You do not need a huge budget or a celebrity mentor to join a trading community online and get real value. You need a place built for learning, a routine that turns ideas into action, and a calm culture.

This article explains the basics of a platform to connect with traders. It shows the key parts of a strong trading discussion forum platform. You will also find checklists you can use today.

Core jobs your platform must do well

- Reduce confusion with channels that match experience level and market.

- Turn research into action using watchlists and risk templates.

- Capture outcomes so wins and losses feed the next decision.

- Protect the room with fair rules and visible moderation.

Feature map at a glance

| Area | Must have | Nice to have | Red flag |

| Onboarding | Role selection and interests | Welcome checklist and guided tour | One giant chat for everything |

| Channels | Stocks, FX, and a shared Learn space | Strategy rooms by timeframe | Mixed assets in a single feed |

| Tools | Watchlists and risk calculators in cash | Paper trading links and note templates | Unverified “signals” with no context |

| Content | Pinned primers and weekly calendars | Short courses and annotated playbooks | Sales pitches without education |

| Analytics | Post quality voting and reply time | Topic heatmaps and retention cohorts | Vanity counts with no action plan |

| Safety | Clear rules and scam filters | Escalation paths and incident notes | Vague policies and silent bans |

“Choose features that lower confusion before features that raise excitement.”

Why people join and stay

Common reasons members join

- Fresh watchlists and daily levels that match their schedule

- Low-pressure Q and A rooms for beginners

- Access to mentors who explain risk in cash, not jargon

- Threads timed to market sessions

Why they stay

- Consistent formats that make posting easy

- Fast, fair moderation with short explanations

- Recaps that connect the dots between plan and result

- A search box that actually finds relevant past threads

“Consistency is the quiet marketing you can afford.”

Choosing a platform to connect with traders

There is no single perfect tool. Pick the path that matches your budget, timeline, and tech comfort.

| Path | Time to launch | Cost profile | Flexibility | Best for |

| All-in-one community SaaS | Fast | Monthly tier | Medium | Teams who want structure without ops |

| Forum plus chat hybrid | Medium | Hosting plus plugins | High | Communities that love organization |

| Private chat with pinned docs | Very fast | Low | Low | Early pilots and small cohorts |

| Custom build | Slow | Upfront dev, ongoing ops | Very high | Large brands with product teams |

Selection checklist

- Can members filter by asset, session, and experience level

- Do posts support images, short clips, and simple tables

- Are threads searchable with tags like “pullback” or “breakout”

- Is there a clear way to archive best answers and recaps

- Can you export data if you ever move

Anatomy of a trading discussion forum platform

Think in rooms, not one river of chat.

- Lobby routes new members to Stocks, Forex, or Both.

- Learn stores primers on order types, bracket logic, and risk in cash.

- Discuss splits by asset and timeframe.

- Act houses watchlists, calendars, and templates.

- Review collects daily recaps and weekly lessons.

- Support manages rules, status updates, and help tickets.

This spine makes information findable and reduces repeat questions.

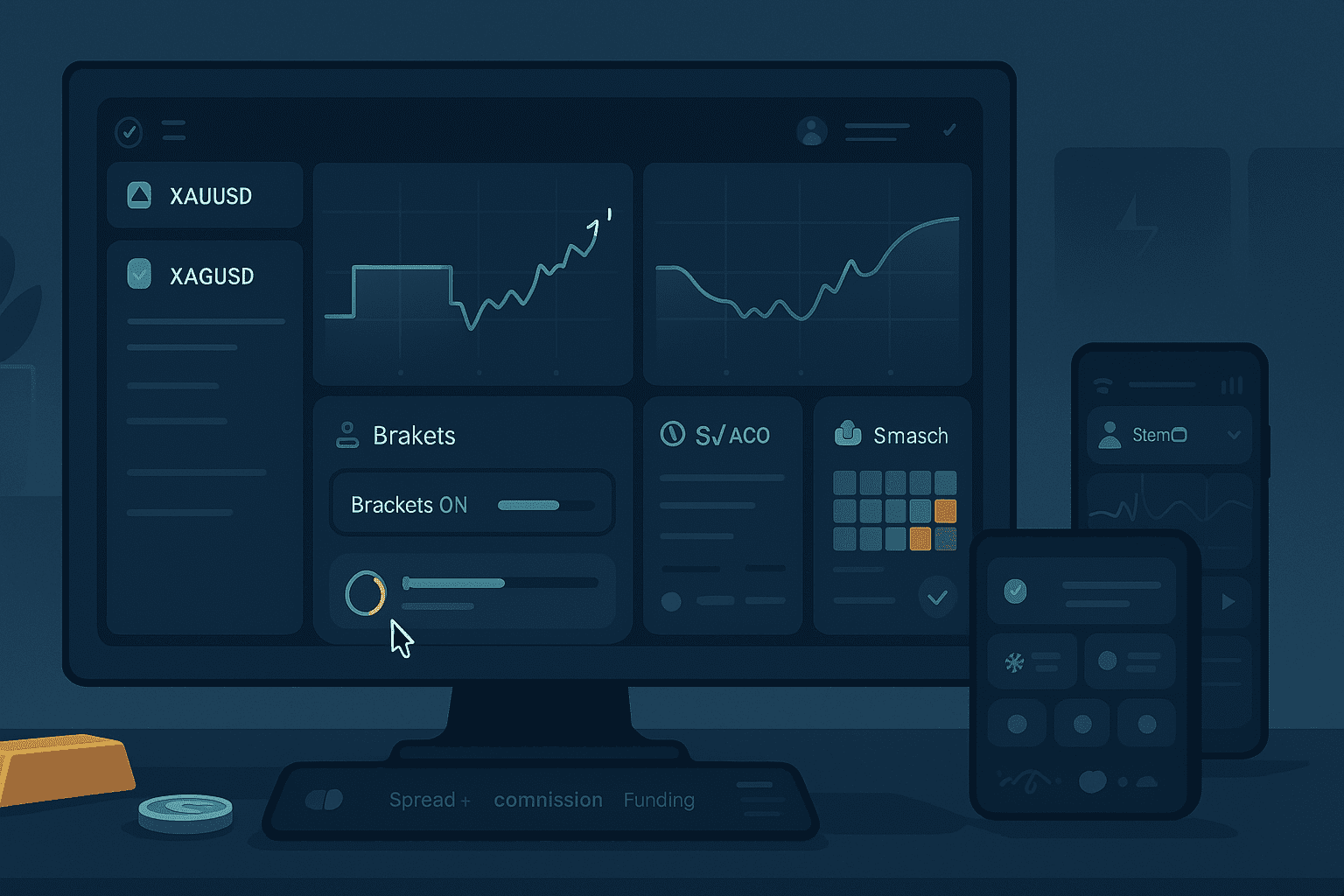

Content that educates instead of hyping

Design small, reusable blocks.

- Primers: order types, bracket orders, margin and risk in cash.

- Playbooks: pullback, breakout plus retest, quiet-session fade.

- Calendars: earnings weeks for stocks, central bank weeks for FX.

- Recaps: one good trade and one mistake with screenshots and risk noted.

Quotable lines that search engines love:

“Risk shown in cash turns scary decisions into simple math.”

“Trade fewer ideas, review more outcomes.”

“If a setup needs a paragraph to justify it, it is not ready.”

Onboarding that lowers noise

- Pick your lane: Stocks, Forex, or Both.

- Choose your rhythm: Intraday, swing, or long term.

- Dial your tools: Turn off global notifications, set level alerts instead.

- Agree to rules: No promises of returns, risk in cash, respect others.

- First post: Share a one-sentence weekly plan with a chart.

Members who complete this path usually contribute again within 72 hours.

Moderation that feels fair

- Publish rules with examples of allowed and disallowed posts.

- Use maker-checker for removals and bans, with short notes visible to staff.

- Archive incident summaries so you can point to precedent.

- Reward teaching with badges or pinned shout-outs.

“Firm lines and quick explanations create the calm tone your community needs.”

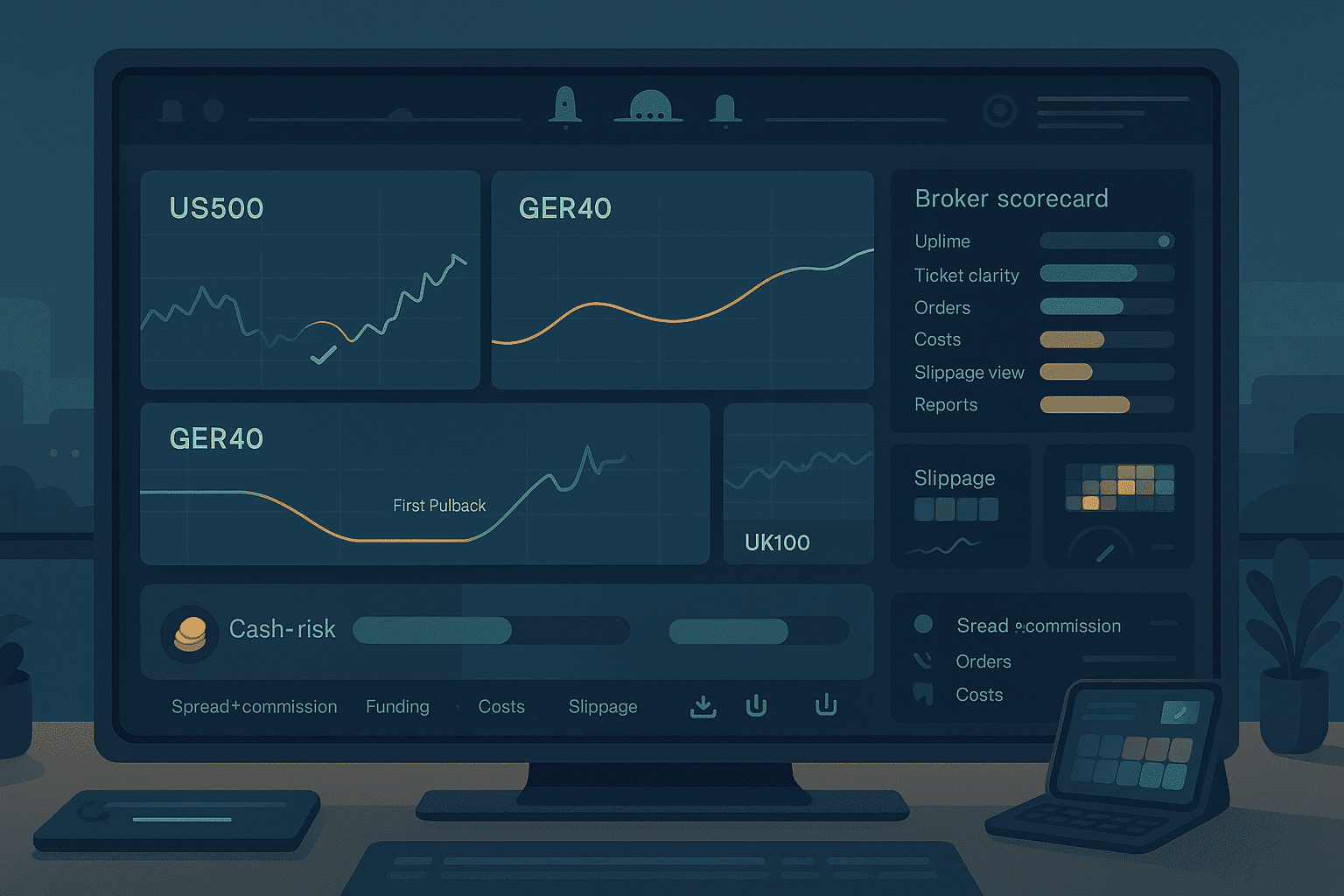

Threads that work across stocks and FX

For a stock trading community platform

- Pre-market thread with SPY and QQQ levels, breadth, and top earnings

- Open range discussion for the first 30 minutes

- End-of-day rotation notes with sector heatmaps

For a forex trading community platform

- London prep focused on majors and DXY

- New York reversal watch pairing gold and dollar moves

- Risk recap with central bank quotes and next day prints

Keep formats short so volunteers and staff can deliver them daily.

Tools that help members act

| Tool | Why it matters | Minimum viable |

| Watchlist library | Gives structure to scanning | Prebuilt lists for majors, metals, indices |

| Risk calculator | Shows size and stop in cash | Inputs for balance, risk unit, stop distance |

| Economic and earnings calendar | Prevents surprise news trades | Color-coded events with local time |

| Journal template | Turns talk into lessons | Two screenshots, reason in and out, result |

| Searchable archive | Saves expert time | Tags for symbol, setup, and timeframe |

“If the platform shows risk in cash before members click, they will last longer.”

Engagement loops you can run forever

- Daily thread: one for stocks, one for FX, posted before each session.

- Two charts Tuesday: one win and one lesson, images only.

- Office hours: weekly Q and A for beginners with live charting.

- Recap Friday: three member posts that taught something concrete.

Rhythm matters more than novelty.

Measuring health without drowning in numbers

| Metric | Good signal | Why it matters |

| First month retention | 40 to 60 percent by niche and price | Shows onboarding clarity |

| Time to first helpful post | Under 7 days | Reflects safety and structure |

| Useful to noisy post ratio | 3 to 1 or better | Keeps experts engaged |

| Beginner reply time | Under 4 hours in session windows | Reduces churn from confusion |

| Recap participation rate | 25 percent of active posters weekly | Builds the review habit |

| Report resolution time | Same day for scams and abuse | Protects trust and brand safety |

Share a trimmed scoreboard with moderators weekly.

Safety, compliance, and brand protection

- Keep plain risk warnings on every trading room page.

- Ban guarantees and implied returns.

- Require recaps to include risk size, not only PnL.

- Separate education from execution in navigation and disclosure.

- Maintain a public status page for uptime and incidents.

“Good rules protect good people.”

Example templates you can paste today

Pre-market template

- Key levels: [list two or three]

- Catalysts: [two events with local time]

- Plan: [pullback, breakout-retest, or stand aside]

- Risk note: [cash risk unit and stop distance]

Recap template

- Chart before and after

- Reason in: [one sentence]

- Reason out: [one sentence]

- Cost notes: [spread, commission, slippage]

- Lesson: [one line]

Beginner Q and A template

- Topic: [order type, bracket orders, position sizing]

- 3 key points

- One example screenshot

Monetization without breaking trust

| Model | Works best for | Guardrails |

| Free plus pro tier | Broad audiences entering the craft | Keep core education free, sell structure and access |

| Course bundles | Focused outcomes like “risk in cash” | Update annually, avoid lifetime promises |

| Partner offers | Data or tool discounts | Disclose clearly, never gate withdrawals or custody |

| Live events | Regions with strong session overlap | Archive replays, post notes for no-shows |

Members pay for clarity and access, not hype.

Launch checklist for your first month

- Write a one-page policy with rules and examples.

- Create Stocks, Forex, and Learn spaces with pinned primers.

- Publish two weeks of session threads in advance.

- Add a watchlist library, a basic risk calculator, and a shared calendar.

- Recruit three mentors, give them templates and office hour slots.

- Turn on post quality voting and require screenshots in recaps.

- Open a simple support form and publish a status page.

“Small, repeatable steps beat big, noisy launches.”

One gentle nudge to get moving

Open a document and write three lines. First, list the two threads you will read every day. Next, write the one rule you will always follow. Finally, note the cash amount you can risk per trade without stress. Join your chosen room today. Post a one-sentence plan with a chart. Save your first recap tonight. With this small start, you will join the online trading community. This will help you make better decisions and improve the room with you.

FAQ

Does a platform to connect with traders need both chat and forums

Yes. Real-time chat supports sessions, while forum threads capture lessons that stay searchable. A balanced stack saves experts from repeating the same answers.

What makes a trading discussion forum platform better than a generic group

Structure and search. Tags by symbol and setup, pinned primers, templates for pre-market and recaps, and a culture that shows risk in cash.

Can stocks and FX live under the same roof

They can if channels are clearly divided. Stocks revolve around opens and earnings. FX revolves around sessions and macro prints. Shared Learn content ties them together.

How can beginners avoid overwhelm in the first week

Mute everything except your chosen asset and session. Use the pre-market template, post one plan, and publish one recap. Small reps beat long lurking.

Which metrics should moderators watch first

First month retention, time to first helpful post, beginner reply time, and useful to noisy ratio. These show whether structure and tone are working.

Are partner promotions safe inside a community

They can be, with disclosures and relevance checks. Keep education independent, never gate custody, and publish rules for what gets approved.