You can start a brokerage firm online without turning your year into a tangle of vendors and vague promises. The work is real and can be repeated easily. Choose the right tools, write simple rules, and test with a small group before sharing with everyone.

Think of this as your practical online broker setup guide with grounded examples and checklists you can copy.

Business model choices you must name early

| Decision | Simple option | Why it helps | What to watch |

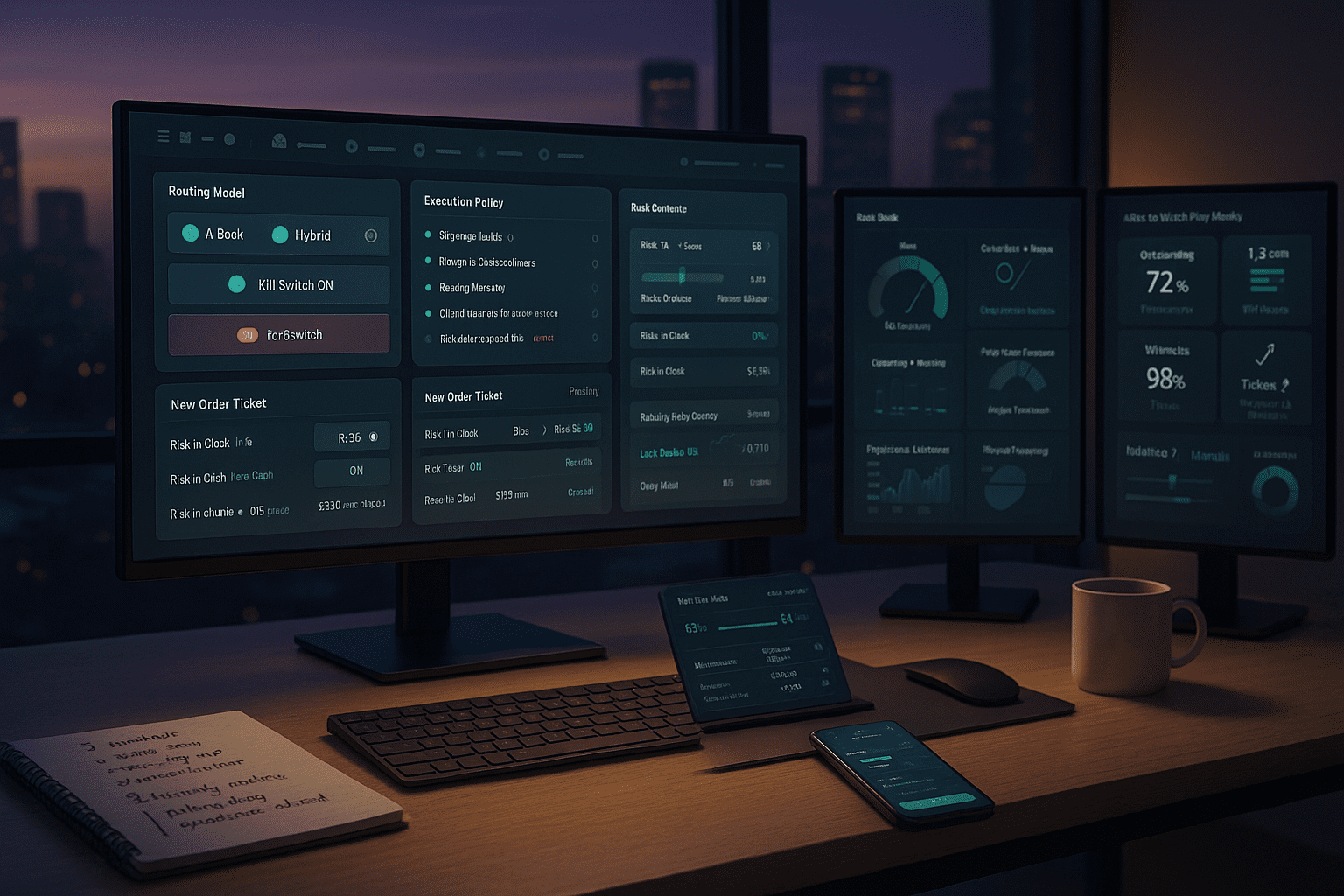

| Routing model | A book, B book, or hybrid | Sets how you manage trade risk | Publish logic in plain words |

| Assets at launch | FX and gold plus one index | Focus beats a crowded menu | Add later with evidence |

| Geography | One region and language to start | Cuts compliance surface area | Expand only after pilot metrics |

| Pricing | Transparent spread and commission grid | Lowers ticket volume on day one | Keep examples in cash, not only percent |

“If a client can explain your fees in one sentence, support gets easier.”

How to become a forex broker in practice

You do not need to chase a mystery playbook. You need to make ten good choices in a row and write them down.

1. Legal and compliance basics

- Choose your jurisdiction and entity type with an attorney who knows financial services.

- Register your brand, secure domains, and prepare client agreements and risk disclosures in plain language.

- Define KYC, AML, and client money policies that you can operate daily, not just file in a folder.

2. Trading technology

- Pick a terminal your market understands, then keep your custom work at the edges.

- Confirm stability on web, iOS, and Android. Users live on phones even if they place entries on desktop.

- Require cash risk preview on the ticket and bracket orders by default.

3. Liquidity and execution

- Select a primary LP for majors and metals with documented fill stats by symbol and session.

- Agree on last look rules in writing and ask for post-incident reviews.

- Keep a kill switch that forces A book routing during incidents.

4. Risk controls

- Pre trade checks for margin, size caps, and stale quotes.

- At trade slippage bands and venue fallbacks with timestamps.

- Post trade exposure caps, correlation brakes, and progressive liquidations.

5. Back office and CRM

- Account opening, KYC, deposits, withdrawals, statements, and tickets in one portal.

- Exportable logs and a reporting API for your warehouse.

- IB and affiliate tracking with simple tiers and clear math.

6. Payments and banking

- Local rails first, cards and wires as backup.

- Publish funding and withdrawal timelines where clients actually read them.

- Reconcile platform, PSP, and bank daily.

7. Education and help center

- Short primers on order types, risk in cash, and platform flow.

- Status page with uptime and incidents that uses timestamps, not spin.

- Plain-text scripts for the top ten support tickets.

8. Pilot, then open

- Fifty friendly users, three weeks, real money, real withdrawals.

- Measure slippage, rejects, copy of status notes, and ticket volume by hour.

- Tweak once, document changes, then open in waves.

“Slow is smooth, smooth is fast.”

The tech stack in one glance

| Layer | Must have | Nice to have | Red flag |

| Terminals | Web, iOS, Android, stable tickets | Depth of Market, OCO, partial close | No cash risk preview |

| Bridge and routing | Low rejects, slippage caps | Routing by symbol and session | No logs, only screenshots |

| Liquidity | Fill stats, last look policy | Secondary LP ready | Wide opens with no notes |

| Back office | KYC, deposits, withdrawals, statements | API, webhooks | PDFs only, no exports |

| CRM | Funnels, IB tiers, audit trail | Attribution to revenue | “Trust us” reports |

| Monitoring | Real-time dashboards, alerts | Correlation dials | No taxonomy for rejects |

| Compliance | Maker checker, audit logs | Screening workflows | Manual approvals in chat |

| Status | Public page with history | Postmortems | Silence during stress |

Budget ranges that keep surprises down

Actual numbers vary by region, vendor, and volume. Treat this as a sanity check.

| Bucket | Typical items | First year feel |

| Licensing and setup | Platform branding, environment creation | One-time fee plus monthly base |

| Platform monthly | Terminals, bridge, back office | Tiered by active accounts or features |

| Liquidity | Spreads, commissions, credit | Volume based, ask for symbol stats |

| Compliance | KYC, screening, legal | Per check plus retainers |

| Payments | Acquiring, local rails, chargebacks | Per transaction plus rolling reserve |

| Data and hosting | Price feeds, servers, monitoring | Predictable if sized right |

| People | Ops, compliance, support, marketing | Hire before launch, not after |

| Contingency | Audits, security, migrations | 10 to 15 percent buffer |

“Budget for reconciliation and incidents. Quiet costs keep you alive.”

Example routes that actually work

Lean education brand

- Audience: students who want real execution after a course

- Assets: FX majors, gold, one US index

- Strength: simple statements and fast withdrawals

- Why it works: trust builds from clear rules and visible risk tools

Regional specialist

- Audience: one country with strong local payments

- Assets: FX majors, gold, popular local indices

- Strength: bilingual support and honest timelines

- Why it works: you win by respecting context more than adding features

Risk controls you should write in plain language

- Equity stop and per day loss cap for copy or MAM features

- Slippage bands that widen during scheduled prints for a fixed window

- Progressive liquidation steps at 100, 95, and 92 percent margin level

- Circuit breaker when quotes go stale beyond a threshold

- Clear rejection messages with the next step in one line

“If a rejection needs a paragraph, your rule is not clear enough.”

The online broker setup guide in five checklists

1. Documents and policies

- Entity formed, regulatory stance documented

- Client agreement, risk disclosure, privacy policy

- KYC and AML policy with roles and escalations

2. Platform and routing

- Cash risk on ticket, bracket defaults, OCO

- Routing rules by symbol and session written down

- Status page and incident workflow with owners

3. Liquidity and monitoring

- LP contract with last look and fill metrics

- Real-time dashboard for exposure and correlation

- Reject taxonomy codes: margin, permission, market, throttle, technical

4. Payments and support

- Funding timelines posted in-app

- Maker checker for withdrawals

- Help center with screenshots for the top ten questions

5. Pilot and go live

- Invite list, feedback channel, daily reconciliation

- Tuning window with one batch of changes only

- Staged opening and weekly internal review

KPIs to watch every Monday

| KPI | Healthy signal | Why it matters |

| Onboarding completion | 70 percent from signup to verified | Shows friction points |

| Time to first trade | Under 48 hours after funding | Indicates clarity |

| Reject mix by code | Margin and stale quote under control | Rules are tuned |

| Slippage by symbol and hour | Stable in your live windows | Execution quality |

| Withdrawal completion | Within the published window | Trust and referrals |

| Tickets per 100 actives | Downtrend over 60 days | Product and education working |

Publish a trimmed scorecard to the team. Transparency improves judgment.

Common mistakes and clean fixes

| Mistake | Why it hurts | Fix |

| Launching fifteen assets day one | Shallow quality and vague training | Launch three, add more with data |

| Customizing the core | Breaks upgrades, slows fixes | Brand the edges, keep core standard |

| Silence during stress | Rumors beat truth | Status notes with timestamps and reverts |

| Fuzzy fee math | Disputes and churn | Show cash examples in the app |

| Manual reconciliation | Month end chaos | Daily match of platform, PSP, and bank |

“Choose partners you can audit, not just admire.”

A short, realistic timeline

| Week | Focus | Outcome |

| 1 | Finalize vendors, write policies | One-page execution policy anyone can read |

| 2 | Brand platform, connect KYC and payments | End-to-end dry runs with screenshots |

| 3 | Pilot with friendly users | Real fills, real withdrawals, real logs |

| 4 | Tune once, train support, open in waves | Quiet go live and fewer tickets |

This is a model, not a mandate. Stretch it if your licensing path requires more time.

One quiet nudge before you start

List the three controls you will apply to every account. Also, share the two metrics you will publish each week. Finally, mention the one change you will always tell clients about ahead of time. With that noted, you are ready to use this article as your online broker setup guide and move from idea to pilot. If each part works in a small cohort, you have already started to become a forex broker the durable way.

FAQ

Is there a simple path to start a brokerage firm online

Yes. Pick a known terminal, a proven liquidity partner, and a back office you can operate daily. Write short policies, pilot with a small group, and open in waves. The secret is clarity, not heroics.

Do I need copy trading or MAM at launch

Not always. Launch lean with core execution. Add MAM or copy once your operations feel calm and your audience asks for it. If you add it, enforce equity stops and per day caps.

How many assets should I list on day one

FX majors, gold, and one index are enough to learn where your platform shines. Add more only after slippage, spreads, and ticket volume stay predictable.

What is the fastest way to keep support tickets low

Show cash risk on the ticket. Publish a one-page execution policy. Add a status page with timestamps. Script answers with links to live documents.

How do I keep regulators and auditors happy

Maintain audit-ready logs, maker checker for withdrawals, clear KYC and AML workflows, and public incident notes. Operate your policies, do not just file them