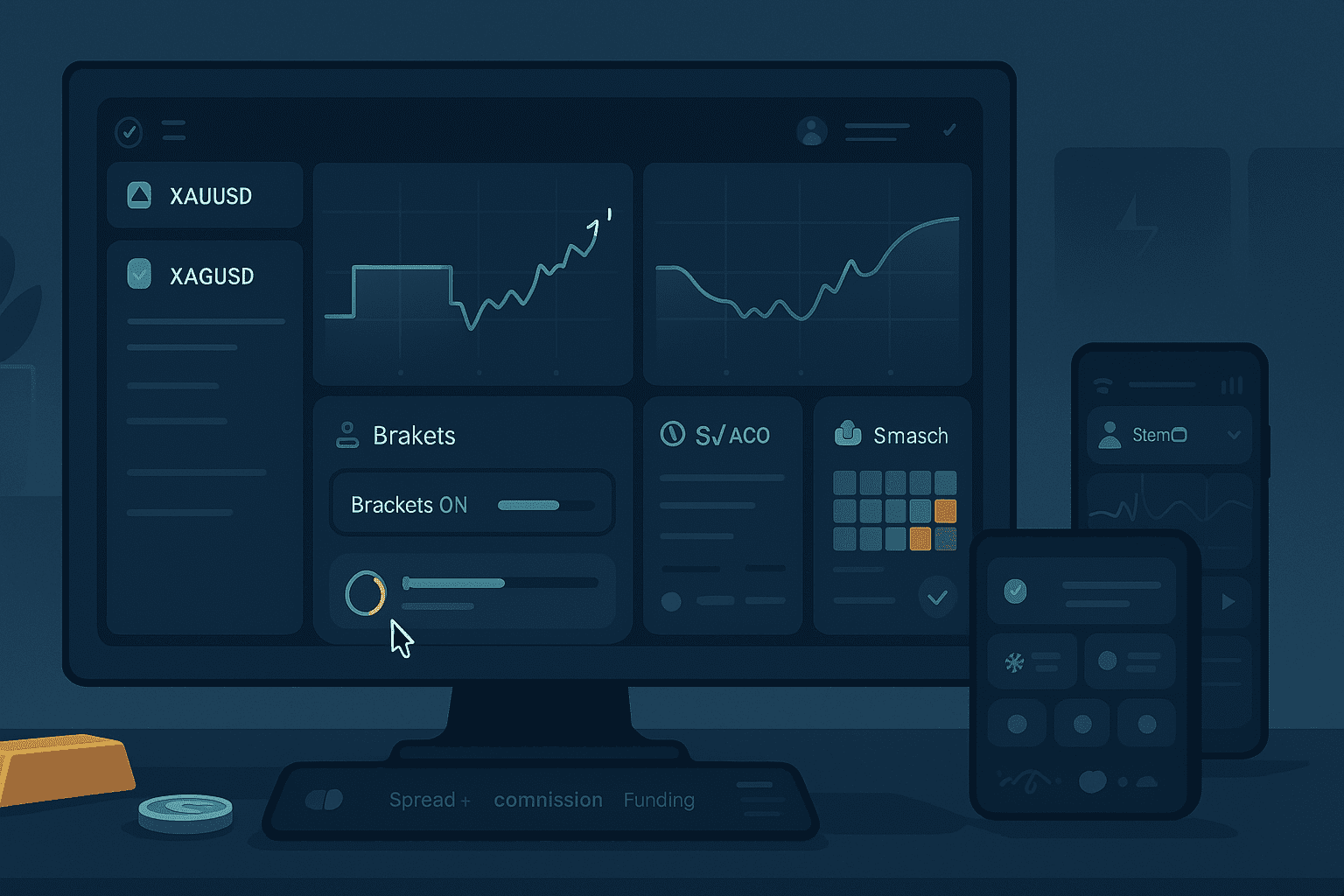

Tooling that helps members act

- Watchlist libraries: prebuilt by asset and session

- Risk calculators: show size, stop, and cash impact before entries

- Calendar alerts: earnings, CPI, jobs, inventories

- Journal templates: one sentence reason in and reason out, plus screenshots

- Searchable archives: by tag, symbol, timeframe, and setup

If you work with brokers or use paper trading, keep education and execution separate. Make sure to explain this clearly.

Accessibility and language choices

- Write at a community college reading level.

- Replace jargon with examples and images.

- Offer bilingual summaries if your member base is mixed.

- Caption videos and add transcripts so search and accessibility both improve.

“Plain words win. Fancy words hide confusion.”

Switching from chaotic chat to clear structure

Before

Endless general chat, mixed assets, missed questions, same mistakes weekly.

After

Threads tied to sessions and assets, searchable archives, templates for recaps, and a help desk with living docs.

Small structural changes lower cognitive load and shrink support tickets.

Example weekly cadence you can borrow

- Sunday: Post economic and earnings calendar with two theme charts

- Each session: Pin a thread for Stocks or FX with three levels and two potential catalysts

- Midweek: Run one class for beginners on risk in cash, record it, and link it under Learn

- Friday: Share three best member lessons and invite feedback on one experiment

Notice the absence of complicated content schedules. Consistency drives retention.

Compliance and brand safety essentials

- Keep plain risk warnings in the footer of every page and at the top of trading rooms

- Ban guarantees or implied returns

- Require trade recaps to include risk size, not just PnL

- Separate education from execution in navigation and disclosure

- Maintain a public status page for uptime and incidents

“Good rules protect good people.”

Stock and forex content starters

Stock threads that convert

- Pre market levels on SPY and QQQ with breadth and leaders

- Earnings spotlight with expected move and top watch

- End of day rotation notes with sector heatmaps

Forex threads that convert

- London prep with major pairs and DXY context

- New York reversal watch with gold and dollar pairs

- Risk recap with central bank quotes and next print preview

Templates make it easy for volunteers and staff to deliver consistent value.

Build vs buy for your online trading community platform

| Path | Time to launch | Cost profile | Flexibility | Maintenance |

| All in one community SaaS | Fast | Monthly per member or flat tiers | Medium with integrations | Low, vendor handles uptime |

| Forum plus chat hybrid | Medium | Hosting plus plugins | High, craft structure to taste | Medium, you patch and scale |

| Custom build | Slow | Upfront dev then ongoing ops | Very high | High, requires product and SRE skills |

Start simple, prove engagement, then graduate to more control as your needs expand.

A short checklist to launch clean

- Write a one page community policy with rules and examples.

- Create Stocks, Forex, and Shared Learn spaces with pinned primers.

- Set up calendars, watchlists, and a risk in cash calculator.

- Schedule daily threads for two weeks ahead.

- Recruit three mentors and give them templates and office hour slots.

- Turn on post quality voting and require recaps with screenshots.

- Publish a status page and a simple support form.

- Announce one monthly theme and stick to it.

“Consistency is the quiet marketing you can afford.”

One small push to get moving

Open a document. List the three most common questions your members ask. Write down the two threads they read daily. Finally, note the one metric you will check every Monday. Spin up channels for Stocks and FX, pin your primers, and schedule next week’s threads now. With that small start, your online trading community platform will feel organized. Your stock trading community platform and forex trading community platform will each have a real home. This way, your team can focus on being helpful instead of dealing with problems.

FAQ

Is it better to split stock and forex into separate communities

Run both in one home with clearly divided spaces. Shared onboarding and rules cut overhead while asset specific rooms keep conversations focused.

How often should staff post market prep

At least once per session for each asset group you support. Short, repeatable formats beat long essays members will not finish.

Do leaderboards help or hurt

They help if you rank by helpful posts and clear recaps, not just PnL. Reward teaching, not gambling.

Which tools matter most at the start

Watchlists, a basic risk in cash calculator, and a searchable archive. Add paper trading and integrations only after members use the basics weekly.

How do we prevent signal spam

Require setup templates with risk in cash and context. Give moderators a fast reject option with a short canned reason and log it for learning.

What KPIs should we show the whole community

Retention, reply time to beginner questions, recap participation, and useful to noisy post ratio. Share wins publicly to nudge the right behavior.